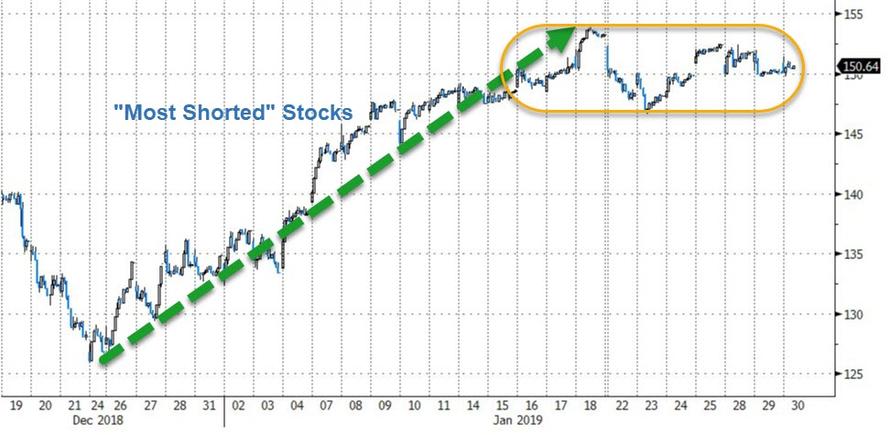

From the Mnuchin Massacre lows on Xmas Eve, the US equity market soared on the back of the greatest short-squeeze (‘Most Shorted’ stocks up a stunning 22%) since the March 2009 lows…

However, the last two weeks have seen ‘most shorted’ stocks suddenly treading water – providing no underlying lift for stocks which have traded rangebound over the same period…

So did the bulls run out of short-squeeze ammo?

The short answer is – YES!

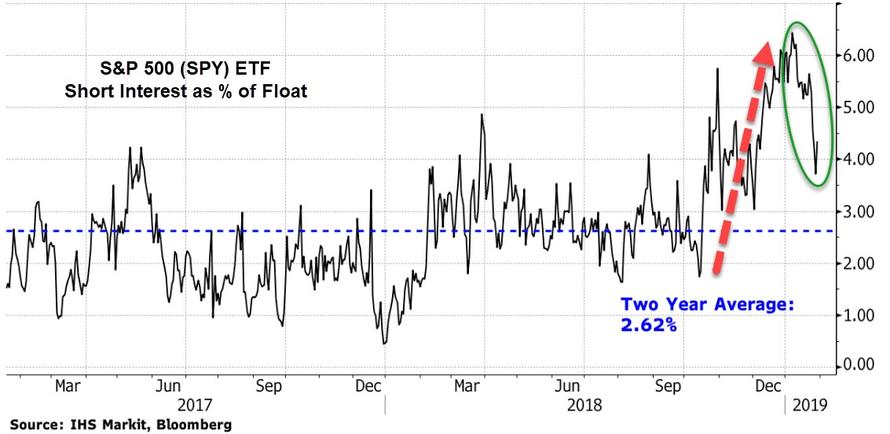

Short sellers have been retreating rather quickly in the last few days, and they’ll probably cave even more today as AAPL and BA lift the indices.

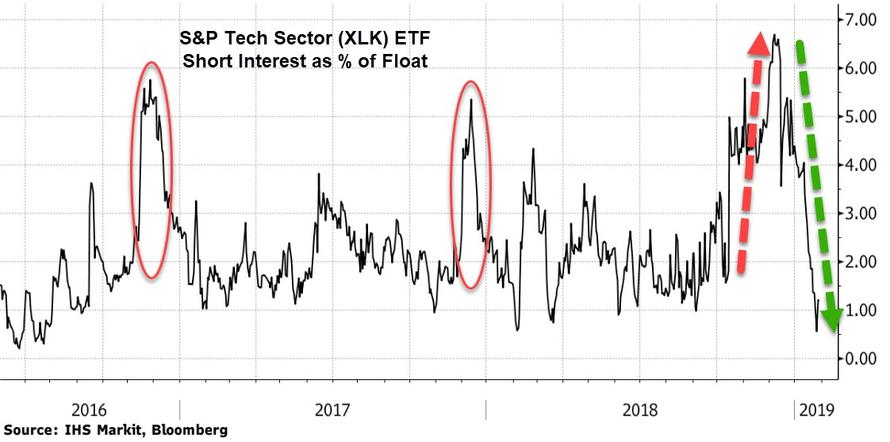

As Bloomberg notes, it’s been an even more dramatic retreat for the bears in the SPDR S&P Technology ETF.

While bulls have had a quite a run recently, we would caution that one of the major pillars of the rebound has now been knocked out – leaving the market to stand on its own two (slightly broken) earnings and monetary policy legs.

So where have all those shorts gone?

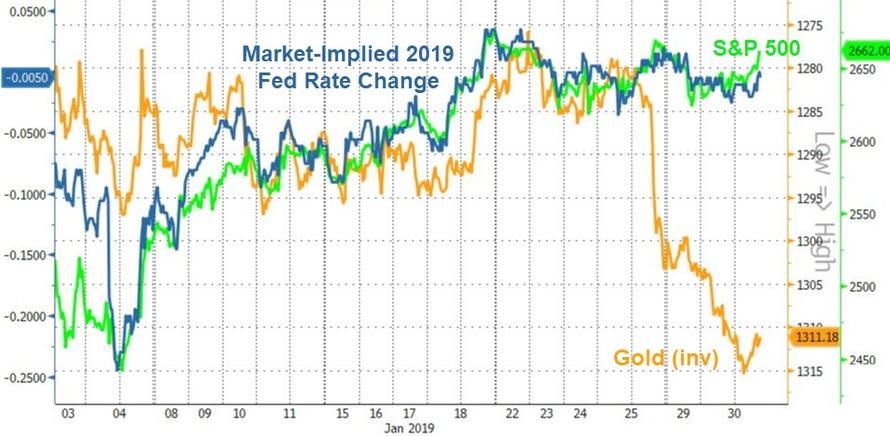

Simple – as gold prices have soared to 8-month highs in recent weeks, short-interest has also soared to its highest since Jan 2018…

This is odd since the stock market is rallying on the basis of an increasingly dovish Fed (and the rest of the world’s central bankers) and yet that ‘dovishness’ is being bet against by gold speculators? Having said that, Gold seems to be pricing in a little more than just Fed dovishness for now (geopolitical chaos anyone?)

For now, they better hope that Jay Powell keeps toeing the “patient” line as it’s all that is keeping stocks alive…

Because fun-durr-mentals don’t seem to matter again in 2019 (until they do of course).

via ZeroHedge News http://bit.ly/2CXBZDa Tyler Durden