If US debt is at $22 trillion and interest rates can barely rise above 2.60%, why can’t the US have $222 trillion in debt?

That, in a nutshell, is the generic MMT argument, which claims that the US government should dispense with a central bank altogether and resort to helicopter money to reflate the economy, a strategy that is especially popular among socialist politicians as it affords them a carte blanche to spend virtually unlimited funds obtained from the sale of debt.

Of course, this only works until it doesn’t – and it usually stops once faith in the reserve currency starts buckling. But while that has yet to happen, as the TBAC pointed out two months ago, it has not prevented a cohort of financial icons and pundits from opining on the intellectual inconsistencies of MMT. And the latest to do so, just hours after we presented the scathing criticism of Convoy Investments’ Howard Wang, was none other than Jeff Gundlach, who during his Tuesday webcast “Highway to Hell“, slammed MMT as a “crackpot” theory, and slammed the “people who have PhDs in economics” and are “actually buying the complete nonsense of MMT which is used to justify a massive socialist program.”

Lashing out at the economists who embrace MMT – who claim that just because the US borrows in its own currency, it can print dollars to cover its obligations, and can’t go broke (just like the Weimar Republic, Venezuela and Zimbabwe) – Gundlach exclaimed that “the problem with that is it’s a completely fallacious argument,” adding that MMT could lead to a “significant boycott” of long-term bonds.

“This argument is ridiculous,” he said. “It sounds good for a first-grader. What happens when the economy turns down?”

As Bloomberg notes, by lashing out at MMT, Gundlach joins an array of financiers and economists including Jerome Powell and Larry Fink who have slammed at the theory that despite being around for over a century (it was known as chartalism around the time it was put to use during the Weimar hyperinflation) got little attention until a band of socialist democrats including Alexandria Ocasio-Cortez were elected.

However, more than just a “crackpot” theory – Gundlach echoed Convoy Investment’s fears that that MMT – which is just the political cover for helicopter money – may end up being more than just a theory if the U.S. falls into a recession next year.

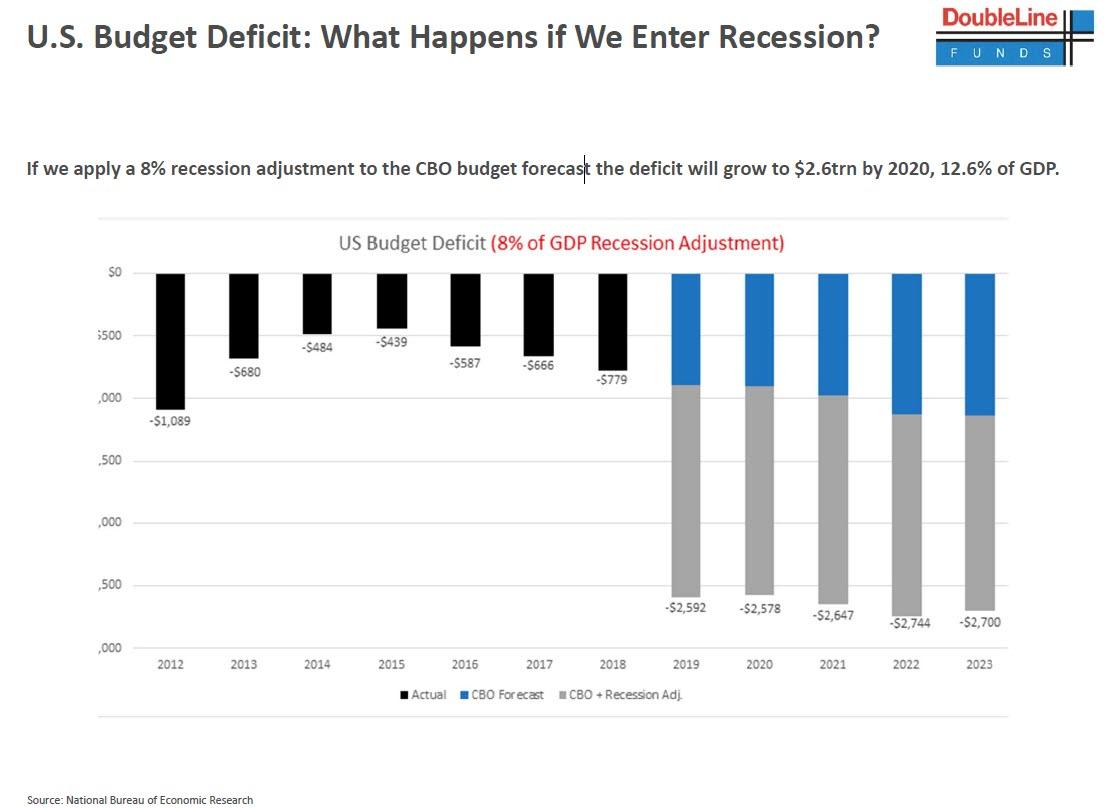

“That means anybody other than an incumbent president would win, which kind of means that we’re headed toward this experiment of modern monetary theory,” he said, although some have argued that Donald Trump is in fact the most MMT president the US has had yet, considering the massive surge in the US budget deficit observed during a period of economic expansion, and which has led some to ask what will happen to the US deficit when the next recession strikes.

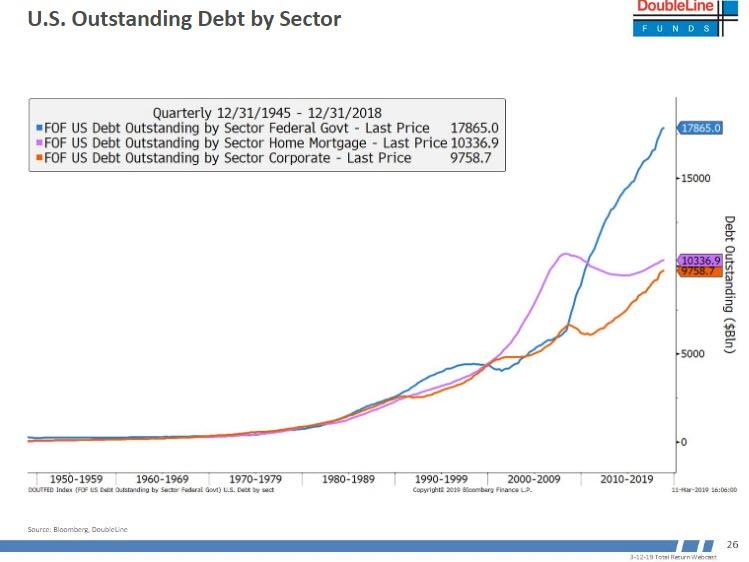

Meanwhile speaking of America’s unsustainable debt trajectory, the basis for Gundlach’s latest presentation title “Highway to Hell“, the DoubleLine founder blamed President Donald Trump for the “shocking” growth in the U.S. debt burden, highlighting the “incredible increase” in corporate and government debt, with federal deficits only poised to grow. Gundlach’s presentation took place just weeks after the Treasury Department said total U.S. federal debt hit a fresh record above $22 trillion.

“This is something that is getting more and more attention, and I think it has to,” Gundlach said, noting that “It’s really shocking that the president ran on the promise of eliminating the national debt, and here it is at $22 trillion and going higher by about $1.5 trillion a year in a growing economy.”

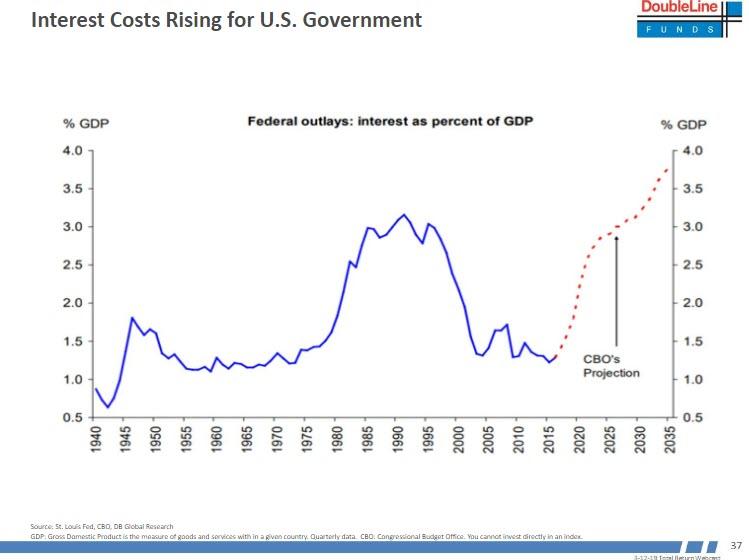

Gundlach also observed that the budget deficit could hit 11% of GDP in the next downturn, and predicted that he would “take the over,” suggesting that 13 percent is more likely, pointing out that as rates creep higher, the US interest as percentage of GDP is projected to “explode higher”…

… and asking rhetorically, “what happens to deficits if we enter recession?”

It may have been rhetorical, but tying it all together, Gundlach said Trump’s ramping up of the US budget and trade deficits means the “next big move for the dollar is down”, although it was unclear if that would be the catalyst that eventually culminates with the loss of faith in the dollar. That moment will come much faster, however, if the next US president decides to pursue MMT.

What happens then? This is what Convoy Investments envisions as next steps:

This would undoubtedly lead to massive inflation, spiking interest rates, and crumbling value of the dollar. While MMT directly addresses inflation, I have yet to see proponents discuss the impact on foreign exchange – the US economy doesn’t exist in a vacuum. Recently our former Fed Chairman Alan Greenspan was also asked about MMT, to which he responded, “You’d have to shut down your foreign exchange markets, people will be trying to fly out of your currency.”

If the government then pursues the MMT recommended strategy of increasing taxation in a massively inflationary economy with plummeting currency value, you’d see additional capital flights, further exacerbating inflation and currency problems. It is also interesting that MMT would reverse the roles of the Fed and the Congress, asking the Fed to keep interest rates low to promote government spending while asking the Congress to adjust taxes as necessary to keep inflation in check.

The US has earned the trust of the global markets over the last century. With the privilege of being the reserve currency comes the responsibility of a disciplined currency management. The leaders of this country have never taken the free lunch of the printing press not because they were dumb or scared, but rather because that free lunch does not exist. Dollars are traded in a free market where both the buyer and the seller need to be incentivized to make the exchange. The markets are not so dumb and naïve to blindly hold on to the dollar while the US prints its way out of fiscal trouble. The moment the US resorts to the printing press, the logical move is to ditch the dollar and all dollar denominated assets and the trust the US has built over decades will evaporate in a moment.

Convoy’s conclusion: “I believe that Modern Monetary Theory is naïve and that it would fail, but I do fear that it is like a seductive infomercial that makes hard-to-resist claims and may lead us down a fiscally destructive path. By the time we realize our mistake, it may be too late. I do not know politics well enough to predict which path we’ll end up choosing.“

via ZeroHedge News https://ift.tt/2HlfhcS Tyler Durden