Seriously… China stocks plunge, US earnings tumbling, US macro data disappointment, Brexit uncertainty, bond yields plunge and still US stocks surge (we’ll explain why below)…

Chinese markets collapsed overnight with ChiNext plunging over 6% from Monday’s highs…

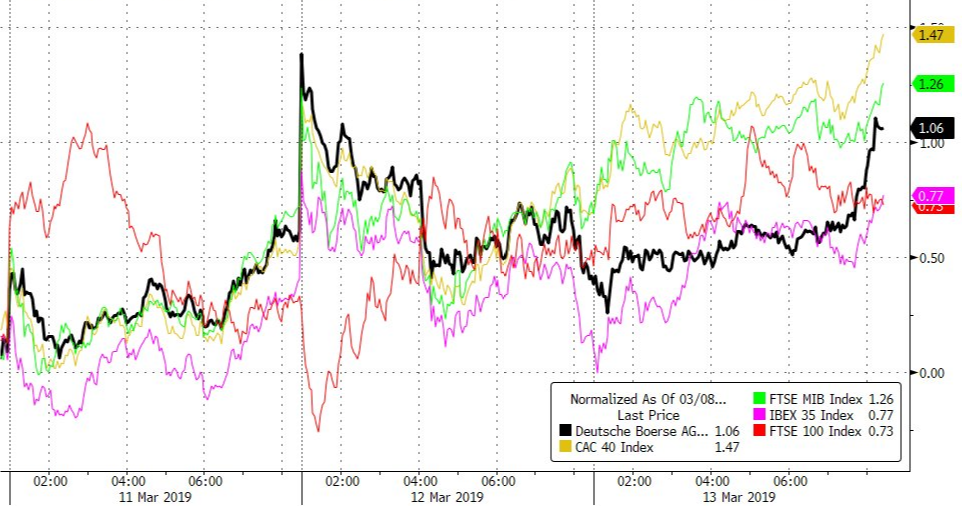

While China tumbled, European markets rallied with DAX outperforming on some positive economic data…

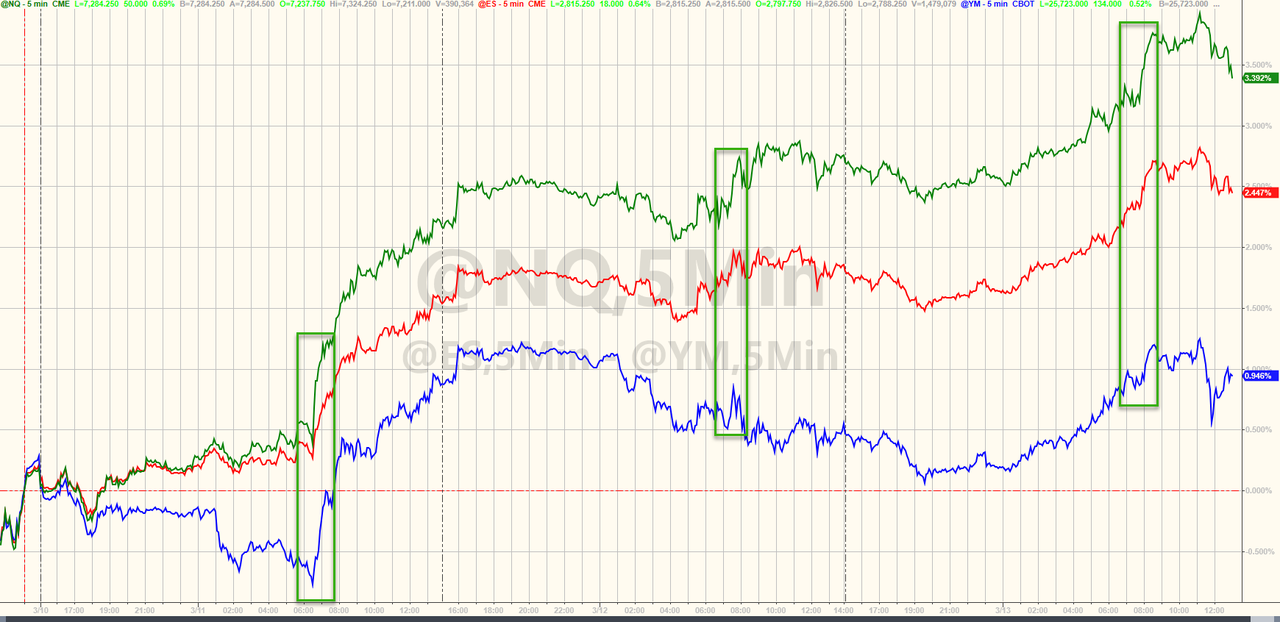

US equity markets surged once again (fading only on Boeing headlines and Trump China trade deal, then rebounding after UK voted against a no-deal brexit)…

Futures show another buying panic at the cash open

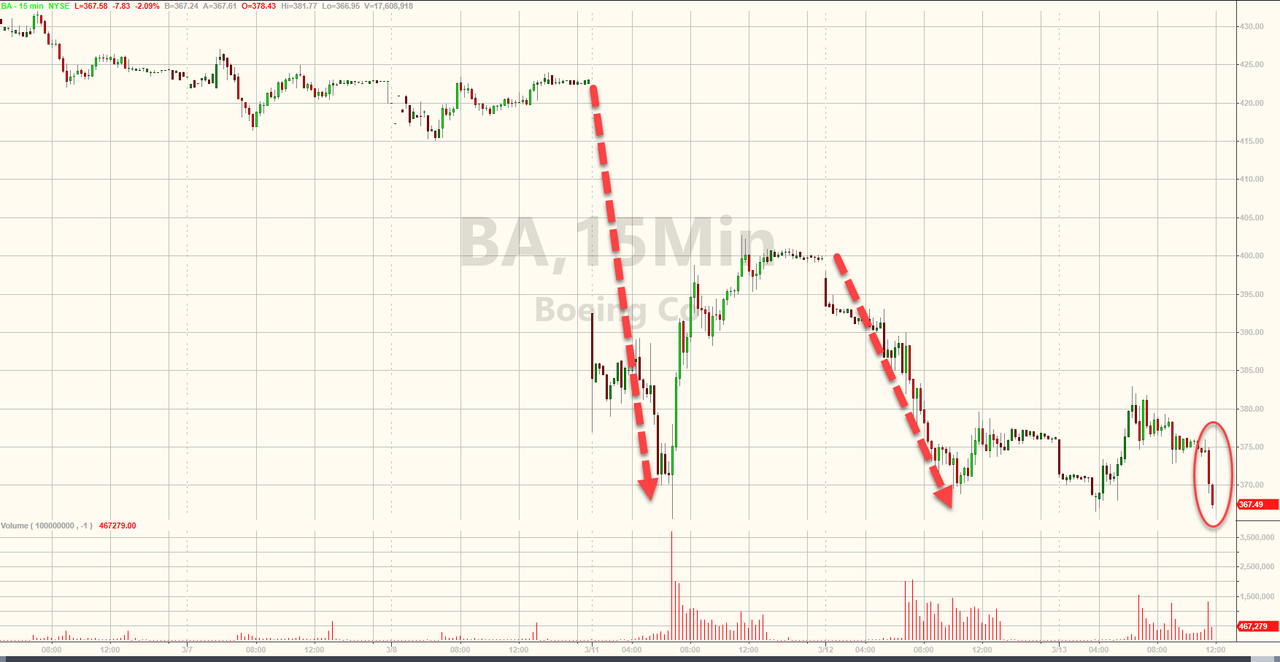

Boeing was ugly as Trump grounded their 737 Max planes…

And then Boeing was bid back into the green…

The S&P 500 broke above a key technical resistance level but ended back below it (a lower high)…

Wondering WTF is going on? It’s simple, as Charlie McElligott, managing director for cross-asset macro strategy at Nomura, wrote in a Tuesday note to clients:

The impending expiration of options contracts is fueling the purchase of those stocks as owning options becomes ever riskier as the expiration day approaches, a process called “rolling out.”

Options-related buying “is syncing up with corporate buyback flows, which typically run at a massive pace this week as well, ahead of going into a ‘blackout’ by next week,” McElligot wrote, referring to a period of when companies and corporate insiders are prohibited from repurchasing their own shares in the month before the release of their quarterly results.

“This demand double-whammy” are the “two largest catalysts” for the stock market’s upswing this week, he added.

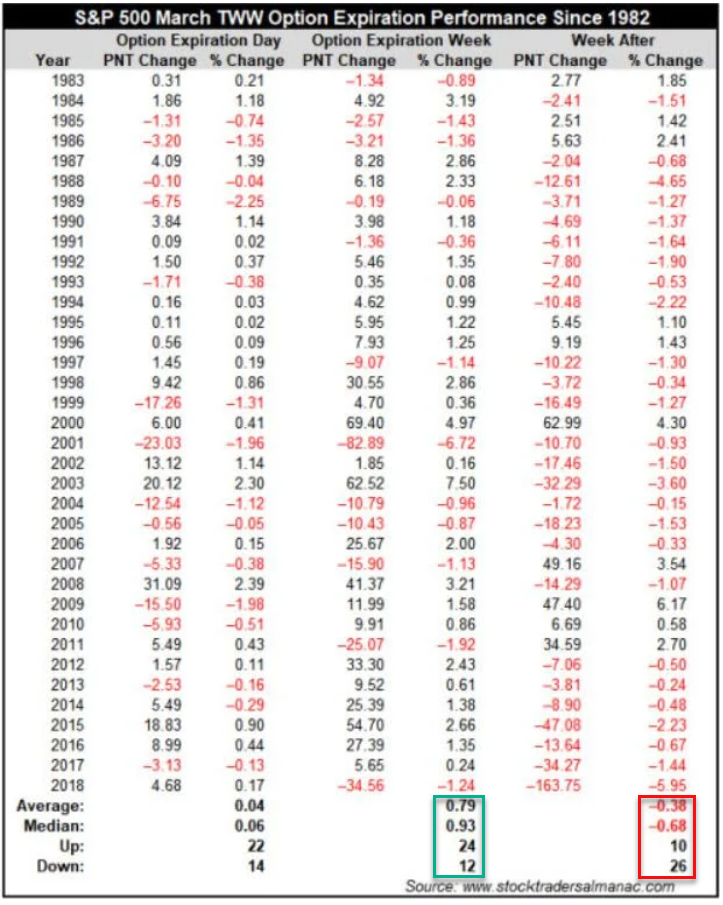

Jeff Hirsch, editor of the Stock Trader’s Almanac and chief market strategist at Probabilities Fund Management, pointed out in a blog post that “March’s option expiration week performance is second only to December’s and has a bullish bias.”

But there’s some downside… the week after quad witch has been ugly…

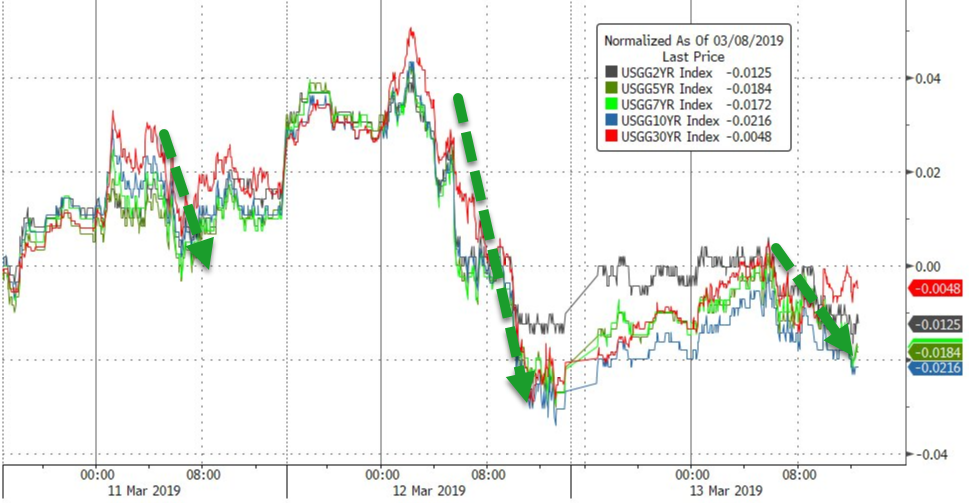

Which is perhaps what bonds are worried about…

With stocks surging on their own on the heels of the biggest short-squeeze since the start of January..

And another surge in buyback-related stocks…

VIX and Credit collapsed further today…

Despite equity gains once again, bond yields were unchanged, dramatically diverging…

30Y Yields hovered around the 3.00% level…

The Dollar Index – DXY – tumbled for the 4th day in a row, well and truly breaking the 97.00 level…

Cable rallied notably as UK Parliament voted to rule out a no-deal brexit on March 29…

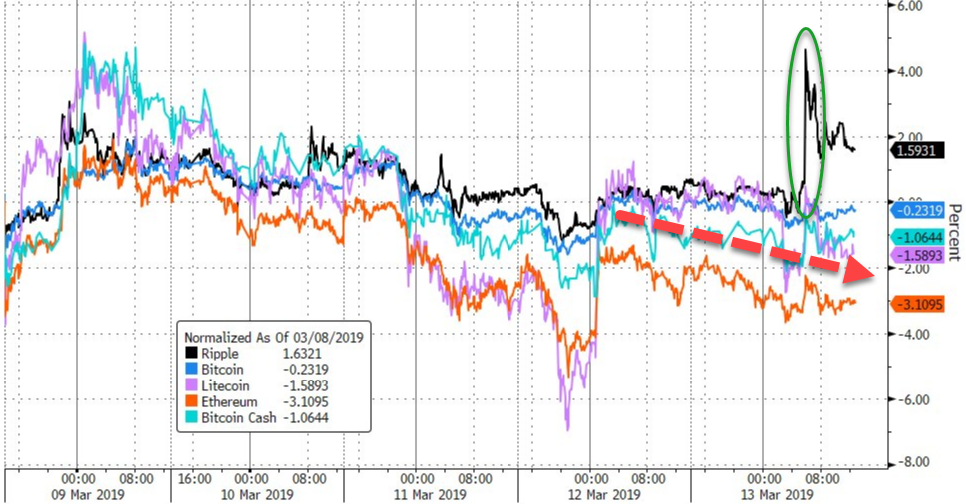

Cryptos broadly drifted lower on the day but Ripple rallied…

The drop in the dollar sparked more gains in commodities…

With gold extending its gains, back above $1300…

WTI Crude surged above $58 to 4-month highs after a surprise crude inventory draw…

Finally, something had to be done…

But, as we noted above, the week after quad witch usually does not end well.

via ZeroHedge News https://ift.tt/2T693z0 Tyler Durden