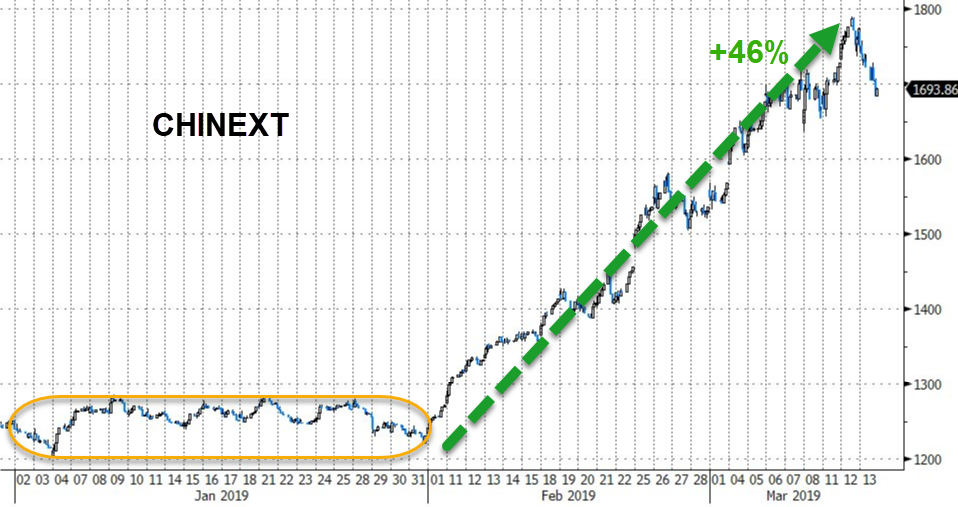

After a quiet January, Chinese small caps (ChiNext) soared a stunning 46% since the start of February…

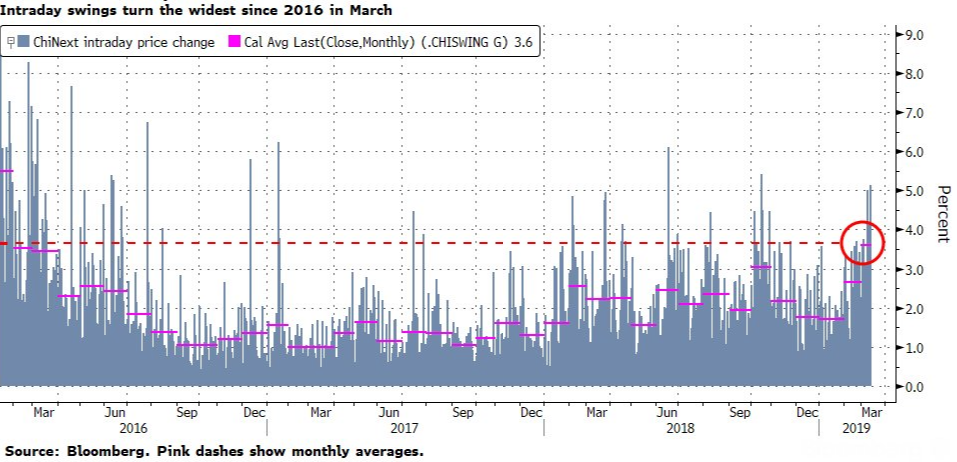

However, Wednesday’s 4.5% drop in the ChiNext index following a 7.2% rally in the preceding two days confirms the massive rise in volatility that Chinese markets have seen – a very different relationship to US markets (which tend to see vol collapse as stocks surge).

As Bloomberg details, average intraday swings this month are now the widest since early 2016.

The index has swung at least 2% for nine straight days, as some have argued the desperation of China’s “National Team” rescuing investors day after day amid the US-China trade negotiations – thus weaponizing their stock market.

So, the question for investors is simple – is the 6% tumble in the last two days enough to spook the maniacal momentum-chasers out of the market as they are finally forced to reduce exposure in the face of spiking risk?

Some insiders are taking no chances – a growing number of companies have announced plans to trim holdings this week, including investor favorite Wangsu Science & Technology Co.

“Risks are rising as stocks reach relatively high levels,” said Ken Chen, a Shanghai-based analyst with KGI Securities Co.

“Upward momentum has weakened and investors are less willing to go long than before. Some retail investors are running for the exit as more listed firms are announcing shareholders’ plans to cut stakes.”

Or is it the dip that you buy – on margin – because Xi told you to? It seems The National Team have stepped away – for now.

via ZeroHedge News https://ift.tt/2FaeNUs Tyler Durden