Having risen to session highs on the back of fresh global optimism over trade, a delay in Brexit and fresh hopes for a “goldilocks” economy (while ignoring China’s worst Industrial Production print on record), US equity futures slumped on Thursday as America and China were reportedly set to push back a key meeting on trade. European stocks trimmed an advance on the news, but remained higher while the pound fell as the Brexit saga rumbled on.

Following the meeting delay report, S&P futures tumbled from a loss to a gain while Treasuries pared a drop, the dollar gained and the yuan dropped.

Major European indices remained in positive territory, initially following the positive sentiment on Wall Street where the S&P 500 finished at a 5-month high and above the key 2800 level, although indices have since fallen off sharply from session highs following the previously noted report that the meeting between US President Trump and Chinese Premier Xi is delayed to at least April. European miners fell with the Stoxx Europe 600 basic resources index sliding as much as 0.8%, as metals slide on the weak Chinese industrial data reported overnight, and after the U.S. and China were said to push back a key meeting on trade. Chinese economic data published this morning are “putting the brakes on the rise in metals prices,” Commerzbank analysts wrote: “China’s industrial production has lost momentum more significantly than expected. Although fixed-asset investments increased slightly, they remain at a low level.”

Earlier, Asian stocks were initially higher across the as the region took early impetus from the US, where sentiment was underpinned by favorable data and a pre-quad witching surge, although the risk tone was eventually clouded as participants digested another round of disappointing Chinese data.

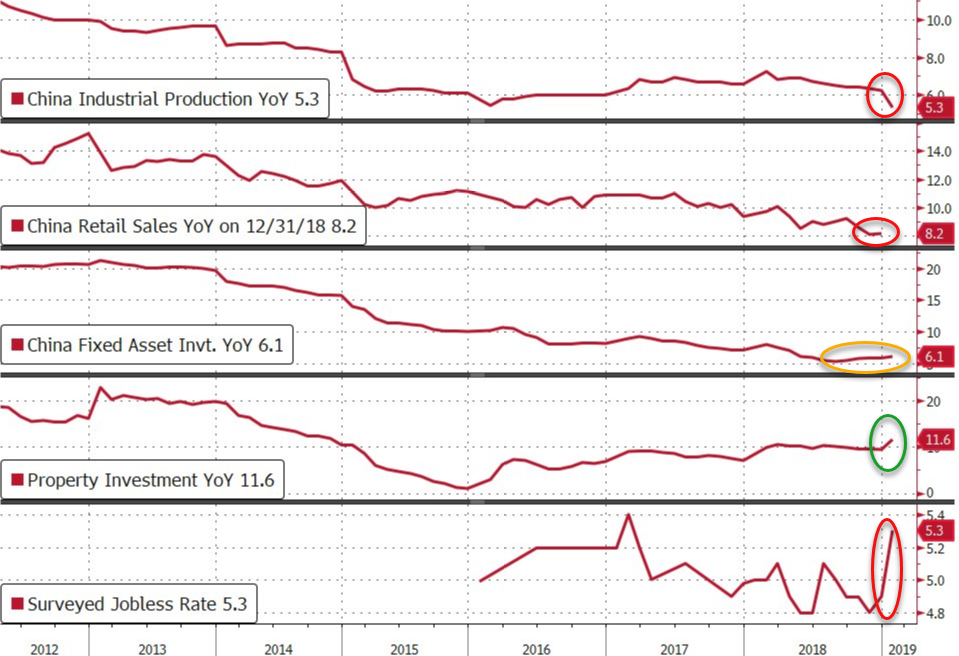

As noted last night, this is how China’s February’s data dump looked like:

- China Industrial Production YoY MISS +5.3% vs +5.6% exp and +6.2% prior

- China Retail Sales YoY MEET +8.2% vs +8.2% exp and +9.0% prior

- China Fixed Asset Investment YoY MEET +6.1% vs +6.1% exp and +5.9% prior

- China Property Investment YoY BEAT +11.6% vs +9.5% prior

- China Surveyed Jobless Rate WEAKER 5.3% vs 4.9% prior

This was the weakest Industrial Production growth since March 2009 and Retail Sales growth was hovering near its weakest since May 2003. But perhaps the most worrisome for Chinese officials is the surge in the surveyed jobless rate to 5.3%, the highest since Feb 2017. Elsewhere, the ASX 200 and Nikkei 225 was unchanged with energy the outperformer in Australia after oil prices hit their best levels since November, while SoftBank shares were among the top gainers in the Japanese benchmark after reports it is in discussions regarding a USD 1bln investment into Uber’s self-driving unit. Chinese markets instigated a turnaround but with the downside in the Hang Seng (+0.1%) limited by notable strength seen in China’s oil majors and as China Unicom rallied post-earnings, while Shanghai Comp. (-1.2%) underperformed and fell below the 3000 level following mixed data with Retail Sales inline with expectations and Industrial Production at a 17-year low.

Emerging-market currencies and shares edged lower.

Summarizing recent price action, Bloomberg notes that investors have a lot to grapple with just now. U.S. stocks have extended gains this week as economic data comes in neither too hot nor too cold, while traders in Europe on Thursday seemed to be shrugging off more warning signs from the region – perhaps because of hopes Brexit can be delayed or derailed. Figures suggesting China’s slowdown deepened in the first two months of the year added to reasons for caution following this quarter’s rebound in Asian shares.

In geopolitical news, the US announced plans to test-launch missiles later this year after President Trump recently pulled out of the Nuclear Force Treaty. Separately, the US Senate voted 54-46 to end US support for the Saudi-led war in Yemen.

In FX, the Bloomberg Dollar Spot Index snapped four days of declines as Treasury yields edged higher. The pound fell ahead of another vote in the U.K. House of Commons where lawmakers will decide on whether to delay Brexit. The yen fell the most in two weeks and, falling against all G-10 peers, as traders positioned themselves ahead of the Bank of Japan’s policy decision on Friday, with some speculation that the central bank may turn slightly more dovish. Australian and New Zealand dollars slid after downbeat China data combined with falling short-end rates weighing on sentiment.

European sovereign debt was mixed as Germany said the economy likely to grow moderately in first quarter.

Elsewhere, oil prices slipped after touching a four-month high following reports that a Trump-Xi summit may be delayed until April vs. prior expectations of an end-March summit. As such WTI and Brent futures fell back into their respective one-month long range of around USD 3.50/bbl. This summit push-back has however been touted for a while as USTR Lighthizer recently noted that sticking points remain in talks

Expected data include jobless claims and new home sales. Dollar General, Adobe, Broadcom and Oracle are among companies reporting earnings.

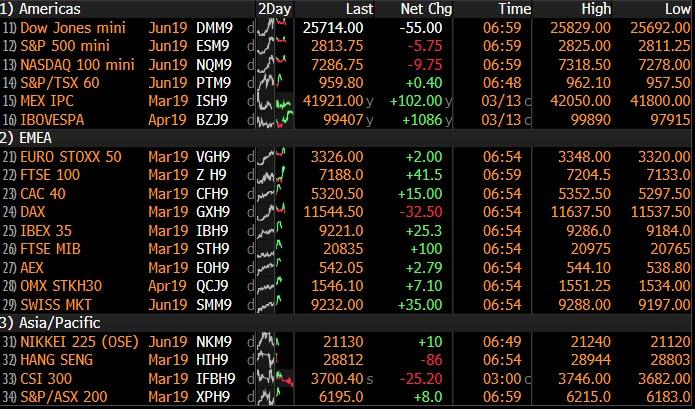

Market Snapshot

- S&P 500 futures up 0.1% to 2,822.75

- STOXX Europe 600 up 0.4% to 377.02

- MXAP down 0.3% to 157.79

- MXAPJ down 0.2% to 521.60

- Nikkei down 0.02% to 21,287.02

- Topix down 0.2% to 1,588.29

- Hang Seng Index up 0.2% to 28,851.39

- Shanghai Composite down 1.2% to 2,990.69

- Sensex down 0.06% to 37,731.10

- Australia S&P/ASX 200 up 0.3% to 6,179.59

- Kospi up 0.3% to 2,155.68

- German 10Y yield rose 2.3 bps to 0.088%

- Euro up 0.01% to $1.1328

- Italian 10Y yield rose 1.2 bps to 2.197%

- Spanish 10Y yield fell 0.2 bps to 1.186%

- Brent futures up 0.8% to $68.09/bbl

- Gold spot down 0.5% to $1,302.26

- U.S. Dollar Index up 0.1% to 96.65

Top Overnight News from Bloomberg

- The pound climbed to its highest level since June after Parliament on Wednesday evening rejected leaving the EU after 46 years without an agreement in place to keep trade flowing. Legislators will now vote on a postponement to the current March 29 deadline

- A gauge of trader positioning from Citigroup Inc. shows short bets on sterling at their highest levels since December and the bearish wagers are set to rise even further, according to market participants

- China’s economic slowdown deepened in the first two months of the year as industrial output rose 5.3 percent from a year earlier, versus 5.6 percent forecast by economists

- Gary Cohn, the former head of President Donald Trump’s National Economic Council, said the U.S. is “desperate right now” for a trade pact with China as negotiators from both countries seek to reach a deal

- U.K. derivatives clearing houses would face tighter post-Brexit scrutiny from European Union regulators if they want to keep doing business in the bloc under an agreement announced by EU negotiators on Wednesday

- Royal Institution of Chartered Surveyors said its headline price index fell for a fifth month in February, dropping to the lowest level since 2011, as uncertainty caused both buyers and sellers to hold off on property deals in the U.K.

- Oil held its advance to the highest level this year as a decline in U.S. crude and fuel stockpiles added to evidence of a tightening market

- A delay to Brexit this week may be better than the alternatives, but that’s cold comfort for the U.K. economy. While a vote Thursday is likely to buy time for an orderly divorce, that would hurt, too, by prolonging the uncertainty for businesses and consumers

- Data showed that China’s economic slowdown deepened with industrial output having its worst start to a year since 2009 and retail sales expanding at the slowest pace since 2012; the unemployment rate jumped to 5.3% in February from 4.9% in December, the highest level in two years. On the upside, fixed-asset investment accelerated and property investment jumped

Asian stocks were initially higher across the as the region took early impetus from the US, where sentiment was underpinned by favourable data. This saw all US major indices finish positive with the S&P 500 at a 4-month high and in turn spurred the momentum in Asia, although the risk tone was eventually clouded as participants digested Chinese data. ASX 200 (+0.3%) and Nikkei 225 (U/C) both gained at the open with energy the outperformer in Australia after oil prices hit their best levels since November, while SoftBank shares were among the top gainers in the Japanese benchmark after reports it is in discussions regarding a USD 1bln investment into Uber’s self-driving unit. Chinese markets instigated a turnaround but with the downside in the Hang Seng (+0.1%) limited by notable strength seen in China’s oil majors and as China Unicom rallied post-earnings, while Shanghai Comp. (-1.2%) underperformed and fell below the 3000 level following mixed data with Retail Sales inline with expectations and Industrial Production at a 17-year low. Finally, 10yr JGBs were lacklustre amid upside in Tokyo stocks and as the BoJ began its 2-day policy meeting, although there was a different picture in the longer-end as both 20yr and 30yr JGB yields fell to November 2016 lows.

Top Asian News

- China Insiders Are Selling Stakes After Mammoth Equity Rally

- Hedge Fund Sees China’s Distressed Debt Generating Juicy Returns

- UBS Said Fined About $48 Million Over Work on Hong Kong IPOs

- StanChart Loses Two Top India Bankers Amid Turn-Around Efforts

Major European indices are in positive territory [Euro Stoxx 50 +0.2%] initially following the positive sentiment on Wall Street where the S&P 500 finished at a 5-month high and above the key 2800 level; although indices have fallen off sharply off of session highs following reports that the meeting between US President Trump and Chinese Premier Xi is delayed to at least April. While this has been seen as a potential outcome for a while markets were still taken by surprise hence the significant drop from session high. Sectors have strengthened throughout the session to all being firmly in the green, after a somewhat mixed start to the session for sectors; with IT names the initial notable laggard. Notable movers include K+S Group (+7.3%) at the top of the Stoxx 600 after their FY18 EBITDA beat on expectations, alongside the Co. presenting strong EBITDA guidance for 2019. At the bottom of the Stoxx 600 are Lufthansa (-5.3%) after the Co. cut its growth plans as higher fuel costs weighed on earnings. Elsewhere, RWE (+0.3%) shares have been volatile since opening lower by around 2% after the Co. posted earnings below expectations, the turnaround in shares may be due to the Co. stating that they are confident the timetable for a E.ON (-0.1%) deal can be adhered to, after highlighting a potential delay to it in the event of a hard Brexit.

Top European News

- Keep Hedging for U.K. Downside Risks, UBS Wealth Says

- Short Bets on Pound Jump to Most This Year on Brexit Chaos

- Brexit Impasse Sees U.K. Property Price Index Drop to 7-Year Low

- Ifo Institute Slashes Forecast for German 2019 Growth to 0.6%

In FX, there was some respite for the Dollar and index after Wednesday’s relatively sharp sell-off, as the steeper reversal from recent 97.000+ highs stopped at the 96.371 level that coincides with technical support on some charts. However, the rebound was at least partly if not mainly due to external factors with several major counterparts undermined bearish impulses or running out of bullish momentum in the case of Sterling. The DXY is just shy of a recovery high inches above 96.750, and the 30 DMA at 96.602 could be key in terms of a firmer rebound or fade before another leg down towards the next downside technical level ahead of 96.000, which comes in at 96.283.

- AUD/NZD/GBP/JPY – It’s a 4-horse race to avoid being last G10 currency to Thursday’s (EU session) finishing post, as the Aussie is undermined by data again, albeit Chinese this time rather than domestic, and fresh reports about a delay to the eagerly awaited Trump-Xi Summit to sign off a trade pact. Aud/Usd has slipped back further from near 0.7100 at one stage to 0.7050 and the Kiwi in sympathy with Nzd/Usd now around 0.6817 vs 0.6865 at best. Meanwhile, the Pound has pulled back following another Brexit-related spurt that catapulted Cable to circa 1.3340 before a retreat through 1.3300 to 1.3250. Sterling got an extra boost from the 2nd UK Parliamentary vote this week that saw a no deal in any guise rejected by MPs, in principle at least. Attention now turns to an extension of the March 29 Article deadline, and the strong prospect of that being approved has prompted PM May to tentatively schedule a 3rd MV sometime before next week’s EU Summit. Elsewhere, Usd/Jpy has backed off from circa 111.73 overnight peaks on the aforementioned breaking US-China news, but the headline pair remains above a key chart level in the form of the 200 DMA (111.43) and could be prone to further upside if the BoJ is as dovish as expected tomorrow, or even more. Note, for a full preview of the impending policy meeting please refer to the Ransquawk Research Suite.

- CHF/EUR/CAD – All holding up better against the Buck revival, as the Franc hovers close to the top of a 1.0050-30 range and perhaps finds some traction from firmer than forecast Swiss import/producer prices (albeit still deflationary in y/y terms). Meanwhile, the single currency is keeping its head above 1.1300, marginally, but shy of Fib resistance (1.1327 represents a 38.2% retracement of this year’s 1.1570-1.1177 move) after another hefty 2019 German GDP forecast downgrade (0.6% from 1.1% per Ifo) and the Loonie is back below 1.3300 vs its US rival against the backdrop of toppy oil prices and ahead of Canadian house price data then a speech from BoC’s Wilkins.

In commodities, WTI (-0.2%) and Brent (-0.1%) futures have slipped following reports that a Trump-Xi summit may be delayed until April vs. prior expectations of an end-March summit. As such WTI and Brent futures fell back into their respective one-month long range of around USD 3.50/bbl. This summit push-back has however been touted for a while as USTR Lighthizer recently noted that sticking points remain in talks. Elsewhere, Iraqi Energy Minister emerged on the wires stating that the nation will decrease crude exports to average 3.5mln BPD from USD 3.62mln BPD in order to comply with OPEC’s output curbs. The metals market is largely on the backfoot amid a pick-up in the USD wherein the yellow metal breached USD 1300/oz to the downside. Gold is now back below its 50 DMA at 1303/oz ahead of its 100 DMA at 1271/oz. Elsewhere, copper erased its three-day gains amidst a firmer Buck couple with a turnaround in risk sentiment after the Trump-Xi meeting. US is seeking to reduce Iran oil sales by about 20% to below 1mln bpd from May and is likely to renew sanctions waivers to Iranian oil buyers but could deny waivers to countries not using them, according to sources. CME lowered COMEX 5000 silver futures margins by 8.4% to USD 3300 per contract and lowered COMEX copper futures margins by 11.1% to USD 2400 per contract.

US Event Calendar

- 8:30am: Import Price Index MoM, est. 0.3%, prior -0.5%;

- 8:30am: Export Price Index MoM, est. 0.1%, prior -0.6%

- 8:30am: Initial Jobless Claims, est. 225,000, prior 223,000, Continuing Claims, est. 1.76m, prior 1.76m

- 9:45am: Bloomberg Consumer Comfort, prior 62.1

- 10am: New Home Sales MoM, est. 0.16%, prior 3.7%; New Home Sales, est. 622,000, prior 621,000

DB’s Jim Reid concludes the overnight wrap

Maybe the next piece should be “How to fix Brexit… and why it matters”. The first part might be more difficult to write then the second. Last night’s Parliament voted 321-278 to reject a no-deal Brexit under all circumstances. This was an amended motion that was stronger than the government wanted and hence they instructed MPs to vote against it. So in effect they lost again with the government’s authority is some disarray. I would note that this is the same government who are 10pp ahead in the latest opinion polls though. In response, Mrs. May has tabled a motion for today that effectively says that if Parliament can agree a deal by March 20th (next Wednesday and on the eve of the EU summit) she’ll ask for an extension to June 30th. If no deal is agreed she suggested an extension could be much longer as the EU will insist on it (assuming they allow one at all). So the stakes are raised and the likelihood of MV3 coming back next week is high. I’m not sure there is any time or consensus for an alternative plan to be ready by then but watch out for attempts and watch out for any amendments today that could complicate this timeline.

Sterling rallied ahead of, during, and after the vote, gaining +2.01% versus the dollar (-0.7% this morning but still up 3 cents from this week’s lows) to reach its highest level since last June. The chances appears to have increased materially for a more positive outcome. Either May’s deal or an even softer version will eventually pass, or Article 50 will be extended for a long period. The threat of the latter scenario, where Brexit might be deferred indefinitely, could be enough of a discouragement to entice the hard Brexit wing of the Conservative party to support May’s deal. However it’s fair to say that they are angry at the moment and their next steps are unpredictable.

In what feels like another planet, the rally for risk this week continues. Anyone that remembers the 1990s band Chumbawamba’s big hit will know of a good soundtrack to the recent resilience. The S&P 500 (+0.70%) rose for a third consecutive day yesterday and has now wiped out last week’s losses and is back above the 2,800 level for the first time since March 1st and to the highest close since 7 November. 2,800 has proven to be a level that the S&P has failed to hold above in recent months, but the index is back to within 4.5% of those September all-time highs now. The index did dip -0.36% off its intraday high late in the session however, after President Trump said that he is in no rush to complete a trade deal with China. Elsewhere even the DOW (+0.58%) climbed yesterday as Boeing shares finished slightly higher – notwithstanding a +/-4.83% intraday range after the US and Canada joined Europe in grounding the 737 Max plane – following two heavy day declines on Monday and Tuesday. The NASDAQ was +0.69% while in Europe the STOXX 600 ended +0.63% and is back above the levels seen before the ECB last week and just about level with its YTD high. European Banks also closed +1.59% (still below ECB meeting levels) with bond yields up 1-2bps in Europe and +0.7bps for Treasuries. Oil rose +1.50% after US data showed another larger-than-expected drawdown in crude inventories. Usually, inventories build during the winter and are reduced during the summer, but they fell by -3.86mn barrels last week.

In Asia this morning markets are trading lower with China’s bourses leading declines due to mixed economic data releases. The Shanghai Comp (-1.09%), CSI (-0.48%) and Shenzhen Comp (-2.39%) are all lower along with the Hang Seng (-0.14%) and Kospi (-0.28%) while the Nikkei (+0.24%) is up. Elsewhere, futures on the S&P 500 are down -0.12% and all G-10 currencies are trading weak (-0.1% to -0.7%) this morning. Overnight, we saw China’s February economic data dump which presented a mixed bag for the economy with YtD industrial output (at +5.3% yoy vs. +5.6% yoy expected) marking the slowest start to the year since 2009. The unemployment rate (at 5.3% vs. 4.9% in December) rose to the highest since February 2017 and YtD retail sales came in line with expectations at +8.2% yoy, marking the slowest pace of growth since 2003. On the other hand, China’s YtD fixed asset investment came in line with consensus at +6.1% yoy (vs. 5.9% in last month) and YtD property investment jumped to 11.6% (vs. 9.5% in last month).

So China data is taking a shine off things but US data seems to be bouncing back with more evidence yesterday. Most notably, the January durable and capital goods orders data beat and painted a reasonable picture for Q1 capex so far. Core capex orders were up a lot more than expected (+0.8% mom vs. +0.2% expected), as were shipments (+0.8% mom vs. -0.2% expected). We should note that the data tends to be a bit volatile however and subject to big swings so best to look across months. Also, the January construction spending print was up a better than expected +1.3% mom (vs. +0.5% expected).

In contrast, albeit helping the carry trade, the February PPI print disappointed coming in at +0.1% mom for the core (vs. +0.2% expected). That said the healthcare component printed at a solid +0.25% which therefore helps the healthcare component of the PCE, although it was somewhat offset by other components which feed into the PCE, such as a -3.5% drop in airfares. So a mixed report.

In the UK yesterday we had the Spring Statement. Unsurprisingly it played second fiddle to all things Brexit related with the highlights being a £3bn improvement in the public sector net borrowing for the 2018-19 fiscal year. Stronger revenues from corporate and income taxes have been the key driver so far, though lower interest rates have also reduced borrowing costs. In a vacuum, this would reduce gilt issuance forecasts and would be bullish, but of course the outlook and price action is going to be mostly swamped by Brexit dynamics.

To the day ahead now, where the non-Brexit events this morning include final February CPI revisions in Germany and France, followed this afternoon by the February import price index print, latest weekly initial jobless claims, January trade balance and January new home sales. The ECB’s Coeure is due to speak in Milan and EU ambassadors meet.

via ZeroHedge News https://ift.tt/2UCurxg Tyler Durden