Never saw that coming…

Why you always look where you’re going. pic.twitter.com/lPtI6gwW4G

— Car Crash TV (@Crashingtv) March 28, 2019

Chinese stocks trod water early on but faded into the close…

UK’s FTSE 100 was Europe’s outperformer while Spain and Italy were down 0.5% on the day…

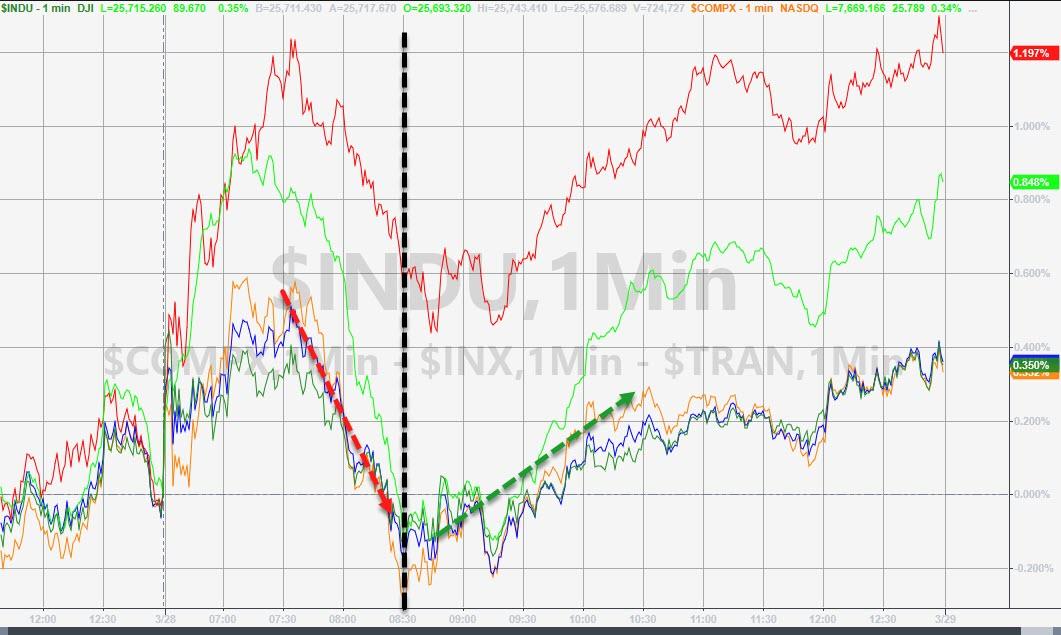

US equities pumped at the open once again and then faded into the EU close (once again), only to reverse trend (once again)…Trannies outperformed, followed by Small Caps…

S&P tested back below 2800 once again today (and bounced)…

FANG stocks were flat on the day with no bounce after yesterday’s tumble…

Credit and equity protection costs plunged again today…

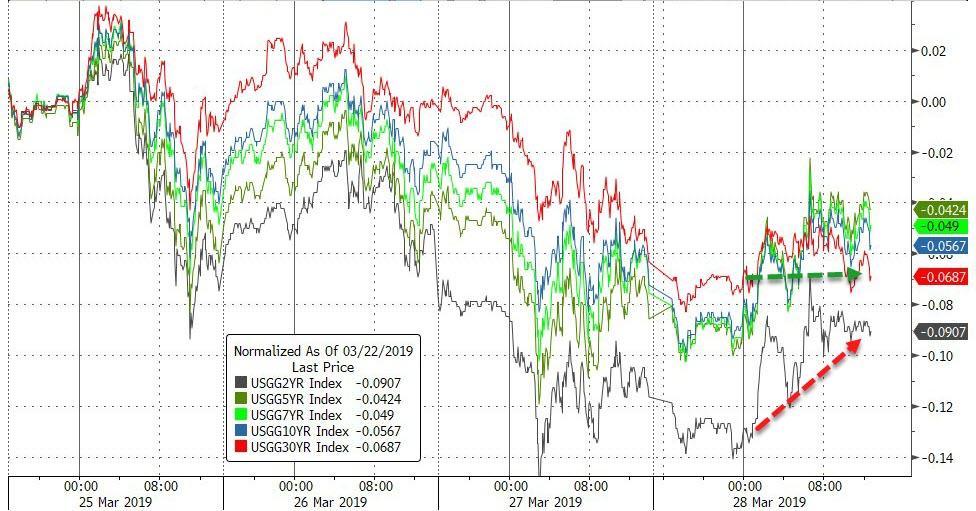

As opposed to yesterday’s ugly 5Y auction, today’s 7Y auction saw major demand, but that was not enough to cover the selling which saw yields up 2-4bps (except 30Y which was unchanged)…

30Y yields dropped below 2.80% for the first time since Jan 2018…

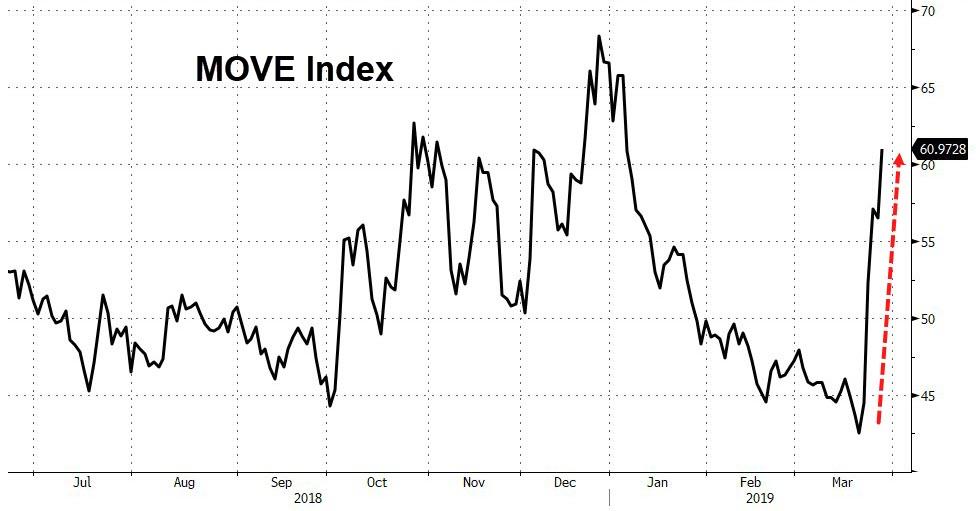

Bond vol exploded in the last week – the biggest spike since 2014…

Spiking to an important resistance level relative to stocks…

The dollar index spiked back above 97.00…

Trending higher in 2019…

The dollar gains were extended by cable weakness…

The Turkish Lira tumbled…

Leading EM FX into the red for 2019…

Cryptos were a snoozefest today…

Ugly day in PMs while copper and crude managed gains despite the stronger dollar…

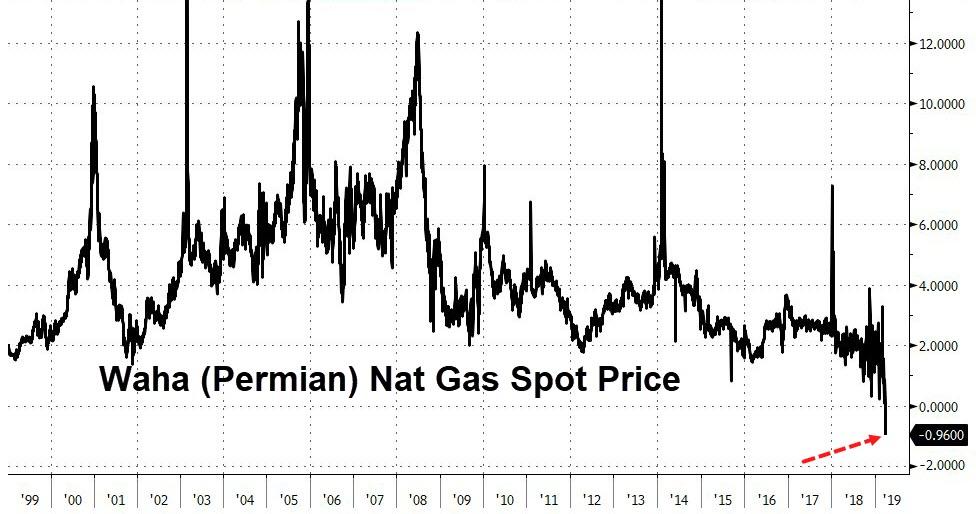

Following up on yesterday’s data, Permian Nat Gas prices have plummeted into negative territory – yes, drillers are force to pay end-users to take the natgas off their hands…

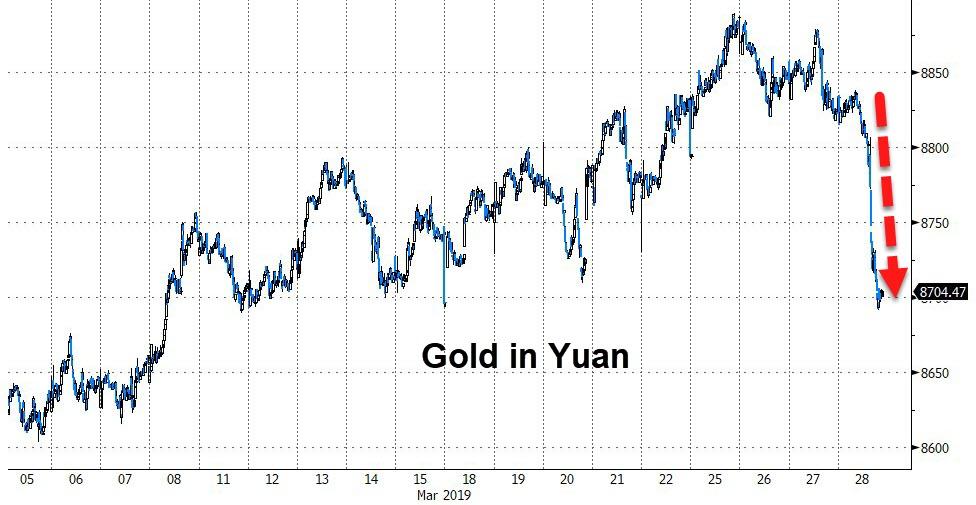

Gold fell on the day (against the dollar and yuan) – biggest drop against Yuan since June 2018…

But Gold in dollars broke below its 200DMA…

And back below $1300…

And silver slipped to its lowest since Boxing Day (12/26/18)…

Finally though, the gap between reality and perception remains near record highs…

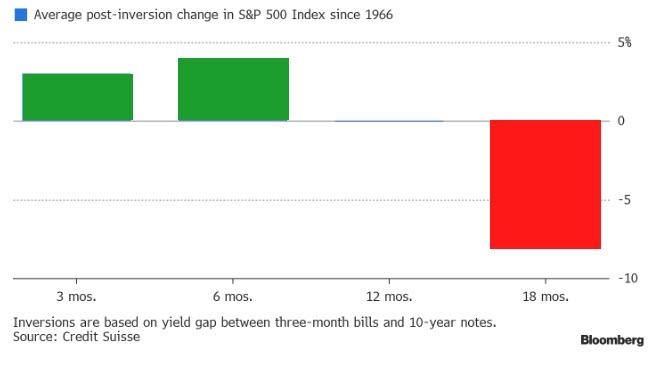

And don’t forget, a year after the yield on three-month Treasury bills rose above the yield on 10-year notes…

The S&P 500 was little changed on average.

Eighteen months later, the index had an average loss of 8 percent — typically because earnings turned lower, Andrew Garthwaite, a global strategist at Credit Suisse, wrote.

via ZeroHedge News https://ift.tt/2WtV4oD Tyler Durden