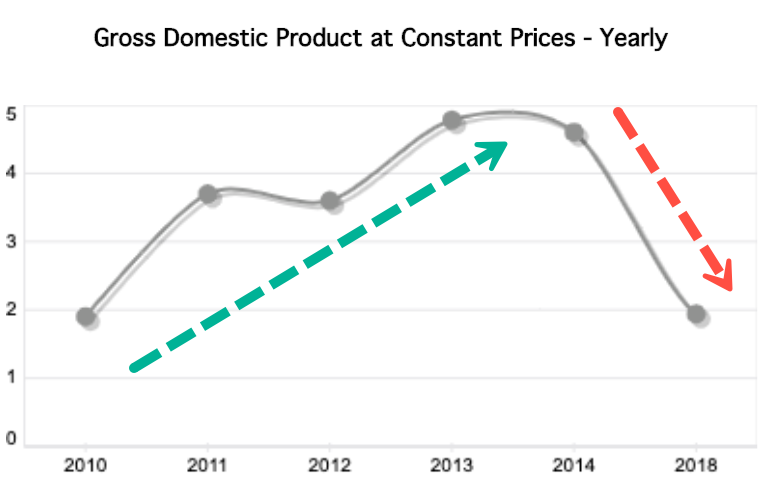

Investors earlier this week were shocked when Dubai’s long-awaited economic growth printed sub 2% — the slowest since 2009, and a sign that the country’s property sector could be in grave danger, reported Reuters.

Data released by the Dubai Statistics Center on Tuesday showed gross domestic product grew 1.9% in 2018, a steep fall from 3.1% the previous year.

“A weakening external backdrop, a strong U.S. dollar and the ongoing correction in the property market are headwinds for a number of vital sectors,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank.

Real estate prices in Dubai have dropped by more than 25% from their 2014 peak. S&P’s latest assessment of the market shows prices could fall by 10% in the coming quarters, before a potential trough in 2020.

The last time property prices crashed in Dubai; the government asked for a $20 billion bailout from oil-rich Abu Dhabi in 2009.

Analysts believe the economy could recover ahead of 2020 when the city hosts the World Expo event, but judging by the rapid global slowdown in Europe, Asia, and the U.S., one year from now seems far fetched.

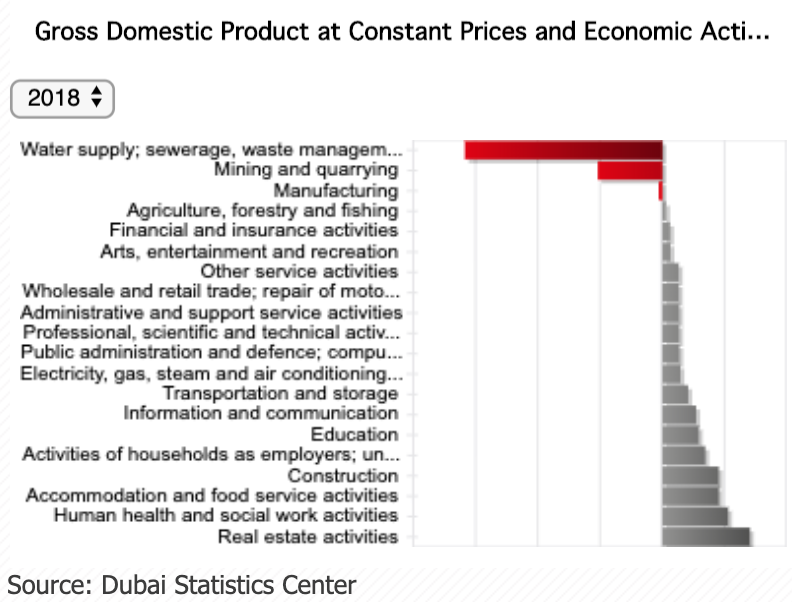

Government data revealed GDP growth was driven by trade-related activities, which rose by 1.3% in 2018 from a year earlier, representing 18.1% of total growth last year. In 2017, wholesale and retail trade increased by 0.9%.

Data showed that real estate increased by 7% in 2018 and accounted for 25% of total economic growth.

Growth in the transport and storage industries came to a screeching halt to 2.1% last year from a revised 8.4% in 2017.

London-based Capital Economics said real estate in the city would remain under pressure while a slowdown in the global economy will weigh on Dubai’s manufacturing and transport industries.

Capital Economics is forecasting GDP growth of 3.8% for 2019 before accelerating to 4.5% (considering global economic growth has slowed already in 1Q19 – the assessment could be too optimistic).

The independent macroeconomic research firm warned there are significant risks to the country’s outlook from long-standing debt problems, citing IMF data that show the debt of Dubai’s government-related entities (GREs) – which is the reason why a debt crisis formed in 2009 – is back to crisis levels, amounting to $60 billion or 50% of Dubai’s GDP.

“Debt restructurings in 2014 have masked the problems in recent years. But around half of GRE debt is due to mature between now and 2021,” said Jason Tuvey, senior emerging markets economist at Capital Economics.

“We’ve warned before that the risk of overcapacity after the World Expo means that the GREs could face weaker-than-expected revenues, harming their ability to service these debts,” he said.

Reuters said Abu Dhabi could roll over for the second time, $20 billion of debt, due sometime this month, that was injected into Dubai during the financial crash a decade ago.

Dubai’s downturn indicates broad stress across the global economy. Western manufacturers have spent decades integrating supply chains into the city’s top ports. So, it’s not surprising that Dubai is a coal mine canary for Western economies-now showing a trade recession could be immient.

via ZeroHedge News https://ift.tt/2V1g1qF Tyler Durden