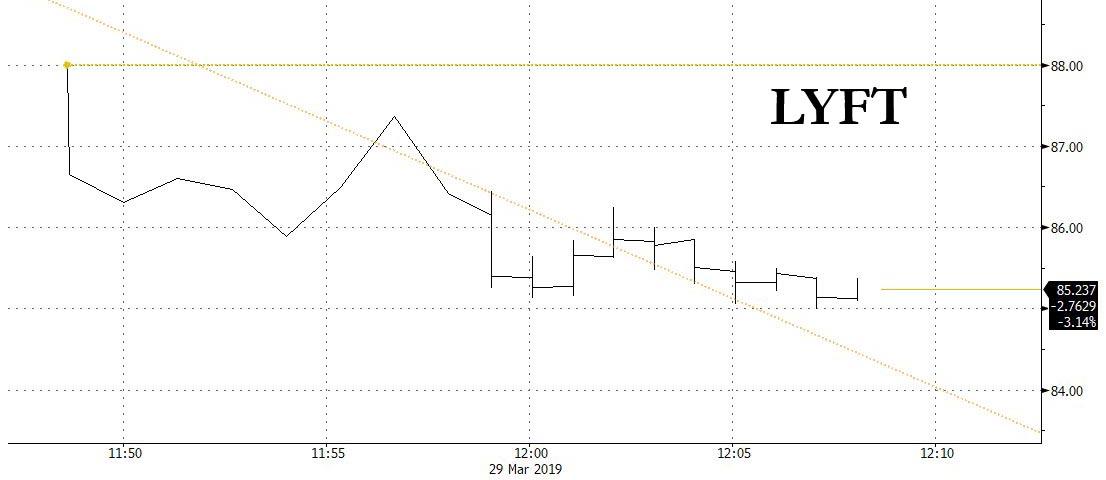

That “other” ride-hailing company, Lyft, surged 20% as it broke for trading just before noon on Friday.

A quarter of the float, or some 6.1 million shares changed hands when the stock began trading on the Nasdaq in New York, opening at a price of $87.24 per share. This followed the company’s initial public offering which raised $2.3 billion late on Thursday at a price of $72 a share, valuing the company at $24 billion.

Lyft’s IPO price was one of the highest ever, and was the largest US tech IPO since Snap in 2017, boosting hopes for a wave of listings by the most highly valued private companies including Pinterest, Slack, Airbnb, and the biggest so-called unicorn of all, Uber. It has also prompted concerns that with nearly three-quarters of a trillion in IPOs coming on deck, companies are rushing to come to market in what some have said is a top tick of the market

Addressing the question of why Lyft came to market now, co-founders Logan Green and John Zimmer said the decision to take the company public had been driven by the company’s internal readiness, not Wall Street enthusiasm.

Confirming that there is no scarcity of greater fools out there, investors rushed to buy Lyft shares despite massive, and increasing losses since it was founded in 2012 as a spin-off of Green and Zimmer’s first venture, a Facebook app for long-distance carpooling. In its marketing roadshow over the past two weeks, the company pitched its rapid growth in revenue and market share, as well as the expansion of the overall ride-hailing market, as a can’t-miss investment opportunity; it did not dwell too much on the company’s chronic and relentless losses.

While Lyft came to market ahead of its arch-rival, Uber, the latter is also preparing to unveil its own IPO as soon as next month, and some say it could be valued at more than $100 billion in one of the biggest public offerings in US corporate history.

“We thought the moment to do it was when we could go public without changing the day-to-day way we ran the company,” Mr Zimmer, Lyft’s president, told the Financial Times in an interview. “It happened to be that this a good moment in the market to do so.”

“Investors were excited to be part of this story because they saw there is a massive shift coming from owned vehicles to transportation as a service,” he said. “We’ve seen this play out in entertainment with Netflix and Spotify. They agree with us that there’s never been a market this large make that shift.”

On Thursday, Lyft sold 32.5 million shares at $72 each, the top end of its targeted range. The offering was “meaningfully oversubscribed”, leading the company to increase both its price range and number of shares on sale. JPMorgan Chase led the listing with Credit Suisse and Jefferies.

Commenting on the blistering IPO, Wedbush analyst Daniel Ives, who has a neutral rating on the stock, said that the $87 break price is “a lightning start for Lyft’s stock as investors are salivating owning a piece of the $1 trillion ride- sharing market. The robust start to trading is also a clear positive for other tech names that are watching Lyft to gauge investor demand and Street reaction on this transformational consumer tech name.”

”Lyft is popping the Dom Perignon today, but how the stock trades over the coming months and especially once Uber comes out and goes public will be the real test in our opinion.”

via ZeroHedge News https://ift.tt/2HVI2wi Tyler Durden