Much was said about the “green shoots” and renewed global growth impulse that emerged from better Chinese and US data yesterday (big beat in China Mfg PMI, strong US ISM, Retail Sales revisions higher and Construction Spending beat), which then led to a flush of newly established positions across USTs, duration and rates, with the implied June 2020 rate cut tumbling from -42% to -27%.

More importantly, according to Nomura’s Charlie McElligott, the purge of outright deflation fears and the re-emergence of the “slow-flation” mindset led to popular “risk barbell” positioning: Long Secular Growth and Long Quality / Defensives / Bond Proxies vs Short Cyclicals / Value), any sustained re-pricing higher of Growth or Inflation Expectations, which paradoxically could once again become a driver of underperformance for consensual US equity positioning.

As a result, while stocks soared on Monday, many investors and hedge funds who had put on the popular growth/deflation trade not only did not participate in the rally, they actually ended up in the red.

Accordingly, US Equities saw a significant thematic shift yesterday off the back of the “positive global growth impulse” via data. Indeed, as McElligott shows, the “value” factor exploded higher thanks to leadership from US cyclicals and the significant macro catalyst of “Bear Steepening” in US Rates Curves. Some more details:

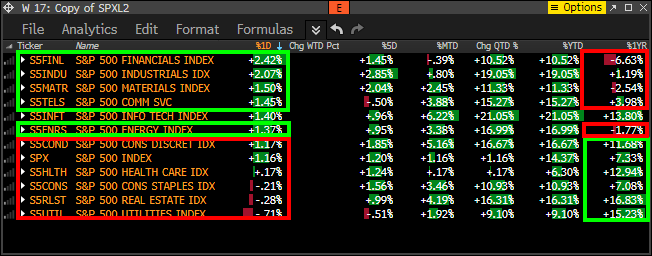

- Top 3 S&P sectors on the day all “Deep Cyclicals”: Financials (+2.4%), Industrials (+2.1%), Materials (+1.5%)

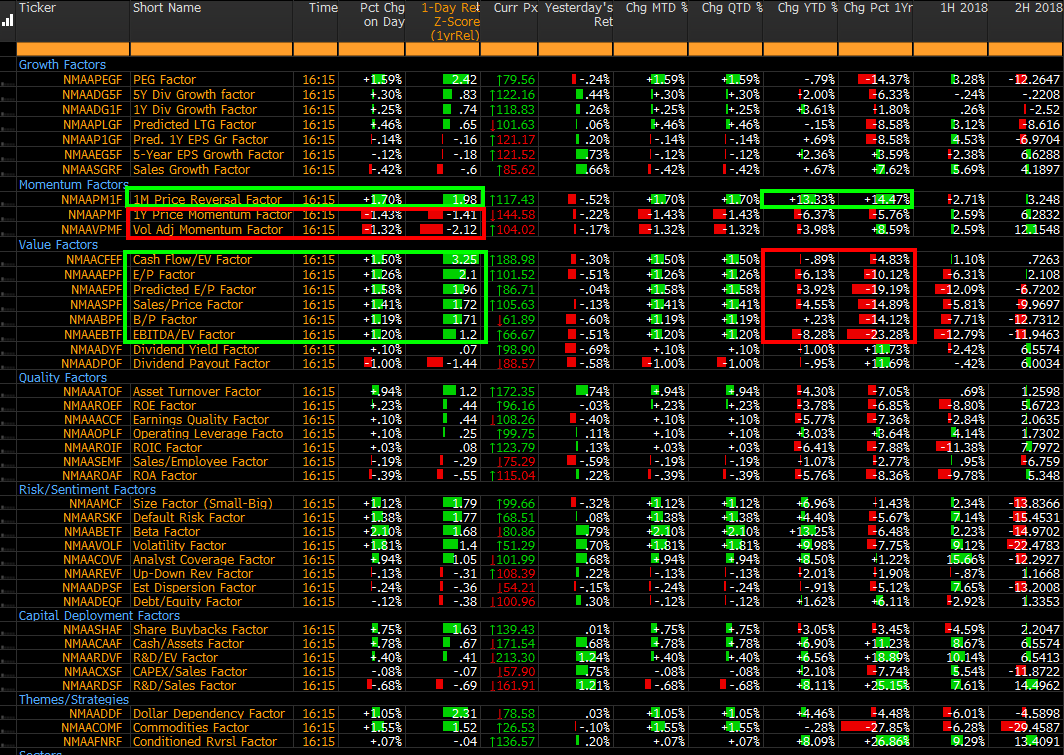

- Value factor proxies thus explode higher: Cash Flow / EV (+1.5%, a +3.3 z-score move over past 1Y); E/P (+1.3%, +2.1 z-score); Predicted E/P (+1.6%, +2 z-score); Sales / Price (+1.4%, +1.7 z-score); B/P (+1.2%, +1.7 z-score); EBITDA / EV (+1.2%, +1.2 z-score)

As a result of this sudden outperformance in “value”, the Nomura strategist observes that the dominant them of Monday’s price action was “Pain” for “1Y Momentum” strategies, as “Value” names/sectors make up significant portions of “1Y Momentum Shorts” being the largest “losers” of the past year, with too the additional macro headwind yesterday in the form of said “Bear Steepening” of the yield curve adding further pressure:

- “1Y Price Momentum” was clobbered -1.4%, a -1.4 z-score move relative to 1Y returns

- “Vol Adjusted Momentum” too suffered, -1.3%, a -2.1 z-score move

- “Sector Neutral Momentum” (proxy for “quant” fund-style momentum) was -1.1%, a -1.4 z-score move

- As “Value” led, “Consensus Shorts” were thus squeezed powerfully—1Y Momentum Shorts +2.3%, 2018 Worst Performers +2.3%, High Short Interest +1.4%

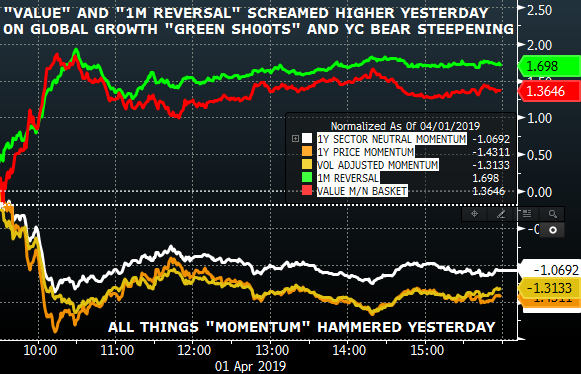

The chart below summarizes best the price action seen as a result of yesterday’s “Green shoots”, where “value” and “1M price reversal” factors exploded higher, while “momentum” factors were all crushed.

At the sector level, action was also all bout reversal, as the past year’s largest losers/laggards lead, while all winners suffered.

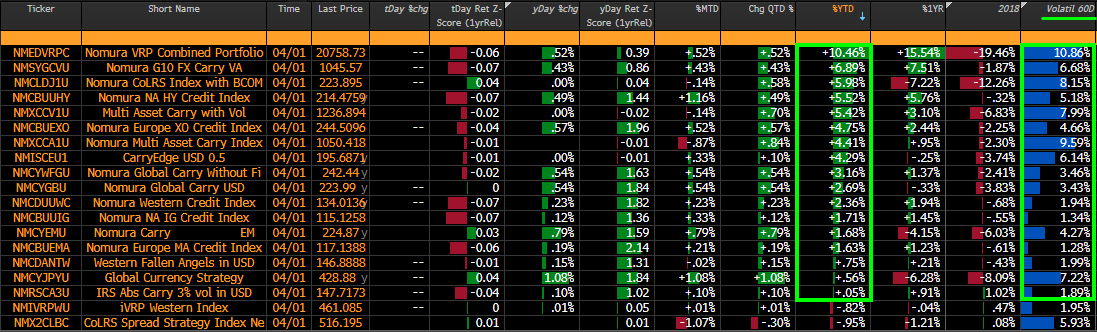

So in addition to the sharp repricing/steepening in the bond market – some of which has reversed this morning as growth fears re-emerge – and the painful underperformance of winners, McElligott also highlights the collapse of volatility, resulting from the world shifting back to “carry” mode as central bank vol suppression returns with a vengeance.

- Cross-asset vols were again smashed yesterday, with Rates “carry” folks re-engaging into the recent jump in realized, while within Equities we saw fundamental funds “rolling-out” options which in turn pressured short-dated vol, while too systematic sellers remained active

- It all comes down to the renewed “Carry is King” worldview in-light of Central Banks being scared of their own shadows and in max “vol suppression” mode

- A look across Nomura QIS’ “Carry” strategies captures this incredible demand for carry / performance YTD, in light of the regime shift back to “short vol”

Finally, with the bitcoin explosion overnight, McElligott observes “things that make you go hmm”, and points out that the return of vol suppression by central banks (recall that in 2017 bitcoin was used by even conventional trading desks due to its massive volatility), and the resumption of speculative assets bubbles, has benefit cryptos which blasted off higher, with most rising above their 200DMA for the first time in a year. As the Nomura strategist puts it “Funny what some excess liquidity and “wealth effect” (likely / particularly in Asia) can do for a completely spec “asset” like Crypto” and recaps the recent action:

- The BGCI Bloomberg Galaxy Crypto Index is now +58.6% off the Dec lows

- Bitcoin is +51.7% off Dec lows

- Bitcoin Cash is +139.2% off Dec lows

- Dash is +111.1% off Dec lows

- EOS is +165.6% off Dec lows

- Ethereum is +86.4% off Dec lows

- Litecoin is +201.0% off Dec lows

- Monero is +69.1% off Dec lows

via ZeroHedge News https://ift.tt/2FJcO8V Tyler Durden