Commenting on recent gyrations in the Turkish currency, Rabobank’s Michael Every writes that the lira ended Monday’s volatile session on the firm footing appreciating more than 1% versus the dollar as the market continued to digest the outcome of local elections held on Sunday and tried to assess potential implications of Turkey’s biggest cities voting against President Erdogan’s AKP candidates.

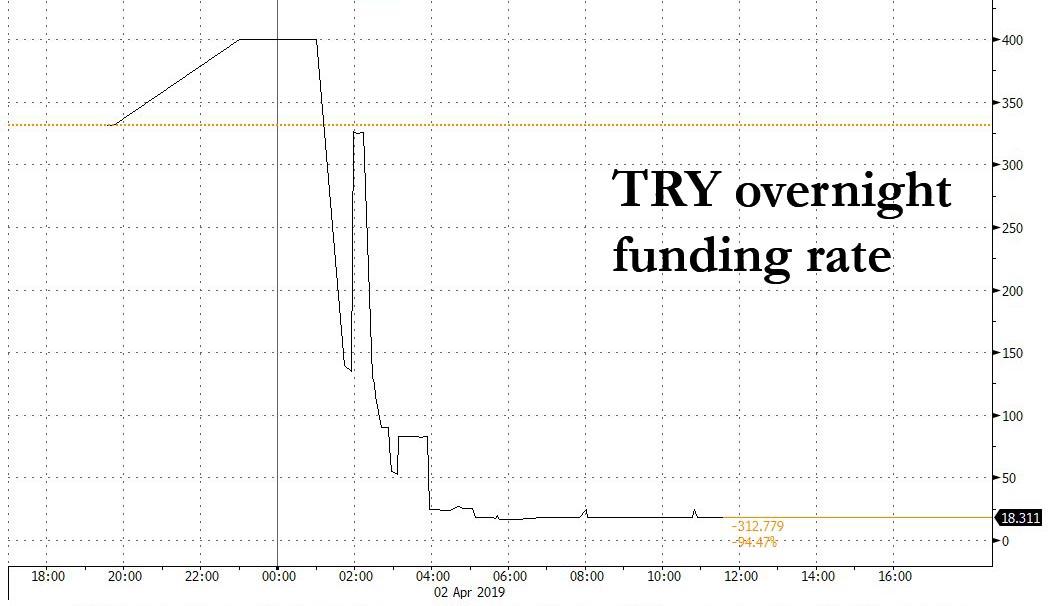

That said, Every notes that he “would be careful trying to read too much into the price action in USD/TRY witnessed on Monday. Lira’s liquidity in the offshore market remains tight as reflected in the overnight swap rate sharply again to more than 300% on the day” and adds that “essentially, it is not a properly functioning market.“

As a result, investors who are concerned that the Erdogan administration may turn towards populist measures – instead of prudent policies to rebalance the economy – find it prohibitively expensive to short the lira. Every concludes that “unless the overnight swap rate falls back to the levels seen before the credit crunch, i.e. around 24%, any lira’s recovery should be taken with a pinch of salt.”

Well, that’s precisely what happened on Tuesday, when the Turkish lira’s overnight funding costs tumbled once again as it has become prohibitive difficult for the central bank to continue its vendetta against the shorts, with the rate plunging from over 300% to just over 18%, below levels seen during the credit crunch, and in fact below the central bank’s prevailing rate corridor.

As a reminder, last week the overnight swap rate gyrated wildly as a result of measures designed to curb short-sellers before this weekend’s local elections drove it to a high of more than 1,300% as liquidity in the offshore market evaporated. As a result, with local banks keeping a lid on lira funding, foreign investors were forced to access the currency by selling holdings of Turkish bonds and equities, resulting in a crash in local capital markets.

Of course, as discussed before, Erdogan’s play to punish lira shorts cut both ways, as the swap market is one of the biggest sources of Turkish lira funding for money managers trading the nation’s assets and the squeeze didn’t just cripple investors trying to bet against the currency, but also those who had sold dollars and bought liras. That’s because many of them had then lent out the local currency via short-term swaps to benefit from a juicy interest rate, then suddenly found themselves unable to get the funding needed to reverse the trades.

As a result, last week’s punishing short squeeze ended up hurting longs just as much as longs, but worst of all, it has crippled foreign investor confidence in the country’s capital markets, which is a major problem for Turkey which for years has been overly reliant on offshore capital to fund its current account gap.

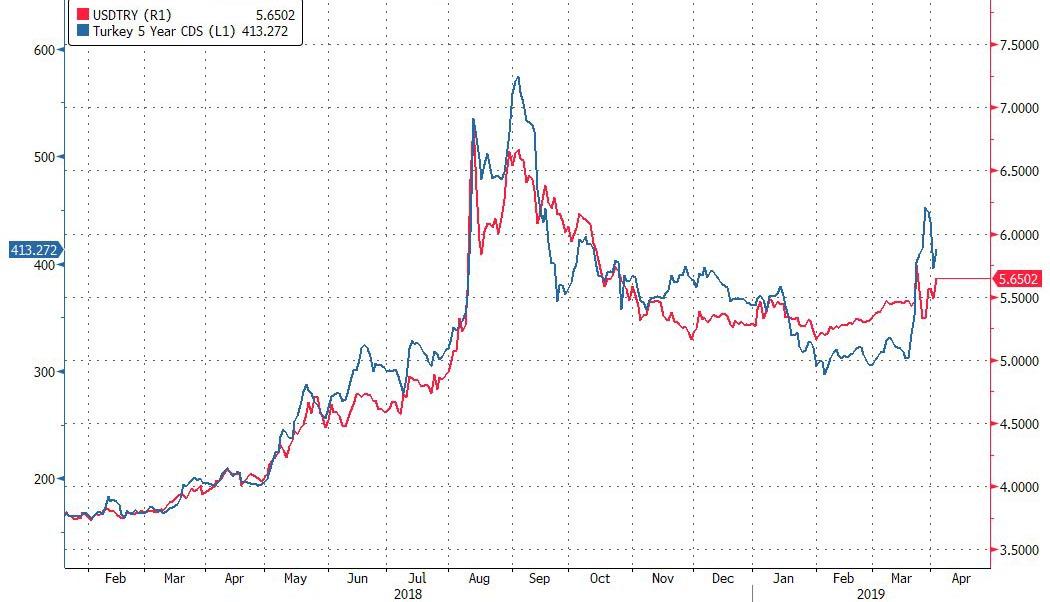

As a reminder, two weeks ago, the most severe bout of market turmoil since Turkey’s August crisis was triggered after a plunge in central bank reserves and a recommendation to short the currency by JPMorgan sent the lira down more than 5%. As Bloomberg wrote at the time, that raised concerns that the money that had poured Turkey to take advantage of the central bank’s 24% benchmark rate would flee.

In any case, it appears that Erdogan’s experiment in currency micro management has ended with a thud, and after spooking shorts, they were back with a vengeance on Tuesday, then the Turkish lira tumbled more than 3% to session low of 5.6806 before fractionally trimming its drop.

And while traders curious just how much further the Turkish lira will fall if indeed Erdogan’s crusade against shorts is now over, one hints comes from Turkey’s CDS, which have historically tracked the USDTRY almost perfectly, and which would imply a fair value somewhere close to 6.00…

… which while quite bad, and in line with JPMorgan’s infamous 5.90 USDTRY reco, is still a ways away from the recent TD recent price target of north of 7.00.

via ZeroHedge News https://ift.tt/2WHooIE Tyler Durden