The market asked Powell, “where’s the ‘dovish’ meat?” and he had no answer…and the market suddenly tightened its rate-cut expectations by 14bps!!

Powell translated:

Oh and in case you wondered where the meat was – it was here! Beyond Meat soars over 175% from its IPO price…

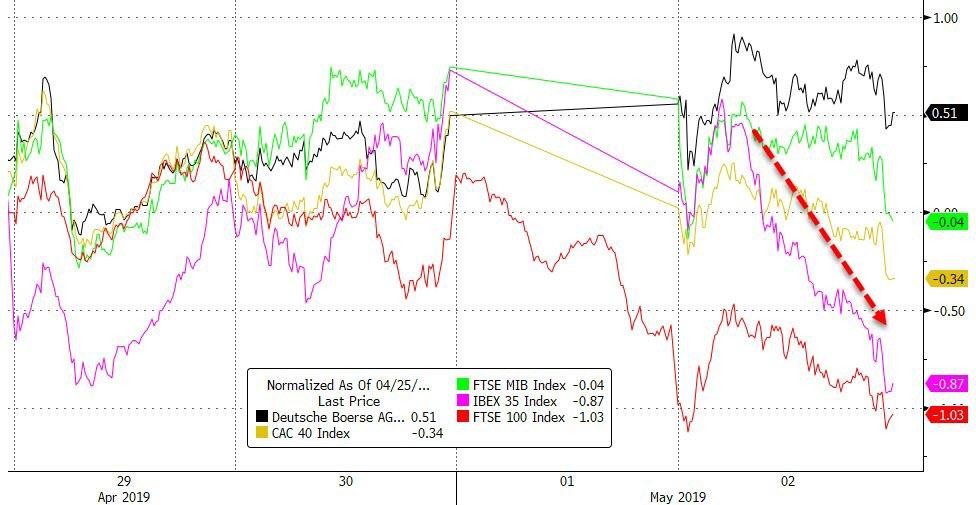

Chinese markets were closed overnight but European markets reopened weaker after US ended lower…

US markets tried to rebound from Powell’s mishap but headlines from China that the trade deal had reached an “impasse” sparked selling as Europe closed…

Nasdaq is suffering the most on the week for now.

The Dow is heading for its second down week in a row (the first consecutive loss since Dec 21st) – a terrifying thought – and as Nomura’s Charlie McElligott noted, CTAs have just flipped to 100% short…

NOTE – The cash Dow filled its gap from the 4/12 open

VIX spiked to almost 16 intraday before ramping back, but remains decoupled from stocks…

And bear in mind that VIX specs are at a record short…

Which, given VVIX’s surge today, makes us wonder if all those VIX shorts are buying VIX protection…

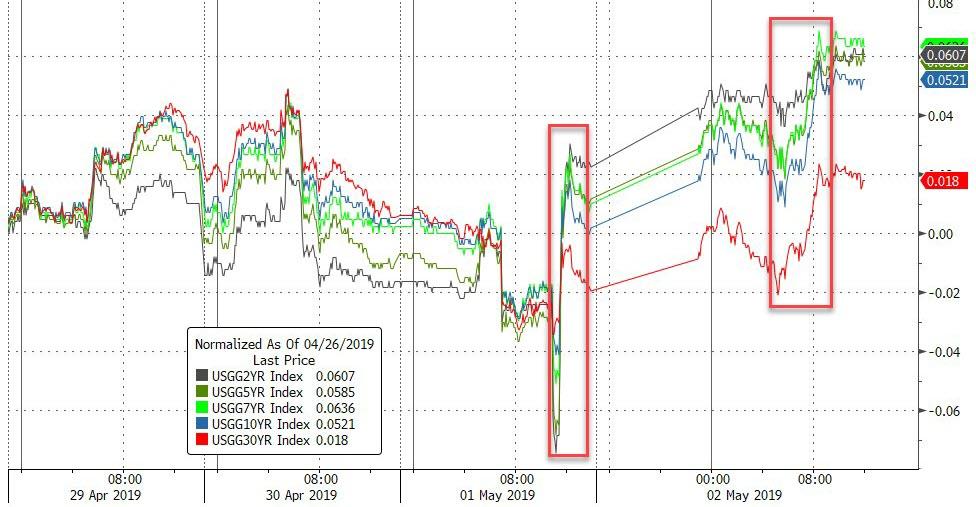

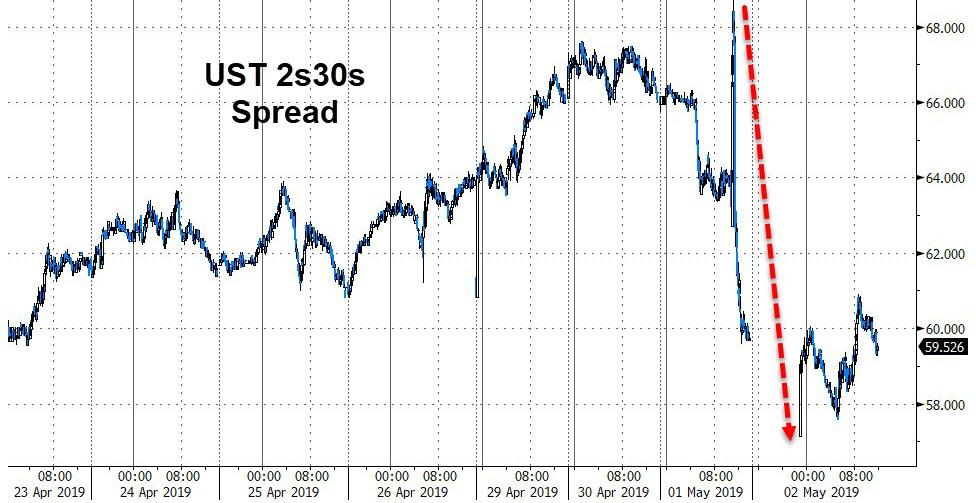

Treasury yields were higher across the curve today as Powell’s “transitory” hawkishness rippled up the curve… (the belly slightly underperformed +5bps vs the wings at +3.5bps)

The yield curve has flattened quite notably after an initially exuberant steepening…

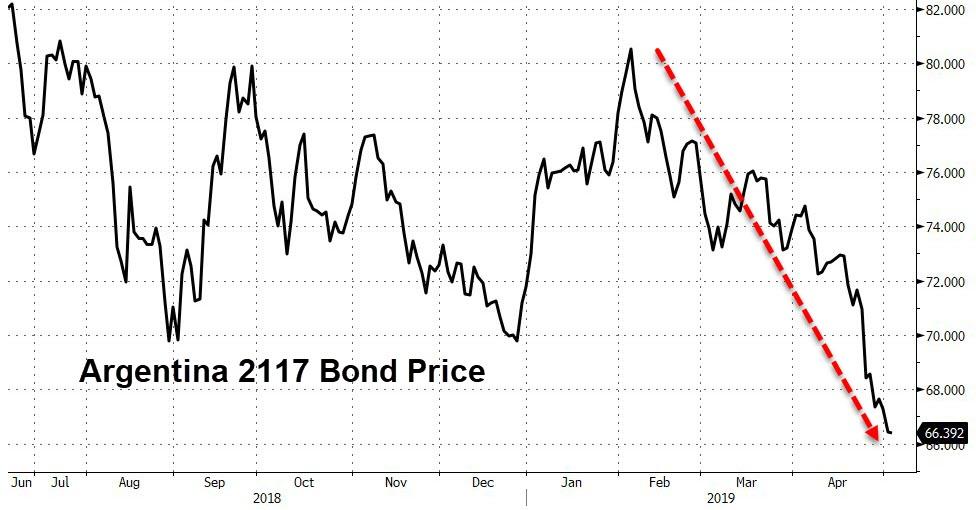

Still could be worse – could be Argentina’s Century Bonds (which just hit a new record low)…

Inflation breakevens continued to slide (along with crude prices)…

The Dollar extended yesterday’s gains post-Powell…

Yuan was pressured on the back of China trade deal “impasse” headlines…

Cryptos held on to gains today with Bitcoin best on the week…

WTI was the worst performer among the commodity complex but all drifted lower…

WTI traded very technically, breaking down to its 50DMA after breaking below its 200DMA, only to rebound back up to the 200DMA

Gold was smacked lower again, testing its 200DMA and bouncing hard once again…

Silver was also slapped to five-month lows…

And Dr.Copper collapsed through key technical levels to its lowest since mid Feb…

And finally, as BMO’s Brad Wishak highlighted, the world’s favorite (and also largest) index to completely ignore is flashing another negative divergence here…the exact same divergence that kicked off the the fall equity slide lower.

Back in SEP the SPX pushed to new all time highs while the NYSE did not, flagging the initial divergence. Y’day the SPX again made fresh all time highs with the NYSE again NOT confirming.

Is it different this time?

via ZeroHedge News http://bit.ly/2ZNA1QB Tyler Durden