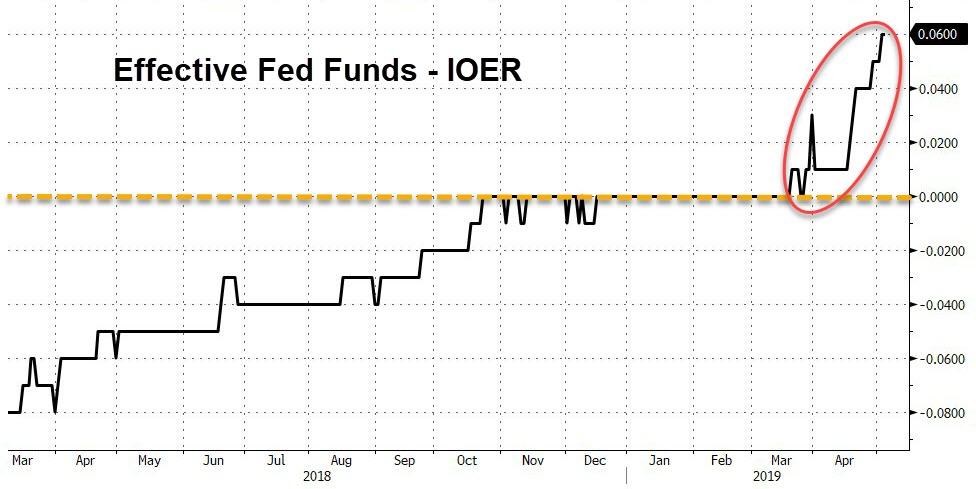

The Fed’s tweak to the funding markets failed to take back control…

As The Fed’s IOER cut left EFF still 6bps rich…

And so, a ‘murder’ of Fed Speakers were unleashed today and they managed to inch the market’s rate expectations in a dovish direction, but on the week, thanks to Powell’s “transitory”

The key message was obvious:

Chinese markets remain on holiday (and will be through Tuesday) but Chinese stocks remain the leader in 2019…

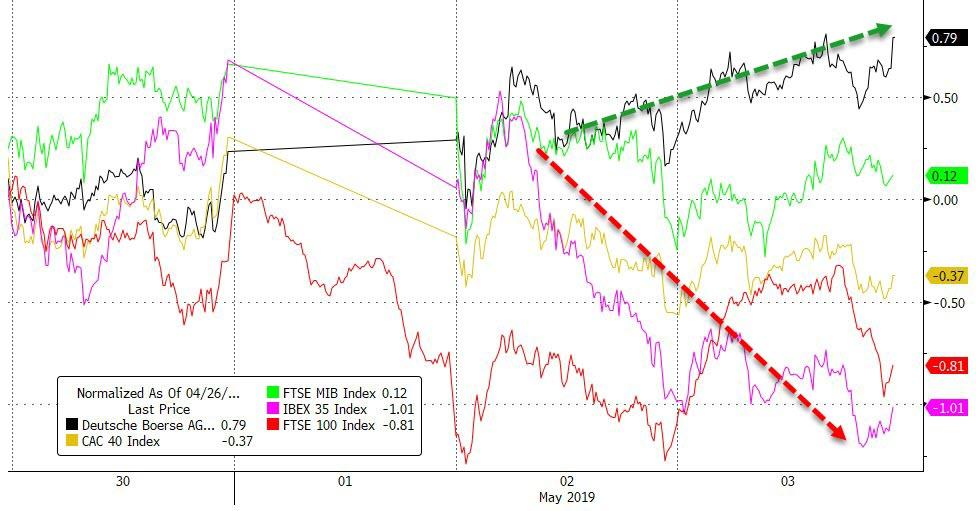

European stocks were very mixed with Germany’s DAX leading and UK and Spain lagging…

An epic short-squeeze ramped US equities back into (or near) the green for the week…

With Small Caps and Trannies leading… Nasdaq and S&P were levitated almost perfectly into the green for the week…

Nasdaq up 6 week sin a row and 16 of the 18 weeks in 2019.

Nasdaq soared today on the back of Berkshire buying some Amazon shares… (FANG stocks managed to get back to breakeven on the week only though after the GOOGL drop)

For The Dow, this is the same panic-bid we saw last Friday… Dow down for 2nd week in a row – first time since Dec 2018

VIX has now risen for 3 straight weeks (albeit marginally) – the longest streak since Oct 2018

Treasuries were bid today, shifting the long-end yields back to unchanged on the week, while the short-end remain notably higher in yield…

The yield curve flattened dramatically on the week (after a brief spike initially on the Fed statement)…This was the biggest weekly flattening in 5 months

Roller-coaster week for the dollar surging back to unchanged on the week after The Fed, then tumbling today after payrolls…

Yuan ended the week unchanged (after a big bounce back today) even with China closed…

The peso surged today ahead of Cinco de Mayo…

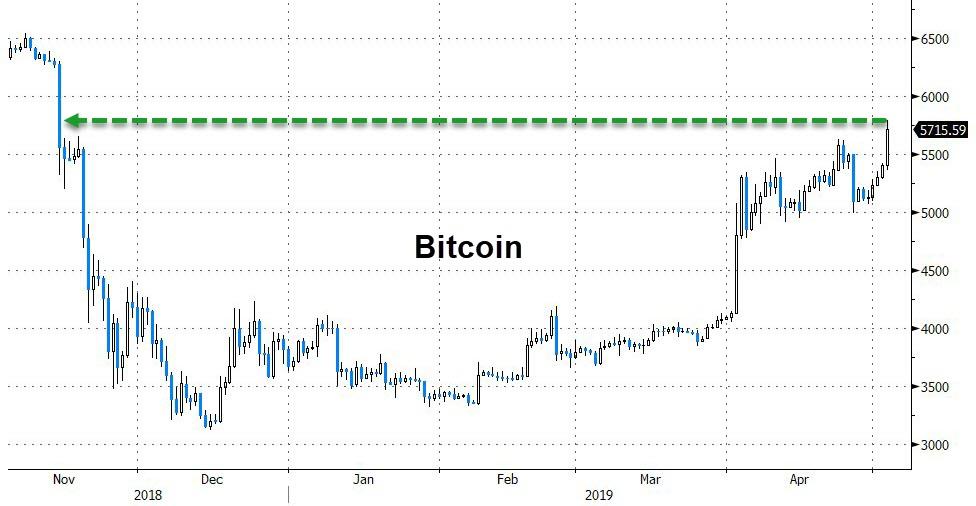

Big week for Cryptos with Bitcoin and Bitcoin Cash leading…

As Bitcoin tests $5800…

Strong bounce back day for commodities today was unable to get them green on the week but gold outperformed as copper lagged…

Gold bounced off its 200DMA once again…

WTI fell for the 2nd week in a row – the biggest 2-week drop since 2018…hugging the 200DMA…

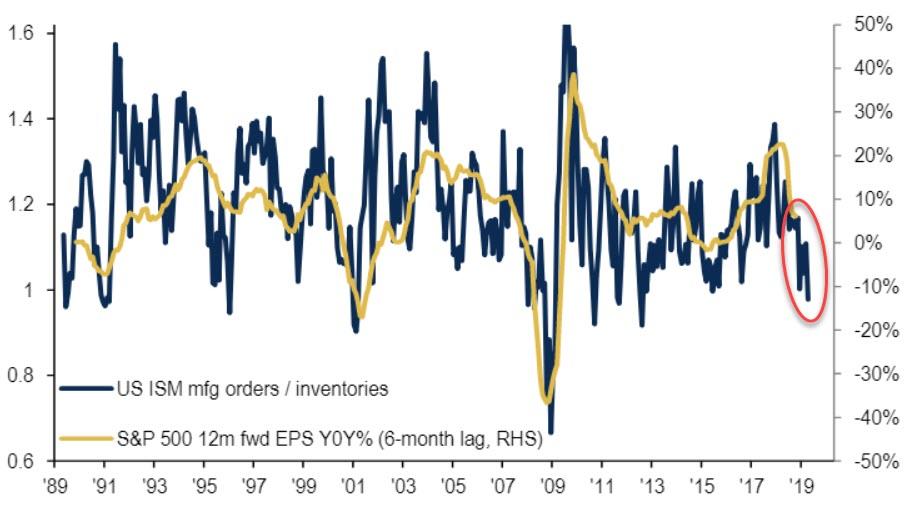

Finally, as BofA notes, ISM’s collapse (which everyone seemed to ignore this week) is a major warning signal for US EPS growth…

Which is already lagging the market’s enthusiasm for free money…

Global money supply better start picking up again soon…

via ZeroHedge News http://bit.ly/2H0pr11 Tyler Durden