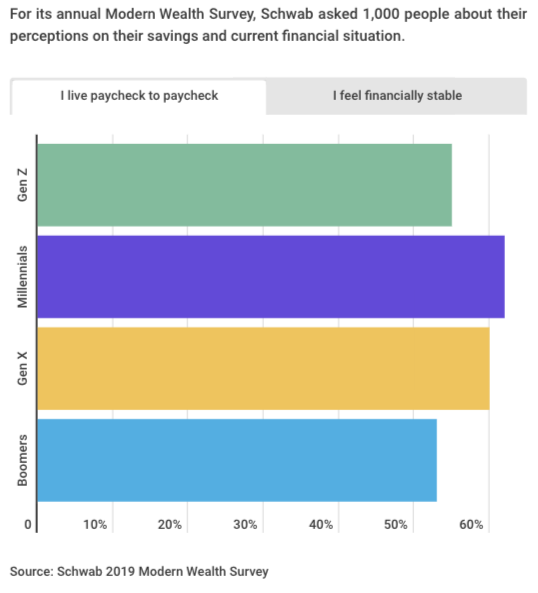

Almost two-thirds of Millennials are living paycheck to paycheck, and only 38% feel financially secure, according to Charles Schwab’s 2019 Modern Wealth Index Survey.

According to the survey, Millennials (ages 23 to 38) seem troubled when it comes to their financial well being. The study examined the finances of 1,000 Americans from different generations, but for our sake, we’re only concentrating on approximately 380 Millennials surveyed by Schwab.

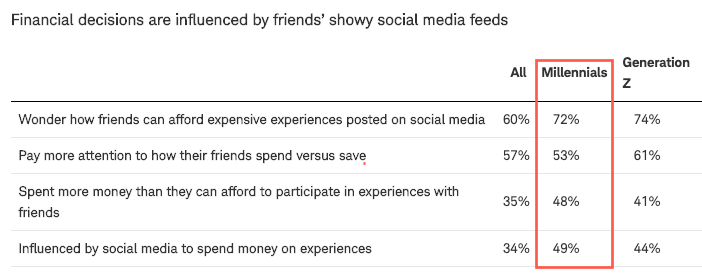

Millennials conveniently blamed social media platforms for their dire financial straits. The need to spend was a symptom of fear of missing out (FOMO) of their friend’s experiences seen on social media posts, stories, and or feeds.

“The burden to ‘keep up with the Joneses’ has been part of our culture for decades, but it appears that social media and the fear of missing out (FOMO) have increased the pressure to spend,” said Terri Kallsen, executive vice president and head of Schwab Investor Services.

“Spending is not the enemy, but when we allow social pressure or other forces to lure us into spending beyond our means, it can impact long-term financial stability and become a larger problem.”

Logica Research conducted the online study for Schwab during the first two weeks in Feburary.

Facebook and Instagram, recently made it effortless for users to shop on their platforms. Instagram announced last month it added a “checkout” feature on posts.

“Instagram is a place for people to treat themselves with inspiration, not a place to tax themselves with errands. It’s a place to experience the pleasure of shopping versus the chore of buying. We build everything with this in mind,” Instagram said in a statement.

While it’s not just a spending problem, Millennials have more debt than any other generation.

In a recent article, we reported that these young adults’ debt loads have risen by 22% in the last five years.

Many of these youngsters are drowning in debt, but the composition of that debt is not the usual mortgage debt. Most of the debt is tied to student loans, credit cards, and auto loans, keeping this generation in a perpetual state of debt servitude to government and corporations.

Skyrocketing home prices and stagnating wages have unleashed the housing affordability crisis that has driven millennial homeownership levels to record lows, forcing many to continue adding debt through renting.

Even though Millennials are on the cusp of surpassing baby boomers as the largest generational demographic in the US, and the next five years will be the majority of the workforce, they still don’t have $500 in savings ahead of the next recession.

Schwab’s new study suggests Millennials will be devastated when the next recession strikes. Judging by the escalation in the trade war, a recession could arrive as early as 1H20.

via ZeroHedge News http://bit.ly/2W1Q9Pj Tyler Durden