Quant Quake Goes Global Amid Momo Meltdown, Bond Bloodbath

Momo traders be like…

The ‘Quant Quake’ has spread across the world…

The global quant reshuffle continues… Catchup moves in Asia and continuation in Europe/US. c/o Morgan Stanley pic.twitter.com/fEu9nycXvn

— Michael Krause (@michaelbkrause) September 10, 2019

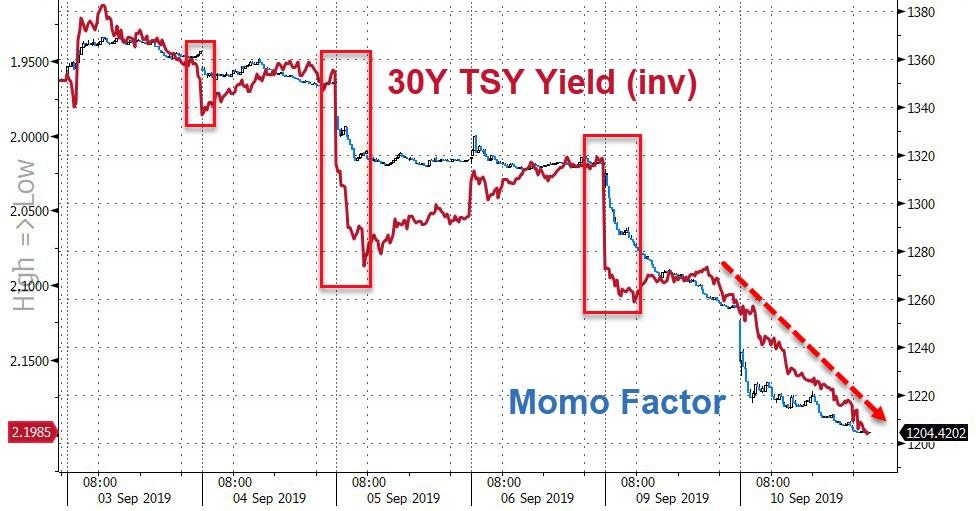

And showed no signs of stopping in today’s trading session…

Source: Bloomberg

In fact the momentum factor has now crashed into the red for the year (after being up over 13% last week)…

Source: Bloomberg

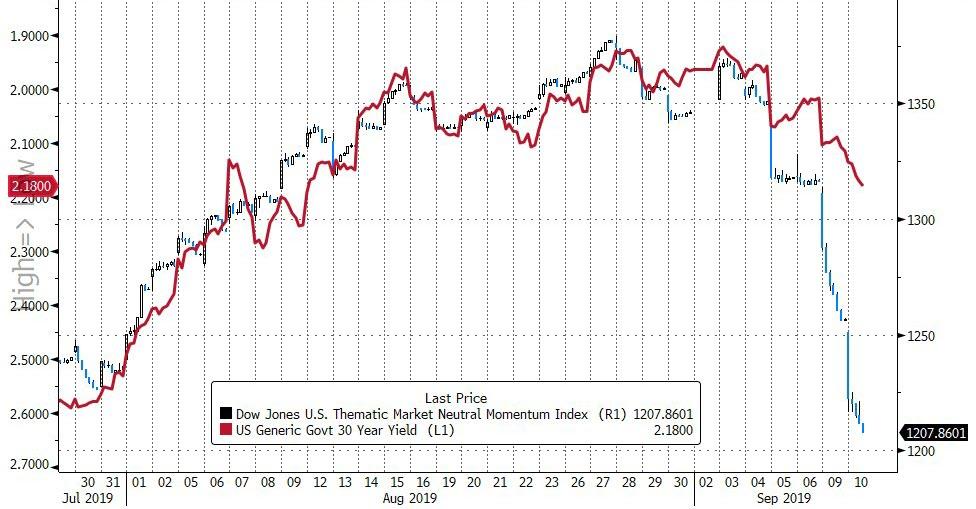

It seems like the momentum factor reached a serious level of resistance once again…

Source: Bloomberg

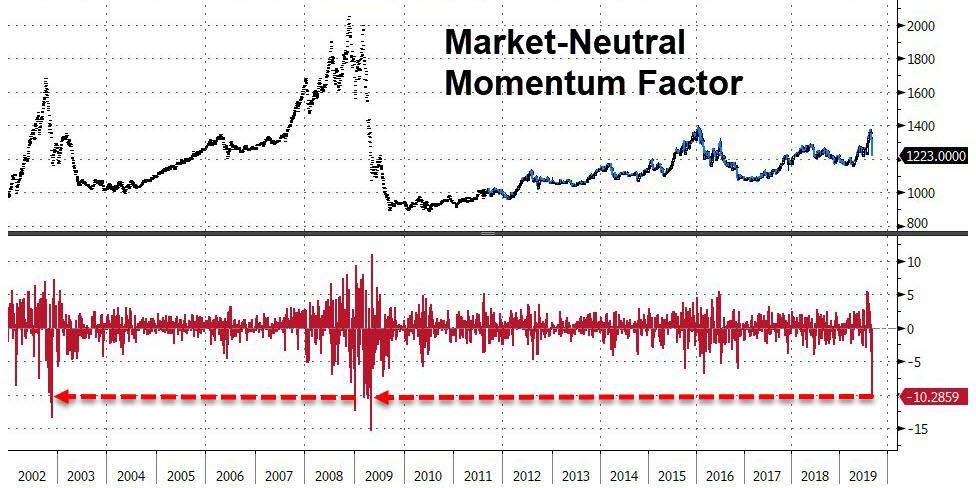

This is now the biggest collapse in the momentum factor since the dot-com era and the financial crisis quant crash…

Source: Bloomberg

How long before this weighs more directly in the broad index?

Source: Bloomberg

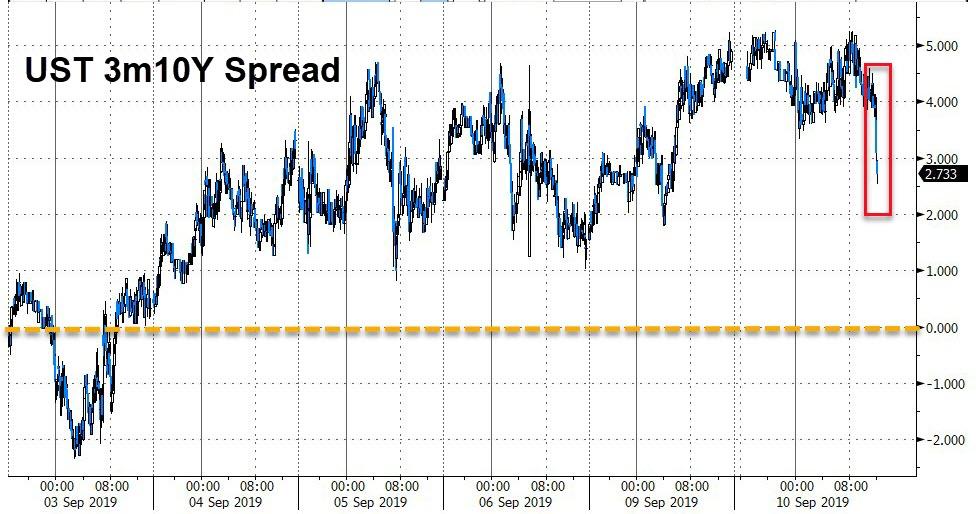

And as momo collapses, Treasury yields are soaring as CTAs are forced to dump bonds…

Source: Bloomberg

And may mean that bonds have a long way to fall before this is over…

Source: Bloomberg

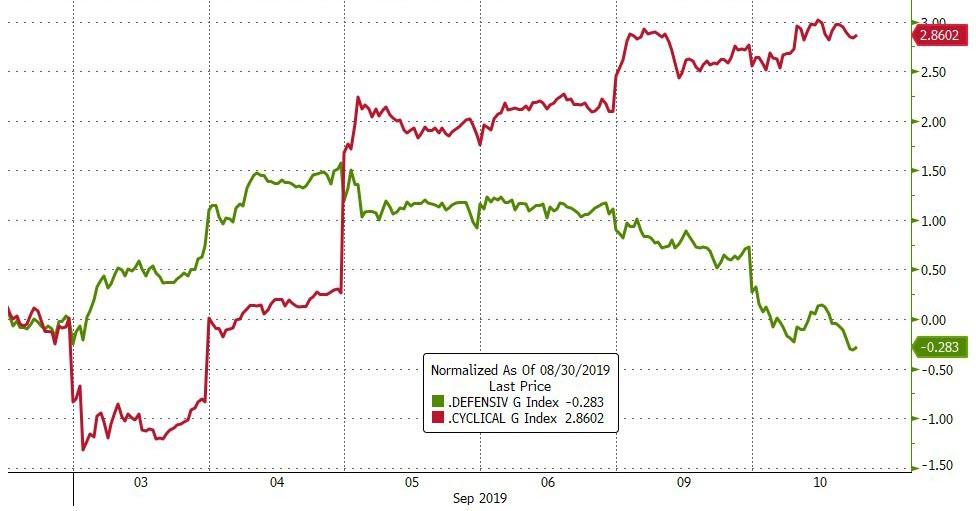

The impact of this factor unwind has sent cyclicals higher and defensives lower as Bob Pisani exclaimed “I think this is a good thing.” Except it appears ol’ Bob doesn’t see the driver of this shift as problematic at all…

Source: Bloomberg

On the day, Trannies and Small Caps surged (see short-squeeze below) as Nasdaq tumbled, only to be panic-bid back near unchanged on the day.

NOTE – stocks melted up in the last few minutes as bond yields really spiked into the close.

Most-Shorted Stocks have soared this week too…(NOTE – this is the biggest 5-day short-squeeze since the start of the year)

Source: Bloomberg

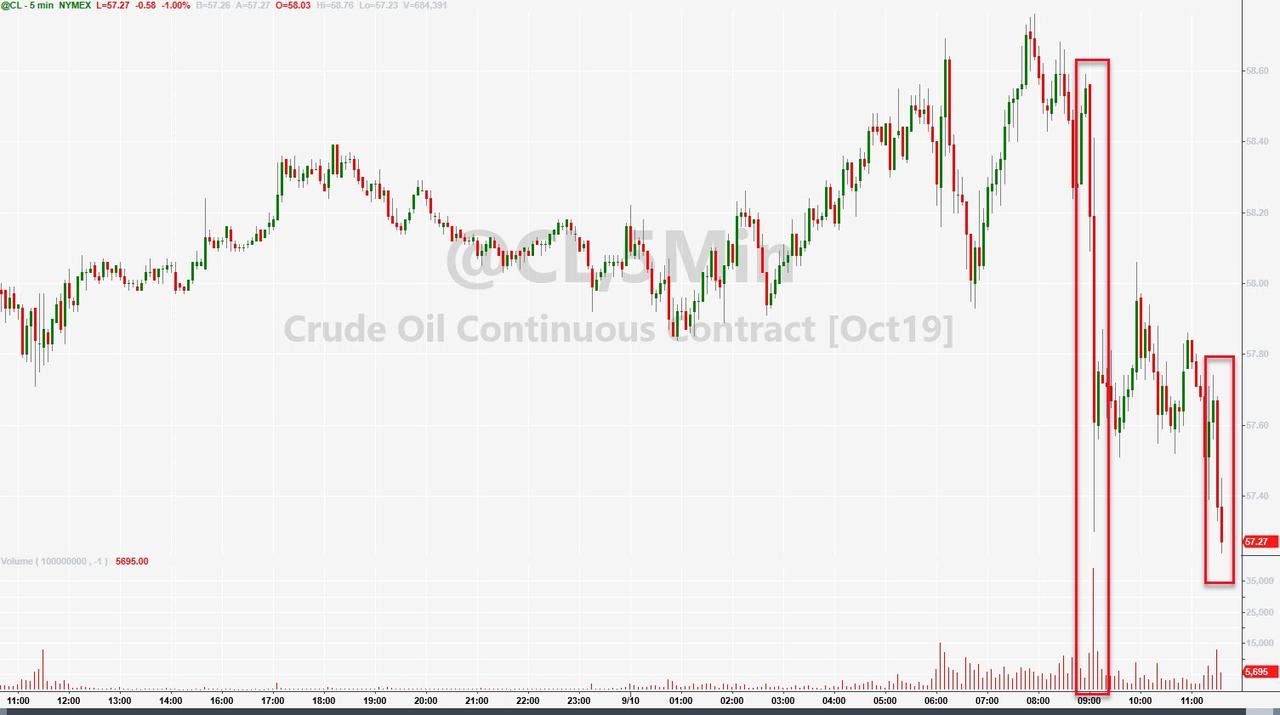

Energy stocks were best today, despite oil prices plunging…

Source: Bloomberg

Bank stocks continue to outperform the broad market (as the beneficiaries of the factor unwind) and track the yioeld curve steeper…

Source: Bloomberg

It’s been a bond bloodbath the last 5 days…with the entire curve shifting higher by 22-25bps (and really getting hammered into the close today…

Source: Bloomberg

10Y Yields are up 5 days in a row – up a stunning 24bps – the biggest jump since Trump’s election in Nov 2016…

Source: Bloomberg

30Y Yields are at a key resistance level…hitting 2.20% today

Source: Bloomberg

The late-day carnage in bonds was focused more on the short-en, sparking a bear flattener…

Source: Bloomberg

Are rates set to soar even further given the positive surprise macro data?

Source: Bloomberg

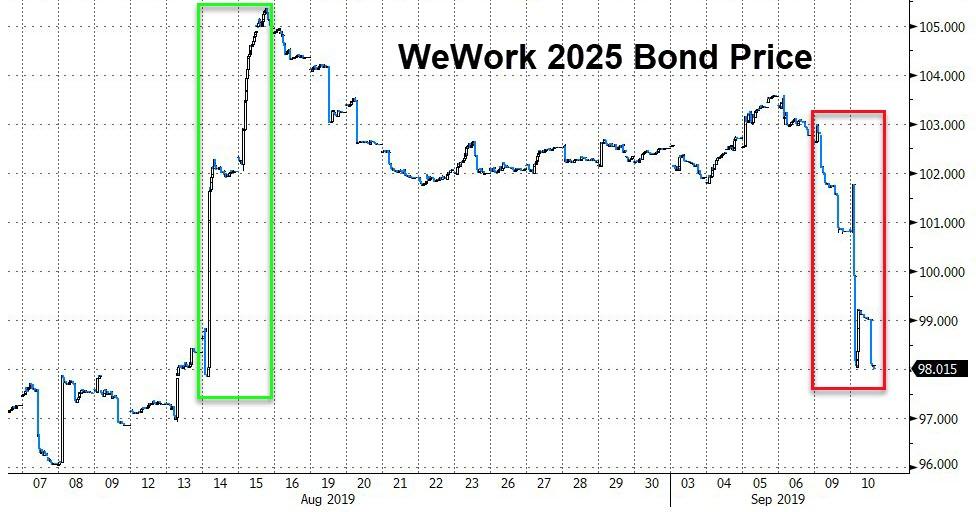

WeWork bonds crashed today, erasing the post-IPO filing gains and falling back below par…

Source: Bloomberg

The Dollar trod water for the 2nd day in a row (hovering around the lows of Trump’s tariff tantrum)…

Source: Bloomberg

Cryptos continued to slide lower today…

Source: Bloomberg

Silver was best, managing to end unchanged as oil and gold underperformed…

Source: Bloomberg

Gold continues to trade in sync with global negative yield aggregate volume…

Source: Bloomberg

Meanwhile, the firing of neocon NSA John Bolton took war premium out of crude very suddenly (and tumbled into NYMEX close)…

Source: Bloomberg

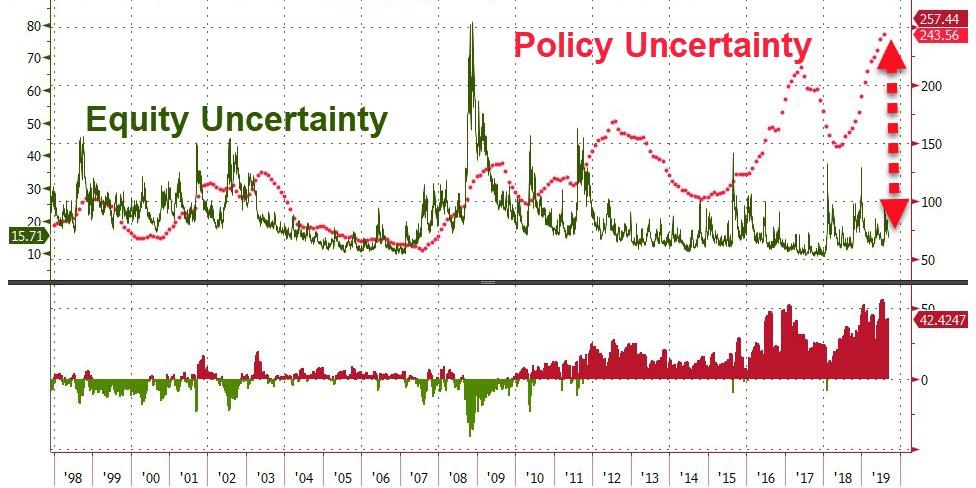

Finally, while policy uncertainty has hit record highs, equity market uncertainty remains delusionally low…

Source: Bloomberg

But the yield knows better what is to come…

Source: Bloomberg

Tyler Durden

Tue, 09/10/2019 – 16:01

via ZeroHedge News https://ift.tt/2A8MN0s Tyler Durden