Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews…

About this MNI story on a possible delay in ECB QE announcement:

1) No substance, including from the ECB “sources”

2) Let’s hope the story is as accurate as the previous ones— Frederik Ducrozet (@fwred) September 10, 2019

… it does highlight just how sensitive the bond market is to an announcement of aggressive easing by the ECB when it meets on Thursday, Sept 12, where consensus generally expects a significant easing package, including a -20bp rate cut (followed by -10bp cut later on), coupled with roughly €30 billion in sovereign debt QE for 9-12 months, coupled with enhanced forward guidance.

The three package expectations (small, medium, large) by Goldman analysts are laid out below:

There is just one problem: while it is unclear if any further easing by the ECB will do anything to stimulate the Eurozone economy, one thing is certain – further easing will only cripple Europe’s banks. In fact, as Goldman writes in its ECB preview, “further rate cuts are a very uncomfortable prospect for the [banking] sector” and estimates that a -20bp cut could lead to an aggregate €5.6bn (-6%) profit cut for 32 €-banks under the bank’s coverage; worse, a further -10bp cut, as per GS macro forecasts, increases the hit to -10% (-€8.3 bn). Overall, 19 banks in Goldman’s coverage face a >10% EPS cut, and 8 banks face as much as a 20% EPS hit.

Then there is Europe’s head on collision with a recession: the weakening rate outlook has been accompanied by >20% fall in €-bank shares (SX7E) since 2H18 and -4% cuts to their consensus Net Interest Incomes (for 2020E). According to Goldman, so far ~40% of the share price decline could be explained by NII cuts; the rest falls into the ‘other’ domain, “where political risk features notably.”

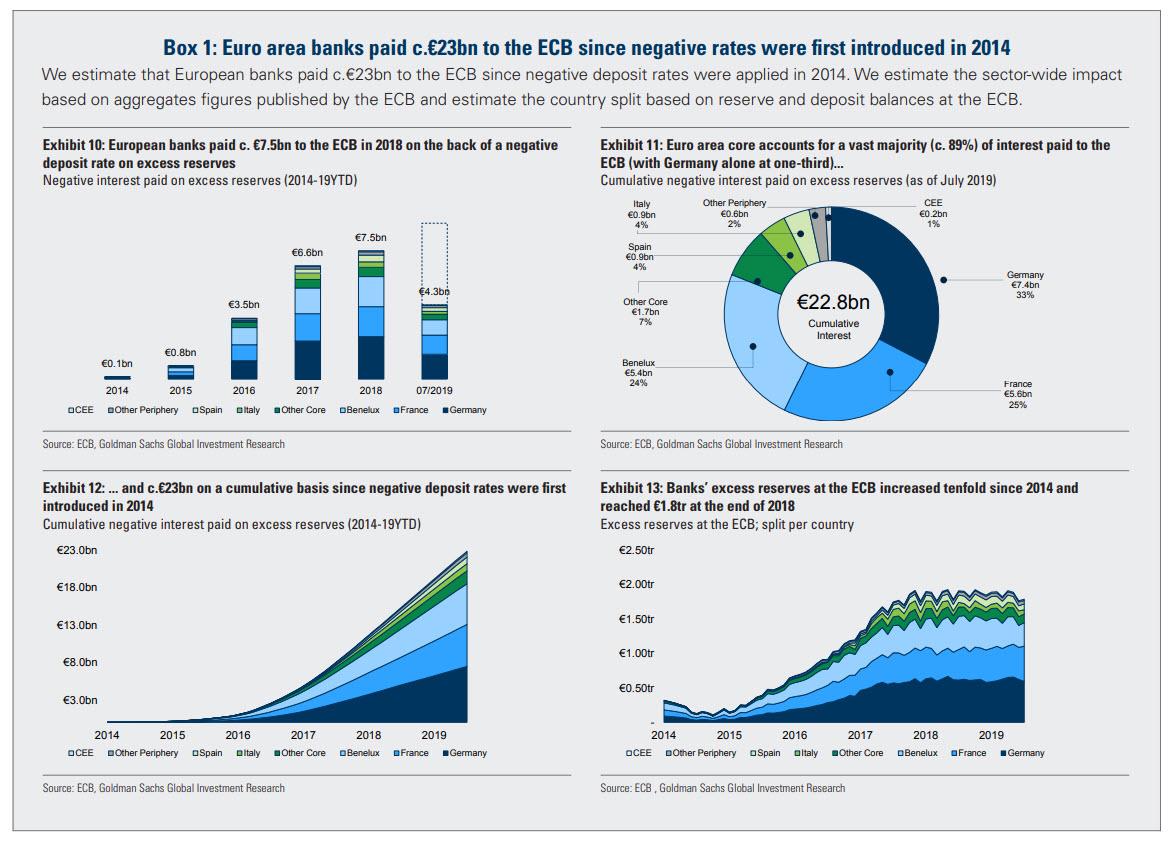

Here is the problem in one sentence, and chart: since negative rates were intorduced in 2014, European Banks have paid €23BN to the ECB!

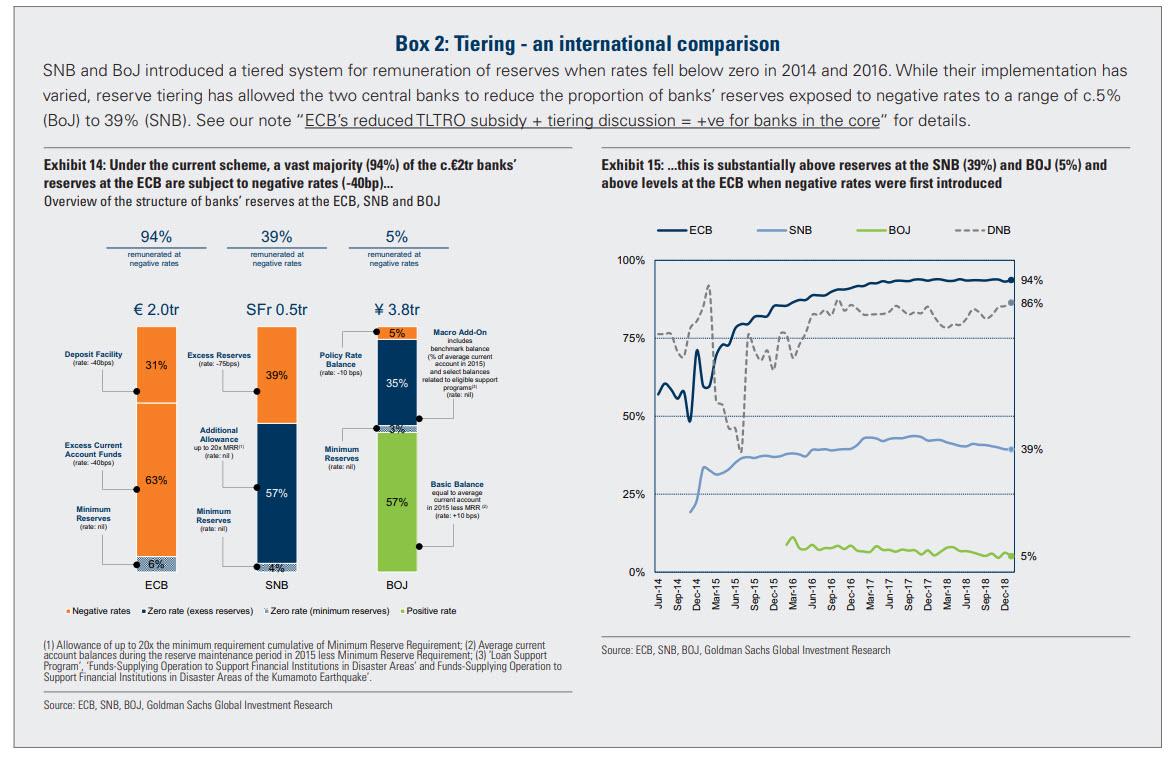

So to avoid a further banking sector, deterioration Goldman warns that “it’s critical that tiering accompanies further rate cuts if a large profit hit for the sector is to be avoided. A -20bp cut could lower €-banks EPS by ~6%. A tiering with efficiency on par with SNB scheme could offset ~30% of the hit.”

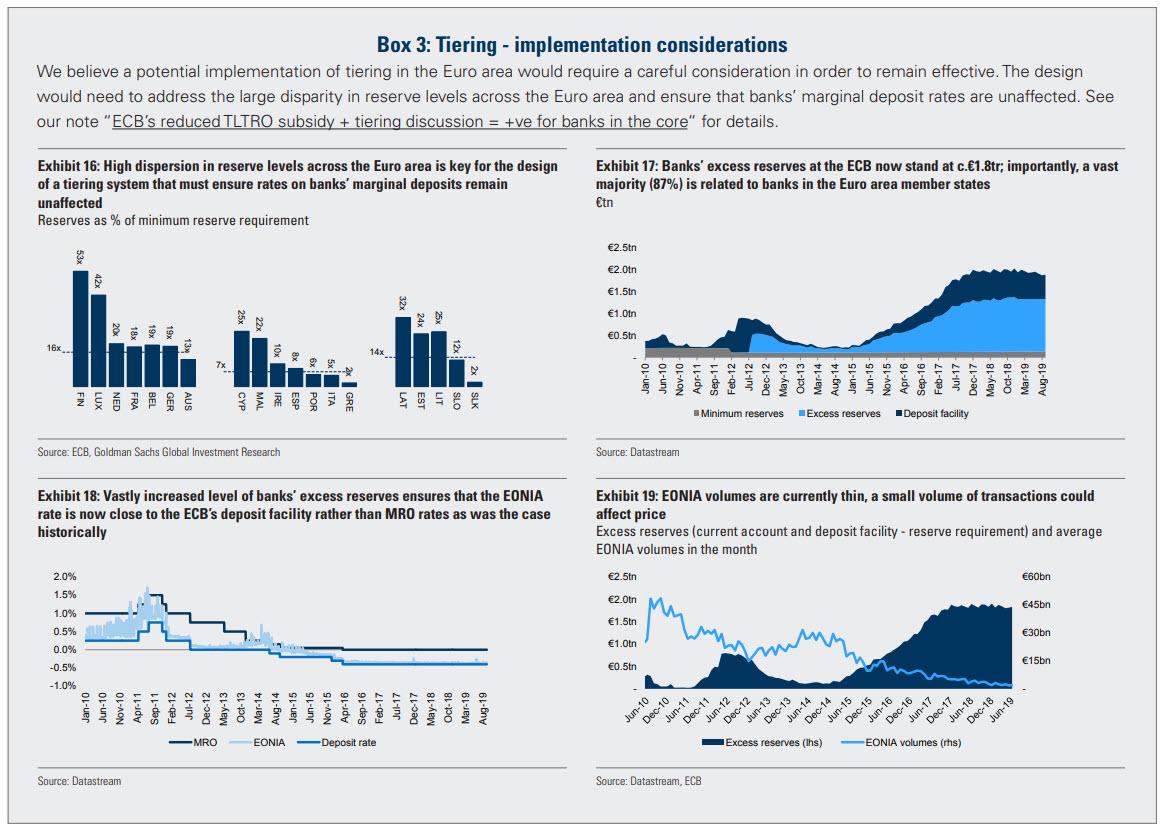

So the big question for Thursday is whether the ECB will also introduce rate tiering at the same time as it eases more.

On this topic, Goldman economists note that the implementation of the ECB’s new scheme is likely to be structured based on a multiple of minimum reserves held by individual banks (SNB model) or on a fraction of their actual excess reserve holdings (BOJ). Their baseline assumption is a two-tiered system, with one tier remunerated at the MRO (currently 0%), similar to minimum reserves, and a second tier charged at the prevailing DFR. They expect c. 50% of excess reserves to be priced at the DFR level.

In Goldman’s view, tiering is a critical part of any incremental easing package. As we have argued before, without it, an extremely challenging operating environment becomes worse, and may push an increased number of banks towards breakeven, or even loss-making territory. However, not all tiering is the same, and the schemes currently in use vary greatly in the extent of the offset/relief they provide to banks.

Key questions for bank investors ahead of the ECB meeting revolve around these following issues:

1. Could ECB’s tiering efficiency be on par with the Swiss or Japanese approach? The Swiss-like approach to tiering is Goldman’s baseline scenario (where c. 60% of deposit balances are exempt from negative rate), but it offers less relief for banks compared to the Japanese approach (>90%).

2. Would tiering be applied to the incremental cut (-20bp) only, or the full -60bp? In other words, would the tiered rate be set at the level of the MRO (0%) or lower. In our view, an offset for the entire -60bp is key. Goldman estimates that a scheme with efficiency on par with a ‘Swiss model’ with a relief applied retrospectively to a full negative rate (-60bps) has scope to shield ~⅓ of a fully-loaded impact of a 20bp rate cut for the Euro area banks under our coverage.

If rates on aggregate fall by -30bp, we calculate that the ‘tiering shield’ would be closer to 25-30% of the aggregate hit. It’s also important to note that even with tiering a 20-30bp rate cut is ultimately profit negative – when fully loaded. The relief it brings, however, is front-loaded leading to a near-term neutral impact for the aggregate.

In short: with the sellside analysts more focused on what the ECB will do to offset the adverse impact of its additional easing – as Europe inevitably careens to the reversal rate of roughly -1%, beyond which it’s game over for central banks – one wonders: just why is the ECB doing anything at all, if the biggest consideration is what it will do to offset the damage it creates by “fixing” things?

Tyler Durden

Wed, 09/11/2019 – 04:15

via ZeroHedge News https://ift.tt/32Bv124 Tyler Durden