The Market Has Priced In The Fastest Economic Recovery Since The Financial Crisis

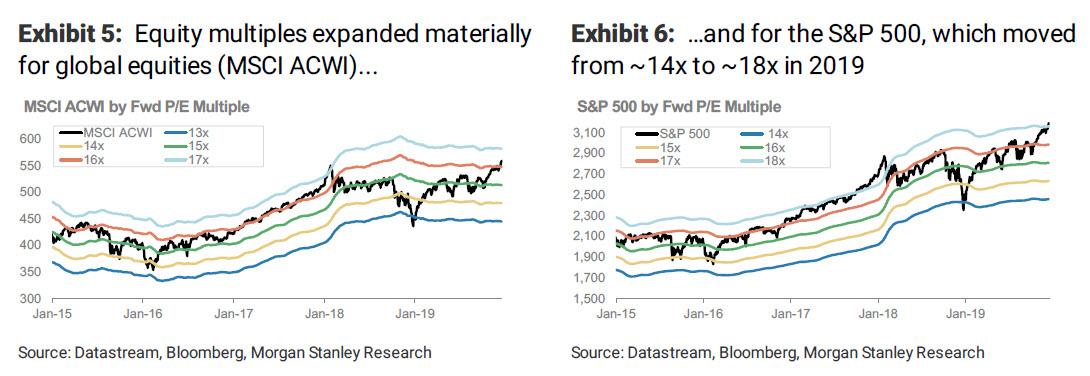

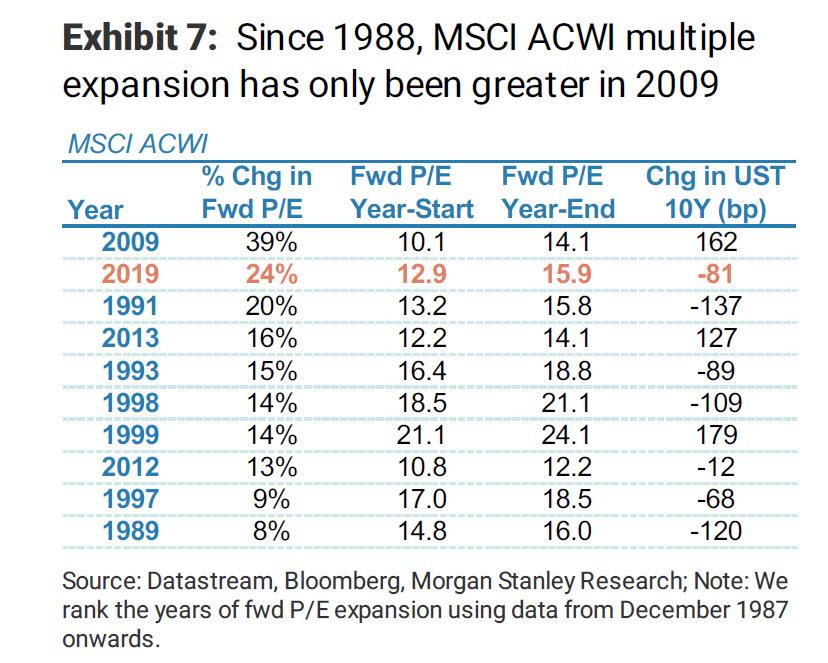

After a terrible for investors and global capital markets 2018, 2019 has been the polar opposite with US stocks set to return almost 30% alongside a 24% return for global stocks. And yet, as Morgan Stanley noted over the weekend, 2019 was ‘one of the most bizarre years ever’ for stocks, if only because the entire surge in risk assets has been due to multiple expansion: consider that in 2019, global corporate earnings were down (both abroad and in the US). This means that since January 1, 2019, the forward P/E multiple for global equities (MSCI ACWI) has risen ~24%. That’s despite worsening global PMIs, an outright decline in 2019 earnings, and increases in US-China tariff rates over the time period.

For the S&P 500, the multiple increased ~24% from approximately 14x to beyond 18x, while the MSCI All World index enjoyed the second biggest multiple expansion on record, with forward PEs rising three turns from 12.9 to 15.9x

The reason for this almost record multiple expansion has been extensively discussed here, and it has everything to do with the Fed’s U-turn. As a reminder, exactly one year ago, the Fed expected to hike rates at least 2 more times in 2019. Instead it cut rates three times even though virtually all of its Dec 2018 economic forecasts turned out to be conservative.

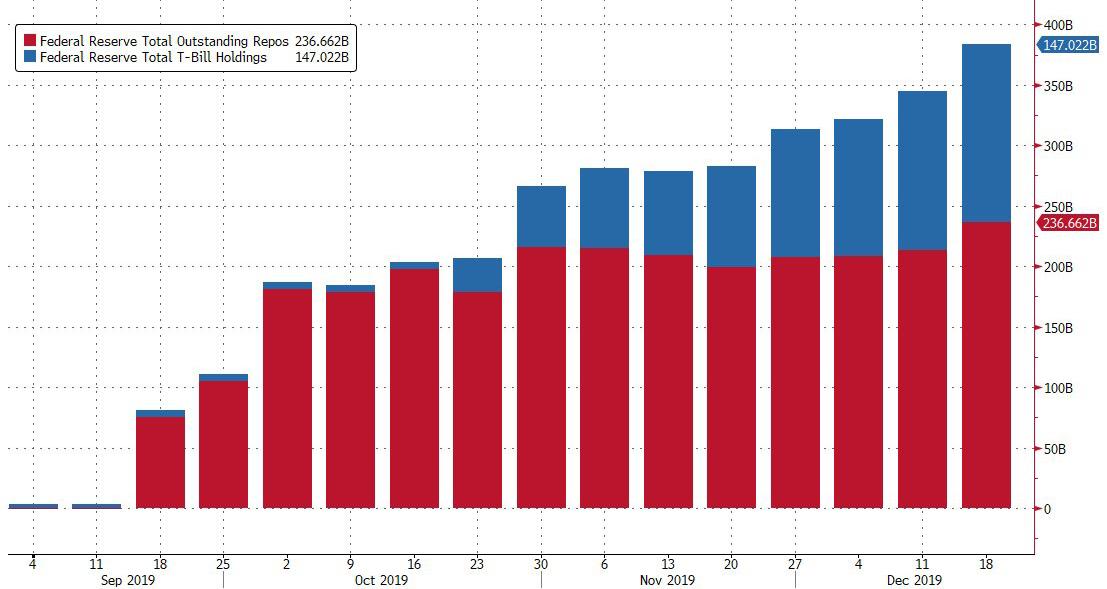

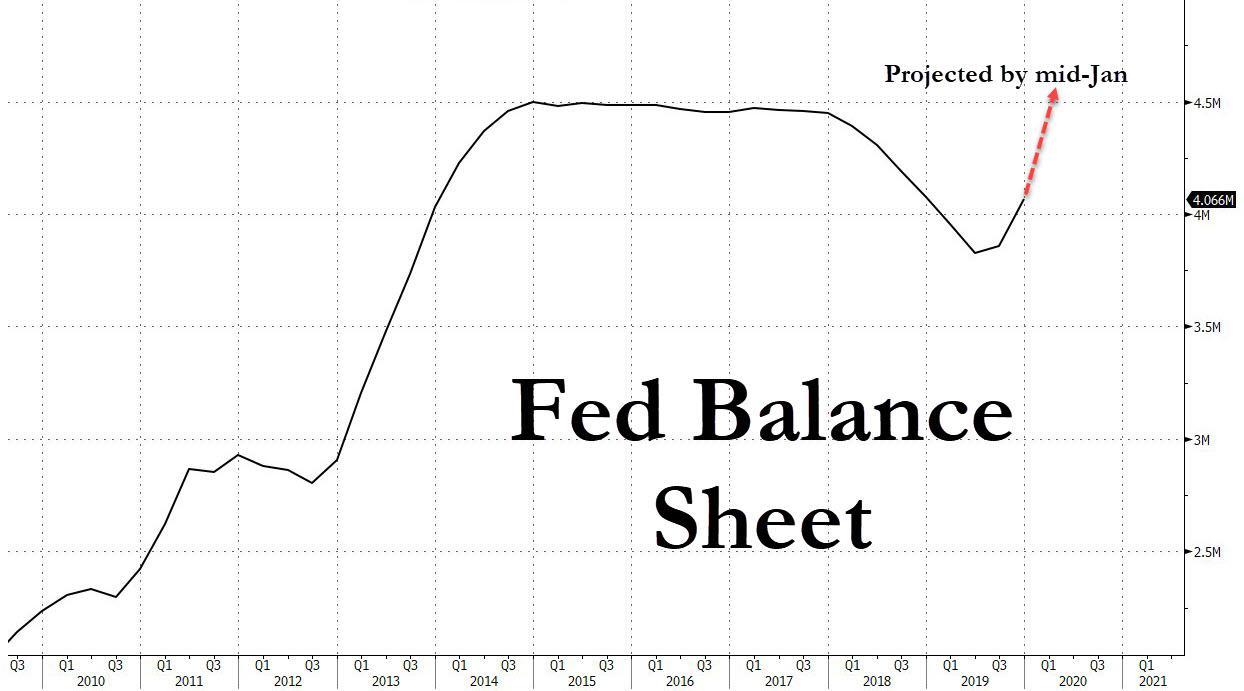

Furthermore, since mid-September the Fed has actively injected $237 billion via “temporary” repos and $147 billion via not so temporary Bill purchases, to prevent a freeze in the repo market, which as we explained previously was orchestrated almost entirely by JPMorgan.

If that wasn’t enough, to ensure a year-end meltup, the Fed also pledged a further gargantuan $500 billion in repo and POMO liquidity between mid-December and mid-January, which if implemented would push the Fed’s balance sheet to an all time high as soon as one month from now.

So as we first look back on what was one of the best years on record, taking place in an environment with zero net income growth and a flood in central bank liquidity, and then look forward to a year in which the bulls say stocks will continue their near-record ascent just because, one thing sticks out.

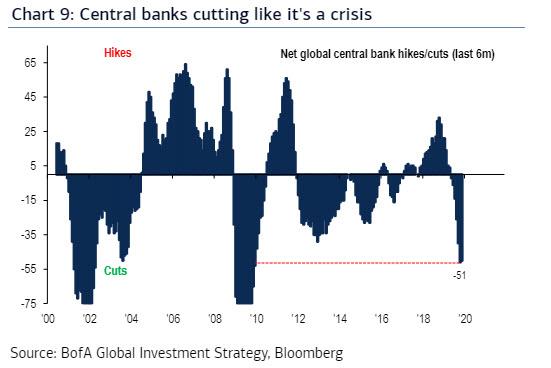

As the following chart from Nordea shows, in addition to the above, 2019 was also a year in which stocks plainly refused to react negatively to any of the year’s bad news (and there was plenty), which is to be expected in a world in which central banks across the globe panicked to cut rates as if a crisis was imminent, just so they could juice risky assets.

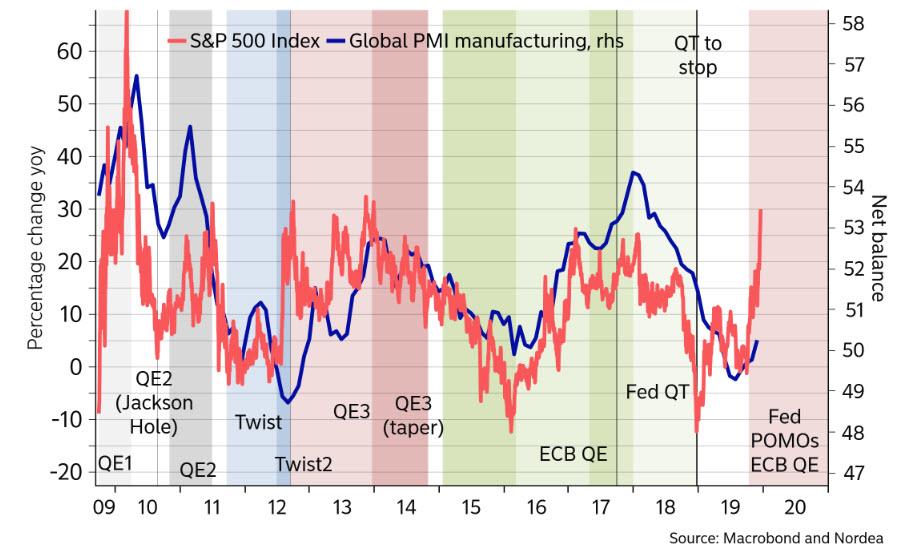

Which brings us to the $64 trillion question: if the market never reacted negatively to all the bad news that it had to digest throughout 2019, isn’t it already pricing in all the good things that may or may not come? The answer is not only a resounding yes, but in fact it now appears that the market is priced beyond perfection. As shown in the chart below, the S&P500 has already fully priced in the strongest rebound in the global economy since the financial crisis… and yet the actual global PMI remains on the verge of contraction.

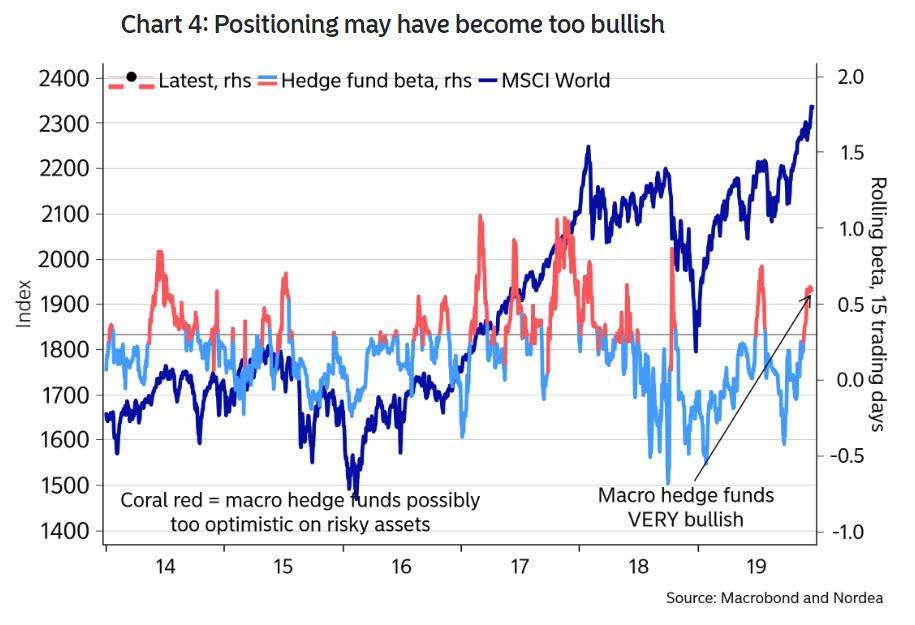

Parallel to this, one reason why equity indices especially in the US have been heading higher this autumn has been positioning. As Nordea noted over the weekend, if market participants are short risky assets the pain trade is often higher equities, and for instance back in September one market collective – macro hedge funds – were truly underweight equities.

However, since then macro hedge funds – and frankly all other funds too – have become the most optimistic since July when risk appetite subsequently faltered. Why is this notable? Because roughly similar bullishness back in 2018 preceded the crash in the fourth quarter of that year.

In short, the market has now priced in not only the strongest economic recovery since the financial crisis, but the vast majority of funds are now positioned bullish and there is nobody left to squeeze. In other words, the market is priced to absolute perfection, the likes of which have rarely been seen in the past decade. And yet, the Fed’s liquidity injections are set to extend for only another 4-5 months while China remains mired in its own economic problems and can no longer afford to massively inject credit into the economy as if did after the 2008 crash and on various other occasions during the past decade.

Which is why Nordea’s advice to bulls is to enjoy 2019 while they can, because in 2020 everything is about to invert and is especially “worried about the downside and remain underweight equities vs bonds.”

Tyler Durden

Tue, 12/24/2019 – 16:13

via ZeroHedge News https://ift.tt/396y2eK Tyler Durden