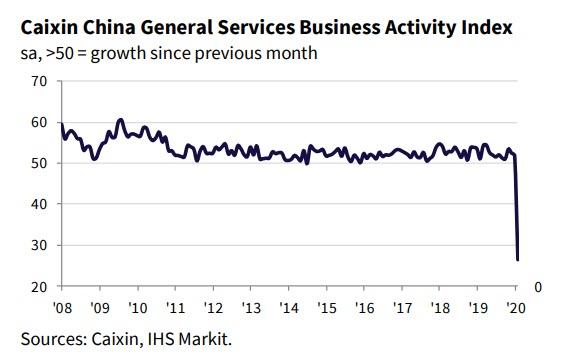

China Composite PMI Crashes To Record Lows As Services Economy Implodes

Stagnating consumption amid the coronavirus epidemic has had a great impact on China’s service sector in February, as one would expect.

February PMI data signalled the first reduction in business activity across China’s service sector on record due to restrictions implemented to contain the recent coronavirus outbreak. Firms across all sectors reported on the damaging effect that the virus was having on the economy via company closures and travel restrictions, with total new orders also falling at a record pace. Restrictions around travel also impacted firms’ ability to source workers, leading a renewed fall in staff numbers. Consequently, backlogs of work rose at a substantial pace.

Commenting on the China General Services and Composite PMI data, Dr. Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said:

“The Caixin China General Services Business Activity Index fell to 26.5 in February, about half the reading of the previous month, marking its first drop into contractionary territory since the survey launched in November 2005. Stagnating consumption amid the coronavirus epidemic has had a great impact on the service sector.

1) Demand for services shrank sharply. Both the gauges for total new business and new export business dropped to their lowest levels on record.

2) It was difficult for service providers to recruit workers, and backlogs of work climbed. The drop in the employment gauge was relatively small, but its February reading marked the lowest point on record. The measure for outstanding orders surged to a record high. Supply capacity across the service sector was insufficient amid restrictions on the movement of people.

3) The measure for input costs dropped at a steeper rate than that for prices companies charged customers, because of a sharp decline in supply capacity.

4) Business confidence also fell to a record low. Although policies have been introduced to provide tax and financing support for industries and small businesses heavily impacted by the epidemic, service companies were still concerned about uncertainties resulting from the epidemic.

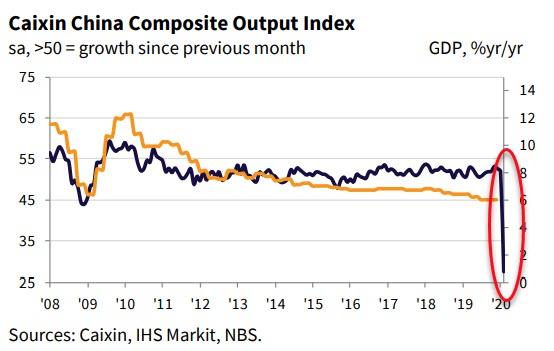

Additionally, the Composite Output Index signaled the sharpest decline in total Chinese business activity on record in February, as company closures and travel restrictions were put in place due to the coronavirus outbreak.

“The Caixin China Composite Output Index dropped to 27.5 in February from 51.9 in the previous month. While the gauges for new orders, new export orders and employment all weakened to their lowest levels on record, the gauge for backlogs of work rose to a record high. The decline in input costs was greater than that in output prices because upstream industries’ supply capacity was less affected.

“The coronavirus epidemic has obviously impacted China’s economy. It is necessary to pay attention to the divergence of business sentiment between the manufacturing and the service sectors. While recent supportive policies for manufacturing, small businesses and industries heavily affected by the epidemic have had a more obvious effect on the manufacturing sector, it is more difficult for service companies to make up their cash flow losses.“

And as China’s Composite PMI collapses, US and Japan are also in contraction with Europe – for now – somehow managing to cling to expansion…

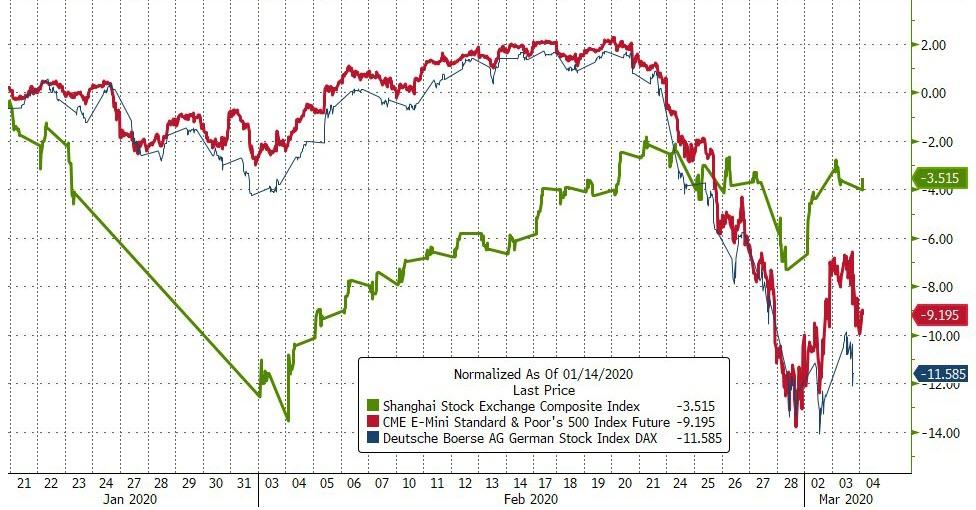

But the funniest thing of all is the fact that Chinese stocks are dramatically outperfoming US and European since the start of the crisis…

Thanks National Team for making it all seem awesome!

Tyler Durden

Tue, 03/03/2020 – 20:57

via ZeroHedge News https://ift.tt/39oASM2 Tyler Durden