Nomura: Why Stocks Are Braced For Another “Violent Upside Shock”, And Why It Should Be Faded

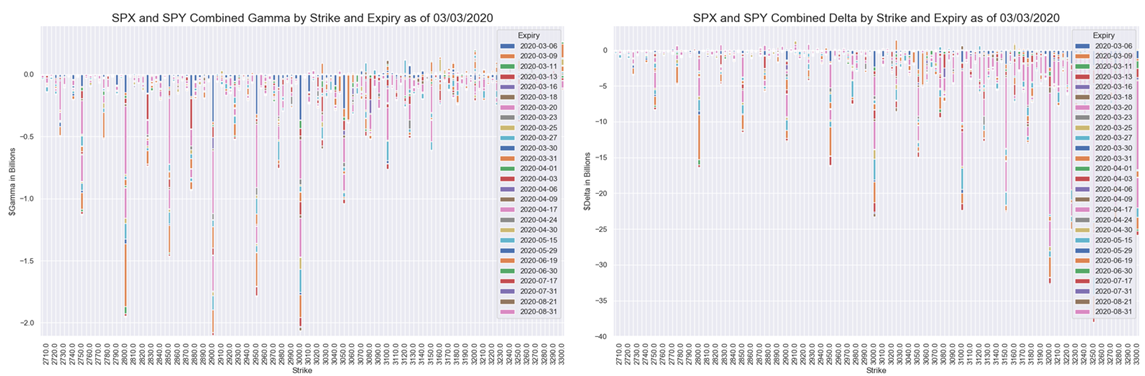

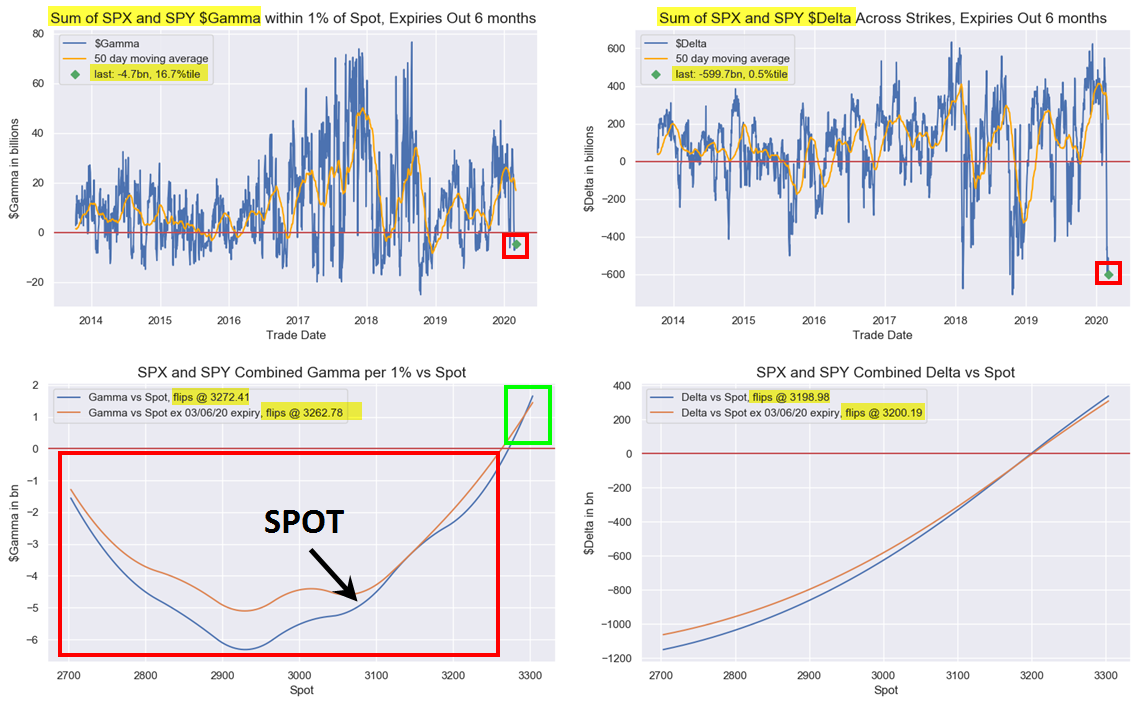

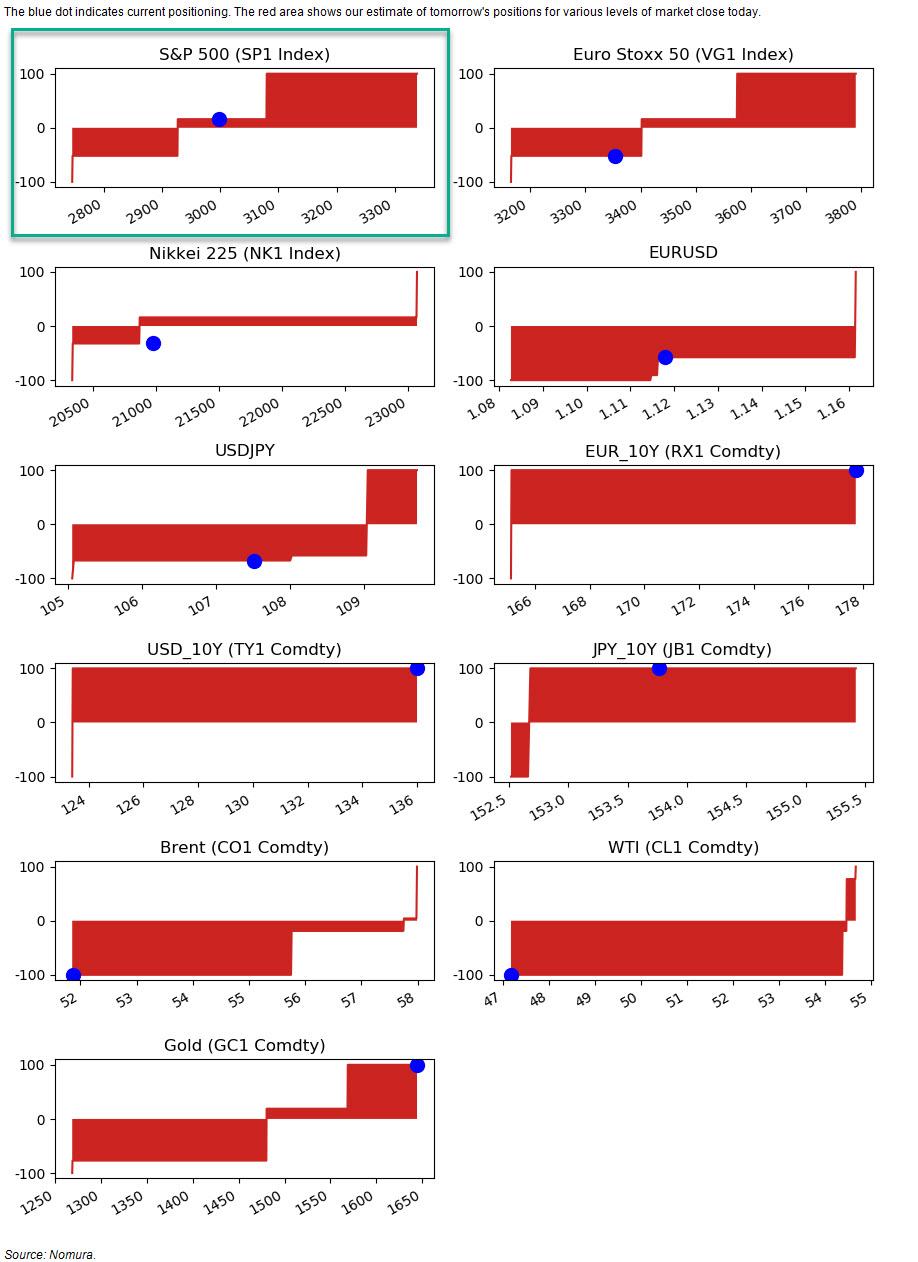

When discussing the positional imbalance in the market ahead of yesterday’s market plunge, Nomura’s Charlie McElligott noted that the market was “trading short”, because it was, largely on the back of the vol-trigger deleveraging flows we discussed first over the weekend, and the extreme negative Delta for options holders, which alongside dealer negative gamma would accelerate any market move into whatever direction sentiment would take it.

So in retrospect, having been short – even if synthetically – yesterday’s action, one would argue that the market is now in the process of closing out some if not all of its latest hedges and undoing its huge negative delta exposure. Sure enough, that’s what McElligott highlights in his latest daily note in which he writes that “one of the two “left tails” which set-off this larger multi-week, rolling gamma- and vol- event is now in the process of being “downgraded” as a probability for markets…

… with the rather remarkable 48-hour upward swing seen in Joe Biden’s trajectory as once-again “front-runner” for the Democratic nomination, a moderate and “market-friendlier” choice against the perceived “hard” negative growth shock implications of a Sanders selection—which was an unthinkable risk at the same time that Coronavirus economic “contagion” impact was being realized.”

And since quants tend to use about 90% more words than they need (it’s called hedging just in case someone actually understands what they are saying and they end up being wrong, a practice perfected by Greenspan), what he actually means is stocks rocketed higher after traders closed out positions after Monday’s rout, and the narrative used to explain the move was the Biden-friendly Super Tuesday results.

With this backdrop, Charlie goes on to note that heading into Tuesday we are experiencing yet another blistering 100-handle “low to high” rally overnight in S&P futures, in which dealer option hedging, or “short gamma”, is still a clearly a partial culprit behind these “accelerant” moves into extremes in both directions (particularly the amazing late-day moves in the US session in recent days), coupled with the general “synthetic short” in the market noted above.

All of this feeds into the market’s stunning reaction to the Fed’s rate cut of course, which as we discussed yesterday, is not what Powell had envisioned:

Clearly the Fed’s first intra-meeting rate cut since the GFC (although essentially “just” pulling-forward the 50bps of easing which the market had already priced-in) still set-off further daisy-chain within markets, with front-end Rates / USTs seeing extraordinary rallies and a violent “bull-steepening,” as even more cuts are now priced-into market expectations

Our econ team updated their forecasts, now expecting 25bp cuts in both Mar and Apr meetings, with markets pricing-in 2.75 more cuts cumulatively before year-end

Why? Well the Fed has already told us that “when they go, they will go HARD and FAST”…which fits the historical analog: The FOMC’s past conference calls during the inter-meeting periods where the Committee decided to cut rates in Sep 2001, Jan 2008 and Oct 2008 were ALL followed by another cut at the subsequent regular meetings

Equities – which are now more driven by liquidity, sentiment, a greeks than any fundamentals – aside, most traders will argue that the real repricing took place in the bond market where the 10Y dropped below 1% for the first time ever yesterday, and today we see the move in TSYs moderating – after all there is less than 100bps left until we hit zero on the 10Y – while the curve is once again steepening.

And speaking on the front-end, in the aftermath of yesterday’s collapse in short-dated rates, first thing this morning we got 3M USD LIBOR crash by -31bps, the largest decline since Oct 2008, and causing the front of the Eurodollar curve to again spike.

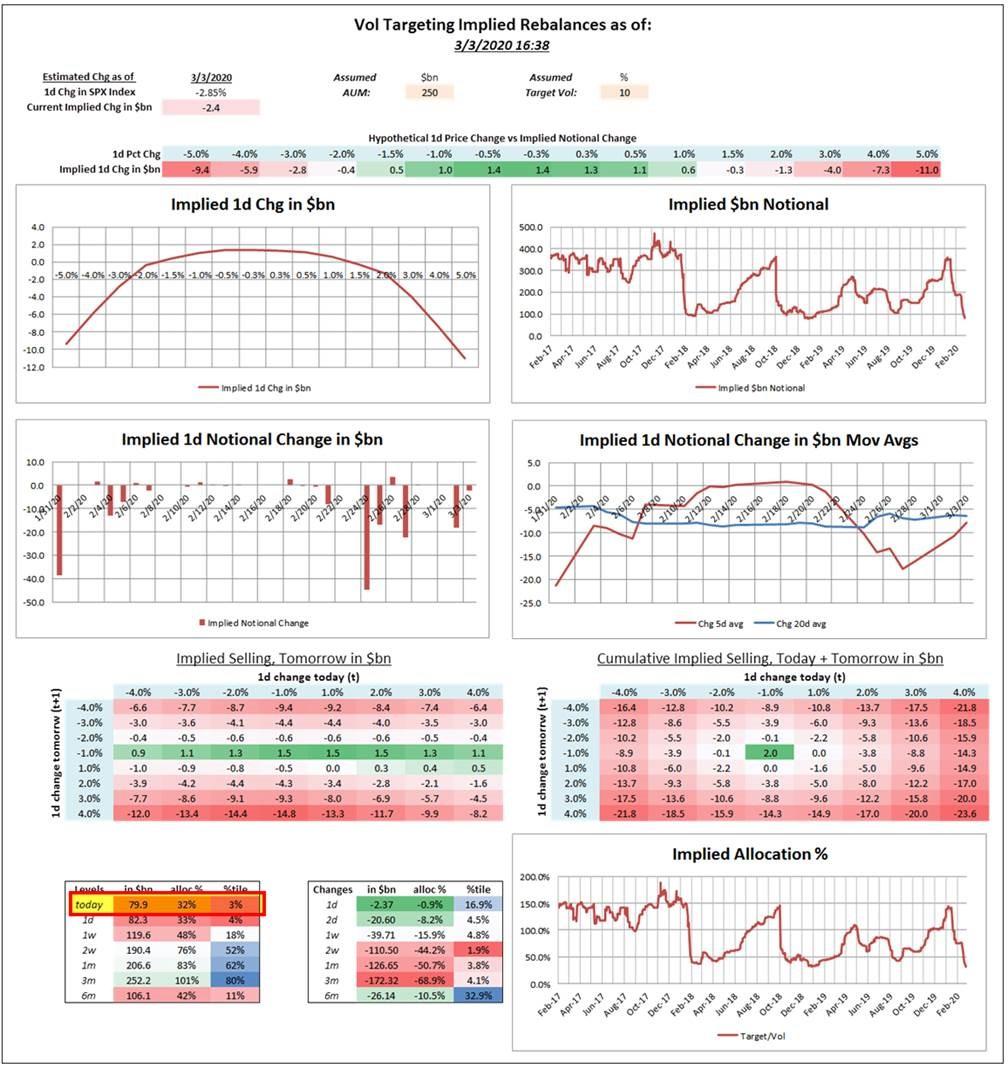

So going back to equities, the Nomura quant finds that despite yesterday’s unwind, stocks continue to trade “short” and after the perceived removal of the US Election “left tail” last night, Vol is again resetting sharply lower, which McElligott notes means a (lagging) releveraging to come from the systematic/target vol universe, as trailing realized windows begin to “catch-down”—thus the crash-down, crash-up “rinse, repeat” that so often happens when market volatility spikes.

What does this mean practically in terms of buy/sell thresholds?

According to Nomura, the Super Tuesday aftermath which the market (erroneously) believes means Bernie Sanders is no longer a contender, has left spot S&P trading effectively at the next “buy” level in the CTA Trend model, which means that a close above 3079 today would see the signal go from current “+16%” (long) back to “+100%” signal, leading to further aggressive buying and more shorts squeezed.

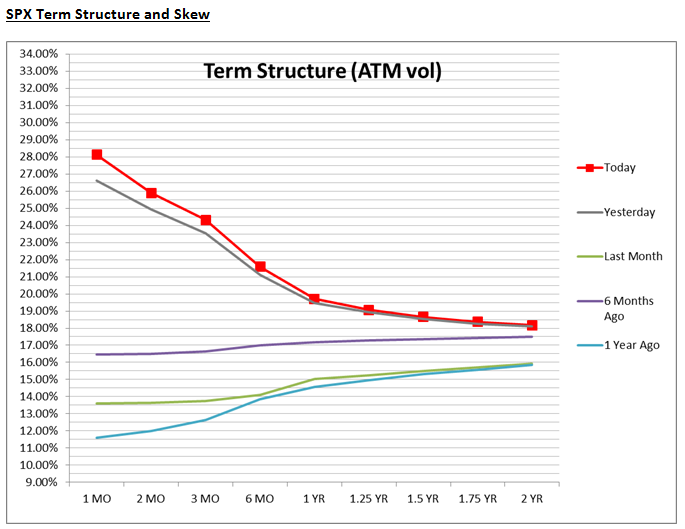

Finally, with market nervousness at all time highs, resulting in S&P skew is at near record extremes (1m at 93rd percentile)…

… and a massively inverted term structure…

… “all back-test for significant rallies to come in Equities—but again, this sentiment is pushed / pulled by the inevitable Coronavirus tape bomb fear” according to McElligott, who concludes that the pressure then builds for “further violent upside shocks (boosted by the vol reset LOWER and the now post deleveraging UNDER-ownership by systematics), which you want to take advantage of to hedge your downside (the 2700 / 2900 1×2 PS I discussed two days ago traded for a CREDIT yday at one point).”

Tyler Durden

Wed, 03/04/2020 – 09:47

via ZeroHedge News https://ift.tt/3cpmZz3 Tyler Durden