If The Virus Hadn’t Caused The Crash, Something Else Would Have

Authored by Satyajit Das, op-ed via Bloomberg.com,

The novel coronavirus has already had a significant impact on the global economy, which will worsen if the outbreak and the shutdowns designed to contain it continue for very long. But it’s only an accelerant: If not Covid-19, as the disease caused by the virus is known, something else would have started the conflagration. Shortfalls in revenue and cash flows, caused by the shutdowns, have simply exposed the vulnerabilities of a structurally unsound economic and financial system.

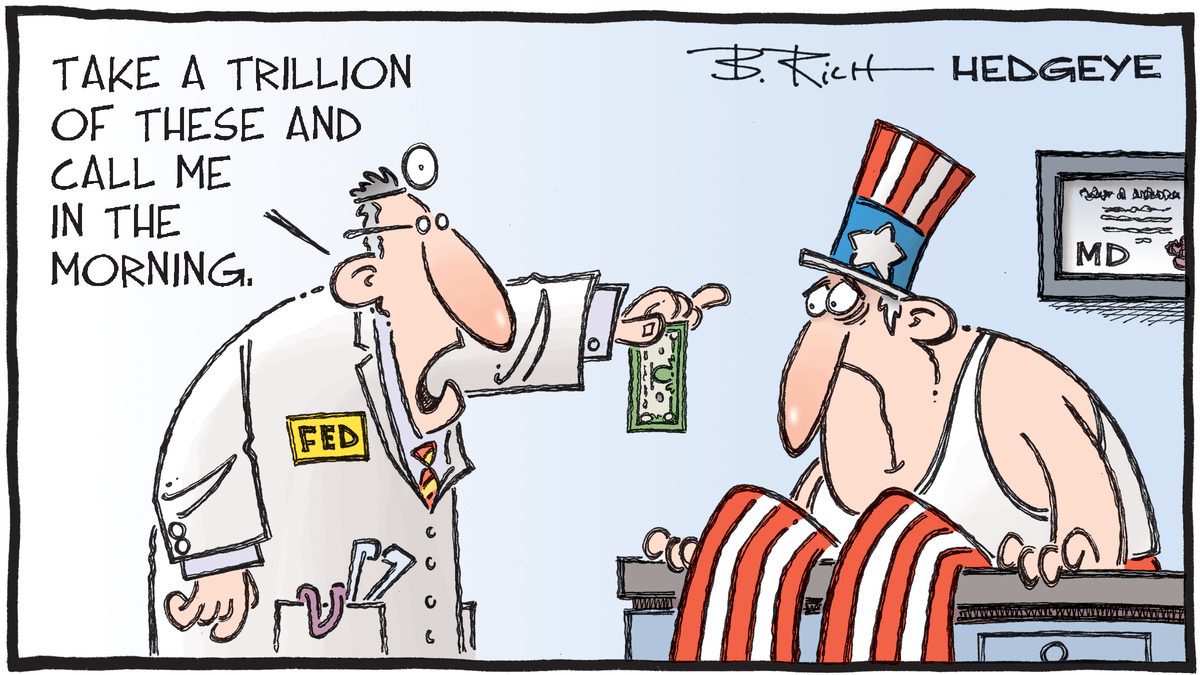

A fall in revenue is problematic but manageable without debt. Unfortunately, in the aftermath of the 2008 crash, debt levels were increased rather than reduced, encouraged in part by low policy rates and the abundant liquidity engineered by central banks globally. Global debt as a percentage of GDP rose from around 250% in 2007 to 325% in 2019.

Current debt levels are triple what they were in 1999. Businesses and households, with declining or no income and high levels of borrowing, now face an existential struggle to meet large financial commitments.

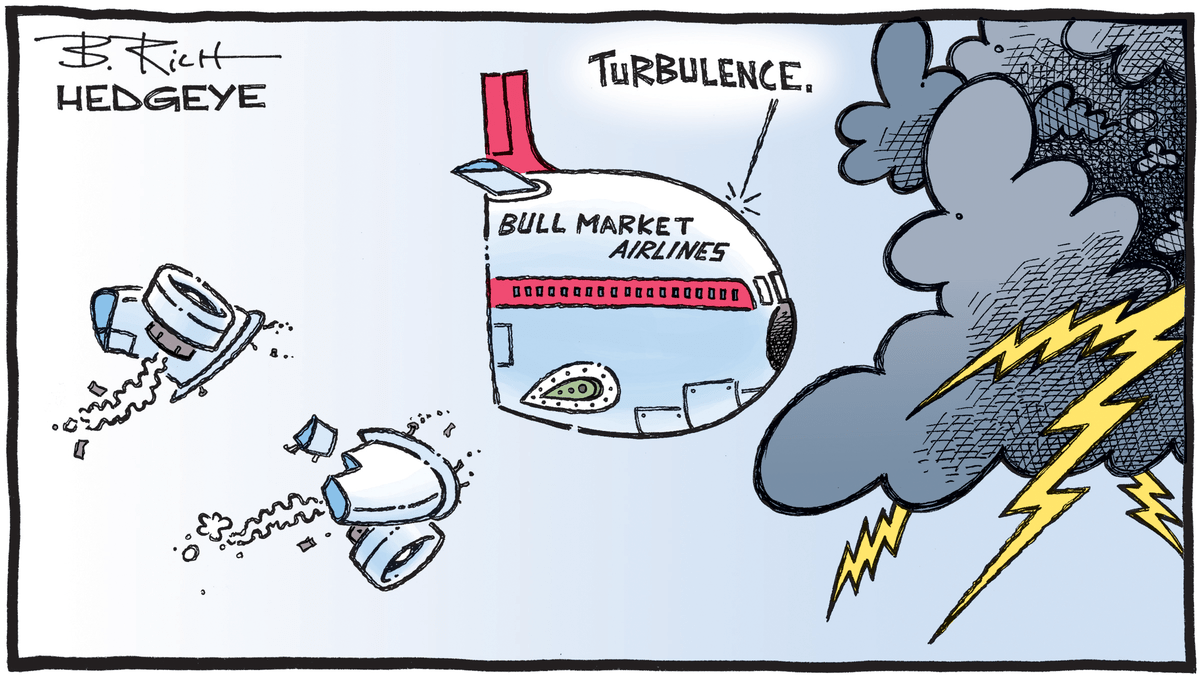

A second problem is that, in the “everything bubble,” asset prices were priced for perfection. Policymakers boosted the values of financial assets to increase economic activity via the wealth effect, and to support borrowing to protect financial institutions.

High asset prices reflected high leverage, in the form of leveraged loans for private equity or structured investments such as collateralized loan obligations. Debt-financed share buybacks and distributions to shareholders inflated equity values by increasing earnings per share, but simultaneously raised corporate leverage. Toxic layers of debt were heavily exposed to significant revenue downturns.

Third, the weaknesses of the banking system were ignored. Regulatory rollbacks and tolerance for large dividends and capital buybacks undermined steps to strengthen bank capital and liquidity. In Europe and many emerging markets, non-performing loans were not appropriately recognized. The growth of the shadow banking sector was not checked. The current problems in the inter-bank market, reflecting increased counterparty risk concerns, are testament to these missteps.

Fourth, declines in trading liquidity were disregarded. In the search for returns, investors assumed liquidity risk, sometimes unwittingly. Redemption terms offered by investment funds to investors were inconsistent with their illiquid holdings. As traditional market makers reduced activity, market-following structures, such as ETFs, and algorithmic traders were relied on for liquidity. In a crisis, these entities are users rather than providers of liquidity—as the current inability to trade even modest parcels of many securities shows.

In a parallel move, investors moved to private markets and unlisted securities, which are difficult to value or liquefy in anything other favorable markets. Gated funds, suspended redemptions and concern about accuracy of valuations were always going to create problems in any financial disturbance.

Finally, over the last decade, most economic actors did not build enough buffers against shocks.

Corporations, convinced that they could access cheap capital at will, reduced shareholders’ equity and increased refinancing risk. Households reduced savings and went into debt to consume and purchase houses. In the case of the economically disadvantaged, this was compounded by low wage growth, lack of employment security and inequality. In the United States, the Federal Reserve found that many would struggle to raise $400 in an emergency.

Government banks and central banks steadily eroded their war chests and weapons, leaving them with limited ability to deal with a major dislocation.

Even the spread of Covid-19 reflects a lack of preparedness. Given the lengthy history of virulent pathogens, from SARS to Ebola, countries should have expected some sort of global pandemic to hit sooner or later. Their struggles to cope now reflect the lack of a cogent health policy, as well as diminished spending on health, due variously to austerity policies and privatization.

Investors expecting a rapid recovery are trying to time markets and catch falling knives. But dealing with these deep-seated systemic flaws will require time.

Given the state of public finances, it is unlikely that governments, especially heavily indebted ones, will be able to sustain the level of support required to keep economies in total lockdown for months. Deleveraging and cleaning out financial excesses will be slow and may not be feasible even if the will to tackle the task is found.

The long-term damage will be great. Hysteresis refers to effects that persist after the initial causes are removed. The current crisis will compound persistent financial and economic weakness; structural damage to industry, employment and public finances; and savings and consumption behaviors which are difficult to foresee. While the Covid-19 crisis will probably pass, our fragile economic and financial system will take longer to recover.

Tyler Durden

Thu, 04/02/2020 – 12:50

via ZeroHedge News https://ift.tt/2wLiUoV Tyler Durden