Meet The “Fed Fighters”: Junk Bond ETF Shorts Hit An All Time High Despite Fed Backstop

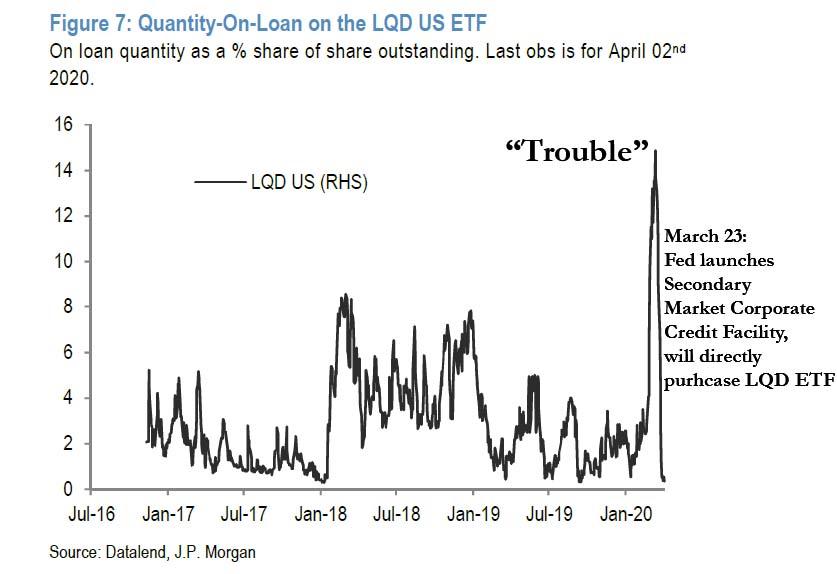

Three week ago we showed the dramatic crushing of shorts in the investment grade bond ETF, the LQD, where shorts initially soared higher in the first half of March as credit prices tumbled, then plummeted to all time lows after the Fed broke a taboo not even Ben Bernanke dared to touch during the financial crisis, when on March 23 Jerome Powell announced he would purchase Investment Grade bonds (followed last week by the even more shocking news the Fed would buy fallen angle junk bond debt).

What happened was unprecedented: as JPM puts it, “looking at credit ETFs, the short base collapsed in spectacular fashion from LQD, the biggest HG ETF after the Fed’s credit backstop programs.” As we wrote, all those traders who naively expected that the Fed would not nationalize virtually every market and – at least implicitly fought the Fed – were carted out following the biggest, most “spectacular” short squeeze in history: that of LQD on March 23. The chart below shows that between March 23 and April 2, the % of LQD shares loaned out – a proxy for shorting – had dropped from an all time high to a record low…

… as the Fed triggered a historic short squeeze, crushing all those who did not even know they were fighting the Fed when they shorted the LQD, which had become a systemically important instrument, explaining why everything in the cap structure above IG debt is no longer subject to any market forces but merely to the whims of the NY Fed’s trading desk – will it buy LQD, and how much. That’s all that maters now.

What happens next, we mused rhetorically, and said that with shorts no longer allowed to speculate in IG debt or anything less risky as it is all backstopped by the Fed now, only a few things remain subject to the whims of markets: junk bonds and stocks.

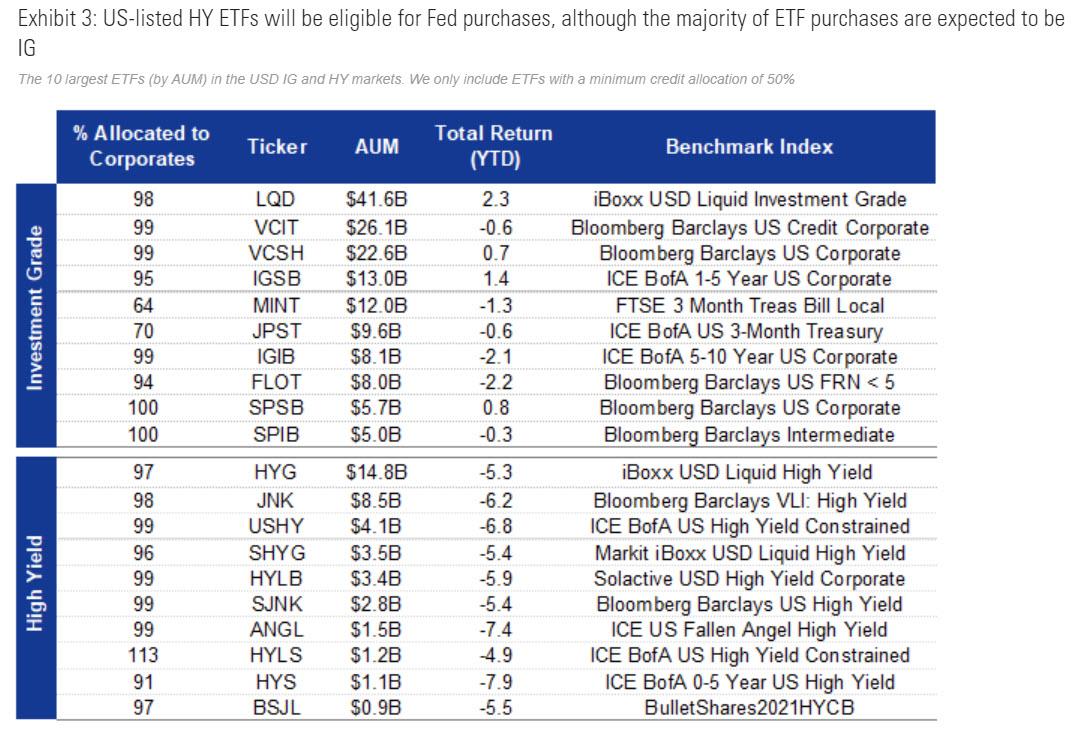

Little did we know that just two weeks later the Fed would “go there” and announce it would also bail out the biggest systemic threat to the US credit market – “fallen angel” junk bonds which collectively could amount to some $3.5 trillion or nearly three times the size of the entire junk bond market – announcing it would purchase BB-rated junk bonds which were rated IG as recently as the date is announced it would purchase IG debt, March 23.

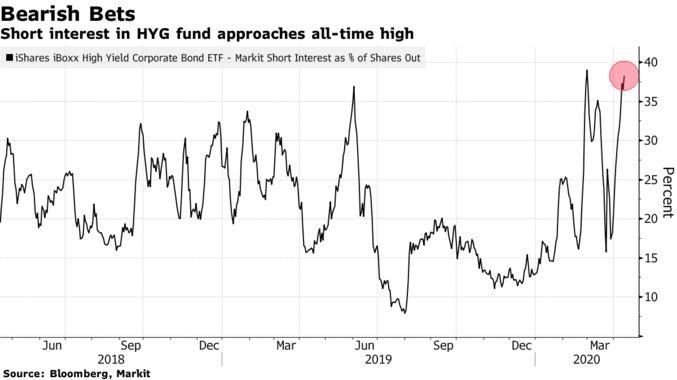

Yet something unexpected happened: unlike the LQD case study where the short interest collapsed, here bearish wagers against the largest junk-bond ETF have continued to build despite the Fed’s explicit backstop of high yield debt, as skepticism grows that the Fed support will not be enough to protect investors.

As Bloomberg shows citing the latest IHS Markit data, short interest on the $16.3 billion High Yield Corporate Bond exchange-traded fund, the HYG is near 38% of shares outstanding, close to a record of 39% reached in late February for the fund.

Remarkably, this is happening after the Fed announced it would buy junk bonds ETFs such as the HYG!

According to Bloomberg the reason for the surge in shorts is that “skepticism is returning after last week saw the biggest rally on record for the ETF, which soared on the back of the Fed’s plan to buy fallen angels and funds such as the HYG.”

Arguably, Bloomberg continues “while the Fed’s support will help keep credit flowing amid the coronavirus pandemic” which is not necessarily correct – the Fed will merely set the prices of junk bonds ETFs to whatever it decides they should be, “it does little to lessen the risk of cash-strapped companies declaring bankruptcy, according to Principal Global Investors.”

In other words, while fallen angel companies may be safe, for now, nothing prevents rating agencies from downgrading BB credits further to B, CCC or lower. And eventually, these former fallen angels may and will declare bankruptcy, and not even the Fed is bold enough to demand Treasury permission to buy bankrupt assets and pretend they are money good.

“Actions to backstop high-yield eases the liquidity strain segment of high-yield spread widening, but it has less impact on the ‘insolvency risk segment’ of high-yield spread widening,” said Seema Shah, Principal’s chief strategist. “It doesn’t necessarily improve the outlook for bankruptcies.”

It certainly doesn’t, and unless the Fed intends to become an active participant in post-reorg valuation fights, the Fed will buy highly-rated junk bonds only to sell them as they become increasingly more insolvent.

That said, the shorts suffered major pain here too – the HYG surged 7% after the Fed announcement, capping its best week since the fund was created in 2007. The fund closely modestly in the green on Tuesday after dropping 1.4% Monday as even more shorts piled in.

In any case despite the Fed’s clear warning to junk bond shorts, there are millions who are still willing to bet that the Fed will fail to prop up the high yield bond market, making a mockery of Marko Kolanovic’ warning from last night who said that “investors with focus on negative upcoming earnings and economic developments are effectively ‘fighting the Fed,’ which was historically a losing proposition.”

Guess some investors still dare to focus on negative economic development despite “fighting the Fed.”

* * *

Curiously, not all junk-bond ETFs have seen a spike in short interest. The $10 billion SPDR Bloomberg Barclays High Yield Bond ETF and iShares Broad USD High Yield Corporate Bond ETF both soared last week, but short interest has fallen. Shorting shares could also reflect moves by investors to hedge other parts of their portfolios, rather than an outright bet on declines, as Bloomberg reminds us.

The fact that the Fed will only be buying falling angels means that the program isn’t necessarily a positive for the entire high-yield asset class, according to Columbia Threadneedle.

“Fed purchases will not extend into the tail of high-yield, and there is an argument to be made that default rates are not fully priced-in yet,” said Ed Al-Hussainy, a senior strategist.

He is certainly correct… for now. Because with the Fed now all in, it is only a matter of time before the Fed has to backstop virtually every asset class, everything from single name C junk bonds to single stocks and equity ETFs. The only question we have is how will the Fed outlaw bankruptcies once companies realize that the pre-coronavirus economy won’t be back for years, if ever.

Tyler Durden

Tue, 04/14/2020 – 17:05

via ZeroHedge News https://ift.tt/2VcAKKZ Tyler Durden