After Billions In Losses, Michael Hasenstab Finally Closes His Treasury Short

There is a saying that bull markets make geniuses out of the biggest idiots, and when it comes one of the world’s most famous “traders”, we just saw that saying in action.

Last October, two months after we reported that Templeton’s “investing wudnerkind” Michael Hasenstab, who for nearly a decade during the most artificial bull market in history had a knack of investing in the crappiest bonds around the globe and betting they would get bailed out by one or more central banks – which is precisely what happened… until last summer, lost $3 billion in the third quarter as two of its biggest investments soured.

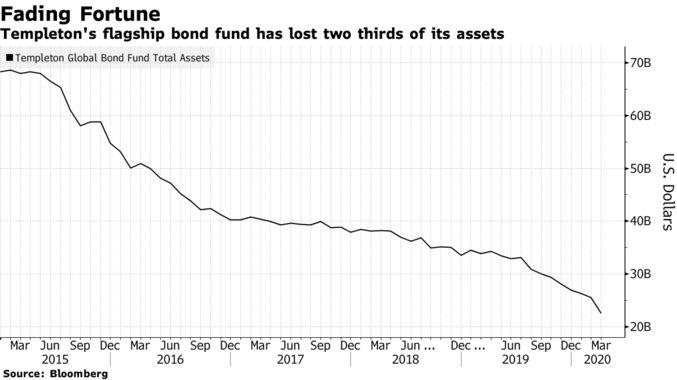

Since then it’s only gone downhill for the “famous” investor (who as we said back in 2015 should be best known for either i) buying the most distressed sovereign bonds and praying for a central bank bailout or ii) doing precisely what everyone else was doing and calling it contrarian), and according to the latest Bloomberg update, the bond fund run by Hasenstab posted a $4.3 billion decline in assets in the first three months of the year, its worst quarter since 2016.

Total net assets in the Templeton Global Bond Fund slumped to $22.6 billion as of March 31, public filings show, down from $26.9 billion at the end of 2019. It was the fourth consecutive quarter of declines, taking the drop in holdings in the past year to $11 billion, and nearly $50 billion since the peak of Hasenstan’s popularity in 2015 (or right around the time we tried to warn everyone that ‘Famous’ Bond Investor Turns Out To Be Nothing More Than A Glorified BTFDer).

While Hasenstab’s career was largely built on betting that Europe would keep bailing out Greece, Italy and other insolvent nations again and again, he turned out to be a one-trick pony when he applied the same investing thesis to Argentina and other nations, losing billions on last year’s Argentina bond crash. But his biggest fiasco was going short Treasurys years ago, which cost the fund billions and billions – to quote Trump – until Hasenstab finally threw in the towel.

As Bloomberg also reports, after suffering catastrophic losses, Hasenstab has ended his “painful” Treasury short, betting that yields are bound to rise, a trade which every Wall Street macrotourist like Hasenstab had put on each year from 2010 through 2019 and got crushed on.

Filings this week showed that the Templeton Global Bond Fund’s average duration – a measure of its sensitivity to interest rates – turned positive for the first time since 2017 in the last three months. A person familiar with the matter who asked not to be identified confirmed the fund has tactically unwound its short position on Treasuries. -Bloomberg

This is perhaps the most prominent capitulation for Hasenstab, who had argued a few years ago that Treasury yields would climb above 4% given rising deficit spending and inflation pressures. While that bet looked “promising” in 2018, before the Federal Reserve embarked on a new cycle of rate cuts, yields have since crashed to record lows as stimulus measures to fight the fallout meant the Fed would rollout unlimited QE forcing Powell to purchase record amounts of Treasury debt, and steamrolling all the Treasury bears.

While Hasenstab’s short Treasury position started off small in 2017 – using mostly interest-rate swaps – it grew steadily until the middle of last year, when it became the biggest such bet of any major global bond fund. In October 2018 Hasenstab said in a podcast 10-year Treasury yields “could easily” get above 4%. Just a few days later the benchmark yield touched a high of about 3.2% before starting a relentless drop decline that has been exacerbated by stimulus to counter the impact of the pandemic. On Tuesday the yield was well below 0.6%.

In the process Templeton has suffered billions in losses, putting even the Argentina fiasco to shame.

Once a top-performer with triple the current assets, Hasenstab’s Global Bond Fund has become a laughing joke, losing 7.6% in the past year compared with a double-digit return for Treasuries. Morningstar meanwhile mainstains its top analyst rating for the fund in October and said in a February note the “often contrarian approach” tends to pay off in the long run. Newsflash here, maybe, for Morningstar but you can’t be a contrarian when you had a position that lost billions and you unwound it. That’s called just being a plain terrible investor.

Tyler Durden

Tue, 04/21/2020 – 14:06

via ZeroHedge News https://ift.tt/2x1URlK Tyler Durden