Has The Recovery Started Already? What Real-TIme Coronavirus Activity Trackers Are Showing

There was some good news in the latest coronavirus activity tracker from Goldman: signs of life amid an unprecedented collapse in aggregate demand.

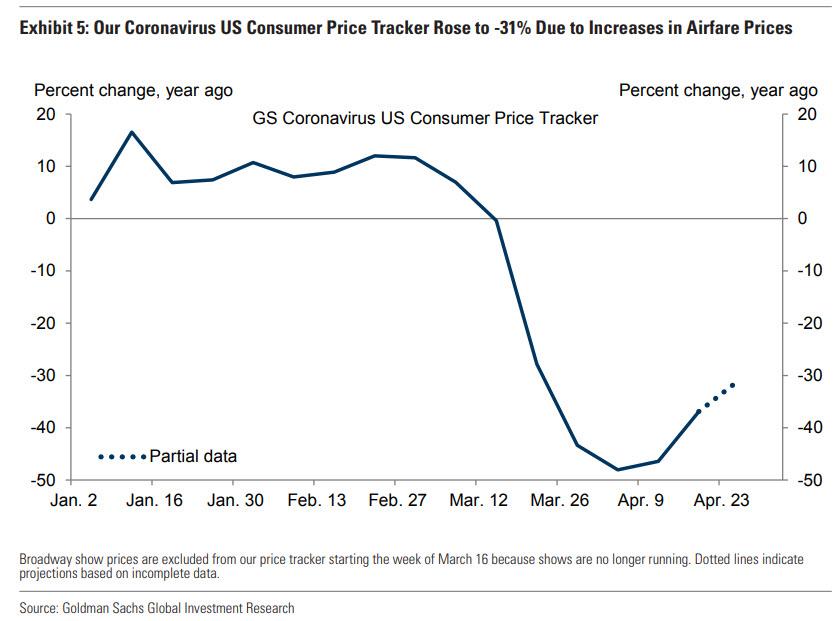

As the following chart tracking daily consumer prices shows, after cratering by as much as 50% into the middle of April, consumer prices have rebounded in the past week to -31%, which while still clearly ugly, indicates that some demand is coming back (in this case rising airfare prices).

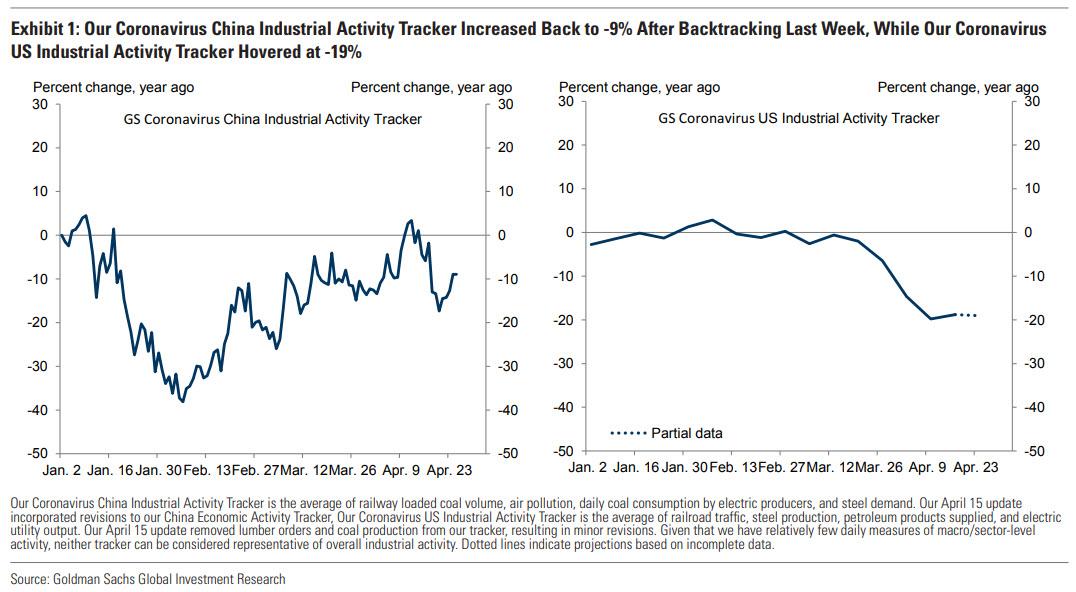

That said, other real-time activity trackers are showing the opposite, namely a downward inflection point such as for example the recent decline in China Industrial Activity which has backtracked in the past two weeks, while the US Industrial Activity Tracker clearly hovered at post crisis lows of -19%. This suggests that after a forced rebound in the past month, China may be again relapsing to the global industrial malaise, even as the US has still to find the lows.

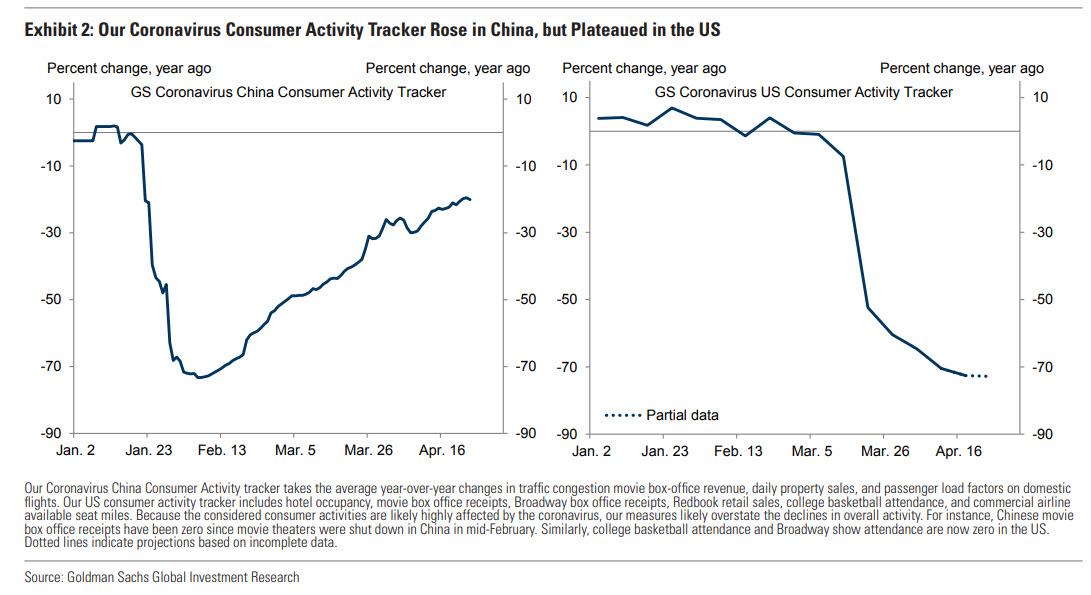

At the same time, a more optimistic picture for China emerges when tracking consumer activity, which tracks spending in categories of consumption that are likely to be disproportionately affected by the virus, which continued to rise in China, even as it remains unchanged at -73% yoy in the US.

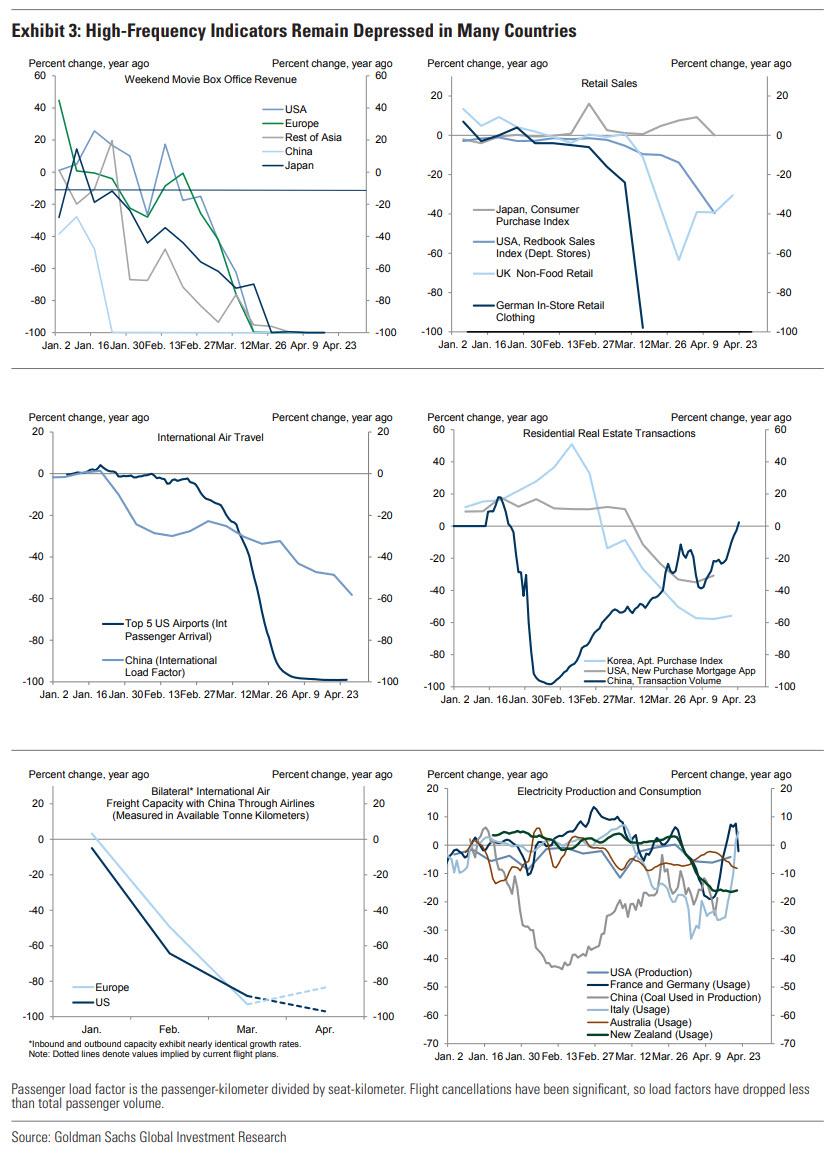

Real-time indicators across other sectors and countries show conflicting trends, with China clearly rebounding in real estate transactions and stabilizing for electricity consumption, while continuing to contract for weekend box office movie revenue, arguably the clearest indicator in the broader population’s confidence that the pandemic has been contained.

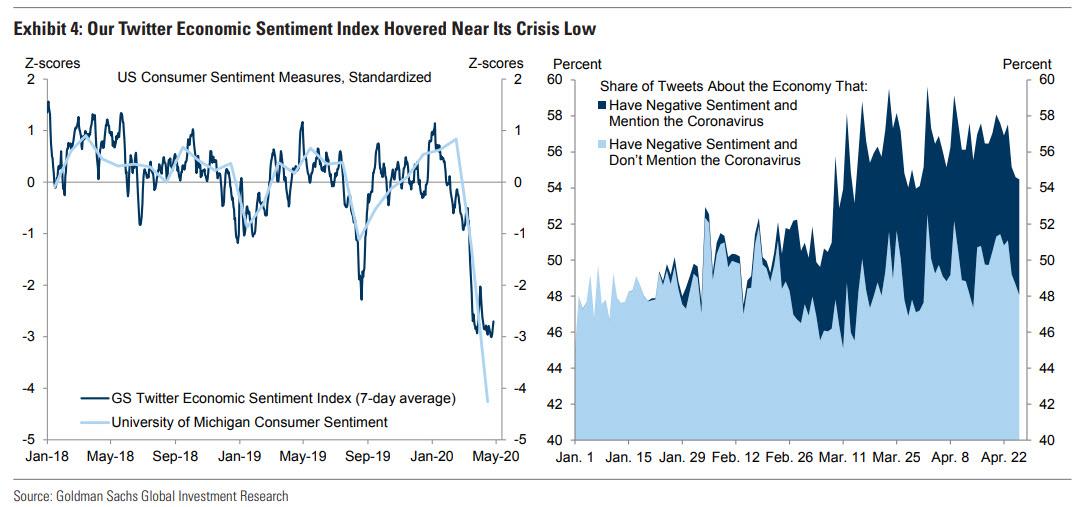

Sentiment remained dismal when viewed through the perspective of social networks, in this case economic sentiment as expressed on twitter.

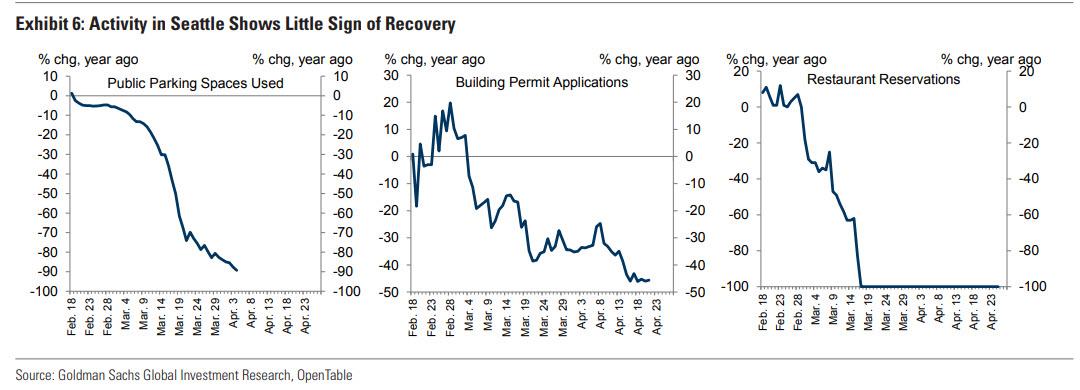

There was more bad news when one looked at the US economy regionally, with the Seattle area showing little sign of recovery…

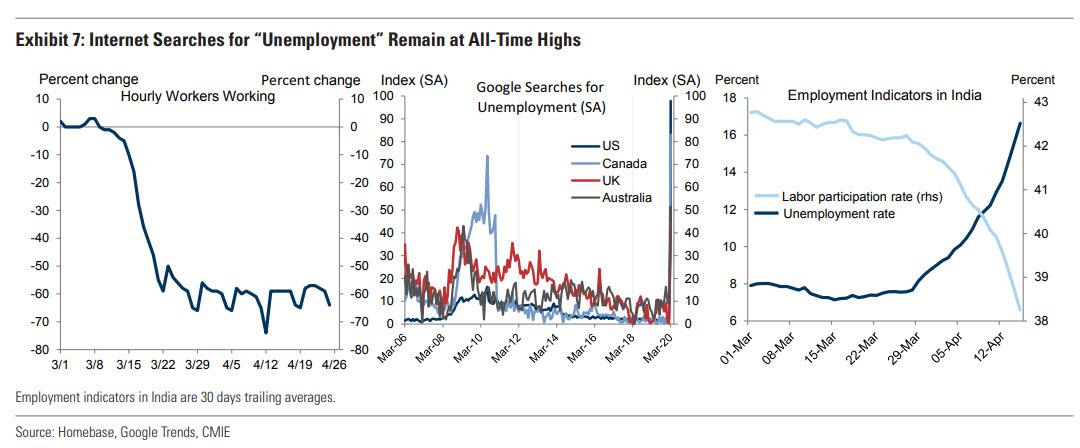

… while “unemployment” searches remain at all time highs, indicating we have yet to hit a peak in the deterioration in the labor market.

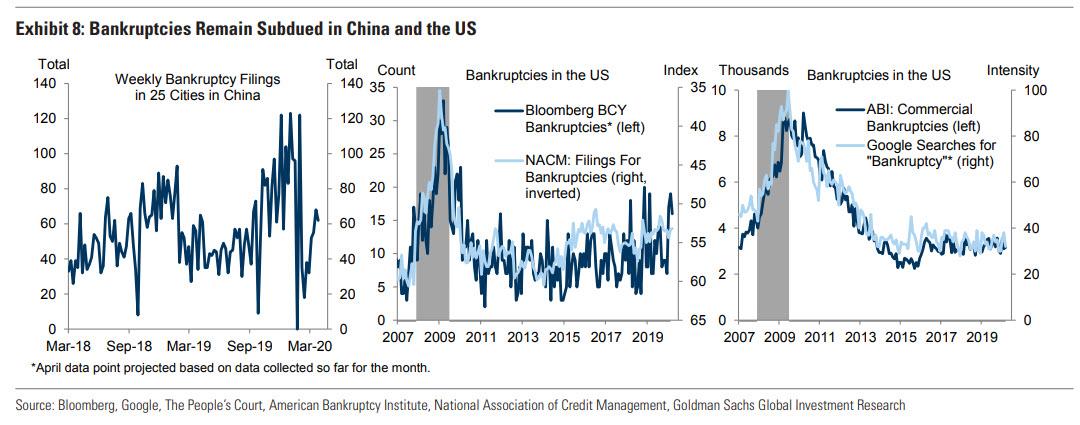

The silver lining: for now, at least, bankruptcies remain subdued in both the US and China, suggesting this could be the next big show to drop.

Tyler Durden

Tue, 04/28/2020 – 19:05

via ZeroHedge News https://ift.tt/2yR2vzW Tyler Durden