Morgan Stanley Buys Eaton Vance For $7 Billion, Bringing Total AUM To $4.4 Trillion

Tyler Durden

Thu, 10/08/2020 – 07:47

Less than a week after closing its acquisition of retail brokerage E*trade, moments ago Morgan Stanley announced that it had agreed to buy Boston-based investment management company Eaton Vance which manages some $500BM in AUM, for an equity value of approximately $7 billion.

Shareholders of Eaton Vance, which is one of the oldest investment companies in the United States with a history going back to 1924, will receive $28.25 per share in cash and 0.5833x of Morgan Stanley common stock, representing a total consideration of about $56.50 per share. The acquisition is subject to customary closing conditions, and is expected to close in the second quarter of 2021.

According to the press release, “Morgan Stanley Investment Management (MSIM) will be a leading asset manager with approximately $1.2 trillion of AUM and over $5 billion of combined revenues. MSIM and Eaton Vance are highly complementary with limited overlap in investment and distribution capabilities. Eaton Vance is a market leader in key secular growth areas, including in individual separate accounts, customized investment solutions through Parametric, and responsible ESG investing through Calvert. A leader in value-add fixed income solutions, Eaton Vance fills product gaps and delivers quality scale to the MSIM franchise. The combination will also enhance client opportunities, by bringing Eaton Vance’s leading U.S. retail distribution together with MSIM’s international distribution.”

“Eaton Vance is a perfect fit for Morgan Stanley,” said James P. Gorman, Chairman and Chief Executive Officer of Morgan Stanley. “This transaction further advances our strategic transformation by continuing to add more fee-based revenues to complement our world-class investment banking and institutional securities franchise. With the addition of Eaton Vance, Morgan Stanley will oversee $4.4 trillion of client assets and AUM across its Wealth Management and Investment Management segments.”

Some more details on the deal structure:

Under the terms of the merger agreement, Eaton Vance shareholders will receive $28.25 per share in cash and 0.5833x of Morgan Stanley common stock, representing a total consideration of approximately $56.50 per share. Based on the $56.50 per share, the aggregate consideration paid to holders of Eaton Vance’s common stock will consist of approximately 50% cash and 50% Morgan Stanley common stock. The merger agreement also contains an election procedure allowing each Eaton Vance shareholder to seek all cash or all stock, subject to a proration and adjustment mechanism. In addition, Eaton Vance common shareholders will receive a one-time special cash dividend of $4.25 per share to be paid pre-closing by Eaton Vance to Eaton Vance common shareholders from existing balance sheet resources. It is anticipated that the transaction will not be taxable to Eaton Vance shareholders to the extent that they receive Morgan Stanley common stock as consideration. The transaction has been approved by the voting trust that holds all of the voting common stock of Eaton Vance.

According to Morgan Stanley, the transaction will be attractive for shareholders and “the combination will better position Morgan Stanley to generate attractive financial returns through increased scale, improved distribution, cost savings of $150MM – or 4% of MSIM and Eaton Vance expenses – and revenue opportunities.”

By financing the transaction with 50% cash, Morgan Stanley will utilize approximately 100bps of excess capital, and the Firm’s common equity tier 1 ratio is expected to remain approximately 300bps above the Firm’s stress capital buffer (SCB) requirement of 13.2%. The transaction is expected to be breakeven to earnings per share immediately and marginally accretive thereafter, with fully phased-in cost synergies, and add approximately 100bps to return on tangible common equity.

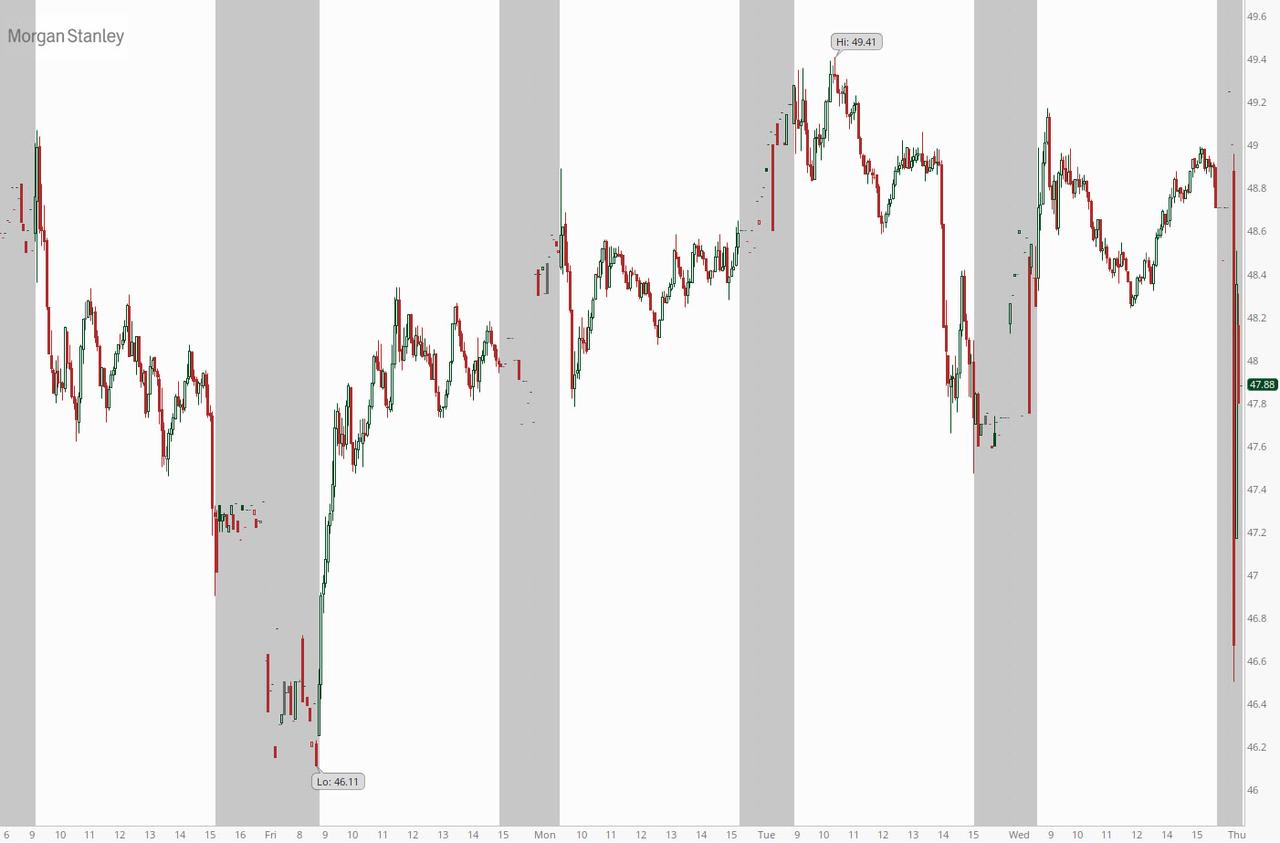

Following the news, Morgan Stanley shares tumbled as much as 4.5% before recovering some losses.

via ZeroHedge News https://ift.tt/3iNMHPO Tyler Durden