Frazzled Traders Turn To Booze, Tear Up The Script And Just Buy Everything

Tyler Durden

Wed, 11/04/2020 – 12:32

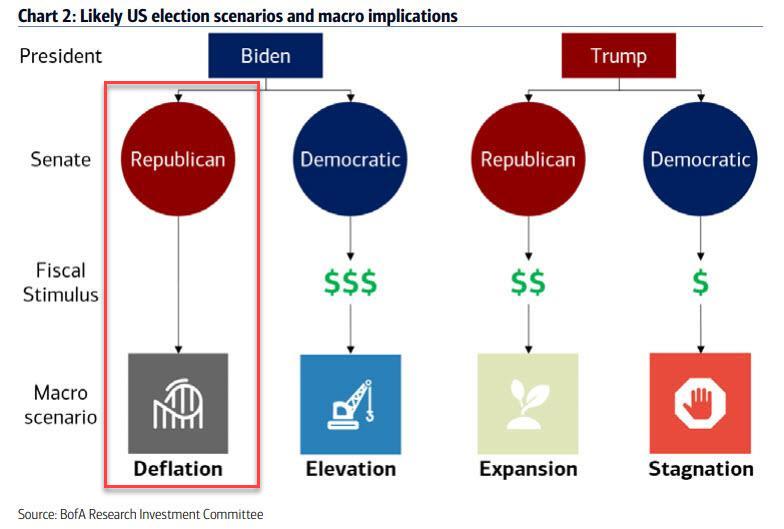

It was supposed to be the second worst possible outcome: a Biden presidency (which appears likely absent a SCOTUS reversal of the mail-in wave in battleground states) coupled with a Republican Senate, was said to result in “Bearish Gridlock” which according to Bank of America would be bearish for economic growth, corporate profits and financial markets (but it would be bullish for more stimulus from the Fed). In any case, as BofA sarcastically puts it, “after $21tn of monetary & fiscal stimulus in 2020, $0 of follow-on support would be deflationary.”

The reason for BofA’s dour outlook: political parties historically have used obstructionist tactics when out of power to thwart key legislation, most often through the “rediscovery” of commitments to “fiscal discipline”. As an example, BofA cites the budget austerity during 2012-2015 as a major reason for the slow economic recovery. Incidentally, the bank’s reco “in this scenario investors should prepare for lower returns and higher volatility. Raise cash and buy Treasuries, munis, and high-quality corporate bonds.”

Visually, you are here:

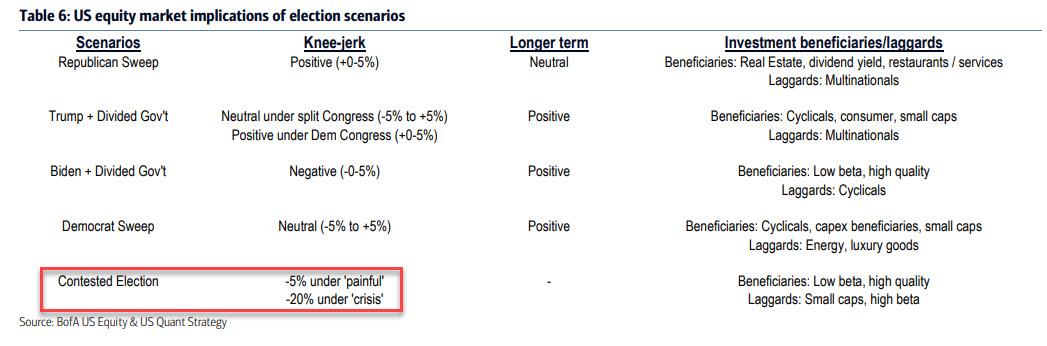

Meanwhile, the all too real possibility that we are entering a period in which the Trump admin will challenge every battleground state result means we have days if not weeks in which where the decision on the ultimate outcome can go all the way to the supreme court. And, as further reminder, just last week, Bank of America predicted that a possible “contested election” crisis could results in up to 20% drop in stocks.

Which is why it is bizarre that today, in a day when we have both of these near worst-case outcomes, risk and Treasurys are both soaring, an unexpected outcome that has taken a heavy toll on traders who found out this morning that the entire election playbook was completely worthless. Indeed, by Wednesday morning, the Nasdaq 100 surged 4.2% – after being briefly halted after tripping a circuit-breaker to the upside – while the S&P 500 Index climbed 2.6% and Treasury bonds rallied.

As Bloomberg writes, after hours of staring at futures, watching financial TV and analyzing charts, Paul Nolte, a portfolio manager at Kingsview Investment Management, turned to something to settle his nerves: “A bottle of bourbon was the only way I could make it through the night.”

He wasn’t alone: Steve Chiavarone was another portfolio manager who picked up the bottle: the equity strategist at Federated Hermes said that while the evening played out largely along his firm’s expectations, he still spent a lot of time Facetiming with teammates and answering text messages. “It was like a big sleepover with some of your good friends, nerding out,” he told Bloomberg. And there might have been a glass or two of bourbon consumed. “I had dinner but I don’t remember what it was,” he said. “It seems like it was that long ago.”

One person who should have been drinking heavily, was Anthony Saglimbene who had the painful job of capturing all the gyrations in a market commentary he sends to clients of Ameriprise Financial every morning. As the S&P 500 December futures contract swung from gains to losses and back, many drafts hit the waste basket.

“It’s looking like a blue wave. You write a little bit. And then you realize as the night goes that’s not really how it’s going,” said Saglimbene, who lives in Rochester, Michigan, the middle of a key battleground state. “Scrap that. Start rewriting.”

DataTrek Research co-founder Nick Colas took a drive around Manhattan around 11 p.m., where almost every storefront in midtown was boarded up in anticipation of potential unrest.

“New Yorkers occasionally get grief for being bluntly direct, fact-based, ‘what’s your point?’ sorts of people, and all the preparations for potential post-Election mayhem here fit that mold,” Colas wrote in a note to clients. “With any luck, we won’t need them. But just like risk management in investing, a little preparation goes a long way.”

In the end, there was no violence; in fact the only “violence” perpetrated was that against shorts, both in stocks – where until recently the Nasdaq sported a near record bearish bias…

… and in bonds, where the 30Y cumulative net short position is the highest on record, and is causing lots of pain for all those expecting higher yields.

Traders in Europe, who were also up all night, were a bit more civilized chugging coffee instead of bourbon.

“I spent a sleepless night in London fueled by copious amounts of coffee while the results trickled in slower than expected,” said Michael Brown, a senior market analyst at Caxton FX. “I’ve spent enough time looking at Electoral College maps over the last 18 hours to last a lifetime.” In Germany, Guillermo Hernandez Sampere, head of trading at MPPM EK, said that it was “the first time in six months when I didn’t hear of Covid-19 throughout the day — the attention had shifted entirely to the election.

Back in the US, however, the alcohol flowed: In Costa Mesa, Max Gokhman got by with the help of his “two friends,” as he called them: cold brew and bourbon. Eventually, the head of asset allocation for Pacific Life Fund Advisors was left alone with his drinks and election scenario tracking models. His wife couldn’t take the suspense and went to bed. His six-year-old German shepherd Wally lost interest, too.

“It wound up just being me and my home office, with the tender glow of the three screens reflecting off of my whiskey snifter.”

* * *

Finally, as for why traders tore up the carefully prepared script and just bought everything, the reason is simple: as JPM explained in a moment of “brutal honesty” on Monday, bad news is great for stocks because the “resultant growth weakness could bolster the above equity upside over the medium to longer term via inducing more QE and thus more liquidity creation.“

In other words, as we have said all along, for the market it does not matter who is president, as long as there is a Fed chairman who will hit CTRL-P whenever things get bad.

via ZeroHedge News https://ift.tt/32fM3F7 Tyler Durden