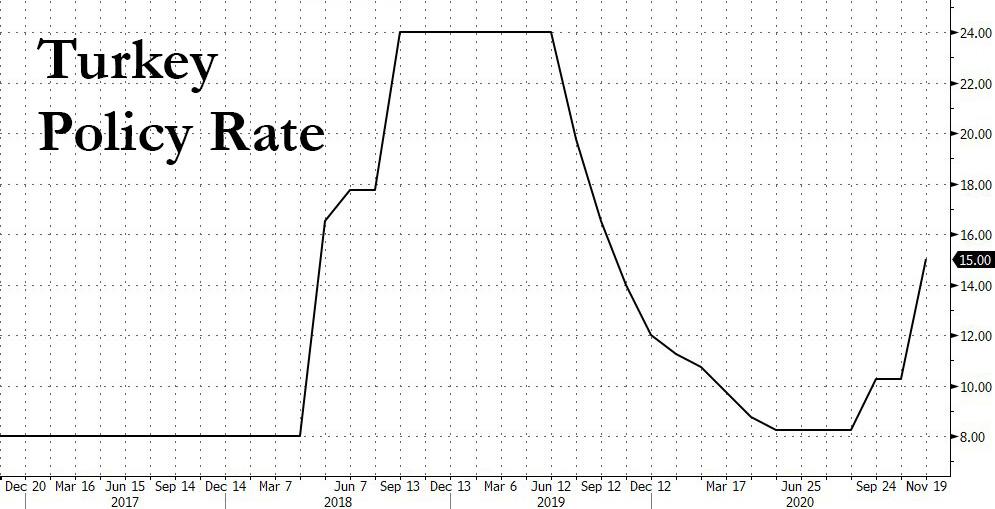

Erdoganomics Is Over: Turkey Hikes Rates By 475bps To 15%

Tyler Durden

Thu, 11/19/2020 – 07:31

Over two years after Turkey launched the great monetary experiment known as Erdoganomics, in which monetary orthodoxy was turned on its head and inflation was “fought” using lower rates, it ended with a thud this morning when Turkey, under a brand new central bank governor, hiked its policy (one-week repo auction) rate by a whopping 475bps to 15%, on top of estimates as the central bank delivered the “stability hike” that analysts were expecting as it aims to regain credibility in its policy as well as the TRY.

All other rates were also hiked:

- The Late Liquidity Window Rate was raised to 19.50% from 14.75%, above the Exp. 18.75%

- The overnight Lending Rate rose to 16.50% from 11.75%, in line with Exp. 16.5%

- The overnight Borrowing Rate rose to 13.50% from 8.75%.

This means that despite president Erdogan’s well-known disdain for higher rates, he has acknowledged that it is far more important to contain the collapse in the lira – which had been the worst-performing currency among emerging market peers this year – than to worry about the economy, which will naturally be hammered by the higher rates at a time when virtually every other central bank is cutting rates and otherwise easing to promote growth.

Below are some highlights from the CBRT statement justifying the decision:

- The permanent establishment of a low inflation environment will affect macroeconomic and financial stability positively through the fall in country risk premium, reversal in the dollarization trend, accumulation of foreign exchange reserves and the perpetual decline in financing costs

- The lagged effects of depreciation in Turkish lira, increasing international food prices and deterioration in inflation expectations affect the inflation outlook adversely.

- While tracked data for November point to an increase in inflation due to the recent exchange rate volatility, this is assessed to be temporary with the decisive monetary policy stance.

- Accordingly, the Committee has decided to implement a transparent and strong monetary tightening in order to eliminate risks to the inflation outlook, contain inflation expectations and restore the disinflation process.

- The Central Bank will attain its main objective of achieving and maintaining price stability by adopting transparency, predictability and accountability principles of the inflation targeting regime.

- In light of these principles, the Central Bank funding will be provided through the one-week repo rate, which will be the main policy tool and the only indicator for the monetary stance.

The lira, which had been in freefall as recently as two weeks ago when the central bank governor was unexpected sacked coupled with the resgination of the finance minister (and Erdogan’s son), rose in the wake of the decision with the USDTRY declining from around 7.68 to 7.4950 but the reaction pared slightly as the dust settled, with the USDTRY moving moving to levels around 7.55. Still, it is hard to see how this upside will be sustained absent carry flows since the nearly 30% increase in rates will now further depress what little economy activity was taking place.

via ZeroHedge News https://ift.tt/3kLLwB2 Tyler Durden