London Braces For Brexit’s Financial Shockwave

Tyler Durden

Tue, 12/08/2020 – 02:45

The turmoil in London’s financial industry as a result of the pandemic looks like it is only going to get worse.

That’s because Britain is entering its final month of its Brexit transition period without a financial-services deal, according to Bloomberg. This means that many financial firms in London could be on their way out in favor of the European Union.

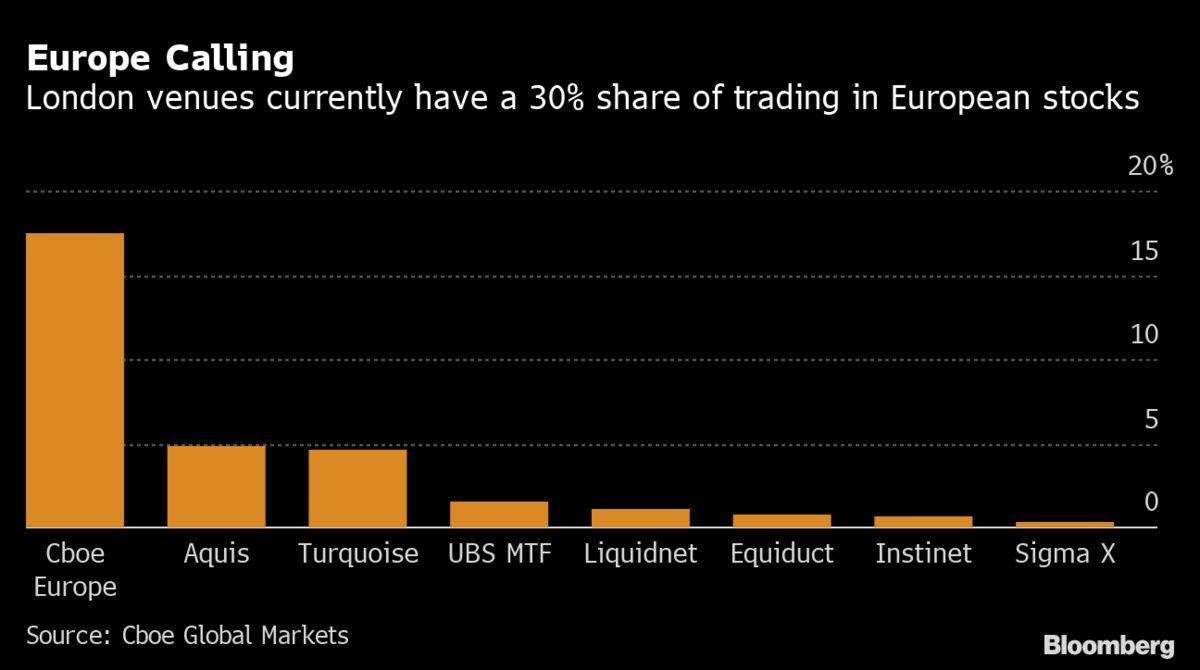

London trading platforms like Turquoise Europe, Cboe Europe and Aquis Exchange are all setting up in Amsterdam as “part of their no-deal Brexit plans”, the report notes. Goldman Sachs has petitioned French regulators to allow it to open its SIGMA X Europe stock platform in Paris, beginning in January.

Aquis already has a presence in Paris, having gone live with more than 1,700 European shares this months. Some other firms have built outposts in places like Dublin, where they can ensure they can serve their clients.

Between JP Morgan and Goldman Sachs alone, more than 300 staff members will be moving to continental cities. Goldman is going to be moving about $60 billion in assets and JP Morgan will be moving about $230 billion to Frankfurt. The group is also encouraging London’s euro swaps clearing business to shift to Europe.

E&Y predicts that only 10% of firms are going to establish or expand operations in the U.K. given the new environment. It noted in a recent report that the $1.6 trillion that has already moved out of the U.K. “may just be the beginning”.

Alasdair Haynes, chief executive officer at Aquis said simply: “The City of London has been thrown to the lions.”

David Howson president of Cboe Europe commented: “We are expecting a big bang on Jan. 4. The industry has never had to move this much flow overnight.”

While the city of London’s financial services won’t come close to shutting down entirely, the shift is seismic in size. But the city’s English speaking populous and its legal system continue to make it a friendly home to many firms. Additionally, a last minute financial services deal isn’t off the table just yet.

But the mood in London has soured. Lord Mayor of London William Russell concluded: “There is a sense of frustration. It is disappointing.”

via ZeroHedge News https://ift.tt/39UEKau Tyler Durden