Call Volumes “Absolutely Absurd” – Nomura Warns Sentiment Overshoot “Getting Scary” Ahead Of Quad Witch

Tyler Durden

Tue, 12/08/2020 – 11:50

The ongoing meltup in stock markets lifted global market caps above $100 trillion for the first time in history yesterday…

Source: Bloomberg

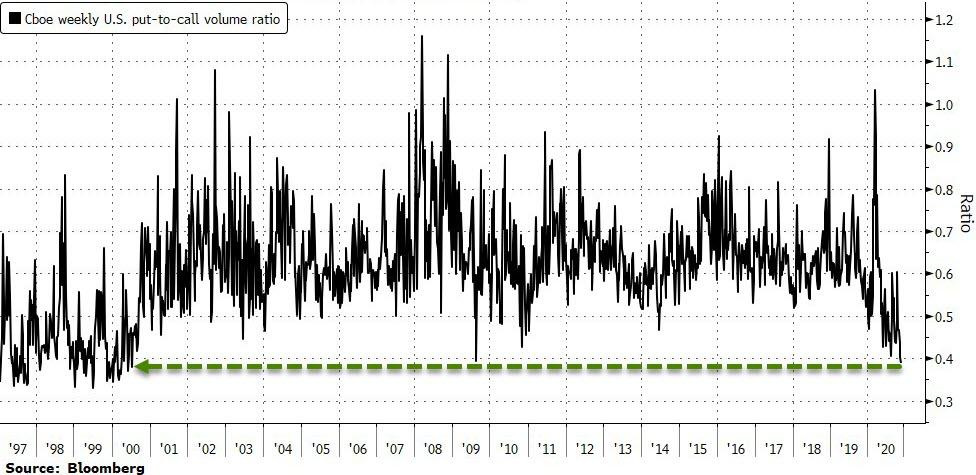

As so-called investors do away with any form of protection, seemingly reliant on a central bank or governmental response to every dip…

Source: Bloomberg

As Nomura’s Charlie McElligott warns that equities’ “weaponized short gamma” remains supportive…

…yesterday’s short-dated Call volumes in the RobinHood YOLO names were again just absolutely absurd, with TSLA seeing ~950k Calls trade, PLTR ~700k, NIO ~425k….while “lowly” SPX only saw 350k Calls traded…

…I’m telling you, this is a “real thing,” with the Retail hordes on Reddit/WSB intentionally creating negative convexity events for Dealers in short-dated out-of-the-money upside Calls in these single-name high-flyers.

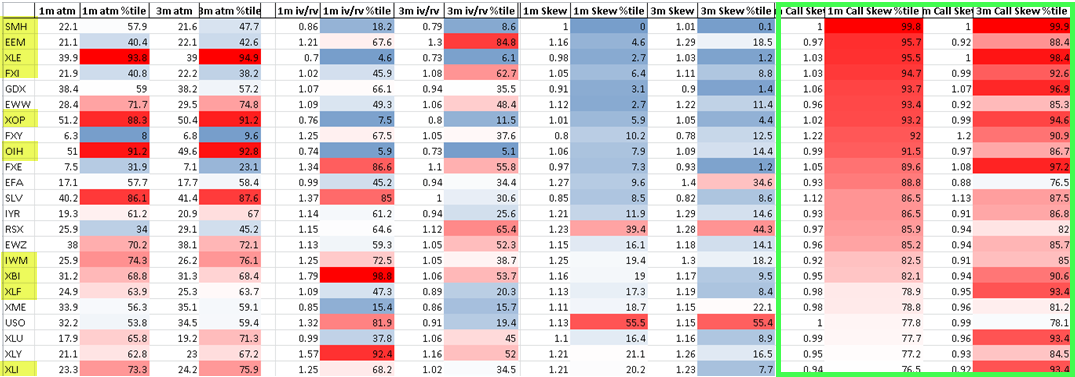

Notable Call Skew extremes seen in growth- / cyclically- sensitives as well—grabbing for “crash-up”

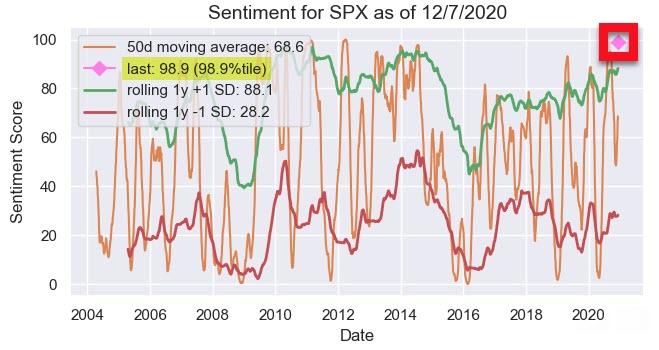

But, as McEllligott warns, the overshoot in sentiment is starting to get scary, especially ahead of quad witch next Friday.

…our SPX Sentiment gauge closed last night at 98.9%ile since 2004…

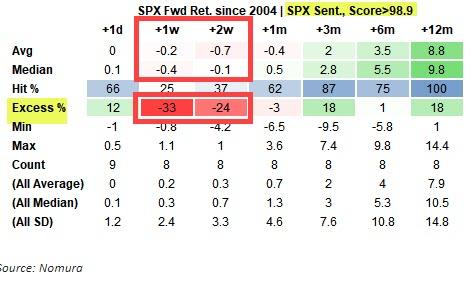

…which back-tests as a slight negative for SPX fwd returns out 1w and 2w historically, but most notably sees powerfully negative “excess hit %” at -33% for 1w ahead and -24% for 2w out…

And, as McElligott notes, it is this “sentiment overshoot” frankly is really the most credible source of potential pullback risk for the next two weeks, as the “right-tail” CRASH-UP scenario remains very much the more likely “play” due to bullish / supportive options flow dynamics into Quad Witch Op-Ex and VIX expiry.

via ZeroHedge News https://ift.tt/39UkR3w Tyler Durden