Snowflake Market Cap Surpasses IBM, AMD

Tyler Durden

Tue, 12/08/2020 – 12:20

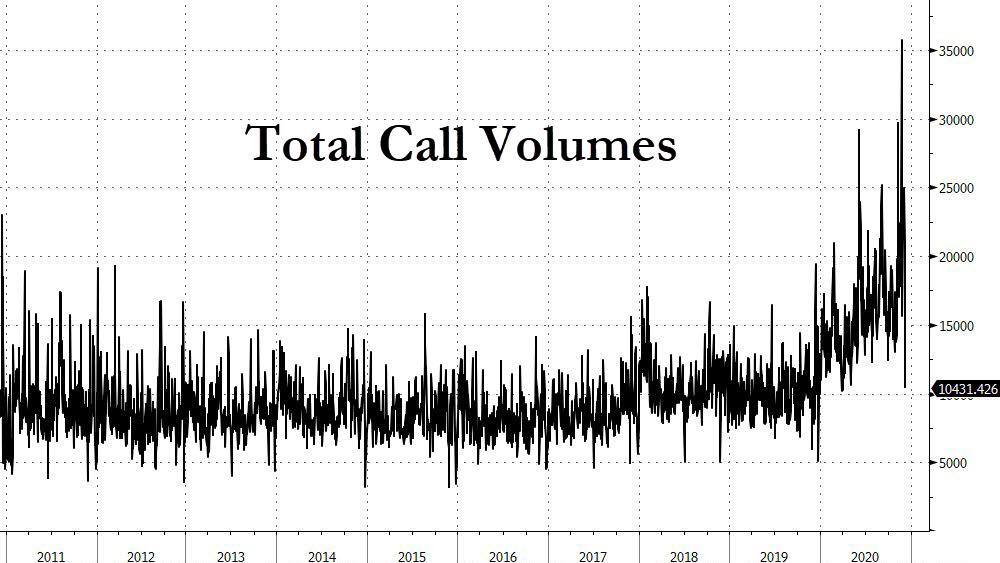

The berserk stock market frenzy resumed on Tuesday on the back of what Charlie McElligott calls “weaponized gamma” only instead of SoftBank ramping stock prices by forcing a dealer short gamma squeeze, this time it appears to be retail behind the burst higher as a result of what the Nomura quant calls “absolutely absurd” volumes in short-dated Calls in RobinHood YOLO names: TSLA saw ~950k Calls trade, PLTR ~700k, NIO ~425k….while the “lowly” SPX only saw 350k Calls traded.

As McElligott puts it, “this is a ‘real thing’ with the Retail hordes on Reddit/WSB intentionally creating negative convexity events for Dealers in short-dated out-of-the-money upside Calls in these single-name high-flyers.”

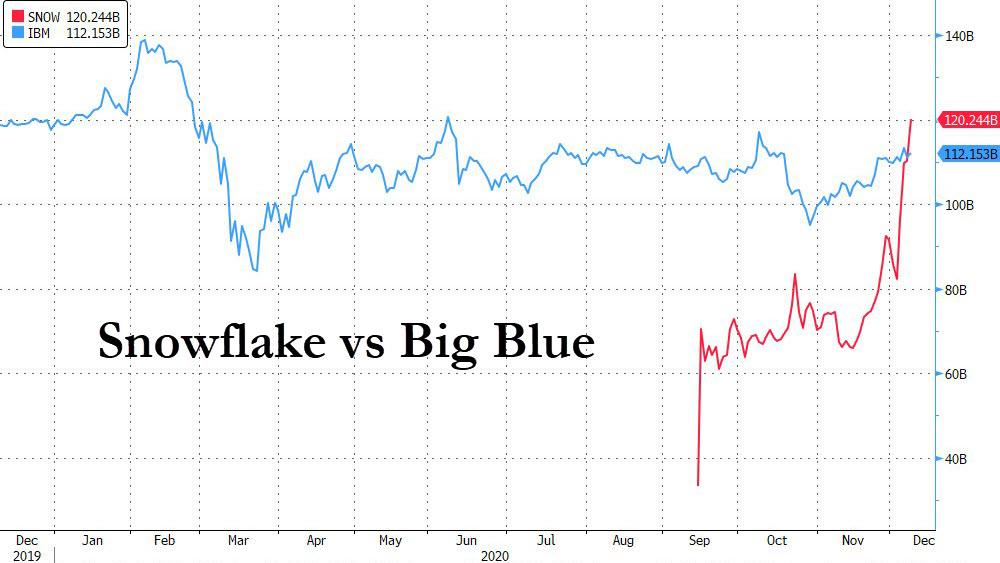

And with the TSLA momentum frenzy temporarily halted following today’s $5BN ATM stock offering, the euphoria has shifted to other daytrading YOLO names such as recently IPOed cloud-computing newcomer Snowflake, whose shares continued their surge on Tuesday, sending its market valuation above both IBM and AMD.

Putting the move in context, IBM, which is expected to generate $74 billion in revenue this year, has a market cap of $112 billion, while AMD, with nearly $10 billion in projected sales, weighs in at $111 billion. Snowflake, by comparison, should hit $578.2 million in revenue this year.

So if it’s not fundamentals, what is it? Simple: everyone is once again scrambling into calls, with the total call option volume on Tuesday exceeded the 20-day average less than an hour into trading, and is set to outpace put options by a rate of almost 3-to-1.

via ZeroHedge News https://ift.tt/2K0PLfI Tyler Durden