The Next Commodity Supercycle

There are three big drivers of the commodity supercycle:

- The long era of monetary-policy dominance is over, leading to a heightening of inflation risks not seen since the 1960s

- Investors are deeply underweight and will need real assets such as commodities as a hedge against inflation

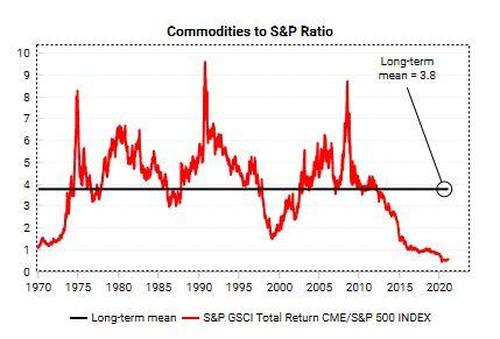

- Commodities are generationally cheap, both compared to themselves and to other assets

It is rare in macro-forecasting when the stars align so perfectly. The combination of substantially different inflation risks, capital scarcity across several commodity sectors, and 50 years’ of underperformance compared to financial assets make commodities one of the most compelling long-term investment opportunities at the moment.

Policy Drivers of Supercycle

The convergence of fiscal and monetary policy represents a profound change to the investment landscape. Monetary policy, hitting up against zero rates and with central banks’ balance sheets already bloated, it is becoming ever more incumbent on more fiscal policy to boost economies and inflation.

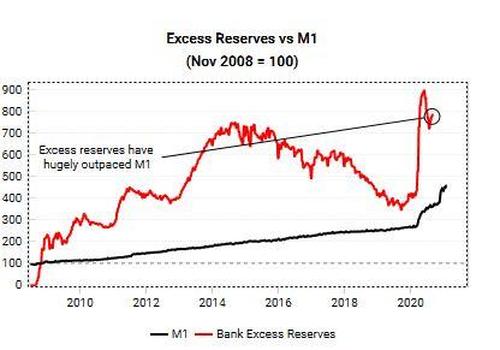

But policymakers should be careful what they wish for. Large government deficits financed by pliant central banks have preceded every high and hyper-inflationary episode of the 20th century, from Weimar Germany in the 1920s, to Hungary in the 1940s, to Argentina in the early 1990s. QE has lulled people into a false sense security as it was not inflationary. QE created a supply of dollars, and relied on the banking system to “transmit” those dollars. But a private sector still licking its wounds from the financial crisis did not want to borrow, and banks did not want to lend, which meant borrowing and therefore inflation did not sustainably pick up.

The pandemic accelerated a trend that was already in place: the increasing impotency of QE. Now we need QE combined with large government deficits, which is a very different beast to QE on its own as it creates supply of money and a simultaneous demand for that money. History shows this has much greater inflationary potential.

Changing Inflation Regimes

We are shifting from the “Lake Regime” to the “Ocean Regime”. In the Lake Regime of the last 20-30 years, cyclical moves in inflation were contained and containable as monetary policy on its own still had teeth. But in the Ocean Regime, where we are today, the underlying risks to inflation have shifted, and garden-variety moves in inflation have a greater likelihood of becoming unanchored and disorderly.

This does not mean inflation is imminent, but it does mean any short-term rise in inflation could turn into something longer-lasting and persistent. However, the nature of inflation is that it does so abruptly and with little warning. It is just like how Ernest Hemmingway described how one goes bankrupt, “first slowly, and then suddenly”.

What Should You Do?

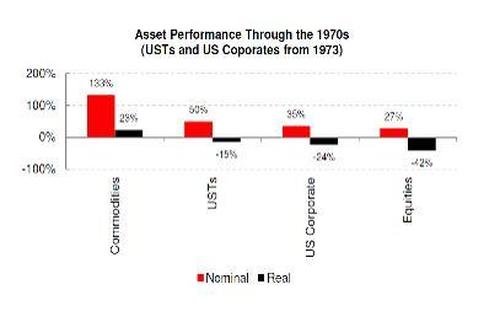

This is why action must be taken today to make portfolios more inflation-resilient. Looking to the high-inflation 1970s, commodities were the only major asset class to deliver a positive real (ie inflation adjusted) return.

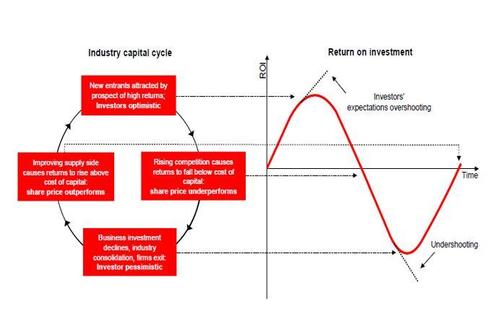

When we combine this structurally positive backdrop for commodities with a capital-cycle analysis the case for commodities becomes more compelling. In short, sectors suffering from capital scarcity tend to outperform as lack of competition causes returns to fall below the cost of capital.

Based on our analysis, several sectors in the commodity space, such as gold and silver mining, integrated oil and gas, and copper are among the most capital-scarce sectors globally. Underinvestment in supply means these sectors will not be able to respond to the strong recovery in demand we should see this year as the world emerges from the pandemic.

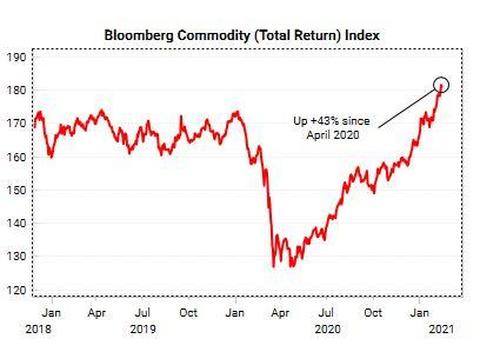

When demand meets excess supply of dollars meets an investment community severely underinvested in real assets such as commodities, the only thing that can respond is price. This is what we have been seeing, with commodities up 43% since April last year.

The shorter-term gains may be behind us, but the potent structural backdrop for commodities and real assets we have outlined support a much longer lasting commodities supercycle that is beginning.

Please see the full report for much more in-depth analysis.

Tyler Durden

Sun, 02/21/2021 – 12:05

via ZeroHedge News https://ift.tt/3uj5UiZ Tyler Durden