JPMorgan Finds No Bounce In Retail Trades Despite New $1,400 Stimmy Checks

Earlier this week, we reported on a surprising finding from JPMorgan: in analyzing trends in retail and daytrading activity, quants at the largest US commercial bank found that retail investor no longer YOLOed into calls of meme stocks, but were instead hedging their (quite impressive) recent gains by buying puts in QQQs, to wit:

… the number of call-buying trades on QQQ is quite significant but is outweighed by put-buying trades. This is in stark contrast to the order flow in the underlying equity market, where retail traders have been net buyers of QQQ and related ETFs. This suggests to JPMorgan that retail investors are now buying Nasdaq/QQQ puts as likely hedges for the long cash equity positions!

Perhaps as a result of this increasingly cautious position among the daytrading crowd, in a follow up report from JPM’s Peng Cheng, the quant finds that “over the past week, despite the beginning of the $1,400 stimulus check disbursement, we have yet to observe a meaningful pick-up in retail trades as a % of total orders.”

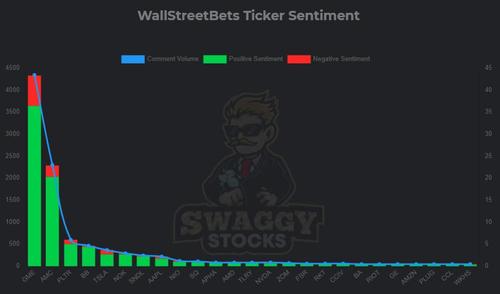

This makes intuitive sense perhaps as a result of the recent fizzle in outright euphoria on Wall Street Bets where the increase in negative sentiment in such former darling meme names as Gamestop and AMC is notable, when one compares the following sentiment report (via Swaggy Stocks) from Feb 25…

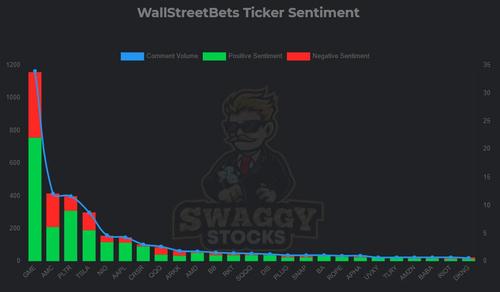

… and compares it to today:

Some other observations from JPM’s Peng:

- Reddit favorites (e.g. AMC and PENN) remain popular and have gathered strong inflows in the past week. In contrast, fuel cell names such as PLUG and FCEL along with small-cap healthcare names experienced heavy selling pressure.

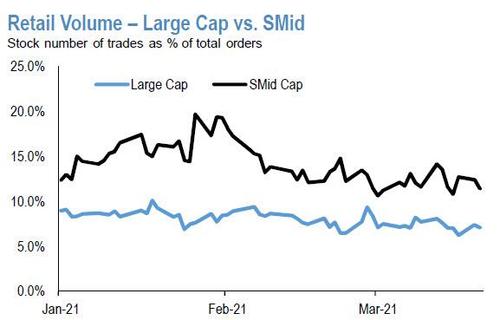

- Retail size bias remains tilted towards SMid vs. Large caps based on their number of trades relative to total market order.

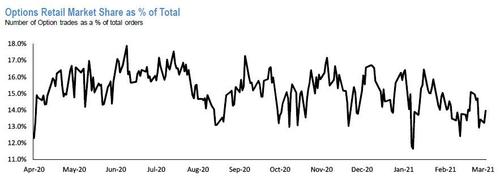

- Retail preference for option trading rebounding after monthly expiry last week.

- SMid-cap sectors: Retail trends mixed at the SMid level. Retail still broadly favoring Communication Services and Discretionary MTD. However, Healthcare, Financials,Staples and Industrials remain under pressure for the month though relatively flat onthe week.

- Large-cap sectors: Retail continues to favor Technology, Discretionary, Healthcare and Staples. Financials are rebounding after strong net retail selling at the beginning of the month. Retail interest in Energy and Communications continues to move sideways through March.

So if retail traders aren’t, well, trading then what are they doing? It appears that they may be going back to life as usual – i.e., shopping.

According to Bloomberg’s analysis of mobile-phone location data collected by SafeGraph, U.S. retail foot traffic soared 58% last week from a year earlier (although much of this is likely due to the base effect comparing to this week one year ago when the US shutdowns started in earnest).

Some more details: off-price, with a gain of 263%, and malls, department stores and apparel, with an increase of 196%, had the biggest improvements among six categories tracked. Grocery stores had the only decrease, with a loss of 6.2%.

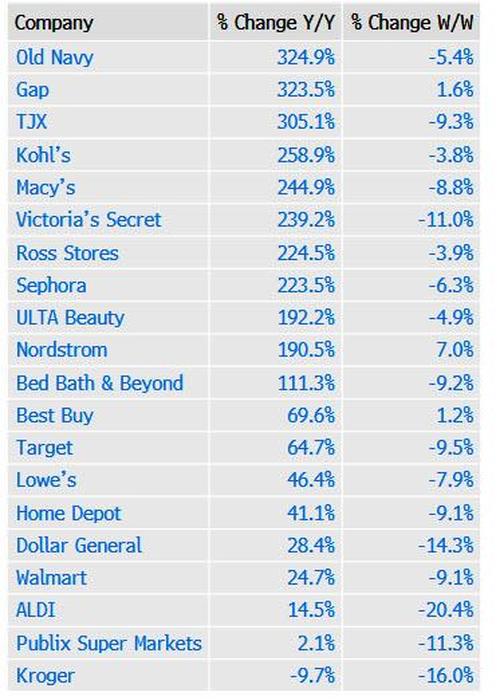

Here are details on foot traffic trends for more than 1 million U.S. retail stores tracked by SafeGraph, as well as for each of the six categories.

Old Navy, with a 325% advance, and Gap, with an increase of 324%, notched the biggest year-over-year gains among a selection of retailers tracked. Kroger had the top year-over-year decrease at 9.7%.

Ironically, just like a year ago the US nationwide shutdowns marked the bottom for the retail sector, so the (nearly) all clear may have marked the top: last week, the SPDR S&P Retail ETF (which itself is massively shorted) dropped 3.6% while the S&P 500 lost just 0.8%.

Tyler Durden

Thu, 03/25/2021 – 15:45

via ZeroHedge News https://ift.tt/3d4S4Jv Tyler Durden