Goldman Analyst Barred From Securities Industry For Insider Trading

A former Goldman Sachs research analyst has just been barred from the securities industry for blatantly trading on insider information extracted from fellow analysts at Wall Street’s most powerful firm.

According to a statement from Finra, Maguire bought shares in two companies via undisclosed trading accounts after seeing internal emails that the research analyst covering those companies was upgrading his ratings from “neutral” to “buy” in April and June 2020.

What’s more, Maguire tried to cover up his insider trades by lying to Finra when it first started sniffing around. Jessica Hopper, Executive Vice President and Head of FINRA’s Department of Enforcement, released a statement about the decision on twitter: “Insider trading by securities industry professionals erodes the public trust in our capital markets. FINRA utilizes sophisticated surveillance tools to detect and remediate this type of misconduct. Ensuring market integrity is one of FINRA’s core missions and weeding out misconduct from within the industry will always be a priority for FINRA.”

JUST IN: We have barred former Goldman Sachs research analyst Brian Maguire for insider trading. Learn more ▶️ https://t.co/8Cm6YlnLCy pic.twitter.com/TjNtSMicHq

— FINRA (@FINRA) April 20, 2021

Maguire purchased the shares after the upgrades were approved internally but before the research reports announcing those upgrades were published.

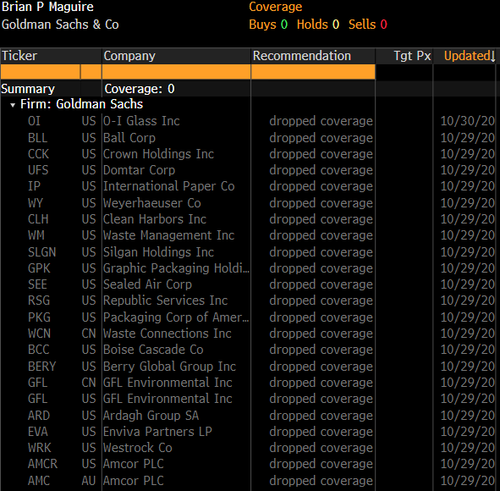

Before the hammer came down, Maguire covered a variety of paper, packaging and environmental service companies according to his LinkedIn page. Data from Bloomberg lists his coverage universe as of Oct. 29 of last year, which is when the hammer apparently came down.

US Federal law prohibits the purchase or sale of a security of any issuer on the basis of material nonpublic information; a person trades “on the basis” of material nonpublic information if the person making the purchase or sale was aware of the material nonpublic information at the time of the transaction. An impending research analyst upgrade may be material and is nonpublic until the research report containing the upgrade is published.

FINRA said Maguire neither admitted nor denied the charges, though he consented to the entry of its charges.

Tyler Durden

Tue, 04/20/2021 – 11:00

via ZeroHedge News https://ift.tt/3sCJnvw Tyler Durden