Canadian Drama: Loonie Dumps And Pumps On Headline Chaos As BOC Tapers Bond Purchases, Moves Up Rate Guidance

There was a lot of market drama ahead of – and during – this morning’s Bank of Canada announcement.

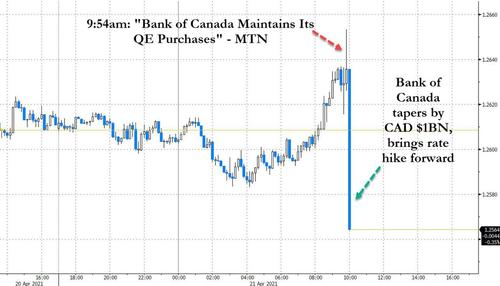

About 9 minutes before the 10am press release, Bloomberg blasted what appears was a fat fingered (and false) MT Newswires headline which said “Bank of Canada Maintains Its QE Purchases”, which was a shock to consensus expectations that the BOC would taper its QE by C$1BN (not because it wants to but because it has to).

This is how Bloomberg’s Laura Cooper laid out market expectations ahead of the BOC decision:

Governor Macklem and Co. want to avoid reaching a 50% ownership threshold too soon. Its purchases since last March are already more than one-third of sovereign bonds outstanding, the highest among its peers. And reduced issuance adds to the need to slow purchases –- there are’t enough bonds to buy following a 4-fold run-up in its balance sheet from a year-ago. An anticipated CAD1 billion reduction from its CAD4 billion weekly pace is largely baked in, and follows a scaling back last October. But even as reductions will be across the curve, confirmation could leave the belly vulnerable where the composition of purchases to-date have been tilted

So, needless to say, when the same BBG blasted said MTN headline, the Loonie tumbled in kneejerk reaction as it meant that the BOC would keep conditions overly dovish even if it meant the bond market would risk running out of bonds soon.

All of that changed, however, the moment the actual BOC statement hit, which revealed that – as expected – the BOC would indeed taper QE by C$1BN from C$4BN to C$3BN, saying that “effective the week of April 26, weekly net purchases of Government of Canada bonds will be adjusted to a target of CAD 3 billion. This adjustment to the amount of incremental stimulus being added each week reflects the progress made in the economic recovery.”

That said “even as economic prospects improve, the Governing Council judges that there is still considerable excess capacity, and the recovery continues to require extraordinary monetary policy support.”

But what was an even bigger surprise is that doubling-down in hawkishness because based on the Bank’s latest projection, the central bank said that it “expects CPI inflation to ease back toward 2 percent over the second half of 2021 as these base-year effects diminish, and inflation is expected to ease further because of the ongoing drag from excess capacity. As slack is absorbed, inflation should return to 2 per cent on a sustained basis some time in the second half of 2022.”

And the punchline: “We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022.“

This matters because previously this was 2023, in other words, not only is the Bank of Canada tapering (because it has to) but it also said it would hike earlier (because inflation is soaring).

As a result of this chain of confusion, the loonie went absolutely nuts, and after sliding in early trading, it then reversed sharply and soared as tapering was indeed confirmed, but the big surprise was the BOC bringing forward its first rate hike to H2 2022.

USDCAD traders will be ripshit as first they got stopped out to the upside, only to then lose money again as the CAD violently reversed.

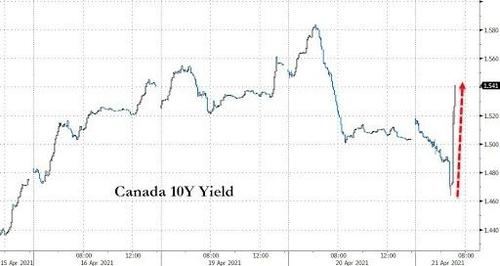

Also unhappy this morning: anyone long – or short – 10Y Canadian Treasuries, where a similar bidirection stopout just took place.

The full BoC statement is here.

Tyler Durden

Wed, 04/21/2021 – 10:15

via ZeroHedge News https://ift.tt/2QLoktG Tyler Durden