Soros Bought $375MM Of The Shares That Archegos Was Liquidating

An interesting thing happened in late March as news spread that Bill Hwang’s Archegos family office was liquidating after being hit with the biggest margin call since Lehman: George Soros, or rather his investment firm Soros Fund Management, was loading up on all the shares that Hwang was forced to liquidating.

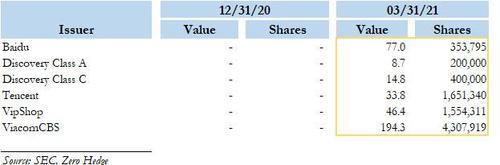

According to the latest 13F filed by the family office shows that Soros bought some $375 Million of the most prominent Archegos holdings just as they were being forcibly liquidated by the likes of Hwang’s Prime Brokers including Morgan Stanley and Goldman Sachs. These were Soros’ holdings as of March 31, or just day after the Archegos liquidation began in earnest:

- ViacomCBS $194.3MM (4.31MM shares)

- Baidu $77MM (353.8K shares)

- Tencent $46.4MM (1.55MM shares)

- Discovery Class C $14.8MM (400K shares)

- DIscovery Class A $8.7MM (200K shares)

A look at the prior 13F shows that the fund did not own any of these stocks before the end of the first quarter.

As a reminder, Archegos was wiped out and Hwang’s fortune evaporated in just a few days after the stock prices of ViacomCBS and Discovery tumbled, triggering margin calls from numerous prime brokers (some of which have leftover exposure to this day), who then sold the stocks in the big block trades. In total, the Archegos blow up which saw the $10BN fund levered as much as 10x as Prime Brokers failed to do any homework on their total exposure, is expected to cost the finance industry about $10 billion, has prompted an investigation by the U.S. Securities and Exchange Commission and caused heads to roll at Credit Suisse Group AG, where the hit exceeds $5 billion.

As Bloomberg, which was the first to note the increase in Archegos-linked positions at Soros notes, “the 13F filing provides one of the first examples of how a hedge fund attempted to capitalize on the distressed remains of Archegos. It also offers an insight into Soros’s investment firm, which is run by Chief Investment Officer Dawn Fitzpatrick.”

In March, Fitzpatrick told Bloomberg in March that she was willing to jump on dislocations in the market, investing $4 billion during the pandemic-induced swoon a year ago, including buying residential mortgages on the cheap. Soros returned almost 30% in the 12 months through February and manages $27 billion across a range of strategies.

“When there’s a dislocation, we’re prepared to not just double down but triple down when the facts and circumstances support that,” Fitzpatrick, 51, said in a “Front Row” interview on Bloomberg TV.

Separately, the latest 13F also shows that Soros increased its bet in Amazon.com and homebuilder DR Horton Inc., which is now its second-largest public equity position; in total the filing showed that Soros held $4.5 billion of U.S. equities, down $77 million from the prior quarter. The biggest exit in the quarter was Palantir Technologies Inc. Soros sold 18.5 million shares valued at about $435 million. The firm originally revealed it owned a stake in the controversial data-mining company controlled by Peter Thiel in November, but rapidly issued a statement saying the original investment was made in 2012 and it regretted the decision.

Tyler Durden

Sun, 05/16/2021 – 11:03

via ZeroHedge News https://ift.tt/3w9SN42 Tyler Durden