Bank of America: Everyone Knows The Fed Will Stop Tapering As Soon As The S&P Drops 10%

There has been much discussion and fierce debate whether the current blast of inflation is permanent, or as the recent sharp drop in bond yields and breakevens despite ever higher CPI prints, which are now annualizing 8.3% or the highest since 1092…

… and which we discussed on Friday in “Here’s Why The “Reflation” Trade Is Collapsing“, the market is already fading the current spike in prices in anticipation of deflation. This is, in fact, the $64 trillion question.

But what if the market is not actually bothering with timing the inflation peak, nor extrapolating how much longer the current inflationary swell can deflect the deflationary continental drift that has been unleashed by the triple-3Ds of debt, demographics and disruption over the past decade. What if the market is far more pragmatic and is merely pricing in the fact that any upcoming taper will force the Fed to untaper yet again.

That’s the argument made by BofA CIO Michael Hartnett who in his latest “flow show” report writes that “nobody knows how to trade inflation, everybody knows how to trade “don’t fight the Fed.”

What does he mean by that?

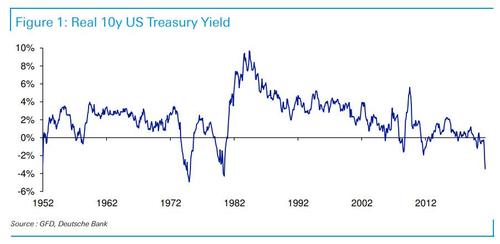

Well, when looking at stubbornly negative real rates, which DB’s Jim Reid discussed on Friday when he pointed out that the current gap between 10yr US yields (1.5%) and US CPI (5.0%) is a whopping 3.5%, the highest since 1980 (In fact, the gap has only been more negative for 10 months in the last 70 years, all of which were in 1974, 1975 or 1980)…

… he said that this is a clear sign that the market views the Fed’s taper is nothing more than “paper tiger” because investors know Fed will stop tapering at first hint of trouble, most likely the moment the S&P drops 10%.

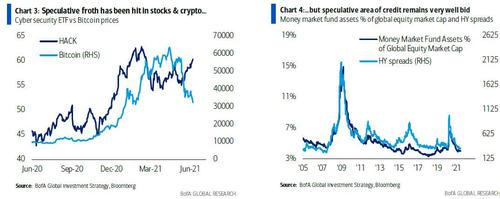

Meanwhile, the market’s liquidity addiction remains, even though speculative froth has been hit in stocks & crypto (Chart 3), for now, but it is now swinging back to IG & junk credit (Chart 4).

This means that trader sentiment now is that “it’s a free call option on credit & stocks” until “return-to-office” Sept payroll (released Oct 8th), the taper announcement some time around Jackson Hole in late August, and return of Goldilocks as macro cannot get any hotter as the (combo of inflation & labor shortages at US small businesses is the highest since 1974.

And yet, to BofA this is not an “all clear” sign; instead, the surging wage growth (which however will reverse in September when extended payroll benefits end), means lower yields are transitory and H2 stagflation means risk-return for stocks (+3-5% vs -10-15%) poor.

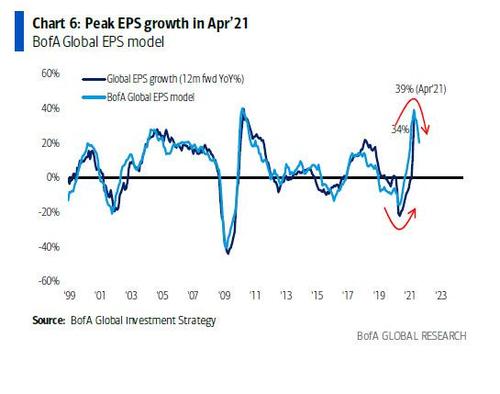

There is another ‘simple’ reason why BofA sees the inflation trade ending: inflation itself. As a reminder, soaring prices are about to crush record profit margins (companies can’t pass on the full input cost spike to consumers even if they tried), and as the chart below shows, global EPS peaked around +40% YoY in April according to BofA Global EPS Model (driven by China FCI, Asia exports, global PMI, US yield curve).

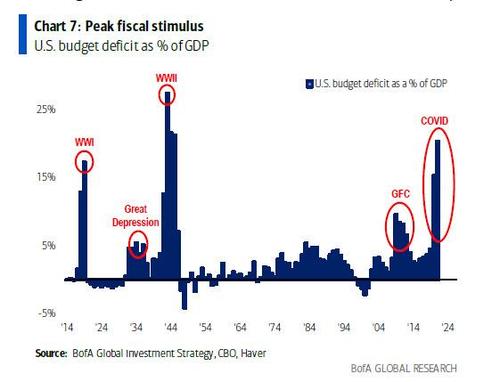

Additionally, not only is the Fed’s monetary stimulus about to be tapered: fiscal stimulus has also peaked (infrastructure hopes for $2tn down to $1tn)…

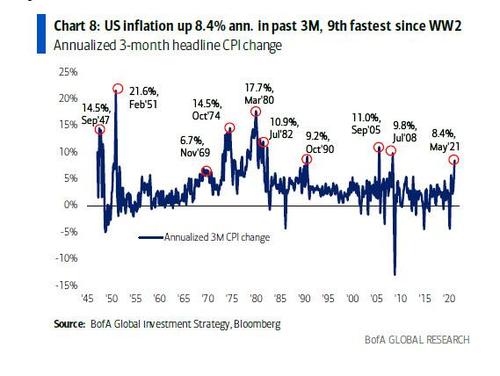

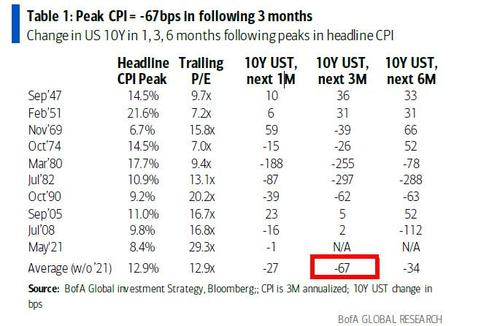

… and jump in inflation (headline up 8.4% annualized in past 3 months = 9th fastest since WW2 – Chart 8) will reduce purchasing power and spending (US homebuilding stocks an excellent example of market anticipating inflation negatively impacting spending on real estate).

As Hartnett concludes it is “little wonder “peak CPI” since WW2 has led to 67bps drop in Treasury yields in following 3-months (Table 1); so Q3 should see defensives outperform cyclicals.”

Finally for those who are still unconvinced and believe there is much more to the inflation is here to stay vs inflation is transitory argument, the BofA CIO says that there is a quick and dirty way to determine the temporal nature of inflation, and it has to do with jobs and wages after the current “Biden benefits” run out.

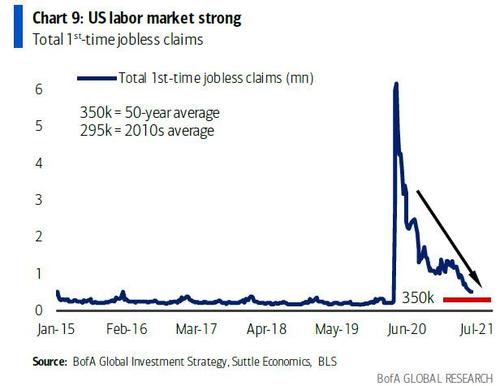

Consider that last week we learned US unemployment claims dropped to 385k, closing in on pre-COVID average of 300k; while small company job offerings are off-the-charts. However, that’s all about to reverse: by end-June 21 states (representing 27% of labor market) will opt out of extended unemployment benefits (by Sept 5th benefits end in all 50 states).

So putting those variables together, Hartnett concludes that “if July/Aug payrolls show jobs ↑, Average Hourly Eearnings ↓ stay-of-execution for Goldilocks; but if jobs ↑, AHE ↑ = inflation here to stay.”

Tyler Durden

Sat, 06/12/2021 – 21:00

via ZeroHedge News https://ift.tt/3iCQR0j Tyler Durden