Futures Jump, China Soars After Beijing Promises More Stimmies

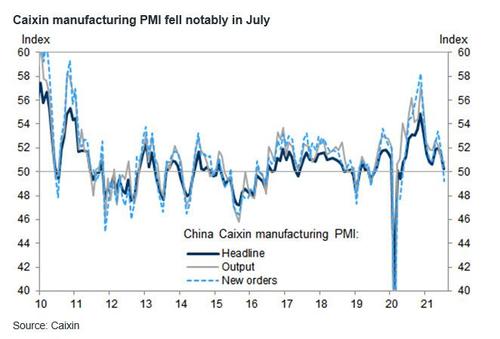

Any other day, especially with traders so on edge over anything to do with China, futures would be deep in the red after Beijing reported another sharp drop in the Caixin manufacturing PMI, which slumped from 51.3 in June to 50.3, missing expectations of 51.0 and on the verge of contraction while the new orders sub-index did contract, sliding to 49.2 from 51.6, the first time below 50 since last May….

… but not today, and instead Chinese stocks surged by the most in ten weeks as traders rushed to buy everything from baijiu producers to construction firms on expectations of increased support for the economy after Beijing signaled it would intensify policy support in the second half of the year to bolster the country’s economic growth amid deceleration, China Daily says in a report on Monday and confirming what we reported two weeks ago in “China’s Credit Impulse Just Bottomed With Profound Implications For Global Economies And Markets“.

The benchmark CSI 300 Index soared 2.6%, its best day since May 25. Consumer shares led gains, with Kweichow Moutai Co. and Wuliangye Yibin Co. adding at least 4.5%. In Hong Kong, the Hang Seng Index gained 1.1%.

Monday’s move higher follows a much-watched Politburo meeting Friday, which was seen to indicate that authorities will likely take more steps to help struggling small businesses, boost fiscal spending and possibly reduce the reserve requirement ratio for banks again. Bets on further easing boosted Chinese sovereign bonds, sending yields sliding.

China’s promise of more stimulus quickly spread across the globe, and with the Chinese stock selloff over, Asian and European markets and index futures gained as upbeat earnings and a surge in corporate dealmaking lifted sentiment, offsetting lingering concerns over China’s regulatory crackdown and the spread of the delta virus variant. A $550 billion infrastructure bill unveiled by U.S. Senators raised hopes of more fiscal stimulus in the US as well, while investors turned to manufacturing activity data to gauge the pace of a domestic economic rebound. At 730 a.m. ET, Dow e-minis were up 101 points, or 0.29%, S&P 500 e-minis were up 20 points, or 0.45%, and Nasdaq 100 e-minis were up 62 points, or 0.42%. Treasuries were steady and the dollar dipped.

Late on Sunday, the Senate unveiled the bipartisan plan to invest in roads, bridges, ports, high-speed internet and other infrastructure, with some predicting the chamber could pass this week the largest public works legislation in decades. Shares of infrastructure-related stocks including Caterpillar Inc inched higher in premarket trading. Shares of banks including JPMorgan Chase & Co, Morgan Stanley, Goldman Sachs Group Inc and Bank of America Corp rose between 0.6% and 1.2%, tracking a slight uptick in the benchmark 10-year Treasury yield. Here are some of the other notable premarket US movers today:

- Chinese large-cap stocks listed in the U.S. including Baidu (BIDU), JD.com (JD) and Pinduoduo (PDD) gain in premarket trading after Hong Kong and China stocks rose, paring some of last week’s.

- Exicure (XCUR) surges in U.S. premarket trading after entering an exclusive agreement with Ipsen to research, develop, and commercialize novel Spherical Nucleic Acids as potential investigational treatments for Huntington’s disease and Angelman syndrome.

- Infinity Pharmaceuticals (INFI) gains 13% after JPMorgan upgraded its recommendation on the stock to overweight from neutral.

- Marin Software (MRIN), a small provider of marketing software that’s been a popular meme stock, slides 11% after reporting second-quarter results postmarket on Friday.

In a sign of global M&A activity picking up again, Square Inc, the payments firm of Twitter Inc co-founder Jack Dorsey, said it would purchase Australian buy now, pay later pioneer Afterpay Ltd for $29 billion. Afterpay’s Australia-listed stock surged 18.8%, while Square’s U.S.-listed shares fell 5%. After mixed quarterly reports from technology behemoths last week, in focus this week are earnings reports from companies such as Eli Lilly, CVS Health and General Motors.

“Shares remain at risk of a short-term correction or volatility as coronavirus cases rise globally, the inflation scare continues and as we come into seasonally weaker months, but surging company profits in the U.S. and lower bond yields are providing support,” Shane Oliver, head of investment strategy and chief economist at AMP Capital, said in a note.

Elsewhere, Minneapolis Fed President Neel Kashkari said the Covid-19 delta strain could keep some Americans from looking for work, potentially harming the U.S. recovery. The latest updates on U.S. jobs are due later this week.

The MSCI world equity index was up 0.4% at 1114 GMT, after Asian shares recouped some of their recent losses.

In Europe, MSCI’s main European Index rose around 0.3%, while the Stoxx 600 hit a new all-time high in early trading, before gradually easing, last up 0.3% after earnings beats from the likes of HSBC Holdings Plc, Axa SA and Heineken NV, though the gauge pared its advance as Allianz SE slumped after saying a US probe may hit results. Aerospace company Meggitt Plc soared more than 60% after agreeing to a $8.8 billion takeover by U.S.-based Parker-Hannifin Corp., the latest in a string of buyouts in the sector. Here are some of the biggest European movers today:

- Meggitt shares soar as much as 62% after the U.K. engineer agreed to a GBP6.3b takeover offer from U.S. motion and control technologies manufacturer Parker-Hannifin.

- Sanne shares jump as much as 9.7% to 926p after saying it’s in advanced discussions with Apex regarding a possible offer at a price of 920p a share.

- Renault shares gain as much as 4.2% in Paris after HSBC upgraded the French carmaker to buy from hold, saying “the worst seems over.” Daimler also outperforms after being added to Goldman Sachs’s conviction list.

- HSBC shares rise as much as 1.9% in London, after the lender tops quarterly earnings estimates and resumes shareholder returns amid the release of some funds set aside to cover pandemic-related loan defaults.

- Allianz shares fall as much as 9.6%, the steepest intraday decline since March 2020, after the company warned that a U.S. investigation could materially hurt its results.

- ConvaTec shares drop as much as 4.5% and is worst performer on SXDP healthcare index on Monday after Stifel downgrades the surgical equipment manufacturer to hold from buy.

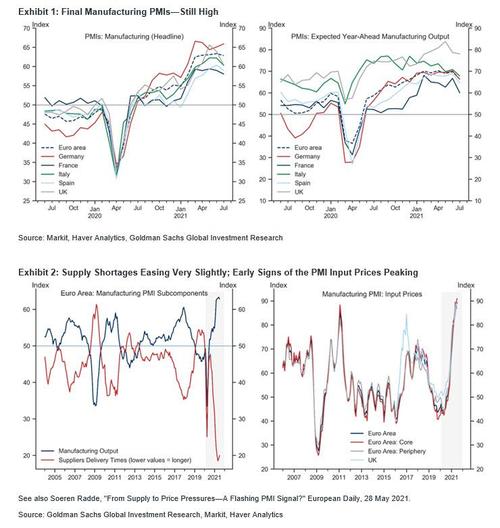

The euro edged higher after data showed manufacturing activity across the euro zone continued to expand at a blistering pace in July as the reopening of the economy led to rocketing demand, but supply bottlenecks sent input costs soaring; meanwhile European factories are hiring new workers at record pace to keep up with persistently strong orders.

- Euro Area Manufacturing PMI (Final, July): 62.8, flash 62.6, previous 63.4

- Germany Manufacturing PMI (Final, July): 65.9, flash 65.6, previous 65.1

- France Manufacturing PMI (Final, July): 58.0, flash 58.1, previous 59.0

- Italy Manufacturing PMI (July): 60.3, GS 61.0, consensus 61.5, previous 62.2

- Spain Manufacturing PMI (July): 59.0, GS 59.2, consensus 59.5, previous 60.4

- UK Manufacturing PMI (Final, July): 60.4, flash 60.4, previous 63.9

George Buckley, chief UK and euro area economist at Nomura said he expects economic activity to remain strong but that a key question among clients is when the rate of growth will slow.

“It’s likely in my view that we will see a very sharp fall-off in the PMIs not because we are looking at a much weaker outlook but…the low-hanging fruit has now been picked.”

Earlier in the session, Asian equities climbed, boosted by the rebound in Chinese stocks following last week’s selloff and sharp gains in developed markets including Japan and Australia. The MSCI Asia Pacific Index rose as much as 1.5%, with the industrials and technology sectors leading. Japan’s Topix gauge jumped 2.1% while U.S. futures also advanced as Friday’s decline in Treasury yields and the approaching passage of a U.S. infrastructure package boosted sentiment toward risk assets. Monday’s gains come after the Asian benchmark plunged 5.1% in July, its worst monthly performance since March 2020, led by a rout in Chinese equities amid Beijing’s regulatory onslaught on tech and education companies.

As noted above, China’s CSI 300 Index had its best day since May 25 on Monday, as Friday’s much-watched Politburo meeting signaled more targeted support for the economy. “The Politburo meeting has emphasized stability again, so the downside for stocks won’t be too large,” said Chen Shi, fund manager at Shanghai Jade Stone Investment Management.

“We think the regulatory changes will continue and the direction is unlikely to be reversed, though the pace could be adjusted,” wrote JP Morgan strategists in a note to clients.

Stocks in Australia jumped to a fresh record, underpinned by a rally in Afterpay. Square Inc. agreed to buy the Australian buy-now, pay-later company for $29 billion in its largest-ever acquisition. Meanwhile, the Philippine equity gauge gained 2.8% on Monday, recovering much of its 3.5% plunge on Friday, the steepest loss in six months, with investors hunting for bargains.

In rates, the US Treasury yield was at 1.2222%, little changed on the day but having seen a gradual decline since April; Treasuries were cheaper by up to 1.2bp across long-end of the curve, while 5-year sector richens 1bp; 5s30s spread steeper by 2.1bp, while 2s10s widens 1.2bp. The curve was steeper as long-end continues to underperform the belly. Support was found during Asia session after a drop in China’s manufacturing indexes spurred gains in CGBs. Bunds underperform, weighing on Treasuries after stronger-than-forecast German retail sales figures. There is no Treasury supply this week, although Wednesday’s quarterly refunding announcement will draw focus as officials may provide details about the timing of reducing auction sizes.

In commodities, oil prices were down after a survey found that China’s factory activity growth slipped sharply in July as demand contracted for the first time in over a year, prompting concerns about demand in the world’s second-largest oil consumer. Brent crude oil futures were down 1.3% and WTI crude futures were down 1.5% on the day. read more.

Focus on Monday will be on manufacturing activity data for July, while on Friday, the Labor Department will issue its monthly employment report. Economists expect nonfarm payrolls to have risen 900,000 last month compared with 850,000 in June. Markets will also watch the Reserve Bank of Australia meeting on Tuesday, the Bank of England meeting on Thursday, and U.S. payrolls data on Friday.

Market Snapshot

- S&P 500 futures up 0.6% to 4,415.75

- STOXX Europe 600 up 0.64% to 464.69

- MXAP up 1.5% to 200.19

- MXAPJ up 1.2% to 660.44

- Nikkei up 1.8% to 27,781.02

- Topix up 2.0% to 1,940.05

- Hang Seng Index up 1.1% to 26,235.80

- Shanghai Composite up 2.0% to 3,464.29

- Sensex up 0.7% to 52,969.48

- Australia S&P/ASX 200 up 1.3% to 7,491.45

- Kospi up 0.6% to 3,223.04

- Brent futures down 1.1% to $74.59/bbl

- Gold spot down 0.4% to $1,807.83

- U.S. dollar index down 0.20% to 91.99

- German 10Y yield rose 0.13 bps to -0.448%

- Euro up 0.1% to $1.1886

- Brent Futures down 1.1% to $74.59/bbl

Top Overnight News from Bloomberg

- Japan’s Government Pension Investment Fund made a record cut to the weighting of Treasuries in its portfolio last fiscal year as the world’s safest asset led a global debt selloff.

- Chinese equities rallied by the most in ten weeks as traders turned buyers of everything from baijiu producers to construction firms on expectations of increased support for the economy.

- China’s top leaders signaled more targeted support for the economy as they look to cushion growth in the face of resurgent pandemic risks, fueling a rally in bonds.

- Manufacturing managers in Southeast Asia saw a slump in activity as the region grapples with one of the world’s worst Covid-19 outbreaks, while North Asia continued to see a pick up as the global economy recovers.

- Chinese equities rebounded from an early Monday loss and sovereign bonds rallied, as investors weighed the odds for monetary policy easing against a regulatory crackdown that has roiled markets.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac equities shrugged off the lacklustre performance on Wall Street on Friday, in which the majors posted mild losses ranging from 0.4-0.7%, whilst Amazon shares held onto post-earning declines to close lower by around 7.5%. Overnight, US equity futures kicked off the first trading day of August with mild gains, which then extended throughout the APAC session as US senators worked over the weekend to pave the way for a vote on the USD 1trln infrastructure bill this week – in turn guiding the ES and NQ back above 4,400 and 15,000 respectively. Back to APAC, the ASX 200 (+1.4%) gained traction and hit a record high ahead of tomorrow’s RBA announcement, which is expected to walk back on the July taper decision amid the worsening domestic COVID situation. The index was also supported by Afterpay surging over 30% at the open after NYSE-listed Square offered to acquire the Aussie payment company in a USD 29bln deal. The Nikkei 225 (+1.9%) was bolstered with gains seen in every sector, with materials and tech leading the charge. South Korea’s KOSPI (+0.4%) lagged as North Korean leader Kim Jung Un’s influential sister warned that the annual military drills between South Korea and the US this month will undermine prospects for better ties between the Koreas. Hang Seng (+1.1%) and Shanghai Comp (+1.5%) were initially subdued amid the ongoing US-Sino tensions and after sub-par PMI metrics. The bourses then rebounded despite a lack of news flow, with some pointing to continued loose policy as an analyst piece on China Daily (seen as the CCP’s mouthpiece) suggested that Chinese leaders are expected to intensify policy support in H2 amid a deceleration in growth. There were also reports that the China Securities Regulatory Commission is ramping up talks with the US SEC to find a suitable resolution after the US SEC halted IPOs of Chinese firms. The Hang Seng was also supported by Evergrande shares as the indebted property developer offloaded its stake in its internet unit to raise funds. Finally, 10yr JGBs track the recent leg higher in the US T-note future as US Senators unveiled the bipartisan infrastructure bill expected to pass this week.

Top Asian News

- Fire at Tesla Big Battery Under Control After Weekend Blaze

- Yesterday’s Wars Didn’t Prepare Pentagon for Tomorrow’s China

- India Is Said to Defer Sale of State-Run Banks to Next Year

- Tiger Is Said to Invest in Indian Startup at $2.5 Billion Value

European equities (Euro Stoxx 50 +0.6%) have kicked the week off on a firmer footing as August trade gets underway. Many news outlets have highlighted the positivity surrounding the US 1tln bipartisan infrastructure bill whereby a vote on the bill could take place “in a matter of days”, according to Senate Democratic Leader Schumer. However, gains for Europe are potentially more a by-product of clawing back Friday’s losses with the macro landscape for the region relatively unchanged since last week’s close asides from a minor revision higher for the EZ manufacturing PMI print. Sectoral performance sees outperformance in cyclical names with upside in Retail, Autos and Basic Resources, whilst Health Care and Insurance names lag. Of note for the Insurance sector, positivity from AXA earnings (+3.9%) has been offset by losses in Allianz (-7.7%) after the Co. flagged a potential financial impact from an escalating legal dispute over actions its US investment funds undertook as the pandemic commenced; albeit, no provision has been allocated at this moment in time. Newsflow surrounding the Travel & Leisure sector has picked up ahead of the UK’s travel review later in the week. There appears to be a fight within the UK government amid reports that ministers are holding talks over creating a new amber watchlist of nations that could move to the government’s travel list with little warning. Naturally, this has received pushback from the industry, however, some optimism for airline bosses might stem from other repots suggesting that UK Chancellor Sunak has called on UK PM Johnson to ease travel restrictions. Large cap earnings today have included HSBC (+0.6%), who trade firmer after reporting better than expected H1 profits and reinstating dividend payments. Heineken (+1.2%) trade broadly inline with the market after reporting an increase in profits whilst flagging the potential for increasing commodity costs for H2. Finally, Meggitt (+56.9%) sits at the top of the Stoxx 600 after the Co’s directors recommended the GBP 8.00/shr takeover offer from Parker-Hannifin.

Top European News

- BOE Sequencing Could Reshape U.K. Yield Curve: Liquidity Watch

- Vonovia Lifts Offer for Rival Deutsche Wohnen to $22.7 Billion

- European Factories Hire Workers at Record Pace to Fill Orders

- Heineken Sees ‘Material’ Commodity Costs Crimping Earnings

In FX, a relatively sedate start to the new week and month, but the Dollar has lost some recovery momentum and is moderately softer vs high beta and cyclical counterparts amidst a general improvement in risk sentiment. Hence, the index slipped back beneath 92.000 within a 92.174-91.962 band before finding a base and awaiting the final US Markit manufacturing PMI, construction spending and ISM in particular for the survey breakdown and first jobs proxy for Friday’s NFP.

- AUD/NZD/EUR/GBP – The Aussie and Kiwi have both regained some composure to pare overnight losses incurred on the back of further COVID restrictions, a Chinese manufacturing PMI miss, technical and cross-related factors. However, Aud/Usd remains heavy above 0.7350 and unlikely to trouble hefty option expiry interest at the 0.7400 strike (1.2 bn) ahead of the RBA tomorrow given expectations that the ongoing pandemic outbreaks could well force the Bank to backtrack on QE tapering plans. Meanwhile, Nzd/Usd is still rotating around the 21 DMA that comes in at 0.6979 today having failed to retain grasp of the 0.7000 handle, and the Euro is back below 1.1900 where 1.4 bn option expiries reside in wake of broadly softer than expected Eurozone manufacturing PMIs, bar Germany’s upgrade. Conversely, Cable is back over 1.3900 and Eur/Gbp is holding under 0.8550 following an unrevised final UK manufacturing PMI in advance of Thursday’s BoE.

- CAD/JPY/CHF – All very narrowly divergent vs the Greenback, and the Loonie holding up well in the face of weakness in WTI crude circa 1.2470, while the Yen is meandering from 109.60-77 in the run up to Tokyo inflation data on Tuesday and the Franc is straddling 0.9055 after in line Swiss CPI, a slowdown in retail sales vs pick up in the manufacturing PMI and weekly sight deposits showing just a small rise on domestic bank balances.

- SCANDI/EM – Contrasting manufacturing PMIs from Sweden and Norway, as the former dipped and latter gathered pace, but the Sek is straddling 10.2100 against the Eur with assistance from the aforementioned pick-up in overall risk appetite, while the Nok wanes within a 10.4910-10.4530 range due to a pull-back in Brent prices from Usd 75+/brl towards Usd 74.00.

In commodities, WTI and Brent have commenced the week on the backfoot, with the benchmarks lower by USD 1.00/bbl on the session. Such pressure comes in spite of the generally modestly constructive risk tone in a quiet European session with final PMIs not moving the dial much; with attention more on the weeks macro themes as outlined above. In crude specifics, updates have been very sparse throughout the session and as such the complex is more focus on COVID-19 related dynamics. With the demand-side of the equation torn between the ongoing case increases in Tokyo, among other areas, but on the flip-side supported by a push from top UK Cabinet Officials for an easing of travel restrictions and more broadly as NIH’s Fauci now does not believe the US is likely to return to lockdowns. Elsewhere, attention is on the geopolitical front and specifically last week’s attack on a ship off the Oman coast on which the US Secretary of State is confident that Iran is behind this attack. Moving to metals, spot gold and silver are modestly pressured with not too much read across from a choppy USD as we stand and likely on the back of the aforementioned broader risk tone; for reference, the yellow metal still holds the USD 1800/oz mark. Separately, much of the mornings focus is on copper where BHPs Escondida, Chile facility is facing strike action after the union rejected BHPs final labour offer. As such, Government-mediated discussions will last for 5-10 days and if the status quo is maintained and there is no breakthrough then strike action will formally commence. Given the uncertainty, LME Copper is supported on the session albeit still well off the pivotal USD 10k/t mark vs the current high USD 9799/t.

US Event Calendar

- 9:45am: July Markit US Manufacturing PMI, est. 63.1, prior 63.1

- 10am: June Construction Spending MoM, est. 0.5%, prior -0.3%

- 10am: July ISM Manufacturing, est. 60.9, prior 60.6

- ISM Employment, est. 51.4, prior 49.9

- ISM Prices Paid, est. 88.0, prior 92.1

- ISM New Orders, est. 64.3, prior 66.0

DB’s Jim Red concludes the overnight wrap

Welcome to the first business day of August. We are just about to publish our monthly and YTD performance review. Top of the leaderboard for July was again commodities as they have survived the loss of momentum for the reflation trade. However it was copper, and gold that led the way with the perennial 2021 performer oil taking a breather. Oil is still way out in the overall lead for 2021 though with WTI up over 50%. At the other end of the table, equity indices in Asia had a poor month in July as a result of rising Covid cases across the region and a regulatory crackdown in China. The Hang Seng is at the bottom of our sample, with a -9.6% return, whilst the Nikkei (-5.2%) and the Shanghai Comp (-4.6%) have also struggled. In spite of the weakness in Asia however, US and European equities both had a much stronger performance, with the S&P 500 (+2.4%) and the STOXX 600 (+2.1%) each posting a 6th consecutive monthly advance. Bonds were also stronger across the board as many investors struggle to come to terms with the recent near 3 month rally. Interestingly, HY credit in USD, EUR and GBP are the only assets in our sample to have recorded a positive monthly performance in every month so far this year. See the full report in your mailboxes soon from Craig.

Over the weekend our equity strategist raised their S&P 500 YE target to 4500 (4395 currently) after a bumper Q2 earnings season so far. They still see a correction over the next quarter even if it’s slightly more delayed than expected in line with a move in the house view for the peak in growth. See here for more.

As we enter August and what is set to be a period of higher than normal holiday taking, given the events of the last year and a half, we’ll likely have to wait until Friday for the main event. That is of course payrolls. Before that we’ll see the release of the July PMIs from around the world (mostly today and Wednesday), a further 150 earnings reports from S&P 500 companies, and 4 monetary policy decisions from G20 central banks, including the Bank of England (Thursday). Don’t forget the US infrastructure bill which seems to be making progress in the background after senators agreed text to a bipartisan bill that they hope to vote on this week.

A lot of attention was placed on Asia last week given the continued regulatory crackdown there. As you’ll see in last week’s review towards the end, Chinese and HK stocks were down around -5%. This morning there are signs that sentiment has started to stabilise with the CSI (+2.09%), Shanghai Comp (+1.50%), Shenzhen Comp (+1.27%) and Hang Seng (+0.92%) all up. The Nikkei (+1.91%), Asx (+1.40%) and Kospi (+0.45%) have also advanced. Outside of Asia, futures on the S&P 500 are also up +0.51% and those on the Stoxx 50 are up +0.53%. Elsewhere, oil prices are down c. -1% this morning.

Headlines have emerged from China’s Politburo meeting on Friday suggesting that there’ll be “no sharp turn” in policy and adding that fiscal spending through the issuance of local government special bonds will accelerate in the second half to support the economy. The PBoC also released a statement over the weekend saying that it will guide actual lending interest rates to a stable and lower level through reforming the rates market.

In terms of data, the official Chinese manufacturing PMI released on Saturday fell from 50.9 to 50.4 in July (50.8 consensus) – the lowest since February 2020 which was the peak of the pandemic related restrictions in China. The non-manufacturing reading dipped from 53.5 to 53.3 but was in line with expectations. The Caixin manufacturing PMI released overnight provided a similar message as it dipped to 50.3 from 51.3 last month as against expectations of 51.0. Other economies in the region also posted weak manufacturing readings as they grappled with a surge in infections. Indonesia (at 40.1 vs. 53.5 last month) posted its worst reading in 13 months while Thailand’s reading slipped to 48.7 from 49.5 and Philippines manufacturing PMI dipped to 50.4 from 50.8. Vietnam’s manufacturing PMI continued to remain in contractionary territory with a reading of 45.1 (vs. 44.1 last month). We also saw Australia’s final manufacturing PMI overnight and it got revised up marginally to 56.9 from 56.8 in the flash reading. There was a larger upward revision for Japan’s final Jibun manufacturing PMI though as it came at 53.0 from 52.2 in the flash.

In terms of the latest on the pandemic, the Telegraph has reported that the UK is set to deliver booster shots to 32 million people starting from September with adults aged 50 and above, as well as the immuno-suppressed, targeted. Meanwhile, in Australia, Brisbane has decided to extend its lockdown at least until Sunday to bring the current wave under control. In a bit of concerning news, Bloomberg has reported that Israel’s public health officials are beginning to see signs of more serious disease among the vaccinated elderly. They are now also embarking on booster shots.

Going through the main highlights of the week ahead in more details now, the next few days will be dominated by the build up to Friday’s US employment report. Fed Chair Powell said in his press conference after last week’s Fed meeting that “the labor market has a ways to go”, and that the unemployment rate of 5.9% “understates the shortfall in employment, particularly as participation in the labor market has not moved up from the low rates that have prevailed for most of the past year.” This is actually the last jobs report ahead of Powell’s speech at Jackson Hole later in August, so could be an important one in terms of providing clues on a potential timeline for the Fed’s tapering of asset purchases. In terms of what to expect, our US economists are forecasting that nonfarm payrolls will have risen by +1m in July (consensus at 900k), which would be the fastest pace of jobs growth since last August. And in turn, they see that bringing the unemployment rate down to a post-pandemic low of 5.6%. July is a seasonally weak month for hiring so the seasonal adjustment is strong. In a year as unusual as this there is high uncertainty as to what impact the seasonals will actually have. So it’s clear that the margin for error could be high.

The other main data highlight this week will be the release of the July PMIs from around the world mostly today (manufacturing) and Wednesday (services and composite). The flash numbers we already have showed significant strength, with the Euro Area composite PMI up to a 21-year high of 60.6, whilst the US reading still showed a decent performance at 59.7, even though it’s down somewhat from its recent high.

On the central bank side, the main highlight this week will be the Bank of England’s monetary policy decision on Thursday. In their preview (link here), our UK economists write that they expect there to be no change in the Bank’s policy settings, with Bank rate kept at 0.1% and the QE target maintained at £895bn. With CPI inflation now running at 2.5% and above the BoE’s target, they see the MPC preaching a patient message with regards to the outlook for now, before a more hawkish pivot occurs later this year once there’s further clarity on the state of the economy coming out of the pandemic. In terms of central bank decisions elsewhere, we see the Reserve Bank of India (Friday – research link here) maintaining its accommodative monetary policy stance, but the forward guidance is likely to put more emphasis on pipeline inflation risks compared to past policies. Meanwhile at the Reserve Bank of Australia’s meeting (Tuesday – link here), we think the lockdown in Sydney (at significant short-term economic cost) means that they’ll suspend their tapering of bond purchases until November.

On the earnings front, it’s another busy week ahead, with 150 companies in the S&P 500 reporting, along with a further 82 from the STOXX 600, among others. In terms of the highlights to look out for, today we’ll hear from HSBC and Ferrari. Then tomorrow, reports include Eli Lilly, Amgen, FIS, BP, BMW, Alibaba, and Societe Generale. Wednesday sees releases from CVS Health, Booking Holdings, General Motors, Uber and Toyota. Then on Thursday, there’s Novo Nordisk, Expedia, Moderna, Siemens, Zoetis, Merck, Deutsche Post, Adidas, Regeneron, Bayer, Credit Agricole and AIG. Finally on Friday, Allianz will be reporting.

Recapping last week now and global equity markets finished just off all-time highs on Friday with the S&P 500 down -0.37% (-0.54% Friday) as growth industries underperformed their cyclicals counterparts, with banks (+1.06%) and energy stocks (+1.79%) notably doing better than technology stocks. The tech losses were led in part by some disappointing earnings releases which saw the NASDAQ fall -1.11% last week (-0.71% Friday). On the other hand, small caps rose for a second consecutive week as the Russell 2000 increased +0.75% (-0.62% Friday). However one of the bigger stories of the week was in Asia where the Chinese government have recently embarked on a widespread regulatory crackdown. This soured sentiment, especially in tech, and caused the Hang Seng (-4.98%) and CSI 300 (-5.46%) to fall sharply. European equities, which are more cyclically focused, outperformed as the STOXX 600 ended the week marginally (+0.05%) higher.

The other large story last week was from the Federal Reserve, where Fed Chair Powell affirmed that the committee had taken a “first deep dive” into how to go about tapering asset purchases, but also that no decisions had yet been made. Financial markets were little changed shortly after the announcement while US 10yr Treasuries eventually ended the week -5.4bps lower, most of that coming with Friday’s -4.7bp fall. On the week, real yields fell -10.8bps, with 10yr TIPS closing out at an all-time low of -1.1798%, even as inflation expectations are near their highest levels since early-June. Sovereign bonds in Europe underperformed slightly across much of the continent, with yields on 10yr bunds (-4.1bps) and OATs (-1.7bps) lower.

There was a number of data highlights on Friday. In Europe, Euro area GDP grew by 2% last quarter, above the 1.5% expected, while the largest economy in the region, Germany, grew by 1.5% – 0.5pp below expectations. Southern Europe drove much of the outperformance with Italy and Spain growing at 2.7% and 2.8% respectively. We also got a look at how pricing pressures were progressing in Europe with the flash CPI print for the Euro Area for July showing a +0.7% MoM increase in core inflation with the headline number coming in slightly higher than expected at -0.1% (vs -0.3%), with the YoY at 2.2% (vs. 2.0% expected). Over in the US, the final University of Michigan consumer sentiment index for July improved to 81.2 from the flash reading of 80.8 due to a better reading on expectations. The MNI Chicago PMI for July surprised strongly to the upside at 73.4 (vs. 64.2) with prices paid rising slower than expected and employment falling at a slower pace.

Tyler Durden

Mon, 08/02/2021 – 08:03

via ZeroHedge News https://ift.tt/3zStJ3k Tyler Durden