Futures Rise Boosted By Solid Tesla Earnings, Chevron’s Giant Buyback

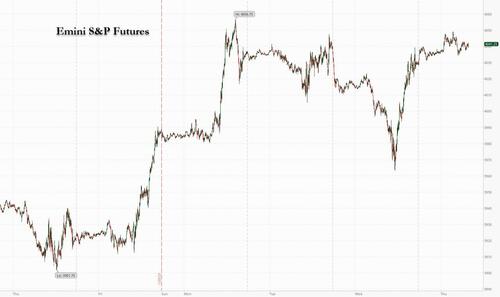

In a mirror image of Tuesday’s action, when MSFT earnings hammered stocks (after first headfaking them higher) only to see the selloff reverse completely during the course of Wednesday trading, on Thursday US equity futures and tech stocks were set to gain after an upbeat earnings report from Tesla reinforced optimism about the health of Corporate America. As of 7:30am, Nasdaq 100 futures were up 0.7% while S&P 500 futures rose 0.3%. Tesla jumped about 8% in premarket trading after the electric-car maker reported better-than-expected profit and said it was on track to deliver about 1.8 million vehicles this year. Risk sentiment was boosted by news that US energy giant Chevron had authorized a massive $75 billion stock buyback, representing 22% of its outstanding shares, helping elevate energy stocks around the globe. Asia stocks jumped to 9-month highs as Hong Kong returned from break and European stocks rose by 0.4%. Meanwhile, the dollar continued to weaken as speculation continued to mount that the Fed is drawing closer to the end of its rate-hiking cycle, and would follow in the footsteps of first Canada and then Indonesia, both of which have officially paused. Bonds and gold edged lower.

In premarket trading, all eyes were on Tesla which rose 7.3% after the electric-car maker reported better-than-expected profits and said it was on track to deliver about 1.8 million vehicles this year. Analysts noted that the EV market leader’s output target looks conservative as new factories in Berlin and Austin are set to add more capacity this year. Among peers: Rivian (RIVN US) +3.5%, Lucid (LCID US) +3.4%, Nikola (NKLA US) +1.9%, Nio (NIO US) +4.9%, Xpeng (XPEV US) +5.1%, Li Auto (LI US) +5%. Bank stocks traded higher in premarket trading Thursday, putting them on track to gain for a second straight day. In corporate news, a New York Stock Exchange employee failed to properly shut down a disaster-recovery system, leading to Tuesday’s chaotic opening session. Meanwhile, Cboe Global Markets wants to list more tokens on its crypto exchange, as established firms from traditional finance seek to capitalize on demand for reliable counterparties following the collapse of FTX. Here are some other notable premarket movers:

- Chevron (CVX US) gains 2.5% after it announced plans to buy back $75 billion of shares and increase dividend payouts after a year of record profits that evoked angry denunciations from politicians around the world as soaring energy prices squeezed consumers.

- Pfizer (PFE US) drops 1.8% in premarket trading as UBS downgrades the stock to neutral, saying estimates for the pharma giant’s Covid-19 franchise still look too high.

- IBM (IBM US) shares slip 2% after the tech infrastructure and IT services company’s free cash flow for 4Q fell short of estimates, which Morgan Stanley analysts say was a “significant blemish” in the quarter. That overshadowed IBM’s estimate-beating revenue and profit for the fourth- quarter.

- BuzzFeed (BZFD US) shares were indicated up about 35% following a Wall Street Journal report that the company reached a content creation deal with Meta. The deal was agreed last year and is worth nearly $10 million, WSJ cites people familiar with the matter as saying.

- Seagate (STX US) shares rise 7.6% as its quarterly update was better than expected and the computer- hardware firm’s guidance underpins a positive view on the stock, analysts say.

- Teradyne (TER US) falls 3% after its 1Q earnings forecast missed the average analyst expectation, on lower demand for semiconductors and storage tests. Fourth-quarter earnings beat analysts’ estimates.

- Las Vegas Sands (LVS US) shares gain 2.1% as analysts raise their price targets on the stock. They said better-than-expected results despite travel restrictions boded well for a recovery.

US stocks have kicked off 2023 with a rally that has set the S&P 500 on course for its best January since 2019, as investors bet that the Federal Reserve will slow the pace of rate hikes in time to avert a recession. Deutsche Bank AG strategists said this week they expect further gains in the first quarter as an economic contraction is “running late.”

Commenting on yesterday’s dramatic market reversal, Goldman trader John Flood writes that “when the market/stocks dont go down on bad news (MSFT guide) typically a bullish signal. I think we learned a lot from this price action today: this mkt is more resilient than most of us are giving it credit for (be very thoughtful/selective with your short positions as squeezes will be common this Q). Worth noting CVX raised the dividend by 6% and authorized a monster $75B buyback…energy complex will outperform on this tomorrow. Reminder buyback blackout period ends post close this Friday.“

Today all eyes will be on US GDP figures due later today, with economists expecting the data to show a slowdown in growth at the end of the year. Focus has also been on the fourth-quarter earnings season for signs of how companies plan to navigate slowing demand and elevated inflation. Analysts are projecting the first quarterly decline in US profits since 2020, but some market strategists have warned profit margin estimates for 2023 are still too high.

“Earnings have not been great but they are not disastrous either,’ said Rupert Thompson, chief economist at asset manager Kingswood Holdings Ltd. “Institutional investors have been short equities so you are seeing some of those positions being covered.” Thompson sees the January stock surge as overdone, given recession risks ahead, but did not discount further short-term gains because “if you do get a 5% pullback, people who missed the rally may think ‘shall we just bite the bullet now rather than wait for another 5% fall?”

“Sentiment remains fixated on the path of inflation, and where the Fed will go with interest-rate policy,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. Today’s economic data will be crucial to see “whether demand is being squeezed out of the economy and whether more storm clouds are gathering on the horizon,” she said.

Soft-landing bets for the US economy and expectations the Federal Reserve is nearing the end of its rate-hiking cycle have lifted stock markets and put the dollar on course for its worst monthly performance since last May. On Thursday, it held around flat against its Group-of-10 peers as investors awaited economic growth and jobs data as well as a core price index that could determine the Fed’s policy path.

In Europe, the Stoxx 600 was higher by 0.5% with outperformance in the tech sector after Nokia and STMicroelectronics posted better-than-expected numbers. Results from telecoms group Nokia Oyj and chipmaker STMicroelectronics NV were applauded by investors, helping to lift the Stoxx 600 index by half a percent. Here are some of the biggest European movers on Wednesday:

- Sabadell shares soar as much as 10% after the Spanish lender reported 4Q net profit that beat estimates and gave above- consensus estimates guidance

- Sartorius AG rises as much as 8.3% after the laboratory equipment firm reassured the market with an update to its financial targets; its subsidiary Sartorius Stedim Biotech rises, too

- STMicro jumps as much 9.3% after the chipmaker projected first-quarter and full-year sales ahead of consensus estimates, defying a slowdown in the broader semiconductor industry

- Nokia shares gain as much as 7.2%, the biggest intraday climb since July, after the telecom equipment maker outlined full-year outlook that met expectations

- Diageo falls as much as 7.4%, weighing on peers in the alcohol and beverages sector, after the Johnnie Walker maker’s results disappointed in North America and delivered an uncertain outlook

- Volvo shares slide as much as 4.9% in early trading after the Swedish truck producer reported 4Q22 earnings that came in below consensus

- SEB falls as much as 4.8%, the most since October, after the Swedish lender reported 4Q figures that beat expectations but were of a low quality, according to Citi

- Novartis falls as much as 2.4% on being cut to neutral from buy at Citi on a more cautious outlook for the Swiss pharma group’s cholesterol drug Leqvio and prostate cancer drug Pluvicto

- SAP shares fall as much as 4.1% after it’s free cash flow outlook for 2023 missed estimates, even though the firm still projected at least a double-digit growth for operating profits

Earlier in the session, stocks in Asia Pacific rose for a fifth straight day as investors in Hong Kong returned from Lunar New Year holidays that delivered a boost to consumption. The MSCI Asia Pacific Index climbed as much as 0.8% to the highest since April 22. Hong Kong-listed stocks rallied as data on spending and tourism during the three-day break signaled a recovery in demand is gaining traction in China. The Hang Seng Index closed at its highest since March. “Stocks in Hong Kong would probably remain on the stronger side,” Chetan Seth, an Asia Pacific equity strategist at Nomura, told Bloomberg Television. “What we might see in the months ahead is improvement in activity indicators.” Benchmarks in South Korea, Indonesia and Singapore also rose as traders assessed the global economy’s prospects.

China’s reopening has triggered a rebound across Asia, with investors now looking beyond Covid infection figures to evaluate how a recovery in the region’s largest economy will impact earnings. The MSCI Asia gauge is outperforming the S&P 500 by more than four percentage points so far in 2023

Japanese stocks fell, while markets in Australia, China, India, Taiwan and Vietnam were closed. Japanese stocks closed slightly lower, erasing early gains and halting a four-day winning streak, as investors assessed prospects for corporate earnings and the global economy. The Topix fell 0.1% to close at 1,978.40, while the Nikkei declined 0.1% to 27,362.75. Sony contributed the most to the Topix decline, decreasing 1.3%. Out of 2,161 stocks in the index, 893 rose and 1,116 fell, while 152 were unchanged. “There is a continued wait-and-see mood as there are two important indicators, the FOMC meeting and ISM employment reports coming up next week,” said Shogo Maekawa a global market strategist at JP Morgan Asset Management

In FX, the Bloomberg Dollar Index swung between moderate gains and losses. The Norwegian krone and Australian dollar led gains, while Sweden’s krona lagged. The euro retreated after six days of gains versus the greenback, though it is likely to enjoy continued monetary policy support, as several European Central Bank rate-setters spoke in favor of further hefty policy-tightening over coming months. Traders are likely to parse reports on US economic growth, initial jobless claims and a core price index due Thursday to gauge if the Fed will opt for a smaller rate hike on Feb. 1. Recent commentary from some central bank officials has backed the case for a quarter point increase

In rates, treasuries were lower after following gilts and, to a lesser extent, bunds during European morning. US yields cheaper by up to 4bp across long-end of the curve which leads losses on the day; 10-year yields back up to around 3.48% with gilts underperforming by additional 2bp in the sector and bunds trading broadly in line. UK and German 10-year yields rise by 4bps and 2bps respectively. A raft of US economic data is set to be released, and auction cycle concludes with 7-year notes following strong demand for 5- and 2-year sales. $35b 7-year notes at 1pm New York time is final coupon auction of the November-to-February financing quarter; all previous coupon auctions during January have stopped through. The WI 7-year around 3.525% is ~40bp richer than January’s stop-out and below auction stops since August.

Saira Malik, chief investment officer of Nuveen, said earnings risk in a consumer-led slowdown will act as a headwind to equities, with a shift into bonds underscoring the fragile sentiment. “You can start to increase your duration in fixed-income and get strong total returns in it without a lot of these heavy macro risks that are going to hit equities,” Malik said in an interview with Bloomberg TV. “Equities considering their valuation are less attractive.”

Elsewhere, oil prices rose for a second day, lifted by expectations of demand recovery in China. Crude future advance with WTI gaining 0.9% to trade near $80.90. Spot gold falls roughly 0.5% to trade near $1,937/oz.

Bitcoin fell more than 2%, reversing much of Wednesday’s gain.

Looking to the busy day ahead now, data releases from the US include the advance estimate of Q4 GDP, preliminary durable goods orders for December, new home sales for December and the weekly initial jobless claims. Otherwise, earnings releases include Visa, Mastercard, Intel, American Airlines and Comcast.

Market Snapshot

- S&P 500 futures up 0.2% to 4,038.75

- MXAP up 0.6% to 170.22

- MXAPJ up 1.1% to 558.68

- Nikkei down 0.1% to 27,362.75

- Topix down 0.1% to 1,978.40

- Hang Seng Index up 2.4% to 22,566.78

- Shanghai Composite up 0.8% to 3,264.81

- Sensex down 1.3% to 60,205.06

- Australia S&P/ASX 200 down 0.3% to 7,468.30

- Kospi up 1.7% to 2,468.65

- STOXX Europe 600 up 0.5% to 454.33

- German 10Y yield little changed at 2.19%

- Euro down 0.1% to $1.0900

- Brent Futures up 0.4% to $86.50/bbl

- Gold spot down 0.5% to $1,937.17

- U.S. Dollar Index up 0.17% to 101.81

Top Overnight Stories

- BOJ members were divided over whether the 2% inflation goal could be sustainably achieved and felt the extreme level of accommodation should be sustained. Also, The IMF suggested that the BOJ could allow more flexibility in 10-year bond yields, a move that would involve policy changes for the central bank. RTRS / Nikkei

- China’s most scenic destinations have been inundated during the Spring Festival holiday, as Beijing’s shift away from Covid Zero spurred a travel frenzy despite the country’s ongoing omicron outbreak. BBG

- Bank of Indonesia has delivered enough interest-rate increases, according to Governor Perry Warjiyo, who signaled that this round of tightening is coming to an end as the Federal Reserve also winds down. This is the second central bank in as many days (after the Bank of Canada yesterday) to signal an end to rate hikes. BBG

- Pakistan’s economy is at risk of collapse, with rolling blackouts and a severe foreign currency shortage leaving businesses struggling to operate as authorities attempt to revive an IMF bailout to relieve the deepening crisis. FT

- Adani Group may take legal action against Hindenburg Research after the US short seller alleged “brazen” market manipulation and accounting fraud. Shares of Adani-related entities slumped yesterday, shaving $12 billion off the empire of Asia’s richest man, and a raft of its companies’ dollar bonds fell further today. BBG

- Eurozone officials start talks on creating a huge multibillion-euro fund to compete w/the US green energy subsidies. London Times

- The NYSE mayhem earlier this week was due to simple human error, people familiar said — an exchange employee didn’t correctly shut down a backup system running overnight so heading into Tuesday, the NYSE’s computers treated the 9:30 a.m. bell as a continuation of trading, skipping the opening auctions. No word yet on the cost of the chaos. BBG

- Donald Trump’s back. Meta will reinstate the former president’s social media accounts “in the coming weeks” following a two-year suspension. He had 34 million followers on Facebook and 23 million on Instagram back in 2021 but, more important, his re-election campaign will now be able to buy ads to raise money via direct appeals or by capturing users’ contact info to solicit them directly. BBG

- Tesla jumped as much as 8% premarket after profit beat, though there were mixed signals on the outlook. Elon Musk said production may top 1.8 million vehicles this year. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed amid key holiday closures and after the flat handover from Wall St where the major indices recouped most of their initial losses after the BoC’s dovish hike. Nikkei 225 was subdued amid a firmer currency and upside in yields, while the government also lowered its overall economic assessment for the first time in 11 months. KOSPI gained despite the weaker-than-expected GDP data although the finance minister flagged the likelihood of a return to growth for the current quarter. Hang Seng outperformed as participants in Hong Kong returned from the Lunar New Year holiday and were greeted by strength in tech, property and autos, although trade across the rest of the region remained relatively quiet owing to the closures in Australia, China, Taiwan, India and Vietnam.

Top Asian News

- BoJ Summary of Opinions from the January meeting stated it is appropriate to maintain current monetary easing including YCC and that the BoJ must keep yields from rising across the curve while being mindful of the bond market function. Furthermore, they must spend more time to gauge the impact of the December decision and must conduct a review of policy at some point although it is appropriate to maintain easy policy for now, while they still see some distance in achieving the price goal and noted it will take some time to achieve sustained wage growth.

- IMF (policy proposal on Japan) says the BoJ should allow bond yields to move in a more flexible manner; If significant upside inflation risks materialise, BoJ needs to be ready to withdraw stimulus strong, e.g. by increasing interest rates; possible options for the BoJ include widening the yield bank, increasing the yield target, targeting shorter yields and shifting to a quantity target; BoJ policy is appropriate as inflation is likely to ease but risks are becoming more pronounced; FX intervention should be limited to special circumstances such as disorderly market conditions.

- Japan is to downgraded its COVID classification on May 8th, via NHK.

European bourses are firmer across the board, Euro Stoxx 50 +0.6%, with a busy morning for earnings dictating the state of play before Stoxx 600 heavyweight LVMH’s (MC FP) earnings, due after-market on Thursday. Stateside, futures are firmer across the board, ES Mar’23 +0.2% and comfortably above the 4k mark and as such the 10- and 200-DMAs which reside on either side of the figure. NDX +0.6% is the incremental outperformer after a well received update from Tesla (TSLA) +7% pre-market while IBM (IBM) slips -1.6% after its Q4 report.

Top European News

- US and EU are reportedly discussing a potential deal regarding critical raw materials and minerals, to enable the EU to benefit from the US’ Inflation Reduction Act/green investment plan, via Bloomberg citing sources.

- UK 2022 car production fell 9.8% Y/Y to 775k units, while car and light van production for 2023 is expected to increase 15% Y/Y to 984k units, according to SMMT.

- UK ONS says consumer behaviour indicators were broadly similar to the prior week.

- Irish Finance Minister McGrath says Brexit talks have reached a new level.

- Italian Economy Minister says before April they intend to extend relief measures to assist families and firms with energy costs, could alter regulations on capital gains tax.

- Denmark Calls for Mandatory Military Service for Women

- Europe Gas Prices Rebound After Slump With Asia Demand in Focus

- Diageo Drops as Sales Growth Slows in Crucial US Market

- Saipem Top Oil Services Pick at JPMorgan, Subsea 7 Cut

FX

- DXY slips to a minor new 101.500 y-t-d low, but holds in and pares some losses pre-US data raft.

- Aussie and Kiwi remain underpinned on inflation grounds, but AUD/USD heavy on 0.7100 handle and NZD/USD clipped around 0.6500.

- Yen recoils between 129.00-130.00 range vs Buck as Japan’s top currency diplomat warns that sharp moves will not be tolerated, CNH bid as HK markets return from holiday with COVID reopening optimism.

- Euro and Pound wobble above 1.0900 and 1.2400 vs Dollar and ahead of technical resistance.

- Morgan Stanley’s month-end USD rebalancing model: expects the USD to underperform in January, with weakness expected vs all G10 currencies ex-NOK.

- CBRT announced support for the conversion of firms’ foreign exchange obtained from abroad into Turkish liras to support ‘liraization’ in commercial activities, with firms to be provided with FX conversion support corresponding to 2% of the amount converted.

Fixed Income

- Core benchmarks have continued to ease from best levels with the IMF’s BoJ/Japan policy proposal adding to the pressure.

- Bunds holding just above 138.00 within 138.62-137.91 parameters while Gilts are just below 105.00 towards the mid-point of a 105.66-104.72 range.

- USTs are similarly contained around the 115.00 handle as participants await US data and a subsequent 7yr auction.

Commodities

- WTI and Brent March futures remain underpinned by the China-demand narrative, though are relatively rangebound overall and spent much of the morning trading with no firm direction with focus on geopols and French strike action.

- US and European gas futures are experiencing a modest divergence, with ING suggesting the US Nat Gas pressure is due to milder weather.

- TotalEnergies (TTE FP) says pension reforms strike action is interrupting shipments at French production sites, except for the Feyzin refinery (119k BPD). Continue to ensure petrol stations are supplied, no shortage.

- 24-hours strike declared at the 140k BPD Fos-Sur-Mer oil refinery in France, according to BFM TV citing an Esso Union official.

- German energy regulator says there is not enough gas saving in the third calendar week; household, business and industry consumption down 9%in total in that week (vs 20% target).

- Spot gold has been dipping from best levels amid seemingly yield-driven USD upside while LME copper is relatively resilient but has slipped from best levels.

Geopolitics

- Russian Kremlin says it sees the sending of Western tanks to Ukraine as direct and growing involvement in the conflict.

- Russian Security Council’s Secretary Patrushev says the US and NATO are participating in the Ukrainian conflict and want to prolong it.

US Event Calendar

- 08:30: 4Q GDP Annualized QoQ, est. 2.6%, prior 3.2%

- 4Q GDP Price Index, est. 3.2%, prior 4.4%

- 4Q PCE Core QoQ, est. 3.9%, prior 4.7%

- 4Q Personal Consumption, est. 2.8%, prior 2.3%

- 08:30: Dec. Durable Goods Orders, est. 2.5%, prior -2.1%

- Dec. -Less Transportation, est. -0.2%, prior 0.1%

- Dec. Cap Goods Orders Nondef Ex Air, est. -0.2%, prior 0.1%

- Dec. Cap Goods Ship Nondef Ex Air, est. -0.4%, prior -0.1%

- 08:30: Jan. Initial Jobless Claims, est. 205,000, prior 190,000

- Continuing Claims, est. 1.66m, prior 1.65m

- 08:30: Dec. Advance Goods Trade Balance, est. -$88.1b, prior -$83.3b, revised -$82.9b

- 08:30: Dec. Retail Inventories MoM, est. 0.2%, prior 0.1%

- Wholesale Inventories MoM, est. 0.5%, prior 1.0%

- 08:30: Dec. Chicago Fed Nat Activity Index

- 10:00: Dec. New Home Sales MoM, est. -4.4%, prior 5.8%

- New Home Sales, est. 612,000, prior 640,000

- 11:00: Jan. Kansas City Fed Manf. Activity, est. -8, prior -9

DB’s Jim Reid concludes the overnight wrap

Morning from Milan. Yet another first time since the pandemic started trip. Always nice to be back. I’d almost forgotten how good the food is here! It was a fairly positive macro dinner with clients generally constructive. It was unique to be in Italy and see no-one really too concerned about Italy credit quality which is testimony to the various EU/ECB packages both pre and post the pandemic and also impressive given how far the ECB has come on rates and how far it still has to go.

With markets overall on the calm side too at the moment we’re getting our mini vol from entering earnings crossfire season where a big name’s quarterly report can pick you off. Indeed, sentiment yesterday was heavily influenced at first by Microsoft’s disappointing cloud sales outlook from after the bell on Tuesday night. The company’s shares were down around -4.5% soon after the open, before sentiment steadily improved as the day progressed. By the end of the day, it had clawed its way back up to have only lost -0.59%. More broadly, the Nasdaq and S&P 500 hit intraday lows of -2.34% and -1.69%, respectively, before closing at -0.18% and -0.02%. So a decent recovery.

After the close, we then heard from Tesla and IBM. Tesla reported adjusted earnings of $1.19 EPS ($1.12 EPS expected) as it sought to boost output quickly to achieve its previous guidance of 1.8mn vehicles delivered this year. In after-market trading it then advanced +5.5%, especially after Elon Musk said that he expected demand would remain strong despite an expected contraction and that there was a new “next-generation” vehicle that would be announced in March. IBM (-2.0% after-market) also beat earning expectations at $3.60 EPS (consensus was $3.58), and increased its sales forecast whilst announcing they would be cutting headcount by 1.5%. Against this backdrop, US equity futures are looking more positive this morning, with those on the S&P 500 (+0.12%) and the NASDAQ 100 (+0.35%) both higher.

With the S&P 500 finishing the day largely unchanged, 12 of 24 industry groups were in positive territory for the day. Telecoms (+2.50%), banks (+1.17%), insurance (+0.78%), and food & beverage (+0.73%) outperformed, whereas transports (-1.43%) and utilities (-1.36%) were the biggest laggards. Europe closed before the last of the rally in the US, with the STOXX 600 finishing down -0.29%. The STOXX Technology index was similarly down -1.66% at the lows before staging a late recovery itself that only left it down -0.13%.

Much like US equities, US bonds saw a decent range and by the close yields on 10yr Treasuries were down -1.1bps on the day to 3.44% (range 3.42-3.49%). By contrast in Europe, yields on 10yr bunds (+0.3bps), OATs (+1.1bps) and BTPs (+3.3bps) all moved higher to varying degrees. That followed fresh comments from ECB speakers, with Slovenia’s Vasle saying that rates should go up by 50bps at the next two meetings. Ireland’s Makhlouf also endorsed continuing with 50bps into March, saying that “We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions – and also at our March meeting.”

Ahead of the Fed and ECB decisions next week, we did get a decision yesterday from the Bank of Canada. They hiked by 25bps as expected, but said in their statement that they expect “to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases.” Governor Macklem did make clear in his press conference statement that this was “a conditional pause”, and said they were willing to do more if needed to get inflation back to target. However, it’s still an important milestone after a series of 8 hikes at consecutive meetings, particularly given speculation about when the Fed might reach a similar point in their own hiking cycle.

Speaking of the Fed, they’re currently in their blackout period, but the Washington Post reported yesterday that Vice Chair Brainard was a top contender to become the next head of the National Economic Council at the White House. If that happened, that would open up a space on the board as well as the Vice Chair position, although as it stands Brainard’s position as both a Governor and Vice Chair currently last until H1 2026. Nevertheless, there is a precedent for such a move from the Fed to the White House, such as when former Chair Bernanke went from being a Fed Governor to Chair of the Council of Economic Advisers in 2005, before going back to the Fed as Chair the following year. Similarly, Janet Yellen made the same move from Fed Governor to CEA Chair in 1997.

Staying with the White House, the Biden administration announced that the US would be sending 31 M1 Abrams tanks to Ukraine, adding on to those confirmed by Germany. Delivery of the US tanks could take months but training would begin soon. The German tanks are expected to be sent to Ukraine within three months.

Overnight in Asia, equities have posted advances for the most part, with the Hang Seng up +1.89% as it resumed trading following a holiday. That leaves the index on track for its highest closing level since April last year, and brings its gains since the end of October to +53% now. In the meantime, the KOSPI was also up +1.44%, but the Nikkei is down -0.20% this morning amidst a further strengthening in the Japanese Yen, which stands at 129.36 per US Dollar this morning.

Looking at yesterday’s other data, the Ifo business climate indicator from Germany rose to a 7-month high of 90.2 in January (vs. 90.3 expected). And the expectations component rose to an 8-month high of 83.2 (vs. 82.0 expected).

To the day ahead now, and data releases from the US include the advance estimate of Q4 GDP, preliminary durable goods orders for December, new home sales for December and the weekly initial jobless claims. Otherwise, earnings releases include Visa, Mastercard, Intel, American Airlines and Comcast.

Tyler Durden

Thu, 01/26/2023 – 08:06

via ZeroHedge News https://ift.tt/OE91DGh Tyler Durden