Novo Shares Drop Most In Two Years On “Disappointing Ozempic & Wegovy Misses”

Novo Nordisk shares in Copenhagen fell 7.7%, marking the steepest intraday plunge in two years. The Danish pharmaceutical giant delivered underwhelming second-quarter sales for its Wegovy (semaglutide) blockbuster anti-obesity drug.

Shares are testing key support.

Wegovy’s second-quarter sales were 11.7 billion Danish kroner ($1.7 billion), while the Wall Street analyst estimate tracked by Bloomberg was about 13.66 billion kroner.

During an earnings call, CFO Karsten Knudsen told investors that revenue from the anti-obesity drug was pressured by higher-than-expected price concessions to US pharmacy benefits managers, calling it a ‘one-off factor.’

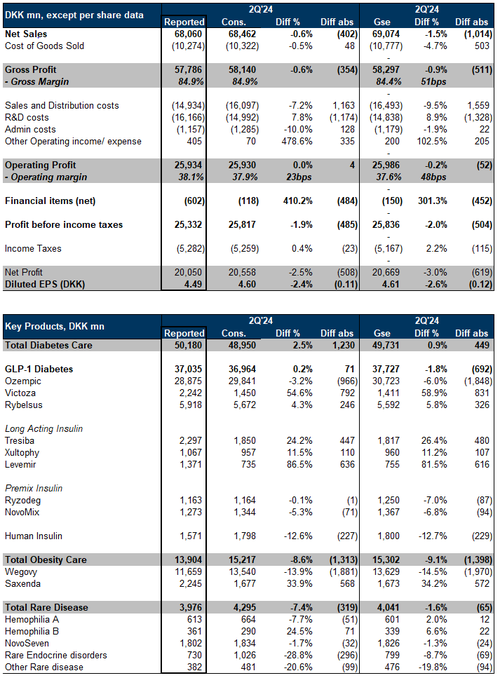

Here’s a breakdown of the second quarter results (courtesy of Goldman):

Goldamn’s James Quigley provided clients with a snapshot of the key beats and misses from the second quarter:

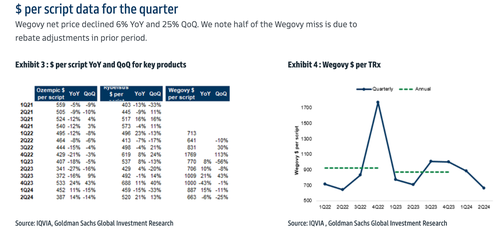

- Wegovy 14% behind consensus (DKK -1.9bn, 468% of group sales miss). North America sales were driven by increased volumes, partially countered by lower realised prices. In the US, demand exceeds supply and to safeguard continuity of care the supply of the initiation dose strength remains capped. We note US Wegovy sales of DKK 9,907mn missed Visible Alpha Consensus Data of DKK 12,242mn by 19%, but ex. US sales of DKK 1,752mn beat VA consensus of DKK 1,360mn. We note the Wegovy US $ per script decreased 6% YoY and 25% QoQ, see below section. We note half of the Wegovy miss is due to rebate adjustments in prior period, so excluding this impact Wegovy would be a 7% miss and the YoY value would have declined by c.3%.

- Ozempic 3% behind consensus (DKK -1bn, 240% of group sales miss).

Novo adjusted its full-year outlook, lowering its profit guidance while raising its sales outlook for the year. It now forecast full-year operating growth to range between 20% and 28%, with sales growth between 22% and 28% at constant exchange rates. Previously, it projected operating profit growth between 22% and 30% on sales growth ranging from 19% to 27% at constant exchange rates.

In Kroner terms, Wall Street analysts had projected operating profit growth of about 25% and sales growth of roughly 26%. The new guidance falls short of Wall Street’s expectations on both the top and bottom lines.

Quigley sheds more color on the new guidance:

FY24 guidance was upgraded to operating profit growth of 19-27% on a reported basis, which is broadly in line with the mid-point of the current company-complied consensus implied growth of 24.8%, therefore we expect limited changes to forecasts for FY24. The Ozempic and Wegovy misses were disappointing, although we note that the guidance appear to reflect an acceleration in Wegovy in the 2H as obesity supply improves. Therefore, with half of the Wegovy miss relating to a prior period GTN adjustment, supply improving, demand still in excess of supply in the US and an implied beat for ex-US Wegovy, we continue to see a positive dynamic for the obesity portfolio into 2025 and beyond.

Quigley added:

Overall we see the underlying guidance upgrade as a positive indicator that Wegovy supply is improving. However, the miss on Ozempic and Wegovy in the quarter is likely to be disappointing in the short term and could weigh on the share price this morning. However, with Novo stock down c.14pp from the June highs, any weakness could be a buying opportunity into 2H’24 with the potential acceleration of the obesity franchise, in our view.

Wegovy deflation…

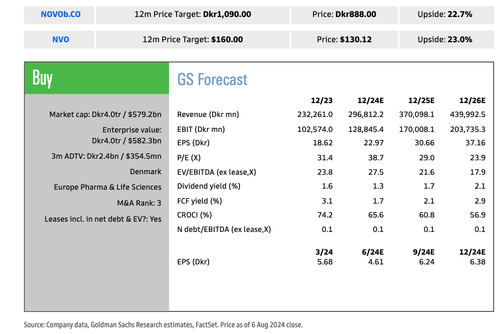

Quigley maintained a ‘Buy’ rating on Novo with a 12-month price target of DKK 1,090 per share.

Here’s what other Wall Street analysts are telling clients after Novo reported (courtesy of Bloomberg):

Barclays (overweight)

- Wegovy will be the focus, with 2Q sales missing estimates, analyst Emily Field writes in a note

- The cut to the operating profit outlook was “widely understood” given the asset impairment

- Although the 2Q results weren’t necessarily the “picture perfect quarter” that Barclays had hoped for, the company’s message is that volume is on track for obesity

BMO (outperform on ADRs)

- The 2Q results were “mixed,” with Wegovy still hurt by supply constraints amid strong demand, analyst Evan David Seigerman writes in a note

- A negative gross-to-net-adjustment also contributed to Wegovy’s sales miss

- Even so, the commentary on continued strong demand for obesity medications is encouraging

Citi (buy)

- Although the Wegovy “miss” will be in focus in the short term, volume trends are strengthening, analyst Peter Verdult writes in a note

- Half of the consensus miss on 2Q Wegovy sales can be explained by gross-to-net adjustments

Jefferies (underperform)

- 2Q sales for focus drugs Wegovy and Ozempic missed consensus expectations, analyst Peter Welford writes in a note

- The FY sales outlook boost suggests there may be minor increases to consensus estimates “at most”

- The “wide” Ebit guidance range for the year was decreased, with the “known” recent ocedurenone impairment charge hurting profit growth

Intron Health (buy)

- The 2Q results were “soft,” with both sales and EPS missing expectations, analyst Naresh Chouhan writes in a note

- The downgraded Ebit guidance is because of the one-time ocedurenone impairment, “which every other Pharma company would exclude from their ‘adjusted’ earnings measure”

- Wegovy’s 2Q sales miss was partly because of gross-to-net price adjustments in the US, which suggests that consensus pricing assumptions were “too high”

The question becomes has the bubble in companies with exposure to GLP-1s finding a peak?

For the bubble to continue, medications for obesity need to be covered by insurers.

only problem is most insurers don’t actually cover it

— zerohedge (@zerohedge) August 1, 2024

And now recession risks are elevated, some folks will have the difficult decision between affording car payments or GLP1 drugs.

Tyler Durden

Wed, 08/07/2024 – 07:45

via ZeroHedge News https://ift.tt/NGQypHx Tyler Durden