Maund: Welcome To The Global Gulag…

Tyler Durden

Tue, 08/18/2020 – 23:45

Authored by Clive Maund via CliveMaund,com,

In case you haven’t noticed, we now live under tyranny, and over the next several years, thanks to the unquestioning zombielike submission of the masses, it is set to get a whole lot worse.

When this whole bizarre virus plandemic, or scamdemic, started to gather momentum I instinctively knew that something wasn’t right, that the official explanations didn’t add up, and that society at large was “being played” by those in power with an agenda. To anyone with even a modicum of real intelligence, the whole thing stinks of an elaborate plot.

So, driven by natural curiosity, and being a person who would rather know the truth, however awful, than go around with blinders on, I embarked on a quest to find out what was really going on, what was really behind all this, and for what it’s worth I am going to share my findings with you today.

Now I understand that there are those amongst you who are programmed by the system to label anyone who expresses views that deviate from what is portrayed as normal as a “conspiracy theorist”. If you are one of those you may want to click out now, but before you go, I want to point out to you that what I am writing about now, what we are living through, is not conspiracy theory, but conspiracy fact.

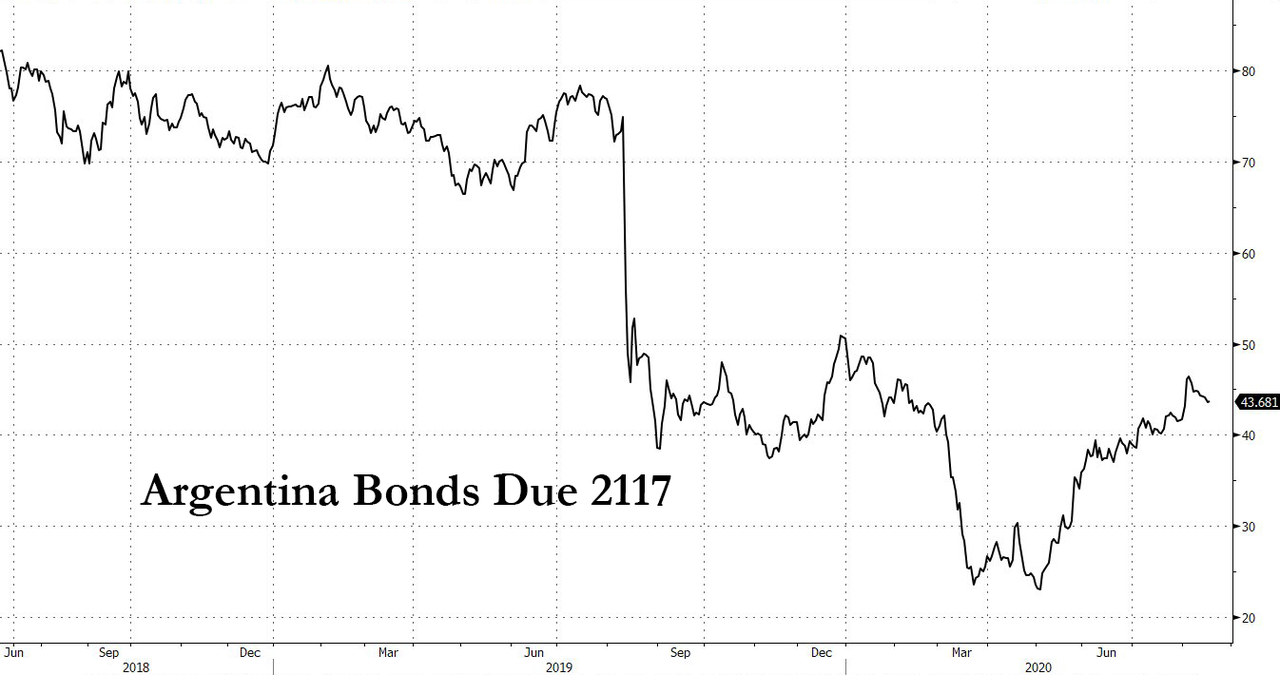

Let’s start with the timing. Why was the virus, or bioweapon if that’s what it is, released when it was? The answer to that is simple; after years of exponentially increasing fiscal profligacy, debt across all levels of society had risen to wild unsustainable extremes so that the world economic system was teetering on the verge of collapse – witness the Fed’s emergency interventions in the repo markets last Fall. If the system was about to collapse those in power didn’t want to take the blame for it, so they needed a scapegoat, enter the virus – “Oh it wasn’t our mismanagement that caused the system to implode it was the virus”

The old adage “Never let a good crisis go to waste” has been embraced with gusto by those in power. For decades, in our relatively free societies, they have had to content themselves with economic plunder – granting themselves inflated salaries and bonuses and stock options and positions on boards etc. but this virus scamdemic has presented them with the opportunity to wield what despots always crave which is raw, unbridled power over people – and the more of it they wield the happier they are. The scamdemic has presented them with the opportunity to implement a totalitarian regime and not just in one country or even a geographical region but for the first time ever over the entire world, and this will have one distinct advantage over all previous totalitarian regimes which is that there will be nobody left to fight back. The window of opportunity for the ordinary citizen to prevent this happening is already rapidly closing and if the current apathy, indifference and conformist stupidity of the masses continues, as it looks set to, then their fate will be sealed as they become entombed in a global gulag.

So who or what are the immensely powerful plutocratic forces that are intent on bringing about this global technocratic totalitarian regime? The first thing to understand is that all of the widely accepted leaders of society such as celebrities, the clergy and politicians are all marionettes – puppets – if they do not speak and act in accordance with the aims of the true masters of society then they are marginalized or replaced. Special mention at this time must go to spokespersons for the medical profession, who must of course be pro-vaccine. Alright, so who are they? Ask yourself a simple question – who has the power to create unlimited wealth for themselves and their favored associates at the touch of a few keystrokes? – you’ve got it – the Central Banks, who pass on the tab for their profligacy to society at large by steadily eroding the purchasing power of money. Thanks to the dollar being the global reserve currency, the Federal Reserve is the King of them all and calls the shots – all other Central Banks are subservient to it – Greg Mannarino even goes so far as to say that the Federal Reserve was behind the virus, and it is certainly easy to see why this might be the case. The Central Banks and the leading largely faceless men within them are the true Masters of the world, the real shadow government, and it is they who are behind this drive towards a global totalitarian society.

What are their goals? – they are already enormously wealthy so more money is not their primary objective. What they crave is more power – absolute power over people and their lives, that is what drives them. They are intent on creating a neo-feudal two-tier society, where they are the top tier – fabulously wealthy and wielding absolute power over everybody else who will exist – if they are permitted to – as an army of servants. This is of course a big reason for the lockdowns, to destroy the independent middle class and their businesses so that they then have to work for the large corporations owned by the elites and are thus more dependent on their Masters, as are those living on meager handouts. It is sad to witness businesses like restaurants struggling to survive doing things like spaced out tables or takeout in the brief interlude before more brutal lockdowns that are designed to finally wipe them out completely.

How is it possible to paralyze with fear billions of people with fabricated and lurid stories about a killer pandemic into giving up their basic rights en masse and submitting to being treated like farm animals? Simple – you control their inputs via the mainstream media. Ordinary people are not called “the masses” for nothing – they are largely ignorant, stupid and gullible, that’s why, instead of seeking to educate themselves about what is really going on, they fritter their lives away watching soaps, video games and following the lives of celebrities etc. By owning and controlling their favorite media, you control their limited thought processes and they are susceptible to any propaganda. Basically, by the skillful use of propaganda you can get the masses, who are about 70% of the population, to do anything you want, and they can then exert peer group pressure on more thoughtful individuals to conform, a classic and glaring example being the wearing of face masks, which is State sanctioned collective paranoia, and if that doesn’t work they are forced to conform and wear them by means of fines or imprisonment. Here it is worth noting that the most powerful institutions in the world, especially the banks, media and Wall St are heavily peopled by “the race who cannot be criticized”.

Virtually all media – newspapers, TV channels, radio stations, and now most websites are controlled by the same plutocratic forces, which is why you have to be careful what you say on Facebook and Twitter or they flick the switch and banish you. This is why, once the scamdemic started, the masses were bombarded with wall to wall 24-hour scare stories about the virus, involving lies exaggeration and distortions on an epic scale, with nonstop repetition drumming it into them. They foolishly and unquestioningly sucked it all up and submitted to being locked up in their houses for months, and now have to wear diapers on their faces to establish their credentials as dumbed down fearful submissive sheep.

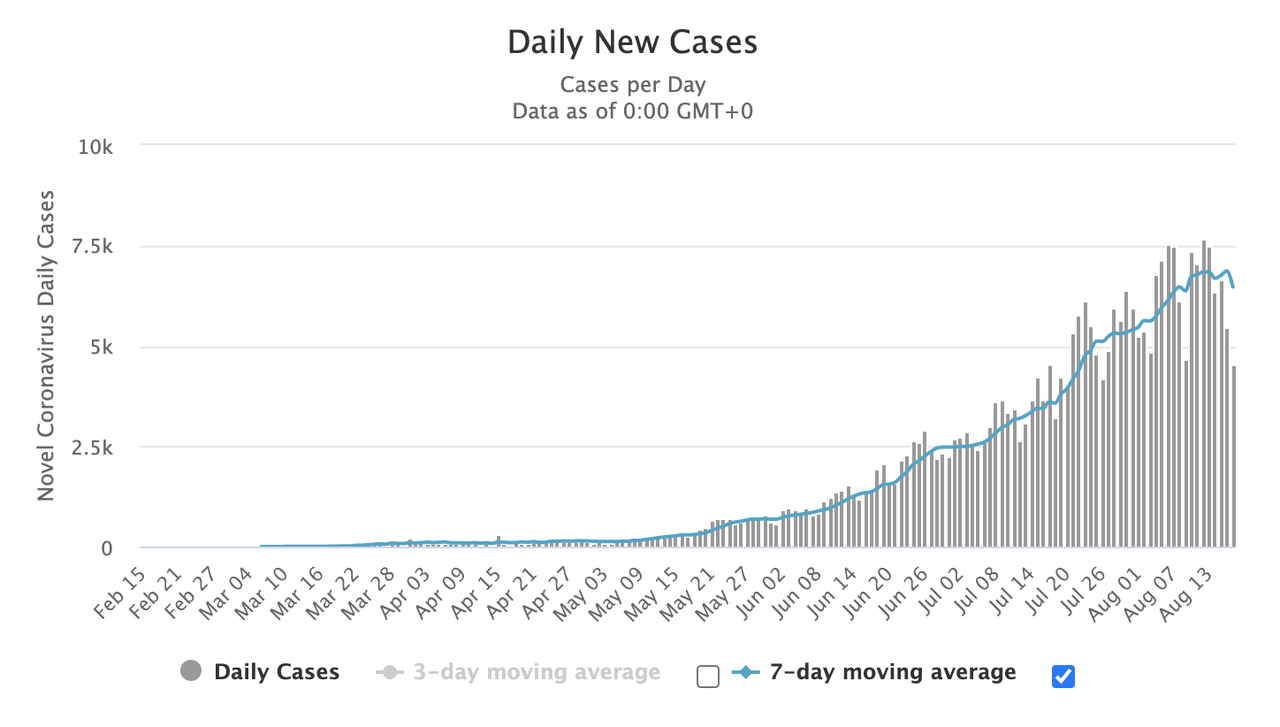

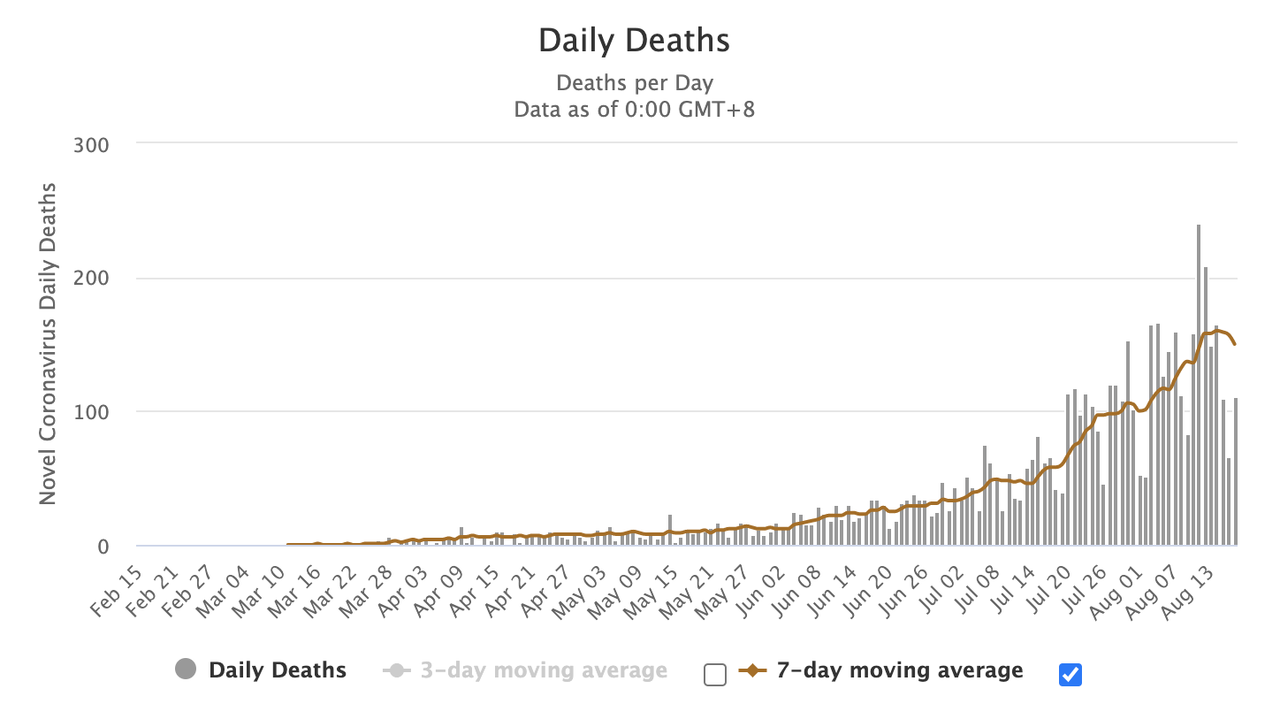

When you confront them with this, they say “Oh, but people are dying!” (of the virus) to which the correct response is “So what? – people are dying all the time, of flu, old age and umpteen other illnesses” Then they try to quote alarming stats at you, if they remember them, not realizing that all these case numbers are gross exaggerations caused by phony test results and anybody who dies of anything being labeled as a Covid-19 death. On the television they quote death stats at you, intended to alarm, but when you do the basic math and compare the deaths, even if you take the grossly inflated figures at face value, and compare them to the total population of the country in question you realize that the percentage of people supposedly killed by the scamdemic is tiny, usually of the order of 0.5% maximum and usually much less, which is hardly the order of the Black Death, which killed 1 in 3. One tactic that they are currently using in the US is to do huge numbers of tests to bump the case numbers up in order to justify more lockdowns. These lockdowns are never justified in any case, because in a normal society you lock up the sick people, not the healthy people.

All of the draconian measures put into place around the world that are purportedly employed to protect the population from the virus, are actually intended to damage the immune systems of people by design, in order to make them weaker and more susceptible to illness later – and don’t forget if they are admitted to hospital with the flu, it will be labeled as Covid-19 to ramp the stats. Thus we have enforced house arrests, the lockdowns, which are designed to stop people getting out and taking air and exercising and spending time in the sun, which is important for the immune system, the masks, which restrict respiration, the social isolation which is intended to make people anxious and fearful and damage the social fabric. Plain common sense dictates that the right way to deal with a virus epidemic, especially one that only kills a small percentage of the population is to carry on with normal life and let it do what it will. Those who catch the virus will mostly recover, especially the young, and will develop some immunity. Another reason for flexing their muscles with the curfews, the lockdown orders and the mandatory mask wearing is to have the population accustomed to getting down on their knees before the power of the State as a warm up to full Martial Law.

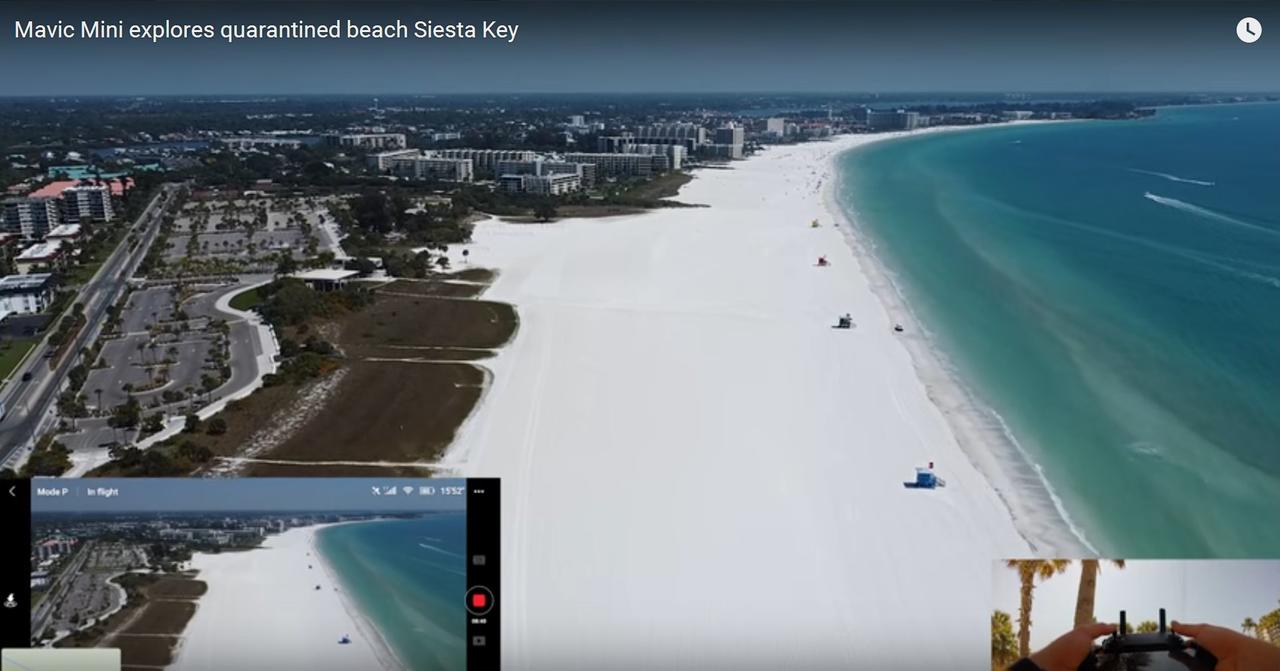

There was and is absolutely no reason to deny people access to beaches or parks, as in this drone photo of Siesta Key in Florida on a sunny Summer day when the car park on the left is normally full. The reasons for doing so are malevolent – to damage the health and wellbeing of citizens and to demonstrate the power of the State…

This picture is a screen grab from the entertaining video Mavic Mini explores quarantined beach Siesta Key.

One of the big reasons that the NWO (New World Order) is determined to isolate people is to stop them gathering in groups the better to prevent the interchange of ideas, which might result in large numbers of people gathering and deciding to overthrow their common enemy, namely the Central Banks and the government, especially when the implosion of the debt bubble and / or hyperinflation renders them destitute and desperate – the NWO are thinking ahead. The storming of the Bastille in Paris in 1789 could not have happened if crowds had been prevented from gathering.

It’s very easy by selective editing and exclusion to control the minds of young people like this, whose literary education largely comes from Facebook and Twitter, many of whom don’t have a thought in their heads that wasn’t put there by someone else…

There are 3 key planks that the New World Order are going to use to impose their planned draconian totalitarian matrix on the peoples of the world:

-

a cashless society,

-

forced vaccination,

-

and forced mask wearing and these plans are already well advanced and already being imposed in the case of the mask.

The four main reasons that the NWO want to implement a cashless society are as follows.

One is that the banks can take a cut even of the smallest transactions.

Another is so that no-one can enter into financial transactions that are not subject to the scrutiny of the State and therefore they cannot escape the taxation dragnet.

Still another is to prevent bank account holders from withdrawing cash and possibly triggering runs on banks,

and the fourth big reason is that banks will be free to impose negative interest rates, which is a polite way of saying that they are going to plunder your accounts, and if they are in a really bad mood they can resort to bail-ins – outright theft from customers’ accounts.

A cashless society therefore means that the banks have absolute financial power over you and your life. No wonder they want to introduce it!

A big reason for imposing draconian restrictions on the population now and going forward is to coerce more people into accepting being vaccinated. The vaccination certificate will be presented as a passport to a relatively normal life. Initially it will be voluntary, and coercion will work with many people as they will not be able to do things like board planes and even eat at restaurants without the required certificate of compliance. Eventually, those who don’t comply who will wind up being a minority will be subjected to more extreme coercive measures bordering on being pinned down and given a jab. The propaganda machine is already going full bore using reverse psychology, by suggesting that initially there might not be enough vaccinations to go round, and that if you are “fortunate” you will get on the list to receive a shot. What the poor unfortunate fools lining up for these shots don’t realize is that these vaccinations will be full of all kinds of unpleasant gunk, some of which could be DNA altering, and they can at any time use these vaccinations to conduct selective culls – Bill Gates has made no secret of the fact that he wants to wipe out a large number of people. Another aspect of this vaccination scam that should be considered is that these vaccines are being fast tracked at such a rate that adequate safety checks cannot and will not be made and therefore they should be regarded as dangerous, and this of course may be due in part to the huge windfall profits in prospect for the companies involved.

The mask is the supreme symbol of the triumph of the will of the NWO over the mass of the population. It is rich in symbolism. To start with it doesn’t work, because virus particles are so small they go straight through it. The purpose of the mask is to demonstrate that the iron will of the State prevails – it is at once a symbol of compliance, a symbol of conformity, a symbol of submission, a negation of individual personality, since people can’t see your face, and best of all, through impeding normal respiration it damages your immune system and makes you more susceptible to catching the virus! The few thinking people who try to refuse to go along with this insanity will in time come under increasing attack from the majority, and are already being subjected to fines. CNN is airing pro-mask propaganda which goes something along the lines of “not wearing a mask says something about the person not wearing it” which is clearly an incitement to discrimination and possible violence. Actually they are right in a way – it says that he or she is not a mindless submissive sheep.

The 3 measures described above constitute a full frontal assault on the basis human rights of citizens.

-

The cashless society makes citizens automatic victims of userers – the banks,

-

forced vaccination makes them victims of Big Pharma racketeers and puts them at risk of death through eugenics programs,

-

and the mask is an attack on one of the most basic human rights of all – the ability to breathe freely.

Taken together they should give you the clearest indication of what the gangsters behind this intricate and comprehensive plot have planned for humanity – and they are only just getting started.

I have told you on numerous occasions that democracy is an absurd self-defeating concept. The reason is simple – you cannot have a system where ignorant stupid people have the same vote as intelligent discriminating people, who they vastly outnumber. The result is mob rule and politicians getting voted into office not because they are conscientious individuals who will work for the betterment of the lives of their constituents, but because they kiss babies and promise the mob the Earth. The result is the current unsavory collection of shameless gangsters and opportunists who now run Western societies and who milk their constituents on the one hand while serving as compliant stooges for their NWO Masters on the other.

Thus, true democracy can only be a temporary state of affairs and must cycle through to tyranny, which is what we are seeing now, and in a way the masses deserve their fate. Whilst it is certainly not true of everyone, a very large number of people these days are brainwashed, careless, cowardly, indulged, insouciant, ignorant of what really matters, physically soft, timid and vapid individuals. If they weren’t, the NWO could never have pulled off what they have so far this year. Their assessment of the masses as gormless sheep that you can do anything to have been proven correct – just walk down any street these days and you will see this. There was a demonstration in Germany a few weeks ago by a quite large number of people who saw through the plot, but this was of course downplayed by the media, and unfortunately not repeated elsewhere.

In the United States, which is one of the countries that will be hardest hit by the economic meltdown, they are playing a very crafty game by pitting Left against Right and black against white. The name of the game is “divide and conquer” – the masses will be too busy hating and killing each other to go after their joint enemy. So the Left call for draconian State intervention to stop the spread of the virus and the Right call for draconian State intervention to stop the rioting, which was bankrolled by powerful forces.

We thus appear to be entering a new Dark Age, and unlike tyrannies of the past there is unlikely to be an early end to it, because it is truly global in scope. As the walls close in and the Matrix solidifies, all sources of dissent will be snuffed out and where deemed necessary, forcibly eliminated.

You might well think to yourself, or say, “Maund if you know all this why are you saying it?- there’s a risk of them coming after you, is there not?” While that is theoretically true, they are only really concerned by articles or reports of this nature that have a high circulation. Hardly anyone in comparative terms will read this and then it will disappear and be forgotten about. Of course, further down the road, when the Matrix really closes in, no dissent at all will be tolerated. The masses are so dumb that me writing this won’t make any real difference, it will only have an impact on the few that read it with whom it resonates. The masses are not going to watch a really important video like this by Greg Mannarino which has a relatively modest 31,800 hits when they can watch slush like this that has more than 642 million hits. It is this mindless obsession with trivia that is one reason why we are now falling into the abyss.

There are few grounds for optimism – the ease with which the New World Order got the masses to voluntarily shut themselves in their homes and wear face diapers etc. without much dissent will embolden them to go full steam ahead with their draconian plans for more severe lockdowns, permanent diaper wearing, the elimination of cash, contact tracing and endless surveillance and forced vaccination. The freedoms so effortlessly being given up will be very hard if not impossible to recover. It is important not to underestimate the ruthlessness of the enemy – in the space of just 6 months in a rampage of unrestrained malevolence they have all but destroyed the airline industry, the catering and restaurant industry, the travel industry and have decimated 50% of small businesses in the US, leading to about 40 million job losses. They have imprisoned people in their homes for weeks and sometimes months on end, denied children schooling and the necessary company of other children and forced the population to wear oxygen stealing masks and permanently damaged the health of millions through this means and by denying them access to air and sunlight. It should thus be clear that they are capable of anything, up to and including the mass murder of millions, which they may achieve through the intentional disruption of food supplies or through tainted vaccinations and perhaps both. Ominously they have been emboldened by their successes up to this point and can now be expected to push on until they have achieved their objective of absolute power over and total control of the population who can look forward to being exploited ever more severely in a neo-feudal Master-servant type society – which will be the reward for their cowardice and docile stupidity of recent months.

I don’t pretend to have all the answers on this. These are the pieces of the puzzle that I have been able to pull together over time, and fortunately we have enough here to see the big picture, and it isn’t pretty.

via ZeroHedge News https://ift.tt/2YgtL4B Tyler Durden