Iran’s Clerics “Put World At Risk” – Urging Pilgrims To Visit Qom Shrine, Outbreak Epicenter, As “House For Cure”

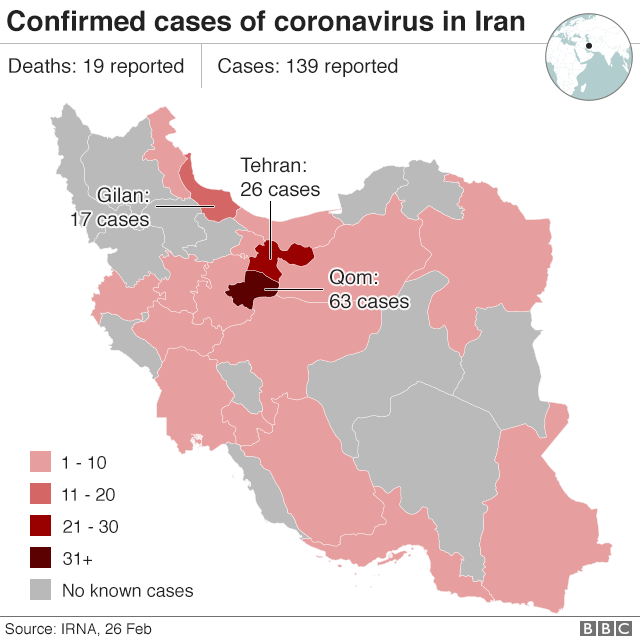

Already sanctions-wracked Iran now has the worst coronavirus outbreak in the Middle East. The official death toll has climbed to 26, with 240 confirmed cases (with thousands still being tested); however, the true numbers are believed much, much higher – also given at least seven government leaders have been infected, including the vice president and a former ambassador to the Vatican and Egypt, Hadi Khosroshahi, who died of the illness, as well as Deputy Health Minister Iraj Harirchi. Media reports suggest the true number of infected could now be closer to 20,000.

And yet in the latest speech by President Hassan Rouhani, he vowed not to quarantine any cities, and ranted against the virus becoming “a weapon at the hands of our enemies,” as part of “propaganda” against the Islamic Republic.

However, Friday prayers have been ordered canceled by Tehran authorities in 23 cities across the country, including Qom, and schools remain closed until at least next week, but the Islamic Republic’s powerful clerical establishment has remained defiant. As the WSJ reports, “Some worshipers in Qom are defying those orders and pushing clerics to continue delivering prayers, say residents of the city.”

“The signs of public defiance in Iran signal challenges ahead for authorities across the region that are hosting large numbers of religious pilgrims or confronting the prospect of their citizens returning from infected areas, particularly in Iran,” the WSJ notes further.

At a moment nearby Saudi Arabia has taken the unprecedented step of blocking all visas for the Islamic pilgrimage to Mecca, which sees on average two to three million plus visitors per year, Shia clerics in the holy city of Qom appear defiant. The city is home to one of the most revered shrines in Shia Islam, which sees some 20 million religious pilgrims a year. “Health experts have expressed concern about Iran’s decision not to restrict access to the shrine of Hazrat Masumeh in Qom,” the BBC noted previously.

Though political and health officials are busy urging Iranians not to visit Qom, considered ground zero for Iran’s outbreak, it appears the powerful clerical establishment has held sway, preventing total closure of some among key sites. In fact, Qom’s Shia clerics are actually still positively encouraging travel to the city’s shrines for “healing”. The WSJ cites custodian of the holiest site in the city, the Fatima Masumeh Shrine, as announcing:

“We consider this holy shrine a house for cure. House for cure means people would come here to get cured from mental and physical diseases,” the custodian, Ayatollah Mohammad Saeedi, said in a video interview published Wednesday by Jamaran, an Iranian news site.

“It should be open, and people should be encouraged to come here. Of course, we believe caution is required, and we follow hygienic issues.”

“We have no plan to quarantine any district or any city. We only quarantine individuals. If an individual has early symptoms, that person must be quarantined,” Rouhani said in a Wednesday speech.

Underscoring that it’s the clerics running the show in Iran, even as the deadly outbreak spreads, the BBC reports further of the emerging divide between politicians in Tehran and powerful clerics on the ground at Shia holy sites in Qom:

Its custodian has insisted it should be kept open as a “house for cure”.

This even as borders have been shut, given Iran has lately been the source of infections in neighboring countries of Afghanistan, Bahrain, Iraq, Kuwait, Oman and Pakistan.

An extensive investigative report published Thursday in The Daily Beast says Iran’s Islamic Revolutionary Guard Corps (IRGC) is involved in an information crackdown, geared toward concealing the true numbers of virus cases:

As The Daily Beast’s partner publication, IranWire, revealed in an exclusive report Thursday, Iran’s Islamic Revolutionary Guard Corps has tried to address the epidemic by telling doctors to shut up about it, much as Chinese authorities in Wuhan did, disastrously, when the disease was just starting to spread last December.

The “official figures” from Iran give the game away. At last count, 16 people have died from COVID-19, but only 95 cases had been confirmed. As Wired UK points out, that would be a death rate of about 17 percent, when the data available from China, where there are huge numbers to work with, suggests the death rate is closer to 2 percent. The statistics don’t add up. Canadian researchers cited by Wired suggest the Iran outbreak probably involves more than 18,000 people, and counting.

As the devastating report observes, Iran’s leaders are putting the world at risk.

One doctor cited in the Daily Beast report alleged Iran’s government has no plans for containing the epidemic. Officials have “no other choice except secrecy,” he said. “This will disgrace the Islamic Republic, if it becomes known that its government is clueless. But this can lead to a humanitarian disaster.”

Meanwhile, Turkey has announced that for 72 hours it will open it’s previously sealed border with Idlib province, making good on prior Erdogan threats to “open the gates” of refugee hordes on Europe. It must be remembered that Iran and Turkey share a border, and that the region is full of vulnerable refugee “tent cities”.

By all appearances we could still be in the earliest phases of a global disaster of apocalyptic proportions in the making. Certainly Iran’s clerics are helping to bring the region and the globe to the brink.

Tyler Durden

Fri, 02/28/2020 – 10:59

via ZeroHedge News https://ift.tt/32AAKWV Tyler Durden