Rabobank: We Simply Don’t Have Enough Hospitals Or ICU Units Anywhere

Submitted by Michael Every of Rabobank

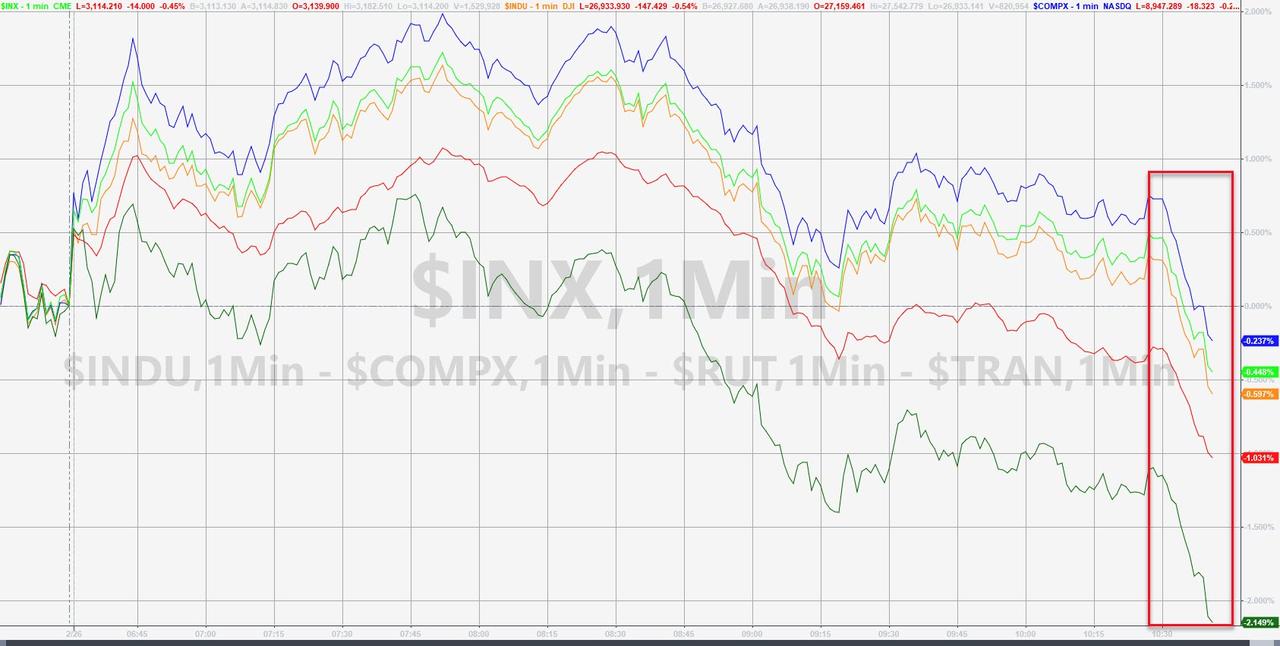

Markets have finally woken up to the threats being presented by COVID-19, which comes on top of what was hardly a healthy global economy. Yesterday saw the S&P down a further 3% to 3,128 and the Dow down 3.1% to leave us close to the “27,000!” base-ball cap level. At the same time we hit new record lows in US Treasury yields. The 10-year touched 1.31%, although this morning we have seen yields backing up again to 1.37%, while the 30-year hit 1.79% and is now at 1.85%. FX markets were somewhat less phased, for once, with EUR/USD still over 1.0860, AUD/USD holding over 0.66, GBP/USD around 1.30, USD/CNY around 7.03, and even USD/JPY around 110.50.

Not waking up so much is the White House. “All is well!” is the tweeted message from the president, when he isn’t busy talking about the US justice system in what can be seen as worrying detail given that little thing called separation of powers. White House economic advisor Larry Kudlow went even further: “We have contained this. I won’t say airtight, but it’s pretty close to airtight,” he said, adding while the outbreak is a “human tragedy” it will likely not be an “economic tragedy” and “At the moment…there’s no supply disruptions out there yet.” Markets seem to disagree. So does the US Centre for Disease Control (CDC), which has stated that it is when and not if COVID-19 hits the States. Of course, if you aren’t testing people you aren’t going to be finding any cases – and there is not a whole lot of testing going on in the US right now.

Indeed, the WHO–who still won’t call it a pandemic, which would be a major ‘event’ trigger–are saying that the globe is “simply not ready”. And they are right: imagine the strain on health services even in developed countries if COVID019 were to sweep in, especially with up to 20% of the population aged over 65 and hence most vulnerable based on the observed mortality pattern so far. We simply don’t have enough hospitals or ICU units anywhere.

Yet at time of writing there were further signs that the virus continues to spread, even if within China the data is pointing in the right direction (this being the one the data-providers want to see: note that Caixin is today saying that in one sample 14% of recovered virus patients in Guangdong tested positive when checked up again, and hence may still be infectious). Elsewhere, we have many more cases and a few more deaths in Italy; a case in Germany near the Dutch border linked to Italy; a case in Austria, and in Croatia; 1,000 people quarantined in a hotel in Spain, again linked to Italy; 169 new cases in South Korea, even despite a draconian lockdown; a US solder in South Korea testing positive, risking infection within the US army; a Korean airline stewardess who may have spread the virus in many locations; suspicions of infections stemming from Bali, where there is also not a lot of testing going on; and cases right across the Middle East, including the Iranian deputy health minister, who could recently be seen sweating profusely–maskless–in a televised public health announcement telling the public “All is well!“; and what looks like a case in Brazil, the first recorded in Latin America.

Economically, the “anti-Kudlow” argument, or the “Kud-LOW” argument is even clearer: Guangdong is keeping schools closed until 2 March, and Hong Kong until 20 April (ouch!); Virgin has cancelled all flights from Australia to Hong Kong; Kuwait has cancelled all flights to Singapore and South Korea; China is freezing some flights to South Korea too; and other global-connectivity threads are being snipped away one by one. There is even muttering that the Olympics is under threat as Japan closes down major public events “for the next two weeks”.

This is all as the WHO and the EU keep insisting that nothing and nobody should interfere with free movement of goods and people across borders, presumably for fear of setting a precedent for anti-globalization forces…who will equally naturally be making political hay from the establishment’s inability to apply standards consistently, this time on quarantine: within national borders completely draconian measures are laudable – with reports on social media alleging that some Chinese firms are even micromanaging where and when workers go during the day, for example. Expect that inconsistency to change in just one direction. The clamour will be for international lockdowns as well as local in the same way that while it was fine to provide unlimited liquidity to banks and nothing at all to the public a few years ago, the current trend is now to provide unlimited liquidity to banks and public money to the public too.

On which note, battered Hong Kong has just announced it will be electronically handing over HKD10,000 (USD1,274) to each of its adult permanent residents in an attempt to try to juice the collapsing economy. Yes, the special administrative region sits on vast fiscal reserves that it usually does nothing useful with other than white elephants and tax rebates. No, this won’t help an economy much when nobody is going out or coming to visit. Yes, it’s ironic that the first location to go the helicopter money route doesn’t even have an endogenous sovereign currency given HKD is pegged to the USD. Imagine how fiscally creative a country that CAN run MMT policies could get in the face of the virus threat. Indeed, recall China has in many ways been doing this quasi-MMT thing for years if you consider the IMF’s estimate of a consolidated fiscal deficit of 12% of GDP even before this crisis started. This is why it cannot afford to run a trade deficit, exposing its currency to the downside of such an ‘MMT-like’ policy. Yet a flood of foreign firms leaving the country due to this virus is going to make that more, not less, likely ahead – as is the fear that Beijing will increase central control over the economy once the dust has finally settled. As mentioned earlier, USD/CNY is still not that Kud-LOW at around 7.03. Think how low global bond yields will go when this hits home and it’s trading nearer to 8.

Tyler Durden

Wed, 02/26/2020 – 14:55

via ZeroHedge News https://ift.tt/382D89W Tyler Durden