After sliding for much of the Asian session, US equity futures reversed sharply and rose alongside European stocks, rising as much as 30 points from session lows and last trading fractionally in the green…

… while yesterday’s main attraction, Gamestop, was up almost 20% in the premarket as reddit traders now appear to be going after Ken Griffin and Steven Cohen, who backstopped the effectively collapsed Melvin Capital.

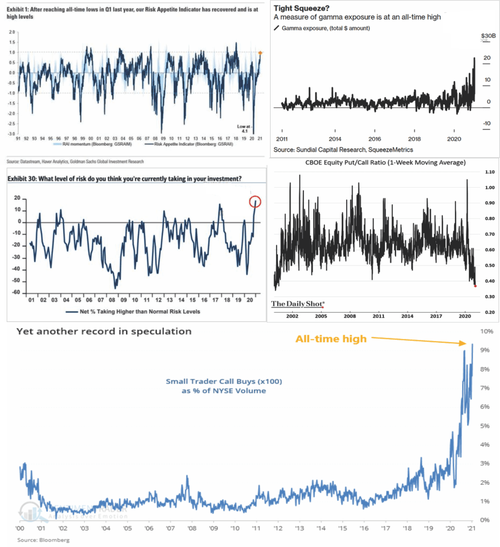

Elsewhere, General Electric Co rose about 5% after reporting a better-than-expected free cash flow for the fourth quarter, as it benefits from a recovery at its power and renewable energy units. Tech heavyweights Microsoft Corp and Advanced Micro Devices Inc were slightly higher ahead of their earnings reports expected after markets close. With the S&P 500 trading at 22 times the 12-month forward earnings, concerns about stock bubbles among some of Wall Street’s biggest banks sparking fears of a pullback.

After starting in the red, European stock markets were almost uniformly green. Naturgy Energy Group SA soared 16% as asset manager IFM Global Infrastructure offered to buy a stake in the Spanish utility. Sweden’s EQT AB, one of Europe’s biggest private equity firms, jumped 14% after agreeing to take over Exeter Property Group in a $1.9 billion deal.

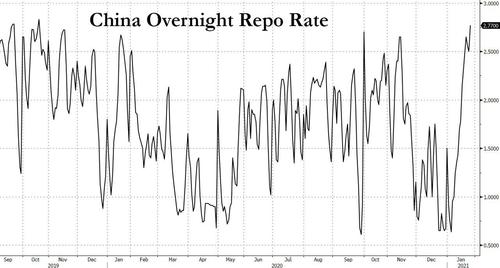

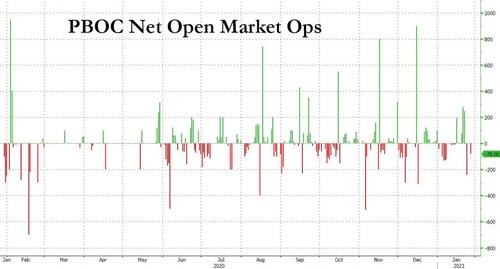

In contrast, Asian markets slumped as China’s central bank withdrew cash from the banking system and an official cautioned about asset bubbles. The MSCI Asia Pac index dropped 1.4%, its biggest drop in two months and internet giant Tencent Holdings Ltd. lost 6.3% as investors paused following rallies in Hong Kong and South Korea. U.S. Senate Majority leader Chuck Schumer’s expectation of timing for approval of a new aid package also weighted on sentiment. Vietnam was Asia’s worst-performing market as stocks continued to face profit-taking pressures. Hong Kong’s stock benchmark was dragged by Tencent, which slumped after an 11% gain on Monday. China’s unexpected withdrawal of funds from the financial system amid a warning about asset bubbles also weighed on sentiment, with indexes in Shanghai and Shenzhen sliding while Chinese 10-year bond futures dropped. Local media reports on Tuesday cited comments from Ma Jun, an adviser to the People’s Bank of China, telling a wealth management forum that the risk of asset bubbles would increase if the central bank did not adjust its policy.

“Whether this situation will intensify in the future depends on whether monetary policy is appropriately changed this year,” Jun said. He added that if not, such problems would “certainly continue” and lead to “greater economic and financial risks in the medium- and long-term”.

Samsung Electronics and Hong Kong Exchanges & Clearing also weighed on the regional equity benchmark as investors pocket profits from recent gains. South Korea’s benchmark index fell 2.1% from a record close as foreign investors increased their selling. The Philippines’ equity gauge declined to a two-month low after President Rodrigo Duterte reversed a decision that would have allowed more children to go outdoors amid fears over the spread of a new coronavirus strain. Australia and India markets are shut for holidays.

Japanese stocks fell with losses deepening during the afternoon session amid concerns recent gains may have been excessive. Automakers and services providers were the heaviest drags on the Topix. Toyota Motor was the biggest contributor to Topix decline and among the biggest drags on the MSCI Asia Pacific Index, even after Nikkei reported the automaker sees a limited impact from a semiconductor shortage. Fast Retailing and M3 weighed most on the Nikkei 225 Stock Average. Today’s losses pared monthly gains to 2.4% for the Topix and 4% for the Nikkei 225. “Investors are wary of the current Japanese stock levels,” said Hajime Sakai, the chief fund manager at Mito Securities Co. That being said, “I don’t think it’s difficult for the Nikkei 225 to try breaching the 29,000 level.”

As Bloomberg adds, adding to the backdrop of market worries was more negative news about the pandemic. Vaccine coverage won’t reach a point that would stop transmission of the virus in the foreseeable future, the World Health Organization said. German Chancellor Angela Merkel told party colleagues the potential threat from faster-spreading variants means the country is “sitting on a powder keg,” according to Bild newspaper.

“There are some negative news on lockdowns, new virus variants, and questions about vaccine efficacy,” said Mark Nash, head of fixed-income alternatives at Jupiter Asset Management. “That’s not a good combination for markets expecting a perfect world.”

In rates, Treasury futures dropped to lows of the day into start of U.S. session as President Joe Biden said he’s open to negotiating his $1.9 trillion Covid-19 relief proposal and erasing Asia-session gains that were aided by block buyer in 10-year note and bond futures. Treasury 10-year yields around 1.05%, underperforming gilts and bunds by ~0.5bp and steepening 2s10s by ~1bp; yields were higher by less than 2bp across intermediates and long-end of the curve ahead of 5-year note auction. Jumbo 7-Eleven bond offering is expected as soon as Tuesday. The auction cycle resumes with a $61BN 5-year sale at 1pm ET, following strong demand for Monday’s 2-year; cycle concludes Thursday with $62b 7-year; all sales biggest ever at tenor.

Germany’s 10-year bond yield fell a basis point to a two-week low of -0.561%, while Italian 10-year yields were up slightly on the day at 0.655%. Italian Prime Minister Giuseppe Conte will resign on Tuesday, his office said, hoping President Sergio Mattarella will then give him a mandate to form a new government.

In FX, the Bloomberg Dollar Spot Index rose and the greenback strengthened against most of its Group-of-10 peers, even as most crosses recovered from session lows as European stock markets advanced from the open. The yen and the Swiss franc were little changed against the dollar, but climbed against most major currencies on haven demand; the euro remained down after weakening toward $1.21. Scandinavian currencies and the Australian dollar led declines among G-10 peers.

In commodities, after rising nearly 1% on Monday, Brent crude fell 0.5% to $55.60 per barrel and U.S. crude lost 0.5% to $52.51. Spot gold fell 0.2% to $1,852.30 per ounce.

Looking at the the day ahead, and there are an array of earnings releases, including Microsoft, Johnson & Johnson, Verizon Communications, NextEra Energy, Texas Instruments, Starbucks, American Express, General Electric and Lockheed Martin. Data releases include UK employment data for November and the US FHFA house price index for November. From the US there’ll also be the January readings of the Conference Board’s consumer confidence indicator and the Richmond Fed’s manufacturing index. Finally, the ECB’s Centeno will be speaking, and the IMF will be releasing their World Economic Outlook Update.

Market Snapshot

- S&P 500 futures up 0.1% to 3,853.25

- STOXX Europe 600 up 0.8% to 408.52

- MXAP down 1.4% to 212.24

- MXAPJ down 1.7% to 715.92

- Nikkei down 1% to 28,546.18

- Topix down 0.8% to 1,848.00

- Hang Seng Index down 2.6% to 29,391.26

- Shanghai Composite down 1.5% to 3,569.43

- Sensex down 1.1% to 48,347.59

- Australia S&P/ASX 200 up 0.4% to 6,824.71

- Kospi down 2.1% to 3,140.31

- German 10Y yield rose 1.2 bps to -0.538%

- Euro down 0.07% to $1.2130

- Italian 10Y yield fell 7.2 bps to 0.567%

- Spanish 10Y yield unchanged at 0.074%

- Brent futures up 0.3% to $56.04/bbl

- Gold spot down 0.2% to $1,852.66

- U.S. Dollar Index little changed at 90.44

Top Overnight News from Bloomberg

- Federal Reserve Chair Jerome Powell heads into what could be his last year atop the central bank determined not to repeat the mistake he made when he was a neophyte monetary policy maker seven years ago when he was among those leading the charge to scale back the central bank’s quantitative-easing program — a stance that led to the economically debilitating and market- wrenching taper tantrum of 2013

- Italian Prime Minister Giuseppe Conte will resign on Tuesday morning to avoid a damaging defeat in the Senate and maneuver for a return at the head of a new government

- Europe’s primary bond market is set for a record month for public-sector deals, after the European Union extended a Covid-stoked flood of government and agency issuance

- Chancellor Angela Merkel told party colleagues that Germany’s management of the coronavirus pandemic has “slipped out of control” and stricter curbs are needed to prevent a new wave of the disease, Bild newspaper reported

- Germany’s health ministry says can’t confirm a report in Handelsblatt newspaper that AstraZeneca’s Covid-19 vaccine is only effective for 8% of people older than 65

- Chancellor Angela Merkel’s chief of staff proposed temporarily adjusting constitutional rules to allow expanded new borrowing by Germany’s federal government, prompting a swift rejection from his own party’s budget spokesman

- Boris Johnson is expected to announce the government’s plan for quarantining travelers arriving in the U.K. to stop the spread of new coronavirus strains from overseas

- An aggregate index of China’s economic performance increased by one step from last month, led by strong performances in exports, property and the stock market

A quick look at global markets courtesy of Newsquawk

Asian equity markets declined across the board with sentiment subdued after the flimsy risk appetite amongst global peers including in the US where stocks whipsawed ahead of this week’s FOMC, tech earnings and month-end, as well as ongoing concerns about vaccine effectiveness against the new COVID-19 variants and doubts on the ability of Democrats to pass the USD 1.9tln COVID-19 relief plan in its entirety, while the absence of participants in Australia and India due to holiday closures also contributed to the lacklustre picture. Nikkei 225 (-1.0%) was negative with the index subdued by recent currency inflows. KOSPI (-2.1%) underperformed despite better-than-expected South Korean GDP growth figures for Q4, as this still resulted in a 1.0% annual contraction for 2020 which was the economy’s worst performance since 1998. Elsewhere, Hang Seng (-2.6%) and Shanghai Comp. (-1.5%) declined with the mainland pressured after the PBoC resumed its tepid liquidity operations which facilitated increases in China’s benchmark overnight repo rate to its highest since November 2019 and with MSCI to delete several securities from its indexes including China National Nuclear Power Co., China Shipbuilding Industry and Inspur International. The losses in Hong Kong were also exacerbated by profit taking in the city’s main index which retreated from the 30k level and near 21-month highs as Tencent shares also pulled back from record levels after it recently approached USD 1tln market cap status. Finally, 10yr JGBs tested the 152.00 level to the upside with prices underpinned by the negative mood across stocks and following the bull flattening in USTs which was helped by a solid 2yr auction, while the 40yr JGB auction results were mixed with a slightly higher b/c.

Top Asian News

- Asia Stocks Slip as Stimulus Timing, China Bubble Warning Weigh

- From Pony Ma to Jack Ma, the Rich Win Big With Wild H.K. Stocks

- Ant IPO Could Resume Once Issues Resolved, Central Bank Says

- Kuaishou to Give Asian IPOs Best Start to a Year Since 2010

European stocks kicked of Tuesday’s session indecisive before gaining upward momentum (Euro Stoxx 50 +1.1%) after sentiment improved from the mostly downbeat APAC trade, albeit US equity futures remain subdued vs their trans-Atlantic counterparts with broad-based losses seen across the four major contracts – which are also weighed on by doubts on whether the Democrats can swiftly pass its much-anticipated relief plan. Back to Europe, the region’s performance is relatively broad-based, with Switzerland’s SMI (+0.5%) initially the laggard amid underperformance in the defensive Healthcare sector post-Novartis’ earnings (see below). Italy’s FTSE MIB (+0.8%) conforms to the gains among its peers following the outperformance seen yesterday as markets somewhat look through reports that Italian PM Conte has announced his resignation to his cabinet, in a move described as a “tactical resignation”. This resignation is merely symbolic amid the unguaranteed hope is that Conte will be able to secure a mandate to form a new government. The tail risk after resides on the whether Conte has the ability to form a new coalition – thus markets will be giving more credence to developments on this front in the upcoming sessions; full analysis piece available on the headline feed. Delving deeper into the European sectors, IT is one of the top gainers in the run-up to large-cap US tech earnings, meanwhile, Nokia (+4%) soared at the open as the Reddit WSB retail traders attempted to pump higher Nokia’s ADR – which rose 15.5% in US trade followed by another 7% after-market, in a similar move to the GameStop (+15% pre-mkt) phenomenon yesterday. On this theme, it will be important to keep an eye on any regulatory moves against this type of speculative trading as any attempt to regulate channels – such as Reddit and/or Twitter – may hinder retail speculative buying which acted as and continues be a major equity driving force. Travel & Leisure resides as the laggard as ongoing COVID-variant woes provides the sector with no reprieve. In terms of individual movers, Rolls-Royce (-4.5%) shares slid at the open after a trading update which brought to light the turbulence ahead for the aeronautical sector “In the near-term, more contagious variants of the virus are creating additional uncertainty. Enhanced restrictions are delaying the recovery of long-haul travel over the coming months compared to prior expectations, placing further financial pressure on customers and the wider aviation industry, all of which are impacting cash flows in 2021” – the company said despite reporting in-line trading and year-end liquidity at the upper end of guidance. On the flip side, AstraZeneca (+1.2%) refuted Handelsblatt and Bild reports which suggested the Co’s vaccine had an efficacy of 8% or less than 10%, respectively, in those over 65. Elsewhere, some large-cap earnings related movers include UBS (+1.5%) and Novartis (-2.2%), with the former firmer following an overall positive update and a share buyback announcement, whilst the latter is pressured on a miss in revenue and EPS.

Top European News

- EU Vaccine Rollout in Disarray as Germany Touts Export Limits

- Dutch Covid Riots Add to Political Tension Ahead of Elections

- Engie Said to Work With Citi, Morgan Stanley on GTT Divestment

- EQT Soars to Record Valuation After $1.9 Billion Property Deal

In FX, The Dollar looked all set to test technical resistance in DXY terms amidst another bout of safe haven demand that propelled the index further beyond 90.500 to 90.614, but fell just short of the 50 DMA at 90.678 as sentiment gradually stabilised and is improving to the extent that stocks are now on course for an emphatic turnaround Tuesday. Hence, the Buck has faded across the board to the benefit or relief of rival currencies that seemed destined to suffer heavier losses and breach chart supports or psychological levels along the way. However, the DXY is holding off lows (90.315) and within sight of the half round number in the run up to a busier US agenda on FOMC day 1.

- NZD/AUD – Kiwi outperformance continues ahead of tonight’s NZ business PSI and trade data on Wednesday with additional traction to complement less dovish RBNZ expectations coming from PM Arden confirming that the country will sign an upgraded FTA with China. Nzd/Usd is back up near 0.7200 after testing the 10 DMA that aligns with a double bottom around 0.7171, while Aud/Nzd has now crossed 1.0700 to the downside, albeit in thinner volumes due to Australia’s market holiday, and Aud/Usd hovering just shy of 0.7700 in advance of NAB’s business survey and CPI tomorrow.

- JPY/EUR/CAD/CHF/GBP – All fractionally softer vs their US counterpart, but the Yen still ‘comfortably’ above 104.00 and Euro surviving another lurch towards 1.2100 following a fade into 1.2150 and loss of the 50 DMA (1.2124). Meanwhile, the Loonie is still straddling 1.2150 with an eye on crude prices and the Franc is afloat on 0.8800 and 1.0700 handles, marginally, wary about further intervention to curb excess strength on any acute investor angst caused by risk events, like Italian PM Conte’s efforts to forge a new coalition Government. Last, but not quite least, Sterling has also staged a comeback after a brief dip under the 21 DMA (to circa 1.3610 vs 1.3624) and is pivoting 0.8900 against the Euro in wake of more UK jobs and wage data ‘propped’ up by Government support.

- SCANDI/EM – The Sek and Nok have unwound more gains relative to the Eur irrespective of the constructive risk tone that might be deemed supportive, or firmer oil for that matter, so it seems that COVID-19 jitters have combined with a less bullish chart backdrop to undermine the Crowns. On that note, Sweden is seeking more clarification on the precise number of does per vial and has suspended payments to Pfizer pending answers. Elsewhere, the Try remains relatively firm and Czk is bid amidst talk of CNB tightening in 2021 (Governor giving guidance for up to 1 or 2 hikes), but the Brl could be in for a long Brazilian post-holiday weekend hangover.

In commodities, WTI and Brent front month futures are modestly firmer in what is seemingly early European consolidation, but the benchmarks remain within recent ranges in the grand-scheme of things. News-flow for the complex has been light with traders eyeing the overall risk sentiment in the absence of catalysts – also comprising of any major COVID-related developments to disrupt the current supply/demand balance. WTI resides around 53/bbl having had printed an overnight base at USD 52.32/bbl, while its Brent counterpart trades narrowly above USD 56/bbl after printing a current USD 55.42/bbl intraday low. Elsewhere, spot gold is uneventful on either side of the 1850/oz mark amid a lack of fresh catalysts and ahead of the FOMC policy decision tomorrow. Technicians will be eyeing some levels in the vicinity including the 100 DMA (1880.90), 21 WMA (1879.50), 21 DMA (1873.08), 200 DMA (1848.87) and yesterday’s low (1846.90). Turning to base metals, copper prices edged lower with LME copper back under USD 8000/t amid uncertainties surrounding the US stimulus package. Conversely, Shanghai stainless steel gained for a second consecutive session amid rising raw material prices and prospects for finer demand heading into Chinese New Year holiday in February.

US Event Calendar

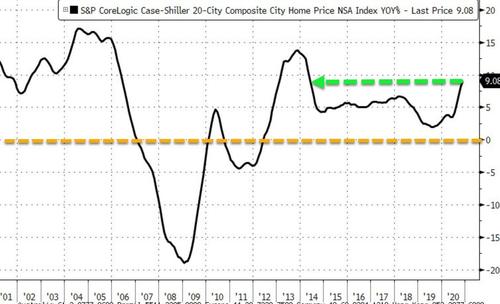

- 9am: S&P CoreLogic CS 20-City YoY NSA, est. 8.7%, prior 7.95%; 9am: S&P CoreLogic CS 20-City MoM SA, est. 1.0%, prior 1.61%

- 10am: Conf. Board Consumer Confidence, est. 89, prior 88.6; Expectations, prior 87.5; Present Situation, prior 90.3

DB’s Jim Reid concludes the overnight wrap

It’s been a decidedly odd 24 hours as while global sentiment suddenly dipped in the US morning session, we simultaneously saw some astonishing moves higher in names that are currently the darlings of the Robinhood/Reddit world. Both then normalised into the close but what a round trip. On this, if you’ve been reading the EMR since it started in 2007 then you would know that my favourite gadget of the 2000s was undoubtedly the BlackBerry. My love affair extended well into the 2010s before the iPhone finally started to become easier and easier to type with. After nearly a decade of carrying both, it was a sad day when saying goodbye to the buttons of the BlackBerry and I genuinely wondered what would become of the company as more and more migrated. However BlackBerry shares have surged +301% since the end of October and are up +172% YTD and +28.4% yesterday (+48.4% at the days highs and at levels not seen since October 2011). It seems this has been a popular stock with online stock chat rooms (on Reddit). Another stock that is getting attention for similar reasons is GameStop. Since the end of October it’s up +633%, +308% YTD and +146% at the peak yesterday before closing +18.1%. So a wild ride and the retail day traders seem to be targeting and battling institutional shorts at the moment with the former generally winning in recent days and weeks.

The only thing I’ve seen like it was in 2000 when well over half the large team I was in at the time were buying tech stocks like they were going out of fashion. At one point virtually everyone had U.K. company lastminute.com in their portfolio at absurd valuations. My boss then said that he had to buy some against his better judgement, as a hedge, as if they continued to go exponentially higher his team would all resign and retire rich leaving him to pick up the pieces! It wasn’t long before they and others collapsed though and he was pleased his team had to instead work harder to pay the bills. 21 years on and a new generation are probably doing even crazier things. Maybe the main difference was that it was global then whereas this is concentrated almost exclusively in the US.

Returning back to more mainstream markets, we saw a sharp intra-day sell-off in risk assets on both sides of the Atlantic yesterday after a healthy start. Growing concerns about the pace and quality of the vaccine rollout, about possible virus mutations, and the potential for further lockdown measures led investors to reassess current valuations. The US reversal took place around 90 minutes into the US session, with the S&P 500 having initially been up +0.46%, before swiftly reversing course to dip to -1.15% in around 45 minutes. The selloff came shortly after new Senate Majority leader Schumer said it may take 4-6 weeks for the new US stimulus plan to pass, which seemed to remind markets of the underlying risks to a market trading at the highs. However after the sharp selloff, the index recovered steadily throughout the rest of the session before recouping nearly all its intraday losses – closing +0.36% higher and at a new record. Tech stocks were a large part of the broad index’s rebound, with the NASDAQ gaining +0.69% for its fourth straight record close. However it was not all good news as the reopening trade suffered as worries surrounding the vaccine rollout spread, with Energy (-1.06%), Banks (-0.88%), and Consumer Services (-0.95%) stocks weighing on the index. Stocks in the Consumer Services industry group such as Carnival (-4.95%), Royal Carribean (-4.92%) and MGM (-4.49%) were among the worst performers in the entire S&P 500.

Europe saw the worst of the losses due to missing the US rebound. The STOXX 600 (-0.83%), the DAX (-1.66%) and the CAC 40 (-1.57%) all lost significant ground, especially from lunchtime onwards, before finishing just off session lows. European airlines saw some of the biggest declines, including Lufthansa (-3.29%), easyJet (-6.66%) and IAG (-7.65%) as news reports from across the continent pointed to the imposition of tougher restrictions domestically and on international travel. For instance, UK Prime Minister Johnson said that the UK was “actively” working on an Australian-style plan to quarantine travellers in hotels, while the French Journal du Dimanche repoted that France could go into another lockdown “within days”. As we discussed yesterday in the EMR and CoTD it’s becoming clearer to us that although vaccines will likely be a huge saviour as expected, countries are going to be more hesitant to remove restrictions than we thought a couple of months ago due to perceived threats of mutations evading vaccines. I’m now increasingly expecting countries to have stricter border controls around the middle of this year than many did for large parts of last year even with high vaccination rates. The desire to avoid imported mutations seems to be increasing.

In spite of the selloff, one outperformer was Moderna, which surged +12.20% following the news that its vaccine still produced neutralising antibodies against the UK and South African variants. With the South African variant, it’s worth noting that there was a six-fold reduction in the number of antibodies produced which might be deemed a bit worrying, but the company said they were advancing a booster candidate against the South African variant into preclinical studies and a Phase 1 study in the US. This came amid a row between the EU and AstraZeneca over vaccine supply and also speculation in the German media about the low efficacy of this vaccine for the older population and concerns that it won’t be approved for use in this demographic on the continent. So vaccine uncertainty is high even if our CoTD yesterday (link here) showed the Pfizer/BioNTech one is doing as good a job as could be hoped so far in Israel.

Amidst the general risk-off tone, sovereign bonds rallied strongly, with yields on 10yr Treasuries down -5.6bps to 1.030% ahead of tomorrow’s Fed meeting, their lowest level in over two weeks. It was real rates rather than inflation expectations that drove the bulk of that decline, with 10yr breakevens down just -0.9bps, and 5y5y forward inflation swaps for the US ending the session down -1.5bps. It was a similar story in Europe, with falling yields driven by lower real rates there too, as 10yr yields on bunds (-3.8bps), OATs (-3.8bps) and gilts (-4.6bps) all moving lower.

Sticking with sovereign bonds, the biggest outperformer yesterday were actually Italian BTPs, whose spread over bunds came down -3.6bps as speculation rose that Prime Minister Conte would resign and form a new coalition government, thus averting early elections. In terms of the latest, PM Conte is expected to offer his resignation to President Mattarella later today, before attempting to form a new government, with Bloomberg reporting officials saying it could include a combination of centrists, unaffiliated lawmakers, members of former Premier Renzi’s Italy Alive party, and lawmakers from the center-right Forza Italia party. For now however, early elections are still seen as unlikely.

This morning in Asia, markets have lost ground as investors continued to weigh the timing of potential stimulus in the US, and the Nikkei (-0.96%), the Hang Seng (-2.46%), the Shanghai Comp (-1.43%) and the Kospi (-2.05%) are all seeing significant declines. Meanwhile S&P 500 futures (-0.54%) are similarly pointing lower.

In terms of other Covid news, there were some positive case numbers out of Europe, with the number of new daily cases in the UK at a one-month low of 22,195 (albeit referencing Sunday data which can be artificially low), while Italy posted its lowest number of new cases since mid-October, at 8,562. The US also had positive news on lower case counts as the country posted its lowest one day rise in cases since December 2. Additionally it was the first day since October that no state had over 1000 new cases per million residents. California lifted regional stay-at-home orders, with the state now returning to its tiered reopening system. While heavy restrictions remain in place, businesses such as outdoor-dining and pickup-only retail are allowed to restart. Vaccine supply continues to be an issue with New York City Mayor de Blasio saying plans to construct vaccination sites at large venues like the city’s stadiums are on hold due to dose shortages. The city continues to believe it could offer 500,000 jabs per week if supply and qualification restrictions were lifted.

On yesterday’s data, the Ifo business climate indicator from Germany fell to 90.1 in January (vs. 91.4 expected), which comes amidst continued extensions of the country’s lockdown. Both the expectations (91.1) and the current assessment (89.2) readings fell on the previous month. According to our German economists’ note yesterday (link here), German GDP in Q1 now looks likely to fall by at least 1% quarter-on-quarter, assuming that the restrictions for retail and services will only be gradually lifted after Feb 14.

To the day ahead now, and there are an array of earnings releases, including Microsoft, Johnson & Johnson, Verizon Communications, NextEra Energy, Texas Instruments, Starbucks, American Express, General Electric and Lockheed Martin. Data releases include UK employment data for November and the US FHFA house price index for November. From the US there’ll also be the January readings of the Conference Board’s consumer confidence indicator and the Richmond Fed’s manufacturing index. Finally, the ECB’s Centeno will be speaking, and the IMF will be releasing their World Economic Outlook Update.