Trump May Leave Small Garrison Of US Troops To Guard Syrian Oil Fields

Update (1215ET): While President Trump confirmed earlier that there was “no need” to leave troops in Syria, he quickly restated his comments, in line with Esper’s earlier remarks, saying that he would work something out to provide the Kurds with cash, perhaps through the involvement of a U.S. oil company.

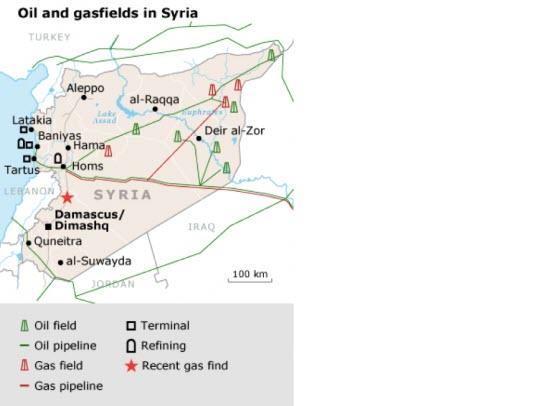

“We’ve secured the oil,” he said, adding that he’s willing to leave US troops in Syria to secure the oil (and in a second region, due to requests from Jordan and Israel).

* * *

The Trump administration may leave some US troops behind in Northeastern Syria to guard oilfields alongside Kurdish-led Syrian Democratic Forces (SDF), according to a Monday statement by Defense Secretary Mark Esper.

The news comes as US troops cross into Iraq as part of President Trump’s announced withdrawal from Syria, after which Turkey promptly launched an offensive against the SDF – whose heads Turkish President Recep Tayyip Erdogan vowed to “crush” last week after he referred to them as terrorists.

Turkey’s nearly two-week old offensive has displaced some 300,000 people and led to 120 casualties among civilians and 470 among SDF fighters, the Syrian Observatory for Human Rights said on Sunday. Turkey says 765 terrorists but no civilians have been killed in its offensive. –Reuters

Over 100 US military vehicles crossed into Iraq early Monday from the northeast tip of Syria, where Turkey agreed to a temporary ceasefire for five days following a deal brokered by the White House according to Reuters. The truce expires on Tuesday, right after Erdogan is set to meet with Russian President Vladimir Putin.

As for guarding the oil fields, Esper told reporters during a trip to Afghanistan that while the US withdrawal was underway, US troops were still operating with partner forces near oilfields, and that discussions about keeping them there had occurred.

Update (1215ET): While President Trump said this morning that he sees “no need” to keep any troops in Syria, he quickly restated his comment, noting that he would work something out to provide the Kurds with cash, perhaps through the involvement of a U.S. oil company.

“We’ve secured the oil,” he said, adding that he’s willing to leave US troops in Syria to secure that oil going forward.

* * *

Esper said that was just one option, and that no decisions had been made “with regard to numbers or anything like that,” adding that the Pentagon’s job is to look for different solutions.

“We presently have troops in a couple of cities that (are)located right near that area,” said Esper. “The purpose is to deny access, specifically revenue to ISIS (Islamic State) and any other groups that may want to seek that revenue to enable their own malign activities.”

Trump’s shift has opened a new chapter in Syria’s more than eight-year war and prompted a rush by Turkey and by the Damascus government and its ally Russia to fill the vacuum left by the Americans.

His decision has been criticized in Washington and elsewhere as a betrayal of Kurdish allies who had fought for years alongside U.S. troops in a region rich in oil reserves and farmland.

The New York Times reported late on Sunday that Trump was now leaning in favor of a new military plan to keep about 200 U.S. troops in eastern Syria near the Iraq border. The White House did not immediately respond to a request for comment. –Reuters

Turkey, in an effort to separate themselves from the YPG – a group which makes up the majority of the SDF, is seeking to set up a “safe zone.” The YPG is seen as a terrorist group in Ankara due to its links with Kurdish insurgents living in southeast Turkey. According to Erdogan, his forces will continue their assault in Syria when the deadline expires on Tuesday if the SDF has not retreated from its proposed zone spanning much of the border.

“We will take up this process with Mr Putin and after that we will take the necessary steps” regarding northeastern Syria, Erdogan said on Monday while speaking at an Istanbul forum hosted by TRT World, adding that Turkey will set up a dozen observation posts in the “safe zone,” which as Reuters notes, drew the ire of Iran.

“We are against Ankara’s establishing of military posts in Syria,” said Iranian foreign ministry spokesman Abbas Mousavi during a Monday broadcast on live state TV. “The issues should be resolved by diplomatic means … Syria’s integrity should be respected,” he added.

Meanwhile, Russia’s Minister of Defense, Sergi Shoigu, said that Moscow – an ally of Syria, hopes it can act as an intermediary between the United States and Turkey to promote security and stability in the region.

On Sunday, the SDF announced their withdrawal from the border town of Ras al Ain during the US-brokered ceasefire, however a spokesman for the Turkish-backed Syrian rebels said the withdrawal was not yet complete. According to Turkish security forces, Kurdish YPG forces were moving toward Al Hasakah – a region south of the proposed safe zone. According to their report, some 125 vehicles had already cleared out, while over 80 Kurdish militants had been captured or had surrendered to Turkish forces.

Tyler Durden

Mon, 10/21/2019 – 12:50

via ZeroHedge News https://ift.tt/35TsTFd Tyler Durden