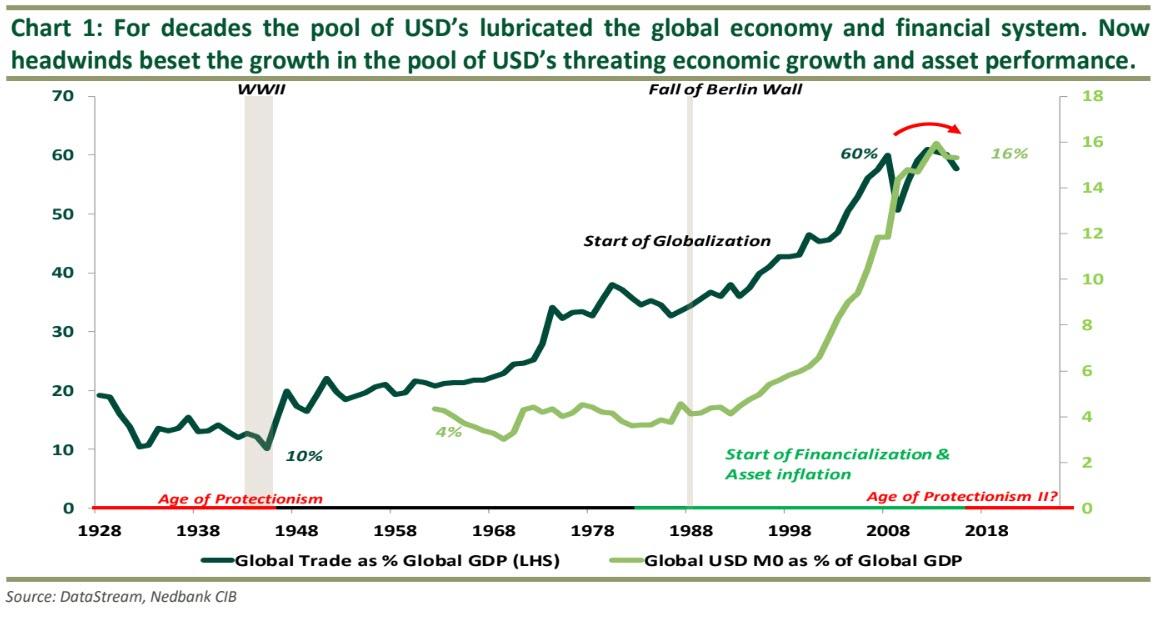

Nedbank’s Mehul Daya writes and I concur… it’s simple: it’s all about Dollar-Liquidity.

Slowdown in global trade is putting pressure on creation and velocity of Dollars via value-chains/Dollar-leverage since the Dollar is the lubricant of the global financial system.

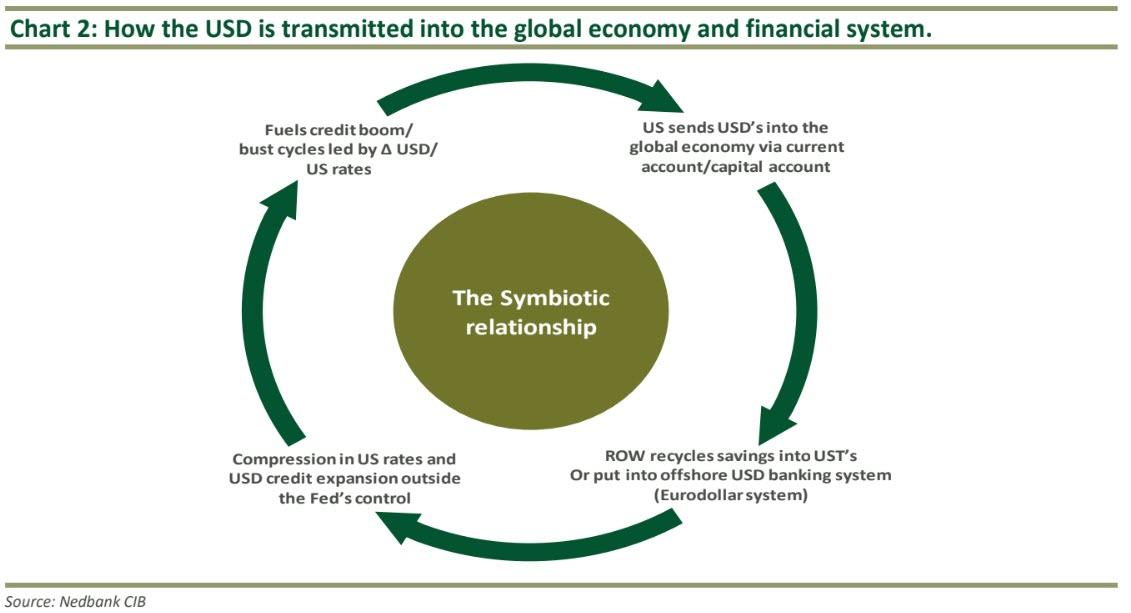

Chart 2 – this is how the dollar gets transmitted into the world

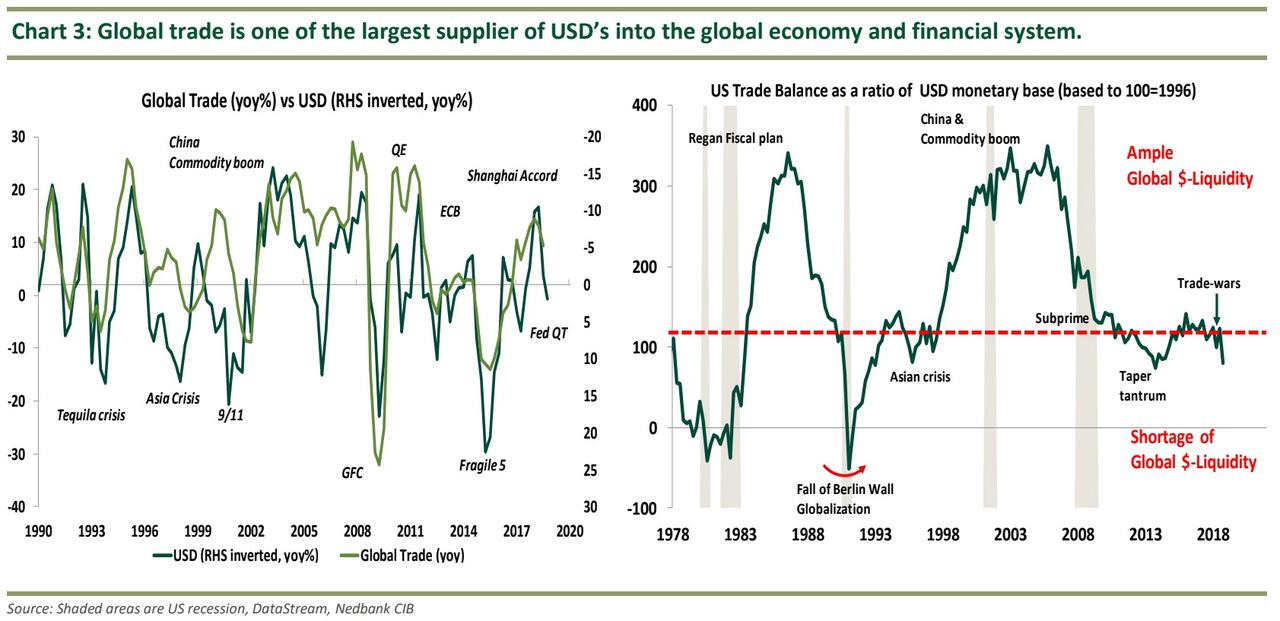

Chart 3 – global trade vs USD vs Triffin dilemma

BIS writes in ”The geography of dollar funding of non US banks”

-

US dollar liabilities of non-US banks grew after the Great Financial Crisis (GFC). At end-June 2018, they stood at $12.8 trillion ($14.0 trillion including net off-balance sheet positions) – as large as at the peak of the GFC.

-

Banks raise relatively fewer dollar liabilities in their affiliates in the US since the GFC. This is due to a rise in the share of dollar liabilities booked in the country where banks are headquartered.

-

European banks, which traditionally have had a large US footprint, have shrunk their dollar business and the role of their US affiliates since the GFC. At the same time, non-European banks expanded their dollar borrowing quite rapidly, but in recent years have also raised relatively fewer dollars in the US.

-

A large share of US dollar liabilities of non-US banks are cross-border (51% at end-June 2018), implying that the location where US dollar funding is raised is different from the location of the funding provider.

-

The global share of US dollar funding provided by US residents is significantly higher than that raised at foreign banks’ US branches and subsidiaries, though these shares vary across banking systems.

Global trade is slowing down and cross border trade is the largest supplier of USD into the global economy and financial system and as BIS summaries…

How might this funding configuration behave in times of market stress? Non-US creditors may be pressured to withdraw funding as they might face a dollar funding squeeze themselves. This in turn is akin to margin call on all assets which were beneficiary of dollar based monetary system.

Nedbank’s Daya concludes:

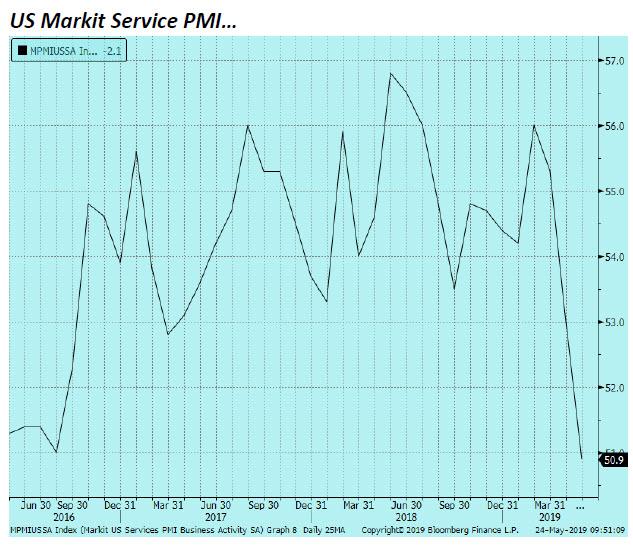

“The consensus is that should the trade wars accelerate it will be inflationary. We agree there obviously be a price shock on the back of the tariffs, but we do not expect an inflationary cycle, we expect the opposite.

As the USD monetary base contracts, it will slow down money/credit growth which is deflationary. This will favour bonds and other yielding assets over growth assets.”

The macroeconomic tailwind arising from the growth in the USD monetary base is under threat, leaving the global economy and financial system vulnerable to tighter financial conditions.

Investment implications: We remain structural USD bulls supported by our view that USD creation is slowing down. However, we expect central bank balance sheets to become even more important role in the financial landscape to manage the changes in the quantum of USD in the global economy – leaving traditional signals like the yield curve, volatility and IR differentials difficult to interpret compared to previous cycle. We will continue to rely on the USD and our measurement of USD monetary base.

via ZeroHedge News http://bit.ly/2HOmOPe Tyler Durden