Authored by Charles Gave via Evergreen Gavekal blog,

Inflation is always and everywhere a monetary phenomenon, in the sense that it cannot occur without a more rapid increase in the quantity of money than in output.”

– Famed economist, Milton Friedman

“Today’s Modern Monetary Theory world, with its double barreled fiscal and monetary stimulus, is crashing head on with an accumulation of years of declining investment in the basic industries such as materials, energy, and agriculture. In our analysis, the ‘end game’ for the Fed’s twin asset bubbles in stocks and bonds is inflation. We can already see it developing on the commodity front.”

– Crescat Capital

INTRODUCTION

As most loyal EVA readers know, for the 15 years of this newsletter’s existence, I’ve been a believer in, and forecaster of, subdued inflation. In fact, I’ve often written that for nearly all of my 42-year career I’ve felt that inflation would stay low, despite some intermittent flare-ups late in economic expansions. Of course, 2% inflation over 40 years means a loss of 55% in purchasing power, which doesn’t exactly qualify as true price stability.

However, for those of us old enough to remember the 1970s, 2% CPI bumps are mere rounding errors. When it comes to the Ghost of Inflation Past, though, the time may be nigh to go into your attics, pull out some dusty boxes like Steve Martin in “Father of the Bride”, and try to fit into those old “threads” from the Disco Decade.

On that point, rarely do we run two Gavekal-based EVAs in a row. But an essay by the venerable Charles Gave recently hit my inbox that I thought was striking enough to warrant an exception to our self-imposed rule. In my opinion, this is one of the most critical topics for investors to consider today.

First, please note that he’s using a dash of tongue-in-cheek humor when he refers to Gavekal’s “impeccable logic”. Like all forward-looking, future-anticipating firms (including Evergreen), our partners at Gavekal often are eminently “peccable”.

Second, Charles prefers to use rules-based techniques – centered on a set of indicators that have proven their anticipatory attributes over many years – versus opining on what he thinks will happen. As you will read, he employs some fairly technical metrics to make the case that the “low-flation” world we’ve become accustomed to is about to experience an axial shift.

In that regard, he’s making a key point about the velocity of money. As a number of our past EVAs have observed, the belief was rampant a decade ago, in the wake of the housing crash and the Global Financial Crisis, that the Fed’s initial quantitative easing (in plain English, fabricating a trillion dollars from its magical computers) would lead to an inflation surge. Instead, even three more rounds of multi-trillion-dollar quantitative easings (QEs) failed to cause an inflation bust-out.

The key reason for the inflation no-show was the collapse in velocity, as I argued back in 2008 and 2009. In other words, the velocity, or circulation rate, of money in the system crashed, more than offsetting the Fed’s relentless binge printing. Of course, we now know—and pretty well did at the time—that the excess trillions made their way into asset prices of all types. In recent years, that has included the cryptocurrencies like Bitcoin.

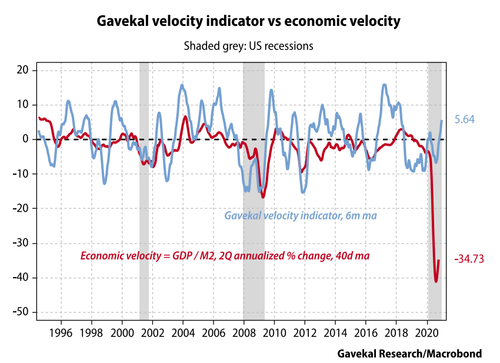

Presently, though, Charles’ velocity indicator is flagging a radical change. While it has certainly had upturns in the past, never has the gap between GDP growth and his velocity measure been as divergent as it is currently. The good news is that he believes the US economy is moving from the deflationary bust (at least for cyclical sectors) into an inflationary boom phase.

As noted in our June 19th EVA, “The Sweet Spot”, the transition from bust to boom is a fun one. There is enough spare capacity left in the economy’s ecosystem—in this case, due to the Covid demand cliff-dive that affected wide swaths of the US economy—that inflation isn’t a problem. Fed Chairman Jay Powell just said as much in his press conference this week. In fact, he sees no risk of excessive upward price pressures anytime in the foreseeable future. (He also stated there are no asset bubbles out there which is a view I will vigorously challenge in next week’s EVA). Thus, the possibility of a bull market-killing Fed tightening campaign is about as likely as politicians following the laws and rules they expect the rest of us to obey.

As Charles notes, what’s different this time are the staggering sums presently pending disbursement. The US Treasury’s General Account is the prime case in point. It has almost $1.5 trillion sitting in it, most of which should soon be spent. Additionally, a $900 billion follow-on stimulus package looks nearly certain to be passed by Congress. Then, there is the trillion plus amount of excess savings accumulated by consumers since the pandemic hit (juiced by the trillions of government aid that has already been distributed).

To have all this coursing through the economy’s arteries at a time when it is reopening and confidence is rebounding, as should be the case of the next six months, is likely to heat things up very, very quickly. Actually, my belief is that heat will quickly morph into overheat—not by the first half of 2021 but probably before year-end, if not sooner. This is a view that both Charles and his son, my great friend and partner, Louis, share.

Beyond Charles’ highly quantitative analysis, I would highlight the past history of massive government spending episodes that are financed by central bank money printing (as opposed to being funded by bond market borrowings). This approach is now known as Modern Monetary Theory (MMT), a topic first covered in-depth in these pages back in our April 2019 EVA titled “Can an Acronym Save The World?”.

MMT has been tried repeatedly in the past and it has consistently led to asset booms initially, such as we have now, followed by asset price “corrections”. The thrill-kill is almost always inflation. With the Fed utterly relaxed about inflation crashing the party it has created in assets values of almost all types—just as it was oblivious about tech in late 1999 and housing in mid-2007—a student of history might be inclined to take the over…like way, way over 2% on the CPI by year-end 2021.

Since it’s Christmastime, however, let’s focus on the good news – if Charles is right – that the next six months should bring. On that note, please let me wish all Evergreen clients and EVA readers, a happy and, especially, healthy Holiday Season.

THE BOOM OF 2021 BY CHARLES GAVE

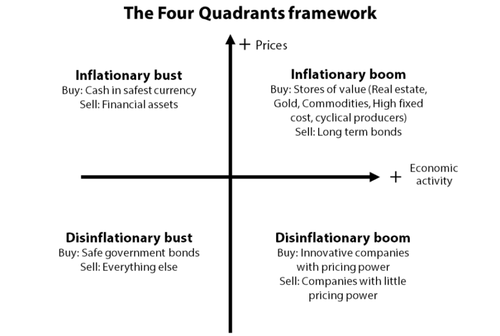

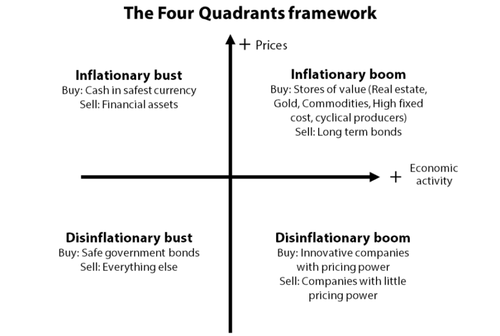

Many readers will be familiar with my four quadrants representation of macroeconomic conditions, which like most Gavekal research is backed by impeccable logic. The tricky part, as ever, is linking the conceptual insight to current market conditions. To put it simply, the questions I want answered are: where are we today and where are we likely going next?

Needless to say, I have worked on such questions since authoring the tool back in 1978. Over the years, I have come up with a few answers ranging from the straightforward to the rather complex, as expounded on in my 2016 book investigating Wicksellian analysis.

Back to MV=PQ

In this paper, I want to show that using tried-and-tested tools, which have not changed since they were built, I can, indeed, pinpoint where we are, and where we are going. Longtime readers will know that I place emphasis on the old equation MV=PQ, except that I consider V to be an independent variable, and not the result of the ex-post tautology V=PQ/M.

They may even recall that around the turn of the millennium, I developed a leading indicator for Q (growth in volume), for P and for V, while M (M2) is provided to me by the Federal Reserve. Hence, a logical solution to my problem of mapping where we are in the four quadrants should be possible.

My growth indicator will tell me whether we are on the left or right side of the four quadrant representation, while my P indicator will give indications of whether we are in the top or the bottom halves. And the V indicator should tell me whether interest rates are going to rise, or fall.

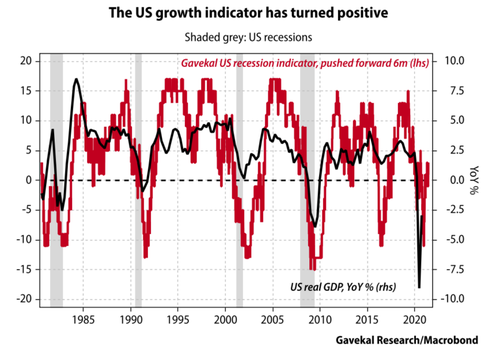

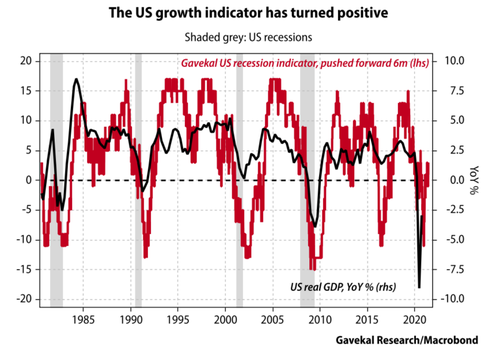

Let’s start with the US growth/recession indicator, shown below, which incorporates mostly economic data.

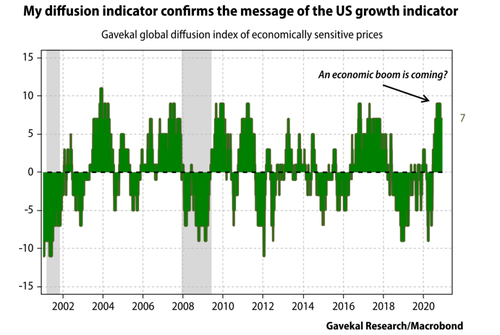

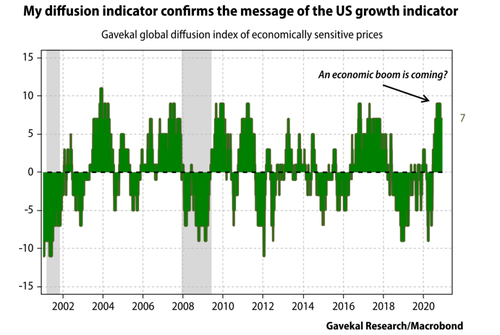

The indicator collapsed at the end of 2019 and the early part of 2020, but has now returned to positive territory. This reading suggests that the US recovery will continue, which is supported by my “control” tool— a diffusion index of economically sensitive prices—which incorporates only market prices. The diffusion indicator is telling me that a boom is coming in the US, which confirms the message of the growth/recession indicator that a US recession is highly unlikely in the near future.

And thus, I can safely assume that we are on the right side of the four quadrants; either in an inflationary growth period (top right) or in a disinflationary boom time (bottom right).

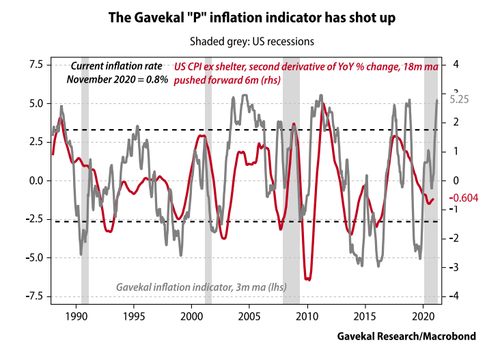

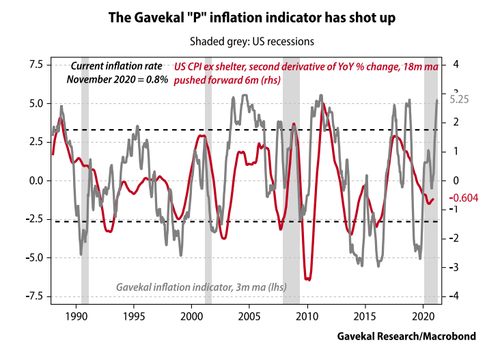

Having established that the US economy sits in the right side of the quadrant, I feel fairly sure that its precise position is in the upper (inflationary) quadrant as my “P indicator” of inflation has shot up.

In the chart above, the P indicator is compared to the second derivative of the US CPI (ex-Shelter). Why the second derivative? Because what matters for financial markets is not the actual inflation rate but the “surprising” changes in this rate, either up or down. And surprises may be coming. The P indicator seems to expect, one year down the road, a rise of at least 200bp in US CPI, which would take it close to 3%, versus 0.8% today.

In summary, my indicators tell me that US growth will be strong and we are on the right side of the four quadrants framework. As prices seem set to accelerate, we are moving into the upper half, which means that 2021 should see an inflationary boom in the US.

The velocity of money turns up

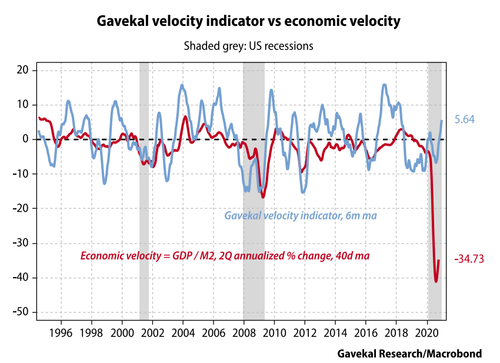

This brings me to the velocity of money V, and to the reaction of the central bank to the US entering an inflationary phase. The amount of money injected into the US economy in the last 12 months has been stupendous. As a result, V has collapsed as never before. But most of this money is still in the accounts of economic agents (the Treasury, individuals, and companies) and is apparently starting to be used. As a result, velocity is starting to rise again, but I will know for sure by how much only with a considerable lag, due to the time needed for GDP data to be compiled.

So, I need a tool to give me some “lead” on the likely direction of economic velocity. This is why I built the Gavekal Velocity Indicator using market-based data that gives a heads-up as to whether what I call economic velocity (PQ/M) is about to turn up, or turn down. The chart is shown below.

The GVI—which is supposed to lead actual velocity by six months—“turned” up at the beginning of September 2020 and is now positive. This implies that cash balances held by economic agents are starting to move into the real economy. It confirms that activity is accelerating.

I have argued before that if the velocity of money is rising, demand for money must be growing faster than the supply of money. This implies that the price of money—the interest rate—will rise. What could upset this logic would be the Fed continuing to print, so that M keeps rising. If this happens, it goes without saying that the US dollar exchange rate will fall big time.

Conclusion

-

Economic activity is going to be strong, to very strong, in the near future.

-

Inflation is going to accelerate significantly in the next 12 months.

-

Yields on 10-year treasuries will rise from an abnormally low level to a more normal level, implying a gain of about 200bp.

-

If the Fed tries to stop rates rising, the US dollar may collapse, which will be inflationary for the US and deflationary in Europe.

In short, the US is moving from a deflationary boom to an inflationary boom. A wrinkle could be a big rise in the oil price, which would make the situation difficult for the Fed, as it was in 1973. In past inflationary booms, non-US markets, especially in Asia, tended to outperform the US, while the dollar usually fell. Hence, investors needed to own gold and long-dated bonds in currencies which were due to revalue strongly (deutschmark and Swiss franc in the 1970s) but large cash positions also had to be held in those currencies.

My advice today is to replace bunds with Chinese government bonds and hold cash in Asian currencies, which are tracking the renminbi. As an aside, Brazilian bonds and cash tend to offer exceptional returns and could be put in the aggressive part of the portfolio as a replacement for equities.