US equity futures and global markets rose this morning, continuing yesterday’s torrid late day surge, as investors looked past supply chain disruptions and focused on the optimistic targets for vaccinations and economic re-openings, after Joe Biden doubled the goal for his vaccination drive even though Covid-19 cases keep rising, and the Federal Reserve freed banks from pandemic restrictions on dividends. Oil rebounded and pushed Treasury yields higher, prompting investors to buy undervalued energy and bank stocks ahead of what is expected to be the fastest economic growth since 1984. Investors awaited key income, spending and inflation data later in the day.

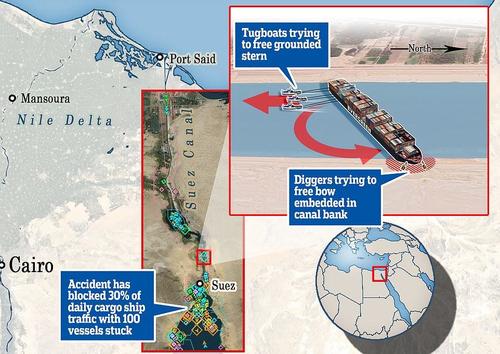

Risk appetite made a comeback across the world on economic-recovery bets, capping a volatile week beset with vaccine-supply disputes, a traffic block on the Suez canal and further deterioration in China’s relations with the West. The renewed optimism helped investors look past another poor 7Y debt auction in the U.S.

“Like a flickering light bulb, the tone of the market has somehow altered from angst to optimism, spurred by President Biden’s doubling of the U.S. vaccine-rollout target and the Fed’s end to pandemic-era dividend cuts,” Nema Ramkhelawan-Bhana, a strategist at Rand Merchant Bank in Johannesburg, wrote in a note. “It’s remarkable how little it takes to shift the mood.”

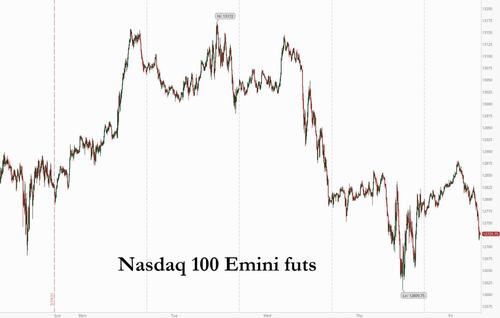

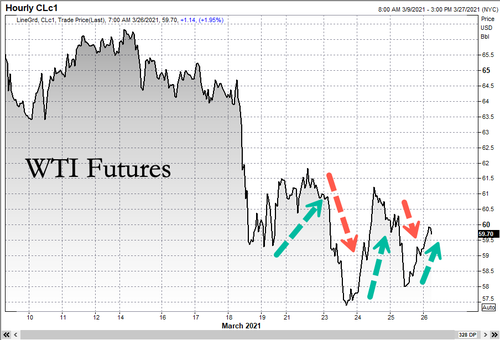

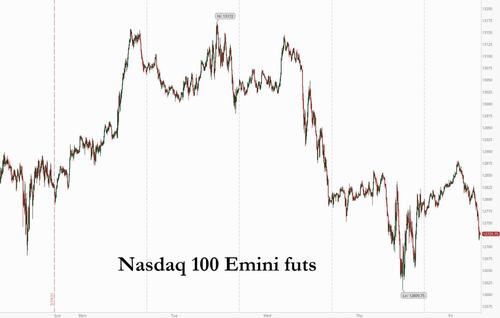

After the reflation trade faded early this week, it was back with a bang on Friday when inflation jitters appeared to take the upper hand again, because as the 10Y yield jumped 5bps today..

… futures gains were capped and pushed Nasdaq futures back in the red.

At 740 a.m. ET, Dow E-minis were up 129 points, or 0.40%, S&P 500 E-minis were up 7.5 points, or 0.19% and Nasdaq 100 E-minis were down 42.75 points, or 0.33%.

Among the notable premarket movers:

- Oil giants Exxon, Chevron, Exxon, Marathon Oil, Occidental Petroleum and Devon Energy rose between 0.7% and 2.6% as crude prices gained 2%.

- Nio dropped about 1% as the Chinese electric vehicle maker said it would halt production for five working days at its Hefei plant due to a shortage in semiconductor chips.

- Big banks JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley were up between 0.6% and 1.8% in premarket trading.

- Cruise-line operators Royal Caribbean Cruises Ltd. and Carnival Corp. rose at least 2.9% in premarket trading.

In Europe the Stoxx 600 Index had gained 0.6% by 750 a.m. Eastern Time with miners by far the best performers, after overnight gains on Wall Street as U.S. President Joe Biden doubled his vaccination target for the first 100 days. European equities rose at the end of a volatile week of trading as fresh U.S. vaccine targets boosted optimism about global growth prospects. Value and cyclical shares led broad sector gains in Europe as miners jumped 2.3%, while oil shares also rallied as the Suez Canal blockage continued. Banks outperformed, while health-care rose the least. Stocks in Europe have whipsawed since mid-March on concern over whether the rising virus rate and setbacks in the vaccination program will delay the economic reopening. Still, many market players are bullish about the region’s equities as cheap and cyclical shares gather pace, and the Stoxx 600 is less than 2% away from a record reached in February 2020. “We look set for a decent end to the week,” said Michael Hewson, chief market analyst at CMC Markets. “It has been notable this week that for all the concerns about a slowdown in Europe and a delay to an economic reopening that any dips in European stocks have been fairly shallow ones. This suggests that for all of the concerns about valuations, in Europe at least the appetite for stocks is still there.” The Stoxx 600 is up 5.3% in March and poised for a fourth straight quarterly increase.

Earlier in the session, the MSCI Asia Pacific Index added 1.3%, poised for their biggest advance in over two weeks, driven by gains in technology firms. Consumer discretionary and financials were also among the biggest contributors to the broad rally in the MSCI Asia Pacific Index. Chinese stocks rebounded, with the CSI 300 adding 2.3% after ending Thursday at a new low this year. Shares climbed ahead of earnings reports from the nation’s largest banks due later on Friday. TSMC was the largest single boost to the Asian benchmark, driving gains in Taiwan’s benchmark as well.

Japanese shares were also strong as they advanced for a second day, with electronics and automakers climbing with help from a weaker yen amid optimism over Covid-19 vaccines and after the yen weakened against the dollar. Electronics and auto makers were among the biggest boosts to the Topix index, with all 33 industry groups gaining. SoftBank Group and Advantest were the biggest contributors to the rise in the Nikkei 225. The yen slightly extended its loss through 109 per dollar. Asian stocks rallied broadly, following U.S. peers higher after President Joe Biden announced a new goal of administering 200 million Covid-19 vaccine doses in his first 100 days in office. Meanwhile, the Federal Reserve announced banks that clear stress tests can raise dividends after June 30. Even with two days of strong gains, the Nikkei still finished the week with with a loss of over 2%. Theblue chip gauge dropped below he 30,000 mark last Friday after the Bank of Japan announced a plan to shift its exchange-trade fund purchases to the focus on just the Topix. “It may be difficult for the Nikkei 225 to push above 30,000 without the support of the Bank of Japan,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank. “The Topix currently looks a little on the expensive side, but with time, corporate profits will come out and justify the strength.”

“There is some risk-on trading with Biden announcing a doubling of the vaccination target for his first 100 days in office and German Chancellor Merkel backing down from her plans for a strict five-day lockdown over Easter,” said David Forrester, a currency strategist at Credit Agricole CIB in Hong Kong. “The Fed is also going to lift pandemic-era limits on U.S. bank dividends from mid-year for those banks that pass a stress test”

In rates,Treasuries were cheaper by 5bp at long-end of the curve, follow a wider bear-steepening move in bunds and gilts as European stocks and U.S. futures advance. 10-year Treasury yields around 1.68%, higher by nearly 5bp, with bunds gilts lagging by almost 1bp each; long-end-led losses steepen 2s10s by more than 4bp, 5s30s by nearly 2bp. Core EGBs continued to lose haven bid after Germany March IFO beat expectations. Raft of U.S. data Friday includes February personal income/spending. U.S. swap spreads are widening into the back-up in Treasury yields, led by intermediates.

In FX, the dollar fell against most Group-of-10 currencies after risk appetite was boosted by a quickening vaccine rollout in the U.S. and the Federal Reserve’s move to lift curbs on dividend payouts. Treasury yields eased after a lackluster seven-year auction, with traders focused on quarter-end flows. Investors are awaiting U.S. employment figures due next week after a report Thursday showed applications for jobless benefits fell to a pandemic-era low last week.

Global equities remain just under record highs as investors consider progress in the fight against Covid-19 and the risks of inflation from heavy stimulus. The U.S. recovery looks on track with latest data showing a bigger-than-forecast drop in weekly jobless claims. Federal Reserve Chair Jerome Powell reiterated the U.S. central bank would wait until the economy has “all but fully recovered” to pull back extraordinary monetary support.

To the day ahead now, and US data releases include February’s personal income and personal spending, and the preliminary reading of wholesale inventories for February, along with the final reading of March’s University of Michigan consumer sentiment index. Over in Europe, there’s also the Ifo business climate indicator for March from Germany, Italian consumer confidence for March and UK retail sales for February. Central bank speakers include the ECB’s Rehn and the BoE’s Saunders and Tenreyro, while the virtual summit of EU leaders will continue into today.

Market Snapshot

- S&P 500 futures up 0.3% to 3,913.00

- SXXP Index up 0.8% to 426.25

- MXAP up 1.3% to 204.82

- MXAPJ up 1.4% to 676.36

- Nikkei up 1.6% to 29,176.70

- Topix up 1.5% to 1,984.16

- Hang Seng Index up 1.6% to 28,336.43

- Shanghai Composite up 1.6% to 3,418.33

- Sensex up 1.4% to 49,129.67

- Australia S&P/ASX 200 up 0.5% to 6,824.23

- Kospi up 1.1% to 3,041.01

- Brent futures up 1.7% to $62.97/bbl

- Gold spot up 0.1% to $1,728.31

- U.S. Dollar Index down 0.2% to 92.70

- German 10Y yield up 6 bps to -0.36%

- Euro up 0.1% to $1.1778

Top Overnight News from Bloomberg

- European Union leaders gave their guarded support to a plan to restrict vaccine exports after it emerged the bloc sent more shots to the rest of the world than it has given to its own people

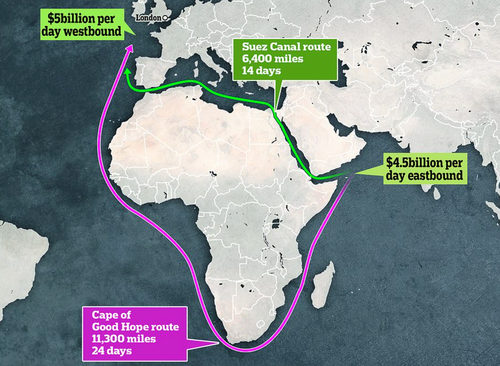

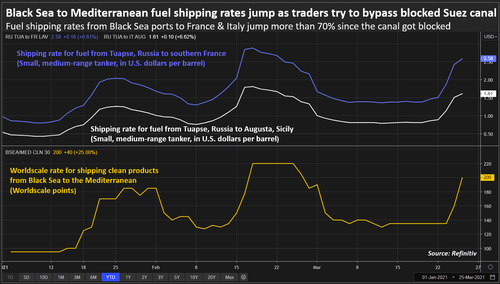

- Efforts to dislodge the massive Ever Given container vessel blocking the Suez Canal will take until at least next Wednesday, longer than initially feared, raising the prospect that the incident will trigger disruptions across global supply chains from oil to grains to cars

- The downgrade of a major property firm has deepened investor concern about China’s debt- laden real estate sector, as defaults among onshore corporate borrowers surge to a record high.

- U.K. retail sales posted a modest rebound in February after a brutal start to the year, when a lockdown to contain the coronavirus forced non-essential stores to close.

Quick look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly higher following the rebound in the US where small caps atoned for the prior day’s underperformance. ASX 200 (+0.5%) was propped up by strength in telecoms and commodity-related sectors but with upside capped by weakness in defensives and concerns regarding Australia’s ties with its largest trading partner after Chinese industry representatives confirmed that some Australian hay imports were halted and that they are seeking alternative sources, while Nikkei 225 (+1.6%) continued to outperform and reclaimed the 29k level amid a weaker currency and with the JPY-risk dynamic intact. Hang Seng (+1.6%) and Shanghai Comp. (+1.6%) adhered to the positive mood with Xiaomi and Great Wall Motor among the biggest gainers in Hong Kong after news that the smartphone maker plans to make EVs and is in discussions to partner with and use Great Wall Motor’s factory for the production. Attention was also on a deluge of earnings releases including China’s oil majors CNOOC and PetroChina lagged. Finally, 10yr JGBs were relatively flat with demand hampered by the heightened risk appetite and following on from another soft 7-year auction stateside, although the downside in JGBs was stemmed amid the BoJ’s presence in the market for JPY 850bln of JGBs with mostly 1yr-3yr and 5yr-10yr maturities.

Top Asian News

- Billionaire Mistry’s Family Loses Court Battle in Tata Feud

- China’s Tariffs on Australian Wine to Last 5 Years as Ties Sour

- China’s Central Bank Estimates Potential Growth of Under 6%

- Hong Kong Buyout Firm EmergeVest Said to Plan $250 Million SPAC

European equities (Eurostoxx 50 +0.6%) trade on a firmer footing bringing the Eurostoxx 50 to relatively unchanged levels for the week. Today’s session has seen a preference towards some of the more cyclically-exposed sectors with Basic Resources the clear outperformer, alongside gains in Autos and Oil & Gas names; albeit, gains for the latter have been trimmed alongside a pullback in crude prices. Note, the gains for cyclicals have not come at the expense of Tech/Momentum stocks with the Technology sector in Europe currently firmly in the green despite the US 10yr yield moving back above 1.65%. The latest IFO report from Germany failed to have much sway on indices. However, it is worth noting that the above-expectations report was relatively bullish on the German economy with IFO economists noting that German industry is very strong and order books have filled up. In terms of stock specifics, notable gainers including Smith Group (+6.8%) post-earnings and Maersk (+4.9%) in the wake of ongoing disruptions in the Suez Canal which has led to a surge in shipping costs. To the downside, Burberry (-1.3%) lags peers with the company embroiled in the Xinjiang criticism row, whilst Ocado (-0.6%) is also lower on the session after being downgraded at Berenberg.

Top European News

- Soaring French Infection Rate Causes Concern in Germany

- Allianz Agrees to Buy Aviva’s Poland Unit for $2.9 Billion

- Santander Signals Boost to Profit After Strong Start to Year

- Ex-Commerzbank CEO’s Fintech SPAC Falls in Amsterdam Debut

In FX, pre-weekend position paring and general consolidation may be contributing to the Greenback’s loss of momentum, but a marked improvement in risk sentiment and the latest recovery in crude prices are also dampening demand for the Dollar that has enjoyed 3 successive winning sessions vs most if not quite all rivals. The DXY closed above a key technical level on Thursday in the form of the 200 DMA that stands around 92.600 today, but could not quite reach 93.000 and chart proponents may have been somewhat disappointed or simply persuaded to take some profit and trim longs. However, the index and Buck remain firm overall ahead of US data including PCE inflation and final Michigan sentiment, with the former meandering between 92.836-684.

- JPY – No relief for the Yen at the Greenback’s expense at all or Tokyo CPI that was a tad firmer than forecast on balance, as Usd/Jpy continues to rebound through 109.00 and has now posted a new y-t-d high circa 109.55. Moreover, there is little in terms of resistance tech-wise before 110.00 and spot month, Q1 and FY end is yet to come on Monday for the Yen that carries a historically large rebalancing hedge SD for the last day of March.

- NZD/AUD – Conversely, the mood has improved somewhat down under along with risk appetite, and to the extent that the Kiwi is back near 0.7000 against its US counterpart, while the Aussie has actually reclaimed 0.7600+ status against the backdrop of Westpac’s dovish RBA call for QE to be extended in October at the current Aud 100 bn pace compared to Aud 50 bn previously and China slapping anti-dumping tariffs of up to 218.4$ on wine for 5 years with effect from March 28.

- GBP/NOK/CAD/EUR – Sterling is fending off an oil-fuelled Norwegian Krona for 3rd spot in the G10 ranks as Cable eyes 1.3900 and Eur/Gbp retests bids/support around 0.8550 due to risk back on impulses and hopes that the UK-EU vaccine stand-off will be resolved before too long. Meanwhile, Eur/Nok is straddling 10.1500, Usd/Cad has retreated through 1.2600 ahead of Canadian budget balances and Eur/Usd has pared declines from the low 1.1760 area that also arrested losses beneath a Fib retracement yesterday to take another look at 1.1800 in wake of an upbeat German Ifo survey slightly tarnished by the RKI’s stark warning of clear signs that the current COVID-19 wave might be more sever than the first.

- CHF/SEK – The other major laggards, as the Franc pivots 0.9400 vs the Buck and 1.1075 against the Euro post-SNB, while the Swedish Crown rotates either side of 10.1800 and reversed through par vs the single currency and its Scandinavian peer respectively with no real impetus from trade or retail sales data.

- EM – While the commodity bloc gleans traction from the aforementioned revival in crude, precious and base metals, the Try remains locked in a battle to hold above 8.0000 or deeper lows vs the Usd even though Turkish manufacturing confidence improved in March, as investors continue to shun the Lira on CBRT credibility grounds.

In commodities, WTI and Brent front month futures have started the last session of the week on the front foot, seeing a continuation of gains, but have since dipped off best levels. Fundamentally, support for prices has come alongside reports that it could take weeks to dislodge the Ever Given container ship from the Suez Canal. The blockage is leading to a squeeze in oil supplies and increasing fears of supply constraints over the coming weeks. Note, gains have been somewhat capped by growing COVID infection rates in Europe and emerging markets, such as Brazil and India. Rising case counts could push back expectations for a summer recovery for jet fuel demand. The May WTI contract trades just below the USD 60.00/bbl handle (vs low 58.32/bbl) whilst its Brent counterpart trades marginally above USD 63.00/bbl (vs low 61.85/bbl). Looking ahead, notable risk events include possible JMMC & OPEC+ source reports ahead of next week’s meeting, where expectations remain that OPEC+ will maintain current production. Note, today’s Baker Hughes Rig Count data is released in the UK today at the earlier time of 17:00GMT. Spot gold has traded choppy, but, like spot silver is firmer on the session alongside a slight pullback in the Dollar. That said, the DXY hit a four-week high yesterday and as such, gold is set for its first weekly decline in three weeks. Spot gold remains just below USD 1,730/oz (vs low USD 1,723/oz) and spot silver is trading around the USD 25.20/oz mark (vs low USD 25.04/oz). In base metals, LME copper follows the broader firmer sentiment and is up on the session and resides in proximity to USD 8,930/t. Additionally, there is growing optimism around the versatile metal amid its faster-than-expected COVID vaccination progress in the US. Lastly, Dalian iron ore is set for its first weekly rise in four weeks, amid declining steel inventories and rising demand in China.

US Event Calendar

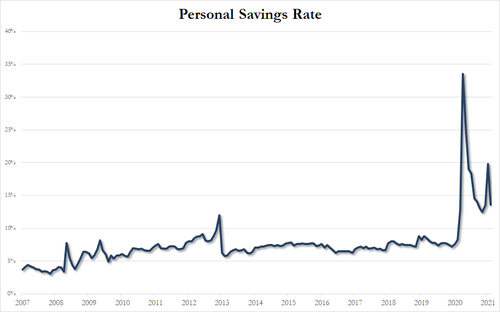

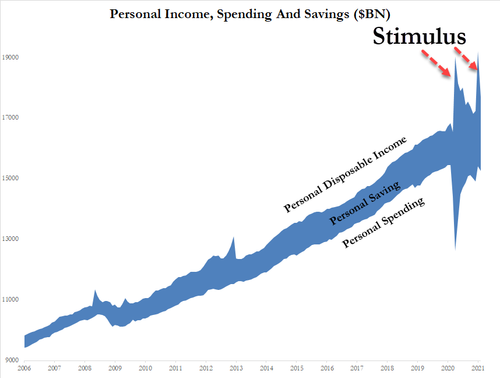

- 8:30am: Feb. Personal Income, est. -7.2%, prior 10.0%

- 8:30am: Feb. Personal Spending, est. -0.8%, prior 2.4%

- 8:30am: Feb. PCE Deflator MoM, est. 0.3%, prior 0.3%; PCE Deflator YoY, est. 1.6%, prior 1.5%

- 8:30am: Feb. PCE Core Deflator MoM, est. 0.1%, prior 0.3%; PCE Core Deflator YoY, est. 1.5%, prior 1.5%

- 8:30am: Feb. Real Personal Spending, est. -1.0%, prior 2.0%

- 8:30am: Feb. Retail Inventories MoM, est. 0.8%, prior -0.6%, revised -0.5%; Wholesale Inventories MoM, est. 0.8%, prior 1.3%, revised 1.4%

- 8:30am: Feb. Advance Goods Trade Balance, est. -$86b, prior -$83.7b, revised -$84.6b

- 10am: March U. of Mich. 1 Yr Inflation, prior 3.1%; 5-10 Yr Inflation, prior 2.7%

- 10am: March U. of Mich. Current Conditions, est. 93.1, prior 91.5; Sentiment, est. 83.6, prior 83.0; Expectations, est. 78.8, prior 77.5

DB’s Jim Reid concludes the overnight wrap

Markets zig-zagged around yesterday like me on the fairways early next week. At lunch time the Stoxx 600 was as much as -1.02% lower before clawing all the way back to nearly flat (-0.07%) by the close. The US followed the trend (-0.92% in early trading) and continued on the path higher after Europe went home before eventually closing +0.52% higher on the day. 20 of the 24 S&P 500 industry groups rose yesterday, while over 80% of all S&P 500 constituents were up. Banks were the best performing industry (+2.28%), followed by other cyclicals such as consumer services (+2.02%), transportation (+1.83%) and autos (+1.58%). Energy stocks (+0.25%) stabilised somewhat even as oil prices fell back over -4% yesterday. Tech stocks struggled even if the NASDAQ managed to recover from an intraday low of -1.35% to end the session up +0.12%. However megacap tech continues to underperform with the NYFANG index down another -2.30% yesterday and now down -4.57% on the week so far.

A focal point in rates was the 7-yr Treasury auction which saw demand fall short of dealer’s expectations as the notes were awarded at 1.30% – 2.5bps higher than just prior to the auction. This was better than last month’s very bad equivalent, but still worse than average. Immediately after 10yr yields rose nearly 2bps and by the close had finished up +2.5bps overall. However this might still put them on track for their biggest weekly decline since last June, having fallen by -9.8bps since the start of the week. The moves came as Fed Chair Powell continued to strike a dovish tone, saying in an interview yesterday that support would be pulled back “when the economy has all but fully recovered”. Nevertheless, market pricing continues to outpace the Fed’s dot plot, with a rate hike fully priced in by Q1 2023, even though the dot plot last week indicated that rates would still be on hold at the end of that year. Over in Europe, sovereign bond yields declined, with those on 10yr bunds (-3.1bps), OATs (-2.7bps) and BTPs (-1.1bps) all moving lower.

Asian markets have taken Wall Street’s lead this morning with the Nikkei (+1.47%), Hang Seng (+1.46%), Shanghai Comp (+1.41%) and Kospi (+1.03) all posting strong gains. Futures on the S&P 500 are up +0.40% while those on the Nasdaq are up +0.61%. Large US banks are extending gains in after hours trading partly helped by the Fed decision to allow those large US banks that clear the next round of stress tests with sufficient capital to resume dividend increases at the end of June. This signals an end to pandemic-era restrictions that dragged on financial stocks last year. JPM (+0.92%), Bank of America (+1.09%), Citigroup (+1.23%) and Wells Fargo (+0.97%) all traded higher in extended trading. Yields on 10y USTs are flattish this morning while those on New Zealand’s 10yrs are up +5.3bps likely on news that the RBNZ will lower its weekly QE target due to lower issuance from the Treasury. Australia’s 10y yields are down -2.5bps. Crude oil prices are trading up c.+1% this morning having fallen around -4% yesterday.

The moves in markets came amidst some strong economic data releases out of the US yesterday where the weekly initial jobless claims for the week through March 20 fell to 684k (vs. 730k expected), which is their lowest level since the pandemic began. Furthermore, the 4-week moving average was also at a post-pandemic low of 736k, as were continuing claims for the week through March 13, which fell to 3.87m (vs. 4m expected). And finally, the latest estimate of Q4 growth was revised up two-tenths, to now show an annualised pace of +4.3%.

Nevertheless, it’s Covid that has partly hampered the recent risk rally, with the data showing a sustained rise in the global case count since mid-February that’s showed no sign of abating thus far, and has led investors to ponder what a renewed bout of restrictions could mean for the world economy. European Commission President von der Leyen yesterday announced that “we’re at the start of the third wave of the pandemic.” In Poland, it was announced that nurseries and preschools would close, as the country reported a fresh record of 34,151 new cases. In turn, this has sent the Polish Zloty to its weakest level against the Euro since 2009. Elsewhere, the Finnish government has submitted a proposal that would see temporary restrictions on movement in the worst-hit areas for 3 weeks, with people only able to leave their homes for essential reasons or outdoor recreation. Meanwhile France extended their lockdown to three additional regions – the Nievre, Rhone and Aube areas – with the government announcing that the newest wave has a higher number of younger people being admitted to hospitals. German Chancellor Merkel also signalled that she would be declaring France a “high-risk Covid Area.” Overnight, French President Macron has said that new measures to contain the epidemic might be needed in the coming weeks and added that “The next few weeks will be tough.”

On the more upbeat side, President Biden announced in his first press conference since becoming President that his administration was upwardly revising its goal of 100m shots within his first 100 days to 200m shots within the same time frame. Supply is expected to pick up in the coming weeks as manufacturers increase shipments, particularly Johnson & Johnson which only received authorisation more recently. The US has administered more than 130mn jabs so far, with 16.5mn coming during the final days of President Trump’s administration. Roughly 13% of the country is fully vaccinated at this time.

President Biden’s press conference otherwise focused on his upcoming long-term economic agenda, which he is expected to unveil next week. He promised a new “paradigm” for the middle class with a focus on expanded support for health care, tax changes aimed at companies and the wealthy, along with a new infrastructure plan. When asked about the filibuster, the measure in the Senate that forces much of the non-fiscal and non-judiciary votes to pass by at least a 60-40 vote margin, President Biden gave his closest endorsement yet to getting rid of the rule, which Republicans argue would make policy much more volatile going forward. Lastly on China, Biden said that China has “an overall goal to become the leading country in the world, the wealthiest country in the world and the most powerful country in the world. That’s not going to happen on my watch, because United States is going to continue to grow and expand.”

Meanwhile at the EU leaders’ summit newly elected Italian Prime Minister Draghi urged other EU leaders to use the bloc’s new rules to make sure that there is an adequate supply of vaccines for the member states. He also endorsed the EC’s plan to curb exports of vaccines and medical equipment, this comes after reports that the EU has exported over 77mn doses vs the 62mn does administered in the region. EC President von der Leyen used slides during the meeting that showed that the EU expects to receive about 100mn jabs in the first quarter of the year and 360mn in the second quarter.

Turning to the Suez Canal, the buildup of congestion has got worse over the last 24 hours as the Ever Given container ship remains stuck in place. In terms of latest, the Suez Canal Authority has said that the Ever Given has been partially re-floated and moved alongside the canal bank. GAC, a Dubai based marine services company has said on its website that “Convoys and traffic are expected to resume as soon as the vessel is towed to another position”. Just as we are about hit print, Bloomberg is reporting that the work to dislodge the container vessel will take until at least Wednesday next week as more time will be needed to dredge sand.

Looking at other markets, it’s clear that the risk reversal over the last few days has been having effects elsewhere, with the dollar strengthening +0.36% to a 4-month high, while the key industrial bellwether of copper (-1.73% yesterday) has seen prices fall to a 1-month low. Bitcoin investors have been hit too, with the cryptocurrency down a further -3.79% yesterday to $52,001, which leaves prices down by c.16% from their intraday peak of $61,742 back on March 13.

To the day ahead now, and US data releases include February’s personal income and personal spending, and the preliminary reading of wholesale inventories for February, along with the final reading of March’s University of Michigan consumer sentiment index. Over in Europe, there’s also the Ifo business climate indicator for March from Germany, Italian consumer confidence for March and UK retail sales for February. Central bank speakers include the ECB’s Rehn and the BoE’s Saunders and Tenreyro, while the virtual summit of EU leaders will continue into today.