Irrational Fears Of Deflation

Authored by Alasdair Macelod via GoldMonmey.com,

The benefits of a deflation of prices brought about by a combination of sound money and markets free from government intervention have been demonstrated to be the best economic environment, the denial of which in favour of inflationary financing has led to repeated monetary and systemic failures.

This article explains how this has come about and puts the record on deflation straight. The development of macroeconomic theory had to deny the benefits of a deflation of prices, unbelievably telling us we need higher prices to stimulate our consumption.

Deflation and investment funded by savings is a far better, natural economic environment than the false gods of easy debt and money printing. There can be no return to the stability of gentle price deflation without seismic shifts in economic thinking and government responsibilities.

Introduction

Talk to any macroeconomist and he will tell you his greatest fear is deflation. He or she may have read Irving Fisher’s account of how in the 1930s deflation forced banks to liquidate loans by selling collateral into falling markets, driving asset prices lower still, accelerating further selling, undermining collateral prices even more, forcing banks to liquidate yet more collateral, driving prices lower still…

Deflation cannot be permitted, for fear of it developing into a self-feeding maelstrom. And to just to make sure, we must have inflation running at a positive 2%, and any dip below is a cause for concern. But is this actually true?

The answer is to be found in the vested interests in a modern economy. Today, critics of deflation are believers in intervention as a means of preserving jobs, convinced that the cause of failure is irrational free markets. Before interventionism took hold, economic failures were associated with cycles of bank credit. In those times, roughly before the early 1920s, deflation was widely understood to be a natural cleansing of past excesses, since they were always preceded by undue optimism and overt speculation. In England, Overend Gurney moved from the staid discount market into mismatching short-term finance into longer maturities, lending into the rail boom before collapsing in 1866. The failure of the City of Glasgow Bank in 1878, followed by Barings in 1890 established a twelve-year cycle of bank credit at that time. We may care to note that it is now twelve years since the Lehman crisis, giving a certain urgency to the current situation.

Banks have never been properly held to account for credit inflation and always resisted attempts to be so. Consequently, addressing the true cause of periodic deflationary slumps has always been ruled out. That left picking up the pieces after a credit-induced boom morphs into catastrophe as the only practical solution. And of course, this bailing out in the so-called public interest was what banks increasingly lobbied for, particularly in America.

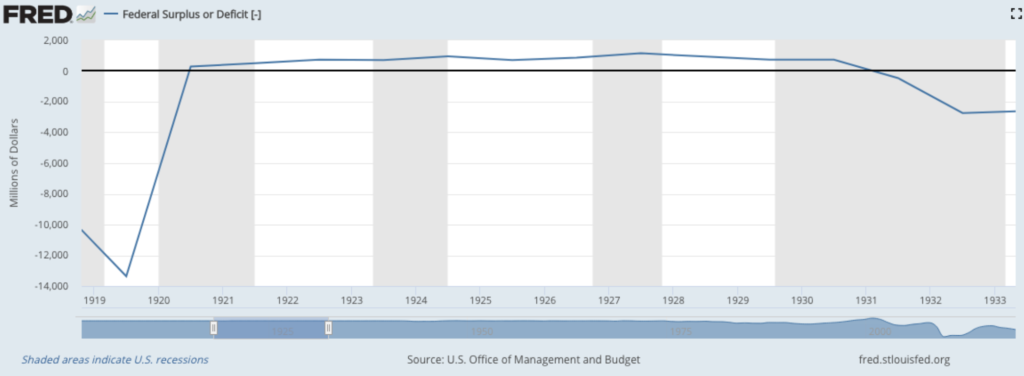

The last cleansing deflation in the old-fashioned sense followed the First World War: in America it was brutal but short. It was the last time the US government refused to interfere, the gold standard at $20.67 to the ounce remained intact, and the roaring twenties ensued. But at the end of that decade, President Hoover had a different, hands-on approach.

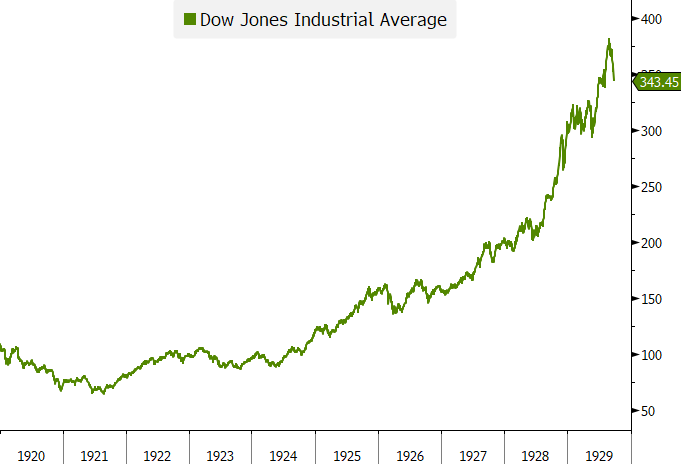

Illustrating the difference of perspective, his predecessor President Coolidge said of Hoover, “That man has given me nothing but advice, all of it bad.” While Coolidge was unfortunately ignorant of what the Fed was doing with money, he was the last of the genuine free-trade presidents and Hoover the first interventionist. The change in policy was marked by the Wall Street Crash in 1929 and the subsequent years when the slump turned from being a short sharp correction into a prolonged depression.

A new breed of economists evolved with it. From a careerist’s point of view, there was no money nor influence to be gained in being a non-interventionist when your paymaster and the paymaster for your alma mater is an interventionist government. Classical economists who had argued for sound money and Say’s law were out in the cold. Rather like the climate change movement today, where objective, qualified meteorologists have been side-lined by a mixed bunch of science opportunists, an interventionist movement gained control of the economic agenda.

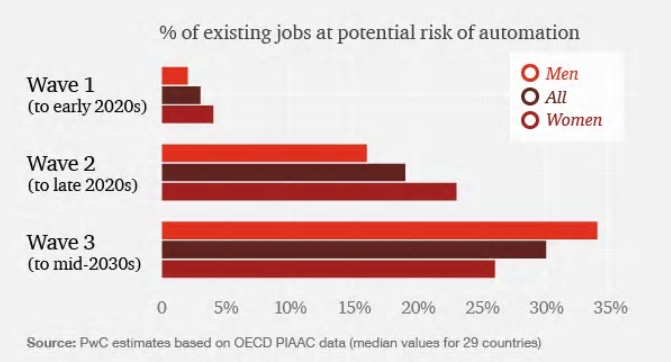

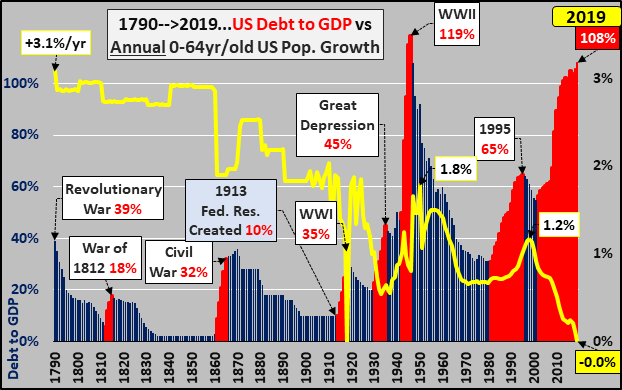

It was this movement that denounced deflation as the ultimate horror, supposedly brought about by a restrictive gold standard. Money now had to be flexible to manage the economy and avoid a repeat of the depression. Targeting prices, first implemented as a policy in the early 1920s by Benjamin Strong at the Fed, along with full employment have been written in stone as objectives for economic and monetary policies ever since. The consequence is debt has taken over from savings as the driving means of economic advancement. Today, the world has an estimated one quarter of a quadrillion dollars of debt, and we can now see this association of both money and debt creation accelerating both further and faster.

For practical purposes, debt is the other side of money-printing. With welfare-driven governments facing escalating commitments and static tax revenues, deflation appears to have been banished for ever.

Deflation and Humpty Dumpty

To think deflation is a danger at a time of accelerating monetary inflation appears to be preposterous. But Irving Fisher was right in one respect, and that is the cycle of bank credit ending in a tendency for credit to contract is always a problem, leading to regular systemic and banking crises in the manner he described. But today, this is counteracted by aggressive expansion of base money, with this cycle in anticipation of a bank credit crisis. So overall, deflation of aggregate money is simply a myth.

An additional problem is modern economists subscribe to the Humpty Dumpty school of definitions: “When I use a word it means just what I choose it to mean – neither more nor less”. They apply deflation mostly to prices, though correctly applied it is of the quantity of money. Google it, and the former comes up.

The error here is to describe the symptom and not the cause. Prices can fall for a number of reasons, monetary deflation being only one. The other principal causes, which are discussed below, are changes in savings behaviour and the effect of technology and competition.

Sticking with the price definition of deflation raises a further problem due to the immeasurability of changes in the general price level. Econometricians have progressively banished price rises by various means, so little or no inflation is recorded. If the price of a good rises, it is assumed consumers will find cheaper alternatives, so the price rise can be ignored. Technological improvements are the excuse to modify prices to take account of them. According to the US Bureau of Labor Statistics, in the twenty-two years from 1997 to 2019 the index value of a new vehicle rose by only 0.6%, while over the same period the average car price rose from $16,400 to $36,718, an increase of 124%. With tricks like this it is easy to see why independent analysts, such as Shadowstats.com and Chapwood Index estimate annual price inflation to have been running at roughly 10% in recent years while the official CPI rises by a goal-seeking 2%.

With statistical manipulation, official figures could even report price deflation when monetary or price inflation is significant. Unfortunately, it is the official CPI statistics that are accepted as the truth even though they are demonstrably incorrect. A narrative that condemns deflation and uses statistical manipulation permits the government and its licensed banks to use monetary expansion as an increasingly important means of funding and for the replenishment of bank reserves, despite consumers being progressively impoverished through higher prices without compensating increases in income.

Today, empirical evidence is ignored

Sound money, that is to say money which expands and contracts at the public’s bequest and not that of the state and its licensed banks, tends over time to lead to falling prices, not that the general level of prices can actually be measured and should remain no more than an economic concept. The clearest example is found in the extraordinary success of free markets in the nineteenth century, spearheaded by wise government in Britain.

Following the Napoleonic Wars the gold sovereign was introduced in 1817 and became the sheet anchor of Britain’s monetary system. Despite the disruption of cycles of bank credit, demand for them and the Bank of England’s gold substitutes in the form of its note issue was a matter for commerce and the public, crystallised in the 1844 Bank Charter Act. Sound money, with the state’s hands firmly bound by the gold standard, saw a small nation of some 27 million (1851) become the most prosperous and influential on earth by the end of the century in a price-deflationary environment.

Food prices fell. A four-pound loaf of bread, which was the food staple in 1810, cost over a shilling, falling to less than ten pence, or by over 20% by the late 1880s. Proceedings at the Old Bailey recorded that prices of manufactured goods fell significantly, particularly clothing. If hedonics had been applied to these prices, as is the custom today, they would have fallen even more due to the massive improvement in overall living standards and production processes from technological innovation.

The fall in prices was even more remarkable, given the gold discoveries at Sutter’s Mill in California in 1848, Australia in the 1850s and later, and in South Africa in the 1890s. Goldmoney estimates that above-ground gold stocks grew from 4,105 tonnes in 1816, when the Coinage Act declared the new sovereign as the sole standard of value and unlimited legal tender, to 23,685 tonnes at the outbreak of the First World War, an increase of 477%. The Californian gold rush produced a doubling of estimated annual mine output, which then remained generally steady until 1891, after which South African production doubled it again in the 1890s. While it would be an error to assume the only use for gold was monetary, there can be no doubt that the increased availability of gold represented significant potential for monetary inflation in the second half of the century.

Despite an inflation of gold stocks, the greatest economic progress ever recorded was in Britain during a period of continual price deflation. An important reason for this dichotomy was it was up to the public to determine the quantity of monetary gold, not the government, and the public only used what was actually needed for its circumstances.

For much of the time Britain was the only significant country on a gold standard, bimetallism with silver or silver standards predominating elsewhere until about 1870. At the outbreak of the First World War, over 80% of world shipping afloat had been constructed in Britain bearing testament of Britain’s economic prowess. And now we are told to believe deflation is bad for us.

Savings

There are a number of reasons the nineteenth century marked a significant improvement in economic conditions and living standards. Tax was low. The Income tax Act of 1842 reintroduced it at 2.9% on annual incomes over £150, equivalent today to about £50,000 measured by gold sovereigns. Ordinary people were permitted to accumulate wealth. But probably the most obvious consideration influencing future prices was an accumulation of savings.

Compared with today’s debt-driven economies, which are fuelled by monetary expansion and government intervention, the savings-driven economies of the nineteenth century required borrowers to bid up for investment capital from savers. Even if he managed to obtain loans for investment and working capital, a borrower with a poor business reputation would end up paying a high interest rate, putting himself at a competitive disadvantage.

Consequently, in a savings-driven culture a debtor’s behaviour of necessity becomes considerably more responsible towards savers’ funds than when debt is available through monetary inflation. Being funded through savings, industrial investment proceeded on the basis that borrowings must be repaid. A knowledge that the purchasing power of gold could rise over time was a further incentive to repay borrowed capital as quickly as possible. Mr Micawber’s Dickensian aphorism about spending within one’s means to avoid misery certainly applied.

Savings had two primary influences on prices. To the extent that they were immediate consumption withheld, in increase in savings lowered potential demand for consumer goods, thereby reducing the general level of prices compared with that at a lower savings rate. Furthermore, savings were the feedstock for industrial and business investment, which improved quality and reduced unit costs.

Despite the inflation of above-ground gold stocks and therefore the availability of gold sovereigns and gold substitutes, the fact that prices fell is testament to the power of an unfettered free market economy to deliver benefits to the general public. It required a benign government strictly limiting its own drain on free markets to appreciate their importance, and nineteenth-century Britain had this in spades.

Britain’s pro-competitive government

Rather than record the entire economic history of the nineteenth century, it is sufficient to focus briefly on the principal actions of two prime ministers, Lord Liverpool and Robert Peel.

Lord Liverpool (1770-1828) navigated Britain back onto the gold standard in 1821, following its suspension during the Napoleonic Wars. At the time of the decisive parliamentary debate in May 1819, money in circulation consisted of almost entirely paper, which before the war in 1792 (five years before the gold standard was suspended in 1797) consisted of £30 million in gold and £20 million in paper. In 1819, despite trade having almost quadrupled it was still £50 million. While more efficient settlement systems and an increased use of discounted bills allowed money to circulate with greater ease, gold had virtually disappeared as circulating money, because as well as its inconvenience for settling trade gold had developed a premium in its value, driving it from circulation.

As Prime Minister, Liverpool oversaw the return from this situation to the pre-war gold standard. He was motivated by three considerations. First, while monetary inflation had enabled the government to finance the war, it could not be a permanent part of the economic system, the need for inflationary financing having passed. Second, the management of the currency should remain with the Bank of England, because it was not a matter to be entrusted to Parliament. And third, with gold having fallen from a 30% premium to paper to only 3%, it appeared eminently possible, if gradually done.

It would require a deflation of paper notes relative to gold to get the old standard to stick. The return to gold having been agreed is attributed to a decline in prices between 1819 and 1821. A six-month recession was recorded in 1819, commencing at the time of the parliamentary debate. But it is a mistake to attribute these conditions entirely to a return to the pre-1797 gold standard when the preceding post-war euphoria is taken into account, which lead to a brief boom. Whether these events or Liverpool’s policies are the reason, the reintroduction of the pre-1797 gold standard provided a background of monetary stability that lasted over ninety years.

Robert Peel was important in two respects. He oversaw the introduction of the Bank Charter Act, which reformed the banking system so that the note issue became the preserve of the Bank of England, which would only be expanded with the full backing of physical gold. While the Act was designed to reinforce the gold standard, sadly it neglected to address the issue of unbacked bank credit.

His second act, the repeal of the Corn Laws in 1846 led by 1860 to the repeal of nearly all other tariffs, producing substantial economic benefits. It meant lower prices for food staples, giving factory workers, who previously had more or less only subsistence-level wages, free money to buy other things. In turn, this led to an expansion of manufacturing activity, lowering production costs even further. The abolition of tariffs was so successful that other countries, such as France, and the German-speaking states on the Continent followed suit.

The reintroduction of the gold standard in 1821 and the Bank Charter Act were designed to remove the temptation of inflationary financing from government, in accordance with Lord Liverpool’s policy. Peel’s removal of tariffs led to lower prices for goods. Together, they ensured a general deflation of prices that lasted until the First World War. It was a period of enormous success for Britain and her trading partners, not just in the Commonwealth and colonies, but it stimulated business in America and Europe as well. And all this from economic policies regarded today to be the greatest threat to the global economy.

Conclusion

The evidence from the past is that deflation of prices offers substantial benefits to consumers, businesses and savers. This article has very briefly shown why this is so by drawing on the experience of Britain in the nineteenth century, and there is no reason to believe that a similar deflationary situation would be any different today. Instead, one of the more obvious contemporary deceits which is paraded as a universal truth is that consumers benefit from higher prices because of the stimulant to business.

On every level this is plainly wrong. The inflationist argument has demolished both savings and personal wealth, leaving the average consumer worse off. It transfers wealth from producers to non-producers, notably the government, its licensed banks and speculators. The fact of the matter is inflationists seek to justify inflationism.

Today’s inflationism has its roots in the ebb and flow of bank credit, a problem unfortunately not addressed by the Bank Charter Act of 1844. More than any other error it led through successive credit cycles to the development of central banks and their attainment of the levers of monetary policy. It required the denial of classical economic theory and its replacement by a new breed of macroeconomist educated to justify the state’s increasing management of money and credit. In the process, reasoned economic theory was discarded in favour of the socialisation of money, and much else besides. Deflation had to be vilified to justify this new macroeconomic world.

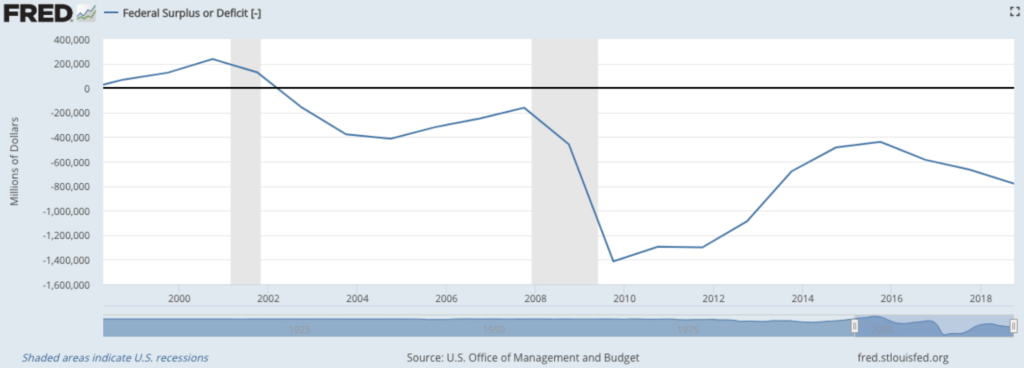

It has led to our current situation, where without further monetary inflation governments would have to deliberately rescind most of the welfare provisions introduced since President Hoover became the first interventionist in 1929. Without further monetary inflation, the global banking system would face liquidity pressures likely to collapse it: in fact, these strains have already appeared in the US monetary system, forcing the Fed to inject large amounts of liquidity on a daily basis through repurchase agreements.

Without further monetary inflation, interest rates will immediately rise, bankrupting indebted businesses and consumers alike, who have become used to easy money never to be repaid.

All that further inflation achieves is to defer these outcomes, not stop them. There can only be one outcome from this macroeconomic fairyland, the collapse of unbacked fiat currencies. A return to sound money, free markets and prices set by the deployment of genuine savings will require shifts of seismic proportions.

A proper respect for the benefits of falling prices might have avoided the looming monetary and economic crisis.

Tyler Durden

Tue, 02/04/2020 – 19:25

via ZeroHedge News https://ift.tt/2RYJjHu Tyler Durden