Worldwide Searches For ‘Virus Mask’ Erupt Amid Deadly Outbreak

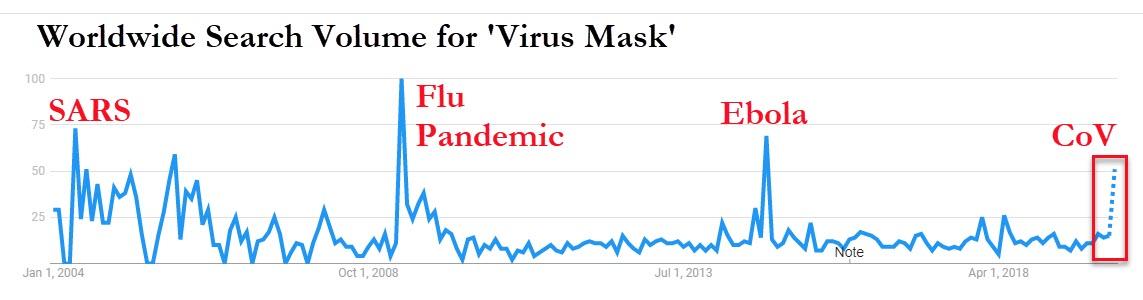

As the number of confirmed coronavirus cases at 830 with 25 deaths, worldwide Google searches for “virus mask” have erupted ahead of the Lunar New Year holiday.

The deadly virus is causing alarm because of how easily it spreads between people. So far, there are no drugs, known at the moment, that can prevent human to human transmission.

Videos are surfacing on social media, showing people in China dropping dead as authorities have locked down seven cities in an unprecedented effort to contain the outbreak.

In #Wuhan,people are collapsing on streets due to the deadly #WuhanPneumonia .

so helpless.#WuhanCoronavirus #WuhanOutbreak pic.twitter.com/X5ho3Llpcm— 巴丢草 Badiucao (@badiucao) January 23, 2020

More and more…pic.twitter.com/z5Dpu7RASa

— Turkish Market (@kamerknc) January 23, 2020

Bugün kaçıncı oldu bu yerde rastgele yatanların videosu… Vücut pat diye gidiyor. pic.twitter.com/29YA3uZCCu

— Turkish Market (@kamerknc) January 23, 2020

There have been multiple cases of people collapsing on the streets due to the coronavirus outbreak in Wuhan & various parts of China#WuhanCoronavirus #Wuhan#WuhanOutbreak #China pic.twitter.com/4iIwJCGl0M

— Jimmy Lee Curtains (@WulfMunkey) January 23, 2020

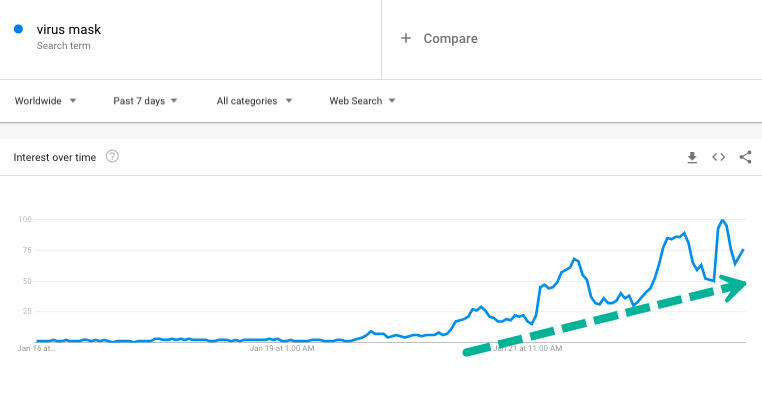

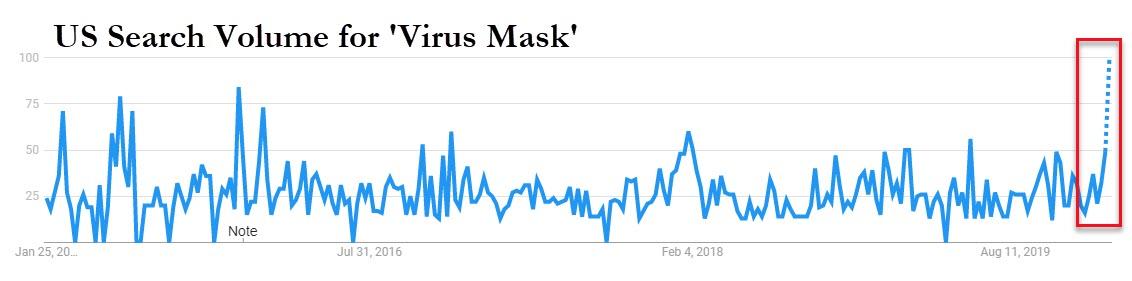

Worldwide searches for “virus mask” have surged in the last five days as cases of the deadly virus have spread from China to the U.S., Singapore, Thailand, Japan, South Korea, and Vietnam.

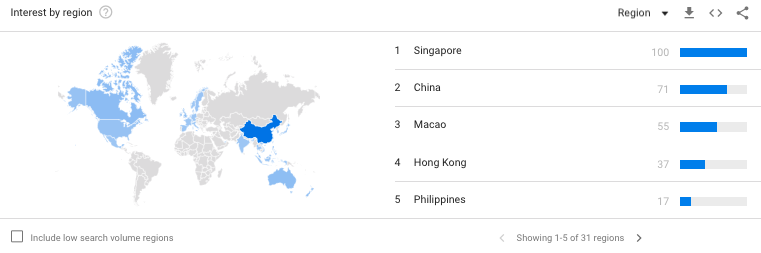

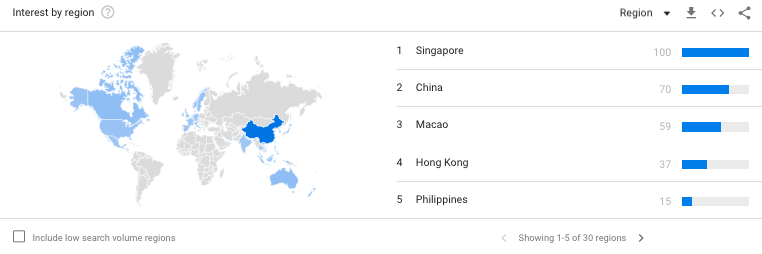

Top regions for “virus mask” searches are in Singapore, China, Macao, Hong Kong, and the Philippines.

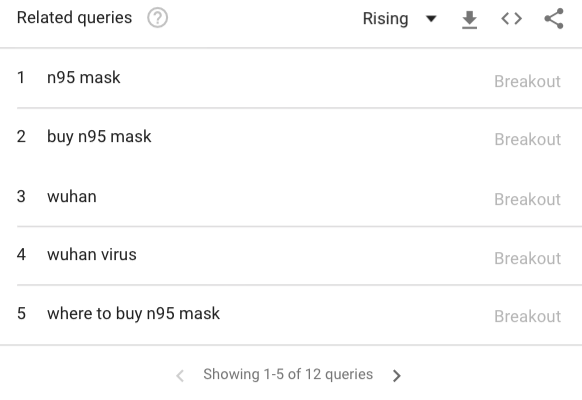

Other related global queries are “n95 mask,” “buy n95 mask,” “wuhan,” “wuhan virus,” and “where to buy n95 mask.”

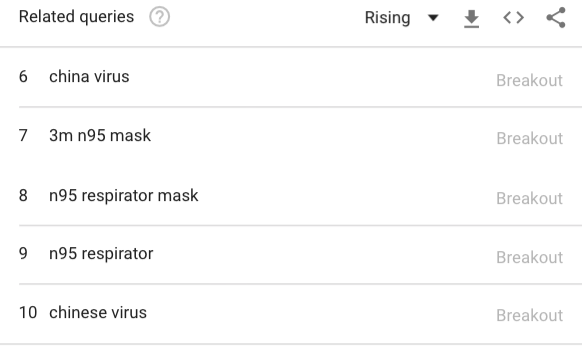

More related global queries include “china virus,” “3m n95 mask,” “n95 respirator mask,” “n95 respirator,” and “chinese virus.”

Google searches for “n95 mask,” a medical respirator designed to protect the wearer from liquid and airborne particles contaminating the face, was the most searched across the world, and in Macao, Singapore, China, Hong Kong, and the Philippines over the last five days.

Since the first coronavirus case was confirmed just north of Seattle on Tuesday, searches for “virus mask” across the U.S. have exploded. People in Washington, Hawaii, California, District of Columbia, and Massachusetts Googled it the most.

On related queries within the U.S. – many searched “n95 mask,” and where to buy the surgical respirator. Some searches include”n95 mask cvs,” “n95 mask home depot,” and “n95 mask target.”

It seems the global run on surgical masks has started as the deadly virus spreads across the world.

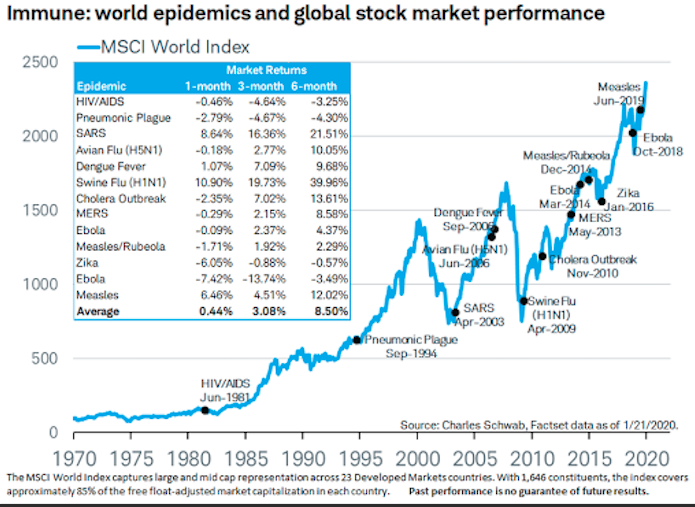

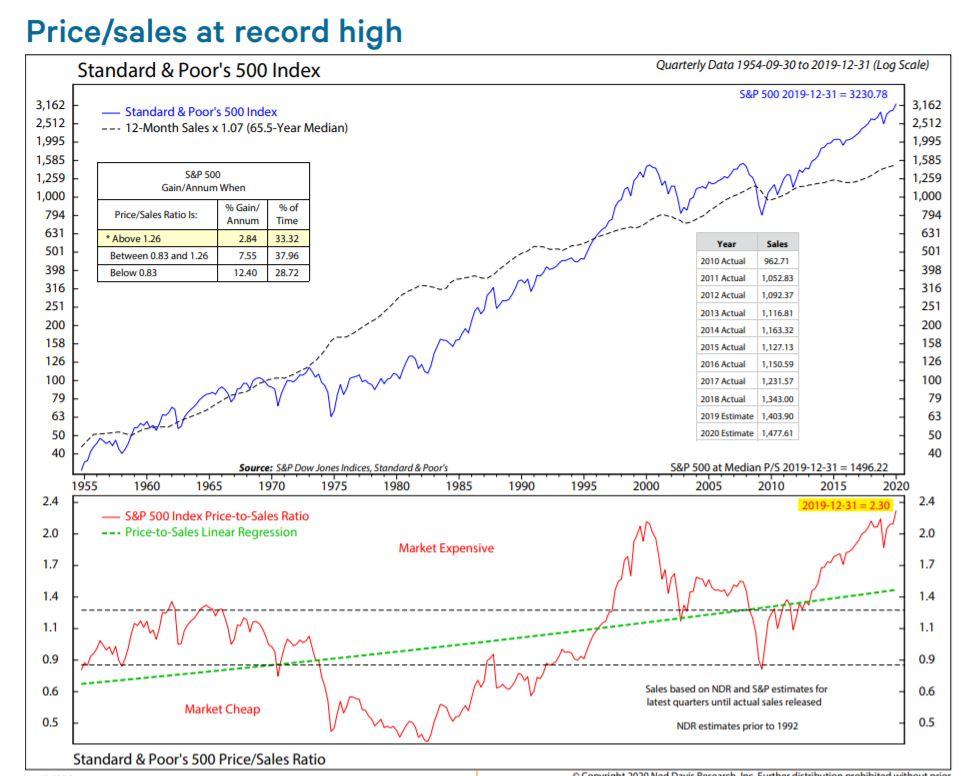

As far as world epidemics and the global stock market performance, here’s a chart showing what could happen next:

Tyler Durden

Thu, 01/23/2020 – 19:25

via ZeroHedge News https://ift.tt/2tL0VgI Tyler Durden