One Essential Insight For The Year Ahead

Authored by MN Gordon via EconomicPrism.com,

On Christmas Day 2018, roughly one year ago, President Trump provided the following market analysis:

“I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.”

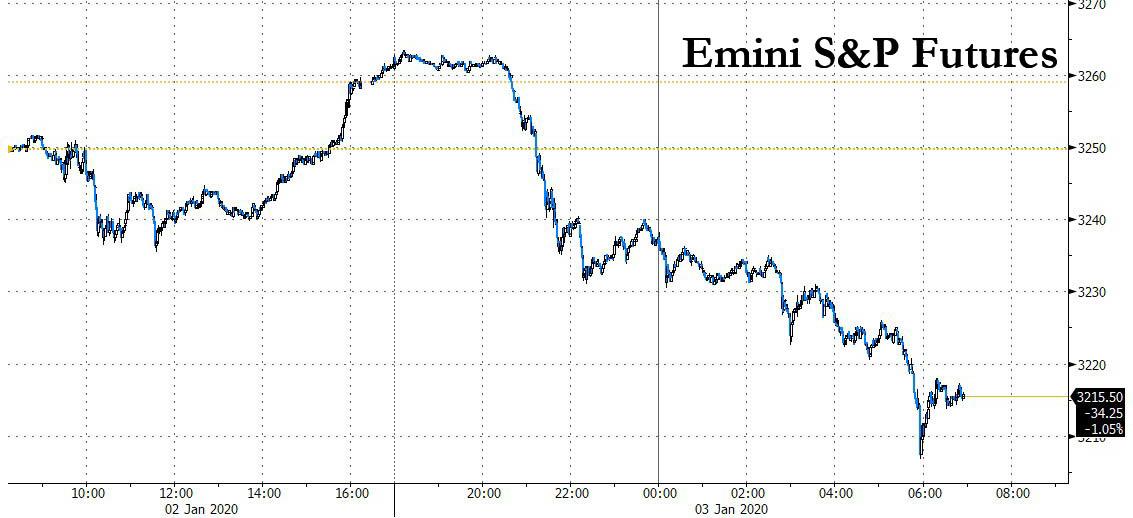

If you recall, the U.S. stock market was in freefall when Trump made these utterances. Between September 20, 2018 and Christmas Day 2018, the S&P 500 dropped 19.78 percent – within a hairline of an official bear market. What’s more, the S&P 500 was at a 20 month low.

The Donald, however, proved himself a “very stable genius.” For he pinpointed to the day, to the minute, the bottom of the late-2018 swoon. From Christmas Day 2018 to Christmas Day 2019, the S&P 500 rose over 36 percent.

Of course, hindsight’s always 2020. Buying the dip one year ago now seems so obvious. But, at the time, it required heavy conviction and intestinal fortitude.

Naturally, it’s easy to know the right thing to do after something has happened. Perhaps Trump deserves a Nobel Memorial Prize in Economic Sciences for his prescient market call. More likely, he knew he had an ace up his sleeve…

After calling the CEOs of the six largest banks on December 23, 2018, Treasury Secretary Steven Mnuchin convened a Christmas Eve call with the President’s Working Group on Financial Markets – i.e. the Plunge Protection Team (PPT). The purpose of the call was to discuss coordinated “efforts to assure normal market operations.”

Make of it what you will, 2019 was a fantastic year to buy the S&P 500. But what about 2020?

Sights On 2020

Today, with perfect 20/20 vision, we set our sights on the year ahead. After all, the New Year’s nearly here. What better time than now to peer out 12 months through our proprietary prism and report back what we discover?

On first glance, we see new dreams, new directions, and new delusions just over the horizon like swirling storm clouds interspersed with warm radiant light. We see opportunities and contretemps. We see doom and despair. And we also see hope and redemption.

Make no mistake, 2020 will be the year that everything happens precisely as it should. Some good. Some bad. Each day shall unfold before you with reciprocal imbalance. You can take that to the bank.

But what else? What are the essential insights we should take with us as we set out to make another pass around the sun? What about stocks, the 10-Year Treasury note, gold, and everything else? Will collateralized loan obligations (CLO) be roiled by mass corporate defaults? Are we fated for complete social distortion? Will this be the year to fight the Fed?

Today we attempt to answer some of these questions with humility and modesty. Predicting the future, like Fed monetary policy, is primarily guesswork. But unlike the Fed, we acknowledge our limitations.

Our methodology is rudimentary. We eschew popular forecasting techniques – including trend lines and data driven models – for a conjectural approach. First, we ingest all matters of fact and fiction. Then, through gut check filtration and biased interpolation we arrive at precise, unequivocal answers.

But before we get to it, a brief disclaimer’s in order. This proviso from King Solomon should suffice:

“A fool also is full of words: a man cannot tell what shall be; and what shall be after him, who can tell him?” – Ecclesiastes 10:14

With that out of the way, we sharpen our pencils and face our limitations. This year we’ve done something extra special – and we’ve done it just for you. After much laboring and teeth grinding we’ve distilled what will come in 2020 down for you to it’s very essence. What follows, for fun and for free, is one essential insight for the year ahead.

Vision 2020: One Essential Insight for the Year Ahead

The late Marty Zweig, in his book Winning on Wall Street, which was published in 1970, included the following observation:

“The monetary climate – primarily the trend in interest rates and Federal Reserve policy – is the dominant factor in determining the stock market’s major direction.”

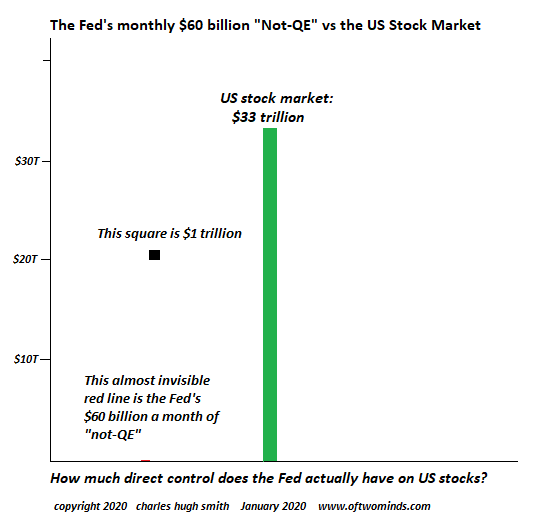

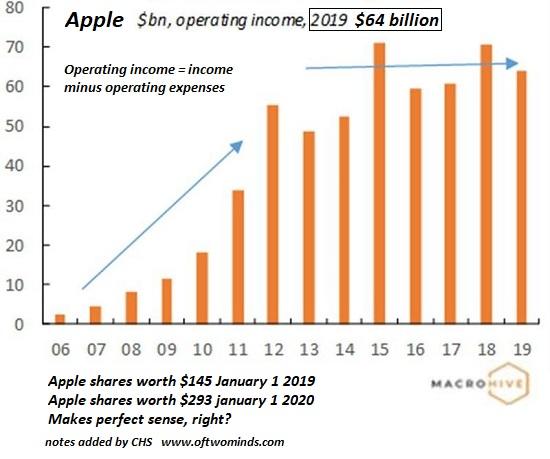

You see, even 50 years ago the secret was out. The stock market’s loosely rigged by Fed policy. Falling interest rates, and more recently quantitative easing (QE), inflate financial assets. Rising interest rates, and quantitative tightening, deflate them.

Zweig is also credited with taking this observation and simplifying it in a way that Wall Street zealots can repeat with mindless refrain:

“Don’t Fight the Fed.”

Without question, this is sage advice…most of the time. Anticipating and front running Fed policy works great, except for the occasions when it doesn’t. Then it works incredibly bad.

For example, on January 2, 2001, the S&P 500 opened at 1,320 and the federal funds rate was at 6.5 percent. On January 3, 2001, the Fed began cutting the federal funds rate and continued all the way down to just 1 percent on June 25, 2003. Yet, over this same time the S&P 500 lost over 26 percent.

Similarly, on September 17, 2007, the S&P 500 opened at 1,484 and the federal funds rate was at 5.25 percent. On September 18, 2007, the Fed began cutting the federal funds rate and continued all the way down to practically 0 percent on December 16, 2008. Yet, over this same time the S&P 500 lost over 38 percent.

Note, these examples do not capture the full peak to trough of these bear markets. The durations provided are aligned with respective Fed rate cutting cycles. The point is, following the refrain, “Don’t Fight the Fed,” during these periods was absolutely disastrous.

Clearly, there are occasions to fight the Fed. And 2020 is one of them. Hence, our essential insight for the year ahead is this:

Fight the Fed in 2020.

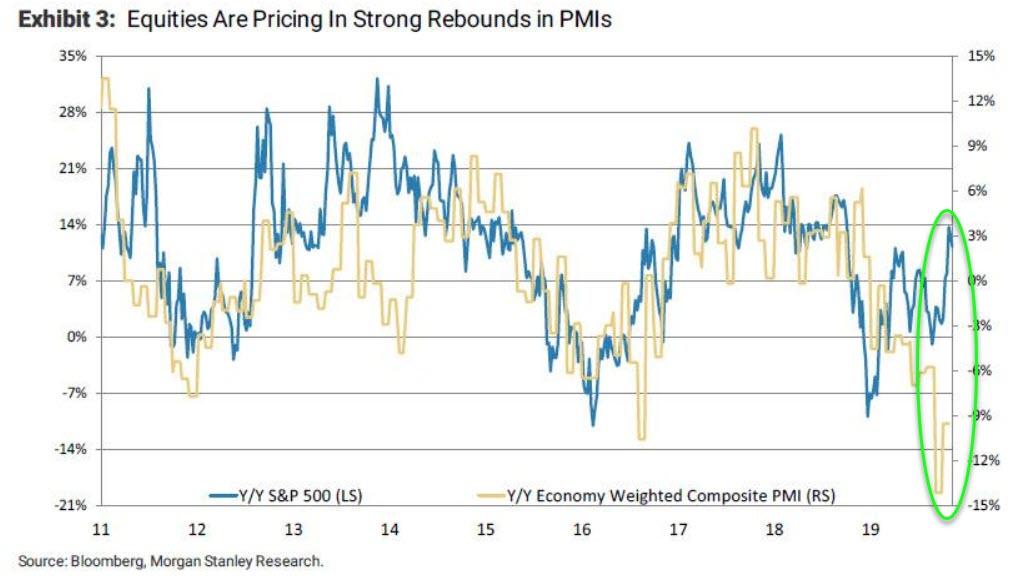

No doubt, in the year ahead the Fed will further its extreme and reckless policies of cutting the federal funds rate, injecting funny money into the system via not-QE, and whatever other harebrained schemes the PPT can dream up to sustain elevated stock market indexes. But what worked so well will in 2019 will fail spectacularly in 2020.

Policy makers are humans too. They’re likely to miss the mark from time to time. By our estimation they already have. With this as our premise, we predict the following for 2020:

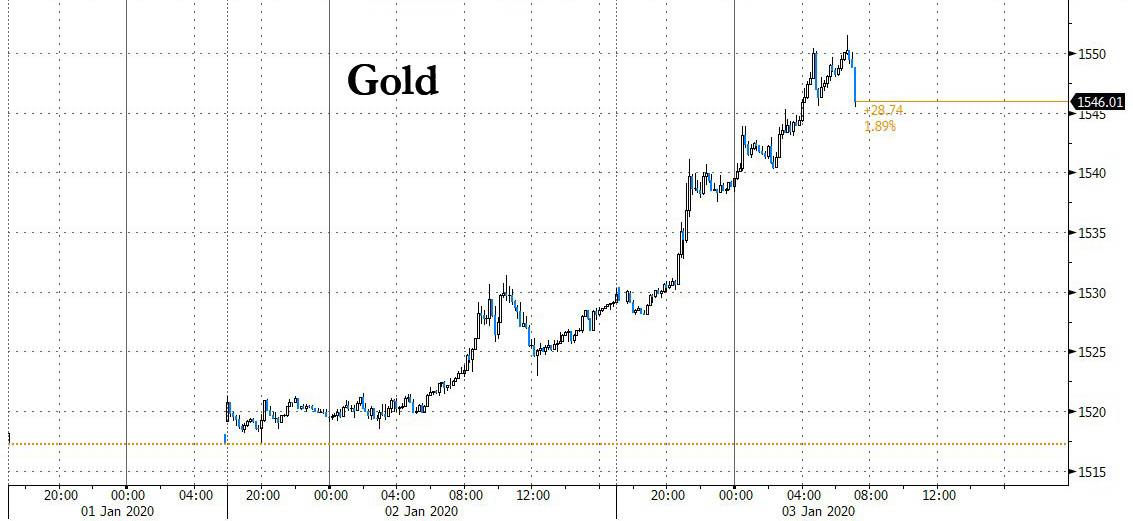

The S&P 500 will close out the year down precisely 32 percent. The yield on the 10-Year Treasury note will rise to 3.19 percent. And gold will sparkle to a new all-time high, eclipsing $1,900 per ounce.

Here’s to a healthy and prosperous New Year!

Tyler Durden

Fri, 01/03/2020 – 10:16

via ZeroHedge News https://ift.tt/2QjEbNo Tyler Durden