US Official Gold Reserves Auditor Caught Lying

Submitted by Jan Nieuwenhuijs of Voima Gold

In my previous post, from March 2018, on the audits of US official gold reserves, I have exposed that during the audit procedures of the US official gold reserves from 1974 through 2008, repeatedly audit staff deviated from the auditing protocol, while internal control meant to prevent this was failing. Many audits and assay reports have been destroyed. For decades a significant share of the metal was excluded from verifications for no apparent reason. And, the US government went to great lengths in withholding information and spreading false information about the audits, among other findings in documents obtained through Freedom of Information Act (FOIA) requests. All in all, these findings made me question the integrity of the auditor.

After my last publication, I have obtained more documents from the US Treasury through FOIA requests, which expose another falsehood that puts the auditor in an even more peculiar position. In conflict with the audit protocol, the permanent seals of the vault compartments have been broken, time and again. In addition, the auditor has lied about these events, and when confronted, it’s unable to explain its actions. By now, I have lost faith in the auditor fully.

Prologue

It’s been a very long investigative journey that has led me to make bold statements, such as the ones above, about the auditor of the world’s largest gold holding. I wouldn’t claim anything of this magnitude if I didn’t thoroughly do my homework and research every single possibility that could have caused the auditor to have accidentally spread inaccurate material, including asking the auditor for an explanation.

If any of their statements appeared to be false, surely, they would be able to explain what I was missing. The head auditor said during a congressional hearing in 2011 (source video 42:50):

Transparency is our business.

Who would disagree? The US official gold reserves, weighing over 8,000 metric tonnes, deserve nothing less than an accurate audit.

My journey started in 2014, when I first discovered—in contrast to what I was accustomed to reading on blogs and in newspapers—that the US official gold reserves are audited every year. I published an article on my discoveries, titled A First Glance At US Official Gold Reserves Audits, which was basically a summary of all publicly available documents about the audits. Logically, these documents present a narrative that looks to be credible at the surface, but I found some questions left unanswered, and wrote in my article “this post will be part one of a series.” (Little did I know what I got myself into.) Given the importance of the subject, I intended to submit FOIA requests at the US government, in an open-minded attempt to have my concerns removed.

Since 2014 I have been prosecuting the US government. I have emailed staff of all related institutions—the US Treasury, The Office of Inspector General of the Treasury, the US Mint, and National Archives—that were initially replied, but as I got closer to the details, ceased altogether. I have submitted several dozen FOIA requests to all related institutions, some of which were honored, some not. In search of answers, I repeatedly called the Inspector General. In one of those calls, my contact simply hung up while I was talking. This incident is emblematic of this whole investigation.

On one occasion, the Mint wrote me a specific FOIA request would cost $3,145 “based on an estimate of 1,200 pages of responsive documentation and the duplication costs associated with the requested documents. This estimate also includes 40 hours of estimated search time and 8 hours of estimated review time…” The costs seemed outrages to me, but I got financed through a crowdfunding campaign and paid the Mint. A few months late(r), I received 223 redacted pages that contained 68 pages of reports I didn’t ask for and 21 pages that were copied twice. Effectively, I got 134 pages for $3,145. After some pressure on the Mint, they agreed the costs had been estimated too high, and I got the full amount refunded. (And I ordered my crowdfunding platform to refund all my donors.) The barrier of the costs was used to keep me at bay. To no avail, instead, I got some essential pages in my possession.

In total, I have written nine articles to inform my audience about the developments (I, II, III, IV, V, VI, VII, VIII, IX). After the last one, which was a comprehensive overview of every piece of information I had found (published on March 28, 2018, at the BullionStar website), a reply to another FOIA request came into my mailbox. I received a document that irrefutable reveals a lie by the auditor.

Today’s article is about this falsehood, and numerous other false statements by the auditor, that all have one thing in common: they hide the fact that most vault compartments have been re-opened multiple times after being put under permanent seals, which were meant to prevent re-opening of the doors. Upon request, the auditor provided me one argument for these actions—the “re-opening” of compartments. Alas the argument is in conflict with another statement by them, made under oath, so the auditor still stands as unable to answer a critical question.

Unfortunately, and contrary to how it could have been done, the entire audit process from 1974 until 2008 is extremely complicated. The account below is simplified—I can’t discuss every detail in every article—but for the ones that want to know the details I have added external sources (in parentheses with hyperlinks), which can be used to cross-check my statements. (Also, you can read my previous posts, and if anything is still unclear, I invite anyone to ask me to expand on my conclusions in the comment section below this article. I’m willing to substantiate any findings—as one should when making bold claims.)

Let’s start with some background information, and then we will discuss the heart of the matter.

Introduction

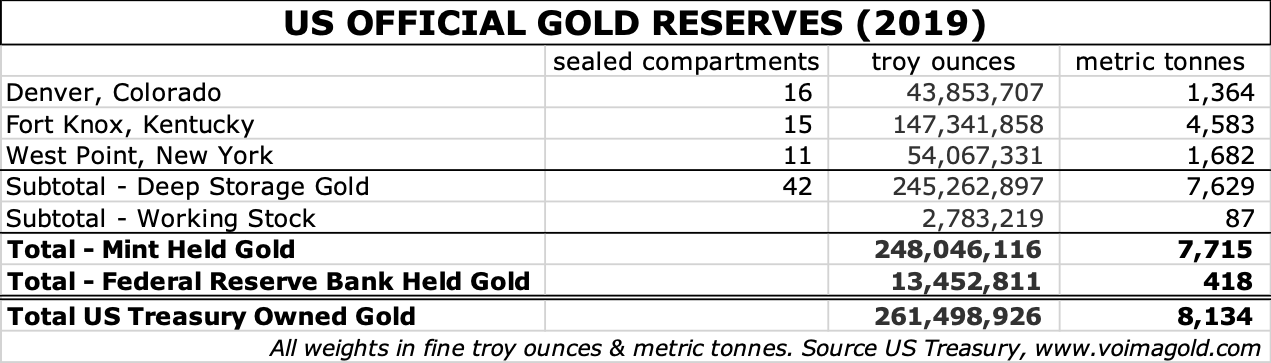

The US official gold reserves are the largest globally at 8,134 metric tonnes (owned by the US Treasury). Although this gold does not back the US dollar at a fixed parity as it did before 1971, it does provide essential support as a final backstop to the dollar and thus credibility to the present world reserve currency.

The majority of the gold is located at the US Mint depository at Fort Knox. Smaller amounts are stored at US Mint depositories in Denver and West Point. Aggregated this metal is referred to as Deep Storage gold and is captured within 42 sealed vault compartments. The remainder is at the Federal Reserve Bank of New York.

When the audits commenced in 1974, the protocol designed was simple (page 534). The following excerpt is from the first auditing committee:

In performing the audit, the gold bars are physically moved from one vault compartment to another. During this operations [sic], the melt numbers and the number of bars in each melt are verified with an inventory listing, and one in fifty melts is randomly selected for weighing and test assay.

One melt averages about twenty bars cast from one crucible of molten gold.

The audit protocol follows that “these actions, having once been performed by an authorized committee, in accordance with established procedures, will not have to be repeated as long as the assets verified remain under an unimpaired joint seal.” Compartments physically verified were placed under Official Joint Seal (OJS) to “avoid the necessity of verifying all assets in each annual or special settlement (audit).” The US Treasury pledged to do a “periodic, cyclical inventory” to “ensure that about 10 percent of the gold” was physically inspected annually, eventually to have audited “all the gold for which the US government is accountable” “by 1984.” The essence of the “established procedures” was to open, audit and seal each compartment once. We will return to this fundamental topic later on.

Since the stated purpose of joint sealing was to avoid the need of “re-audits,” all the gold could (after 1984) be verified by simply checking if the seals were unimpaired. Great intentions, but this is not what happened.

The current auditor of the US monetary gold is the Department of the Treasury’s Office of Inspector General (OIG). Representing the OIG, Eric M. Thorson attended the congressional hearing for the Gold Transparency Act (not enacted) that was initiated by Ron Paul in 2011. Mr. Thorson’s testimony at the hearing serves as the official statement by the government on the audits. Having weighed his words carefully, Thorson spoke under oath:

… 100 percent of the U.S. Government’s gold reserves in the custody of the Mint has been inventoried and audited. … I can say that without any hesitation, because I have observed the gold and the security of the gold reserves myself.

… the Committee for Continuing Audit of the U.S. Government-owned Gold [The Committee that started the audits] performed annual audits of Treasury’s gold reserves from 1974[*] to 1986. … by 1986, 97 percent of the Government-owned gold held by the Mint had been audited and placed under joint seal. So once you have done that, and that seal remains unbroken, then I am not sure what other benefit there would be to going back into it at that point. …

Since 1993, when we [OIG] assumed responsibility for the audit, my office has continued to directly observe the inventory and test the gold. In fact, my auditors signed the official joint seals … placed on those compartments, inventoried and tested in their presence. At the end of Fiscal Year of 2008, all 42 compartments had been audited by … the Committee for Continuing Audit of the U.S. Government-owned Gold, or my office, and placed under official joint seals.

Thus, in summary:

- From 1974 until 1986, 97 percent of the gold at the Mint had been verified by the Committee for Continuing Audit.

- In 1993 the OIG became responsible for the audits, and by 2008 all compartments had been verified and sealed.

The conclusions we derive from Thorson’s testimony:

- From 1987 until 1992, there were no audits.

- From 1993 until 2008, the remaining 3 percent of the gold was verified.

Thorson doesn’t mention anything about vault compartments having been re-opened.

The Problem

First of all, the OIG did not assume responsibility for the audits since 1993, but since 1982 as disclosed in one of the few documents that survived the 1980s (page 2).

Effective October 1, 1982, the Internal Audit Staffs of BGFO and the United States Mint [Committee for Continuing Audit] were reorganized under the Department of the Treasury, Office of the Inspector General [OIG].

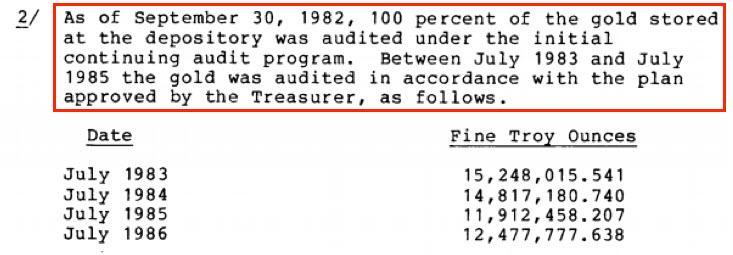

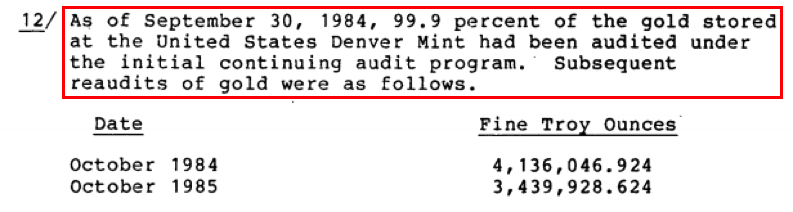

Ever since the OIG became part of the audits in 1982, exactly what was not supposed to happen, did happen: vault compartments that had been physically verified and sealed were re-opened. Read with me, from the 1986 audit report regarding the Fort Knox (page 8) and Denver (page 9) depositories:

For some reason, starting in 1983, “re-audits” were performed over 1,929 tonnes “in accordance with the plan approved by the Treasurer.” However, in 1983, both depositories had already been fully audited, while West Point had not. Why were these compartments re-opened when the protocol stated that, “these actions” (physical verification) “having once been performed … will not have to be repeated as long as the assets verified remain under an unimpaired joint seal”? The OIG can’t explain this to me, and neither can it explain to me what “the plan approved by the Treasurer” was.

What Thorson carefully refrained from mentioning under oath, he mentions in a written statement for the Gold Transparency Act. At the surface, his official testimony seems identical to his written statement, but when I compared both word for word, the latter crosses a topic that’s excluded in the former. Thorson never spoke about this in the congressional hearing (page 45):

From 1987[**] to 1992, the Mint continued to perform an annual inventory and verification of the gold reserves in accordance with its own policies over those compartments that had not been placed under Official Joint Seal…

Note that from the quote above, we learn that the US Mint—mind you, the custodian of the gold—audited the US monetary gold “in accordance with its own policies” from 1987 through 1992. This is arguably like a bank opening its customers’ safety deposit boxes. According to universal auditing principles, a custodian is not authorized to audit its client’s assets. An independent entity should audit custodial gold. This might explain why Thorson failed to mention this in the congressional hearing.

Note also that Thorson writes that the Mint exclusively opened “those compartments that had not been placed under Official Joint Seal.” This is false, and I can prove it.

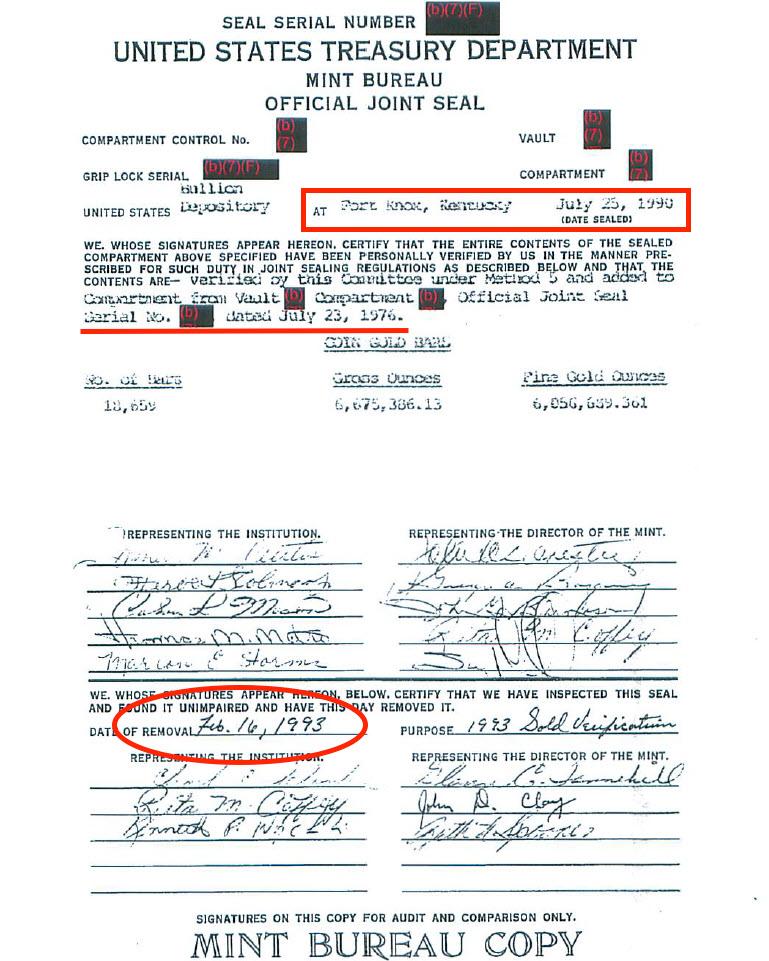

I have obtained copies of the seals that were placed by the Mint on 5 Deep Storage compartments (together containing 795 tonnes of gold) between 1987 and 1992 (download here). Thorson’s written statement is false, as these compartments had, for a fact, already been verified and sealed, because they were all at Fort Knox and Denver, which were fully audited by 1982. Let’s have a look at one of the seal copies.

We can see the “date sealed” at the top, “July 25, 1990,” and the depository is “Fort Knox, Kentucky.” Thus, Thorson lied to us when he said that the Mint was only verifying “those compartments that had not been placed under Official Joint Seal,” because we know Fort Knox was fully audited, and thus all of its compartments put under Official Joint Seal, by 1982.

We can also see on the seal when this compartment was “sealed previously.” It was in 1976 (underlined in red). Confirming it was a “re-audit.” If it was the first audit, the “sealed previously” date had to be prior to 1974, before any audits were performed.

Last but not least, at the very bottom of the seal, we see a date, “February 16, 1993” (in the red oval), which is when this seal was removed by the OIG (presumably for yet another “re-audit”). More evidence that the OIG must have known what happened to these compartments in between 1987 and 1992. As, removing the seal in 1993 by the OIG, clearly would have shown the history of this compartment. Attentive readers might see a pattern emerging.

From 1993 until 2008, additional compartments were “re-audited.” Thorson, again, did not mention these “re-audits” under oath, but in this specific period, more than 2,000 tonnes*** of gold saw the light of day again. I know through an excel sheet (download here) the OIG sent me in response to a FOIA request. When I asked the OIG for confirmation on how much they audited since 1993 they replied (source):

[Since 1993]…we observed the counting of 246,203 bars, which equates to 81,638,569 FTOs (or 2,539 tonnes).

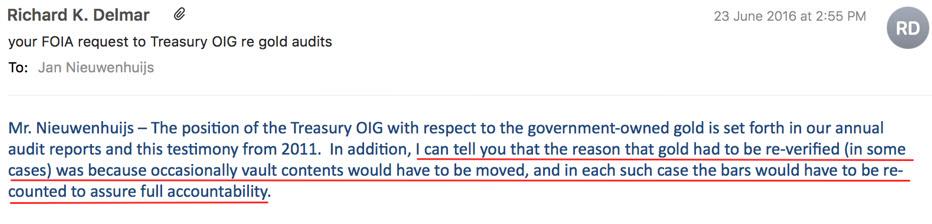

When I asked my contact at the OIG why thousands of tonnes had been “re-audited” in periods from 1983 until 2008, he replied:

Unfortunately, the OIG stopped responding to my emails by late 2016. Everything had to be submitted through FOIA requests, I was told, which made my investigations take a few years extra.

Notice that the OIG doesn’t mention “the plan approved by the Treasurer,” which at least could have explained the “re-audits” from 1983 until 1986.

An explanation of why so many compartments had been “re-verified (in some cases) was because occasionally vault contents would have to be moved.” However, this argument makes no sense. It is true that since 1974, when the audits started, gold has been moved. Roughly 1,900 tonnes were moved from the New York Assay Office to West Point. But this movement occurred in 1982 before any “re-audits” began. There have been no other substantial movements of gold (read the chapter “Problem 11”).

Additional evidence indicating there hasn’t been any movement of Deep Storage gold comes, ironically, from Thorson. Let’s go back to the congressional hearing with Paul and Thorson in 2011. After Thorson’s testimony, a Q&A follows wherein Paul asks Thorson about the audits from 1974 until 1986, and if it would be “worthwhile to inventory and assay [audit] this portion of the gold” again. Thorson replies that would be unnecessary because (39:00):

. . . there is no movement. Those doors aren’t opened. There is nothing there that can happen. Because once those doors are sealed … it’s very obvious if those seals are ever broken. … There is no movement. Those doors are not opened.

A strange thing to say, for Thorson, as this is exactly what he was continuously doing: re-opening the compartment doors. With this statement, Thorson confirms that any compartment should never have been re-opened. Not only is this what happened time and time again, but it also started precisely from the moment Thorson’s department (OIG) became involved with the audits in 1983.

In trying to think of any legitimate reason why compartments have been re-opened, ever, I decided to submit a FOIA request for the audit protocols that prevailed after 1992. Maybe the audit approach had changed? If the OIG can’t explain it to me, maybe I can find the answers in some documents? What if I’m still missing something?

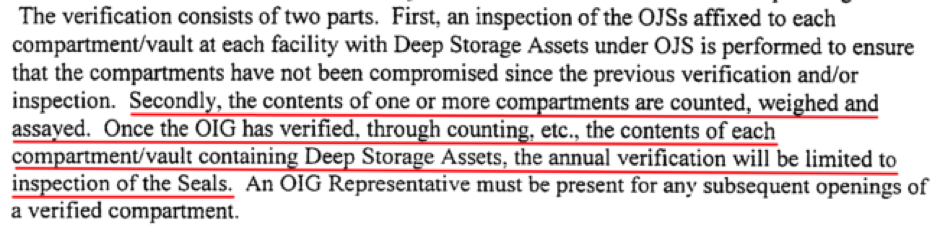

Eventually, I received the Mint’s 2005 audit directive that shows us whenever a compartment has been “verified. . . the annual verification [i.e., audit] will be limited to inspection of the Seals.” Put differently: once physically verified the doors remain closed (from page 11):

Makes sense as this auditing approach matches the one from the 1970s. Like Thorson said during the congressional hearing in 2011: “So once you have done that [physical verification], and that seal remains unbroken, then I am not sure what other benefit there would be to going back into it at that point. . . . There is no movement. Those doors are not opened.” (Note in the quote above that “An OIG Representative must be present for any subsequent opening.” The issue isn’t whether it’s possible to re-open a compartment. Gold inside a compartment that can never be opened again has no value. You might as well put it in a rocket a blast it into the sun. The point is that barring legitimate reasons to re-open a compartment (e.g., selling the metal inside), they should remain closed.)

Conclusion

Altogether, the vast majority of Deep Storage vault compartments have been re-opened for dubious reasons. (For exact data on “re-audits,” see my article “Audits Of US Monetary Gold Severely Lack Credibility.”)

After years of prosecuting, these are the facts as they lay in front of us:

- The majority of Deep Storage vault compartments have been “re-opened” for unknown or dubious reasons. (Again, for details, see “Audits Of US Monetary Gold Severely Lack Credibility.”)

- Under oath, the auditor, Thorson, carefully avoided the subject of “re-opening” compartments.

- In another written statement, the same auditor lied about the subject of “re-opening” compartments.

- When this auditor was asked for an explanation regarding the “re-opening” of compartments, it could only muster an unfitting one.

I find it astonishing that all falsehoods the auditor (OIG) has spread have in common that they hide the fact compartments have been “re-opened.”

My investigation concerns the audits, which appear to have been executed with an inadequate degree of integrity. Accordingly, there should be a new audit authorized by Congress, which, incidentally, is also the opinion of former US Mint Director Edmund C. Moy (see tweet below).

@NotoriousCLO @HereTizz @KoosJansen Not much but wouldn’t satisfy him. IMO there should be a comprehensive audit authorized by Congress.

— Edmund Moy (@EdmundCMoy) January 19, 2015

Naturally, if the OIG or Treasury wants to respond to my findings, that would be more than welcome, and I would be happy to engage with them.

Notes

*: The original documents states “1975” but for the sake of simplicity I have changed it into “1974”. Officially, the Committee for Continuing Audit of the U.S. Government-owned Gold started in 1975, but because they accepted the audit performed in 1974 in their program effectively their program started in 1974.

**: The original documents states “1986” but to improve the readability of this post I have changed it into “1987.”

***: An overview of the “re-audits”:

– From 1983 until 1986, 1,929 tonnes were “re-audited.”

– From 1987 until 1992, 796 tonnes were “re-audited.”

– From 1993 until 2008, 2,296 tonnes were “re-audited.” (By 1986 only 243 tonnes at West Point were not audited. According to the OIG, from 1993 until 2008, 2,539 tonnes were audited. 2,539 minus 243 is 2,296, which is the amount “re-audited” from 1993 until 2008.)

Altogether from 1983 until 2008, 5,021 tonnes have been “re-audited” for unclear reasons.

Tyler Durden

Tue, 12/17/2019 – 18:45

via ZeroHedge News https://ift.tt/38HYvz0 Tyler Durden