While global stock markets surge and swoon with every headline indicating fresh optimism (or pessimism) for a US China trade deal, the same trade deal that has been around the corner ever since the summer of 2018, things aren’t looking too healthy for whatever lies beyond the allegedly easy “Phase 1” deal, that was announced as clinched with much fanfare by Trump on October 11.

The ambitious “phase two” trade deal between the US and China is looking less and less likely as the two countries find it near impossible to reach an agreement on even the preliminary “phase one” agreement, according to U.S. and Beijing officials, lawmakers and trade experts told Reuters.

Recall back in October, when stock markets roared higher after President Trump said during a press conference with Chinese vice premier Liu He that he expected to quickly dive into a second phase of talks once “phase one” had been completed. The second phase would focus on a key U.S. complaint that China effectively steals U.S. intellectual property by forcing U.S. companies to transfer their technology to Chinese rivals, the US president said then.

And yet, despite what appeared to be a modest concession by Beijing which Bloomberg earlier reported had issued various guidelines for IP theft, arguably in preparation for “Phase 2”, Reuters notes that the November 2020 U.S. presidential election, “the difficulties in getting the first-stage done, combined with the White House’s reluctance to work with other countries to pressure Beijing are dimming hopes for anything more ambitious in the near future.”

In fact, with the December venue for the Phase 1 deal announcement scrapped and still not replaced with a new one, it remains unclear if – or when – any deal will be formalized.

The news follows a previous Reuters report last Wednesday, according to which the signing of the Phase 1 deal could slide into 2020 as the two countries have hit an impasse over Beijing’s demand for more extensive tariff rollbacks. Officials in Beijing say they don’t anticipate sitting down to discuss a phase two deal before the U.S. election, in part because they want to wait to see if Trump wins a second term.

“It’s Trump who wants to sign these deals, not us. We can wait,” one Chinese official told Reuters, refuting a daily refrain from Trump who in turn has claimed that it is China that is looking to sign a deal quickly.

At the end of the day, with neither side willing to compromise and show weakness, a deal may never actually happen.

To be sure, as we drag closer to the Nov 2020 elections, China’s leverage seems to grow, if for no other reason than a collapse in trade talks could spark a major market selloff and torpedo both the economy and Trump’s approval rating.

As such, Trump’s main priority at the moment is to secure a big phase one announcement, locking in big-ticket Chinese purchases of U.S. agricultural goods that he can tout as an important win during his re-election campaign, according to a Trump administration official. After that, and as the news cycle entered the home stretch of the elections, China would recede on Trump’s policy agenda as he turns to domestic issues, the Reuters soruce said, speaking on condition of anonymity.

He will probably leave other major contentious issues to senior aides, who are likely to continue pushing Beijing over the theft of U.S. intellectual property, its militarization of the South China Sea and its human rights record, the official said.

“As soon as we finish phase one we’re going to start negotiating phase two,” a second administration official said. “As far as timing around when a phase two deal could be completed, that’s not something I can speculate on.”

The Trump White House initially laid out ambitious plans to restructure the United States’ relationship with China, including addressing what a 2018 United States Trade Representative investigation concluded were Beijing’s “unfair, unreasonable, and market-distorting practices.” Alas, in the past year, this ambitious goal shriveled to what amounted to China buying the same amount of agricultural products from the US… as it did in 2017.

Ironically, in a massively divided Congress, there is broad bipartisan support for Trump’s drive to hold China accountable for years of economic espionage, cyber attacks, forced technology transfer and dumping of low-priced goods made with hefty government subsidies. However, most of these critical concerns will not be addressed in the phase one agreement, which focuses on China agricultural product buys, tariff roll backs, and includes some intellectual property pledges.

“That’s the easy stuff,” said Costa. The harder issues are “industrial espionage, copyrights, complying with those issues, privacy and security issues.”

It’s those issues that will certainly not be resolved before the 2020 election… if ever.

Further complicating the issue, Trump’s economic advisers are split: some – such as Larry Kudlow – are pushing Trump to agree to a quick phase one deal to appease markets and business executives, others – such as Peter Navarro – want him to push for a more comprehensive agreement.

At the same time, Beijing officials are balking at pursuing larger structural changes to managing China’s economy, anxious not to appear to be kowtowing to U.S. interests.

That said, both China and the United States have a clear interest in getting a phase one deal completed relatively soon to soothe markets and assuage domestic policy concerns, said Matthew Goodman, a former U.S. government official and trade expert at the Center for Strategic and International Studies. Which is why there is a very good chance that the two sides will hammer out some phase one deal, even if just a placeholder for a photo opportunity, but a broader deal will not be reached before the election, or perhaps after. One key problem, he said, was the continued lack of a coherent U.S. strategy for dealing with China.

“I think phase one probably will happen because both presidents want it,” Goodman said at a Congressional briefing last week. But he said China was less willing now to make structural changes that might have been possible in the spring. “They’re not going to do those things,” he said.

Josh Kallmer, a former official with the U.S. Trade Representative’s office and now executive vice president of the Information Technology Industry Council, told Reuters that it was “technically possible, but hard to imagine” that the United States and Beijing could negotiate a phase two deal in the next year.

One reason for the logistical complexity is that the United States needs better coordination with its allies to pressure China to make urgently needed structural changes, including ending the forced transfer of technology and better intellectual property protections, trade experts and former officials say.

And as Trump’s trade feud with Beijing escalated, Europe and other U.S. allies have been reluctant to join Washington’s pressure campaign on Beijing, partly due to frustration with the administration’s focus on unilateral action but mostly due to their reliance on Chinese investment.

“We need an international coalition to successfully attack phase two,” said Kellie Meiman Hock, managing partner at McLarty Associates, a trade consulting group in Washington.

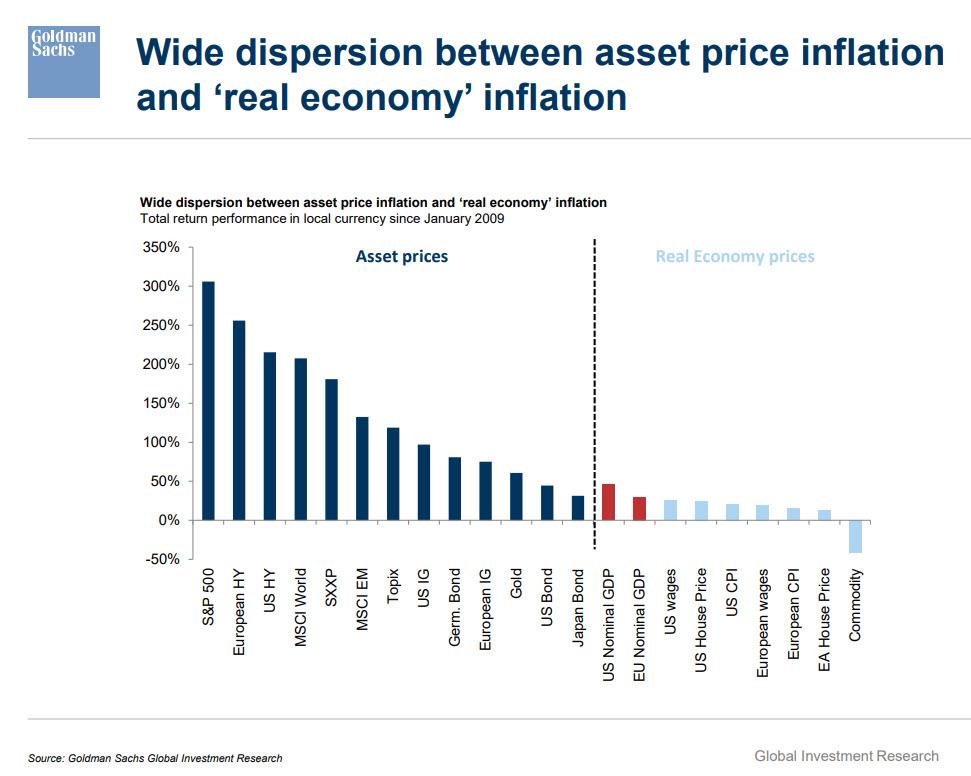

Such a coalition is not coming, which is also why anyone hoping for more than a token “deal” will be disappointed. On the other hand, with markets pricing in a successful deal every single day since the summer of 2018, dangling the carrot that a Phase 1 deal is “just around the corner” may be precisely what the doctor ordered to have the S&P trade around 3,400 or higher just before the presidential election. And that, far more than getting an actual trade deal with China, is what Trump has been after all along.